Ben Carlson provides a nice summary of how recency bias causes investors to leave a lot of money on the table:

This is why we had Depression babies who were risk averse for decades after the Great Depression. Investors who came up during the 1970s expected interest rates and inflation to stay high forever. Almost everyone who invested in the 80s or 90s became complacent and assumed mid-double digit stock market gains were their birthright. The latest generation of investors have decided that the world is going to end once a week because we’ve lived through two huge crashes in the past 15 years.

This is where I think it can be instructive to review the landscape of managers in the Tactical Allocation space. These are the managers who are seeking to adapt to different economic environments.

See the following definition of this category from Morningstar:

Tactical Allocation: Tactical Allocation portfolios seek to provide capital appreciation and income by actively shifting allocations between asset classes. These portfolios have material shifts across equity regions and bond sectors on a frequent basis. To qualify for the Tactical Allocation category, the fund must first meet the requirements to be considered in an allocation category. Next, the fund must historically demonstrate material shifts within the primary asset classes either through a gradual shift over three years or through a series of material shifts on a quarterly basis. The cumulative asset class exposure changes must exceed 10% over the measurement period.

How likely do you think it is that many Tactical Managers succumbed to recency bias and managed their portfolio over the past 5 years as if the “world is ending?” Judging by the numbers, I suspect that the answer is quite a few. However, note how our own Arrow DWA Tactical Fund (DWTFX) has outperformed 88 percent of our peers in the Tactical Allocation category over the past 5 years and has outperformed 92 percent of our peers over the past 3 years.

Source: Morningstar

Here are two key reasons why I believe this fund has stacked up well against its peer group over time:

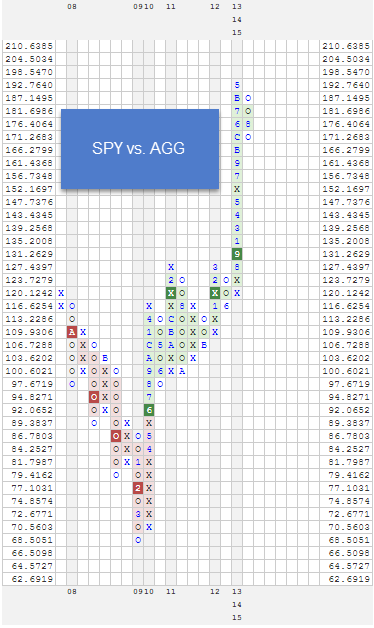

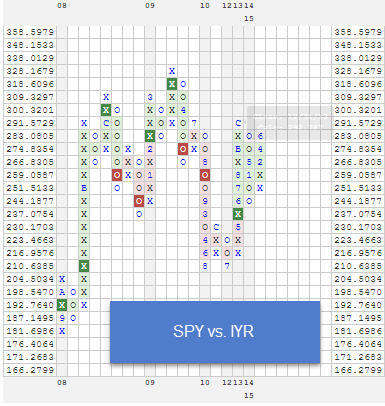

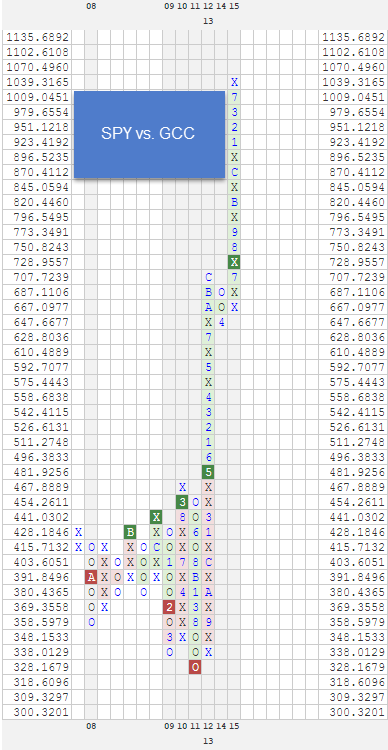

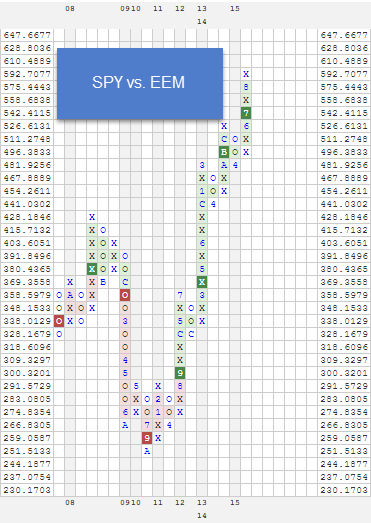

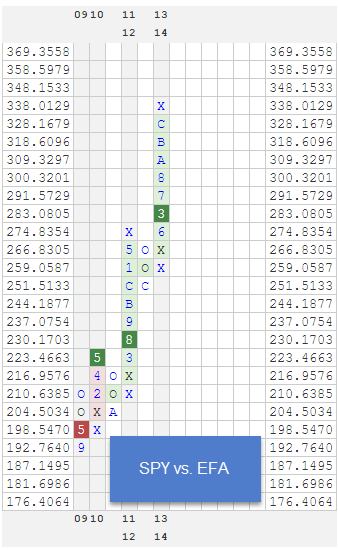

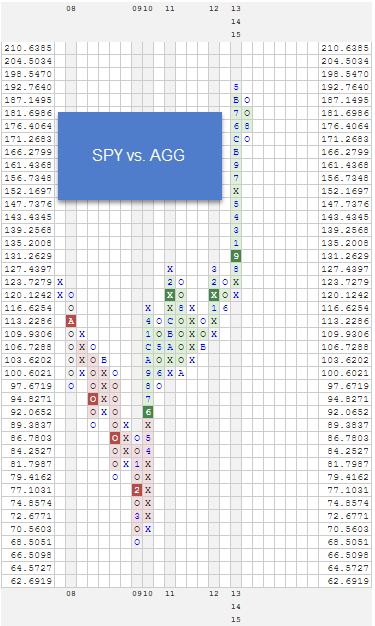

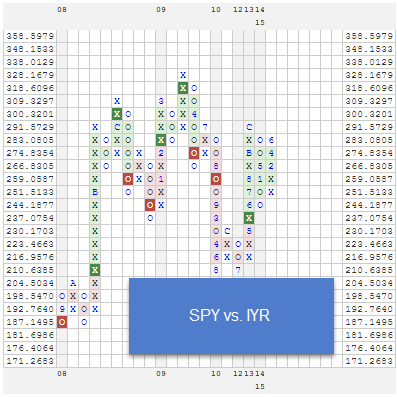

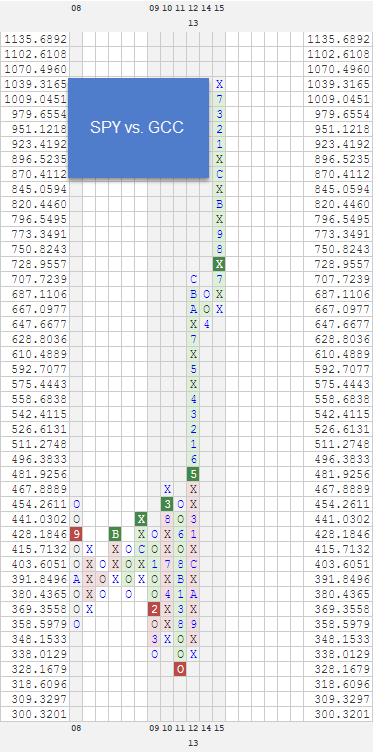

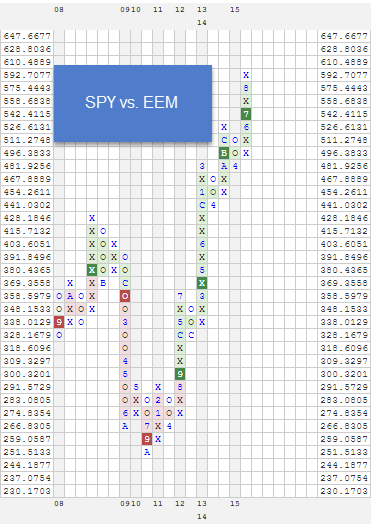

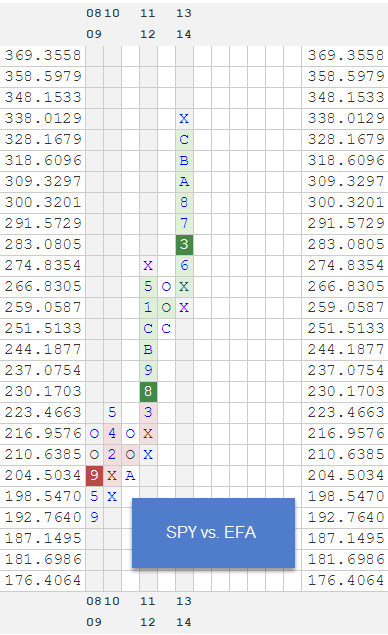

- Relative strength drives the allocations of the fund rather than human emotions.

- We intentionally gave ourselves wide asset allocation flexibility. You will note that this type of flexibility allows us to perform well in a variety of market environments. See below for details:

Holdings of the fund as of 8/31/15 are shown below:

It is understandable that investors, most of whom have felt the pain of two major bear markets within the past 15 years, want a strategy that can play defense. However, that objective need not be sought at the expense of also having a strategy that can make money in good markets! Recency bias is a killer in the financial markets. I believe a relative strength-driven approach to asset allocation is a good solution to that challenge.

This portfolio is available in a number of different investment vehicles:

- The Arrow DWA Tactical Fund (DWTFX). This fund adopted this strategy in 8/2009.

- The Arrow DWA Tactical ETF (DWAT)

- This strategy is also available as a separately managed account (called Global Macro). E-mail andy@dorseywright for a brochure on the SMA.

The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Dorsey Wright is the signal provider for the Arrow DWA Tactical Fund and Arrow DWA Tactical ETF. See arrowfunds.com for a prospectus.