On March 1, 2007, we partnered with PowerShares to bring to market the first momentum ETF, The PowerShares DWA Momentum ETF (PDP). This ETF is based on our Technical Leaders Index which is designed to rank a universe of about 1,000 U.S. mid and large cap stocks, using our PnF relative strength methodology, and identify the top decile (top 100 stocks) in our rankings. This index is reconstituted on a quarterly basis.

PDP now has $1.9 billion in assets and has outperformed the S&P; YTD, over the last 1, 3, and 5 years, and inception to date (ITD).

Source: Bloomberg, as of 10/29/15. Returns are inclusive of dividends, but do not include all transaction costs.

If someone simply bought PDP on 3/1/2007 and held the ETF to today, they may not be aware of all the changes in the Technical Leaders Index over time. The table below summarizes all the index changes that have happened behind the scenes.

Source: Dorsey Wright, as of 9/30/15. Returns are not inclusive of dividends or all transaction costs.

Some observations:

- 83% of all index trades were held for less than 4 quarters. In other words, these were the strong momentum stocks that we bought that did not sustain their momentum and were quickly removed from the index. The highlighted column shows the return of our index holdings relative to the S&P; 500 during the period of time that we held them. Stocks held for only 1 or 2 quarters underperformed the S&P; 500 on average.

- 17% of all index trades were held for longer than 4 quarters. These were the holdings that, on average, outperformed the S&P; 500. You’ll notice that the longer the stocks were held in the index the better they tended to perform relative to the S&P; 500.

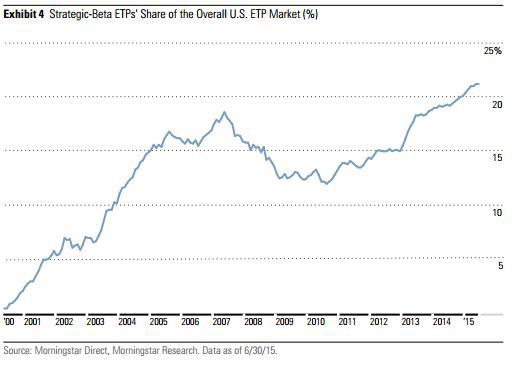

This type of return profile is probably not surprising to those familiar with trend following. After all, the essence of the strategy is to cut your losers and let your winners run. We’ve all read the statistics about the percentage of active managers that fail to beat an index. Here is a smart beta alternative to active management that has demonstrated the ability to add value over time.

The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value.