The growth of assets in Smart Beta ETFs is staggering. From Michael Batnick:

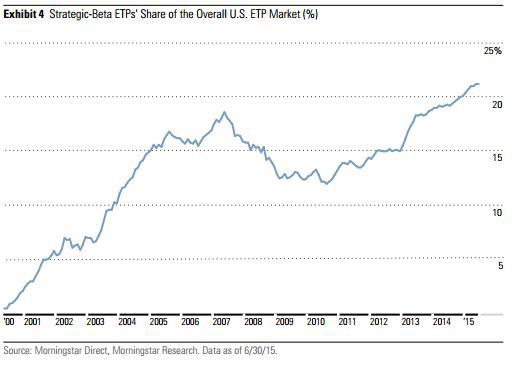

Investors have become enamored with alternative ways to slice and dice the indices. According to Morningstar, “Strategic Beta” now accounts for 21% of total industry (ETP) assets, up from under 5% in 2000. As assets have exploded, so too has the number of strategic-beta ETPs, which have grown from 673 to 844 in the past year, while assets grew 25% to $497 billion.

While much of the focus is on the nomenclature- “smart” vs. “factor” vs “strategic,” perhaps the most important aspect is being overlooked; like all things investing, the product won’t to be drive returns as much as your behavior will.

To demonstrate this point, I chose five popular strategies that differ from the traditional plain vanilla cap-weighted index: Nasdaq US Buyback Achievers Index, S&P 500 Equal Weight Index, Nasdaq US Buyback Achievers, MSCI USA Momentum Index and the S&P 500 Low Volatility index.*

Every one of these Smart Beta strategies has outperformed the S&P 500 from 2007-today**. The problem investors run into, as you can see below, is that very often the best performing in each year lagged the S&P 500 in the prior year. Myopia is a huge impediment to successful investing as much of our “discipline” is driven by “what have you done for me lately?”

Each of these five strategies has outperformed the S&P 500 over the previous eight years.

Had you chased the prior year’s best strategy, you would have compounded your money at just 3.5%, less than the 6% you would have earned if you invested in the prior year’s worst strategy. This goes to show that mean reversion is a powerful force for a proven, repeatable process.

Interesting. There are all kinds of studies showing that when it comes to individual stocks, buying last year’s winners works great (click here for just one of the white papers written on this topic). However, Batnick is arguing that buying last year’s winning Smart Beta ETF is not effective (at least in this short sample) when it comes to investment factors.

This has important implications for building an asset allocation that includes a variety of Smart Beta factors: You may well be better off simply seeking to identify those factors that are likely to outperform over time (we like momentum and value in particular) and make passive allocations to those factors rather than trying to time your exposure to them.

Smart Beta has, in our view, been a tremendous positive for investors. However, it won’t keep performance-chasing investors from hurting themselves if they fail to allocate money to them in a prudent way.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss.