October 2, 2015

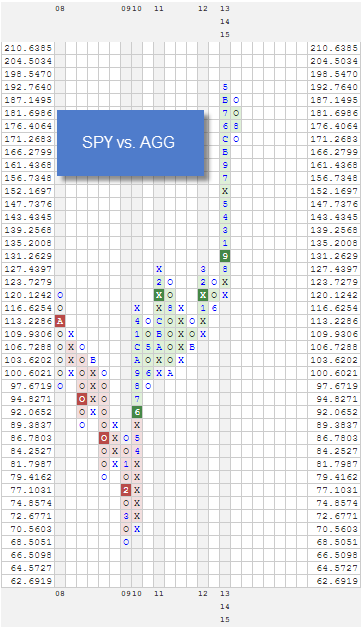

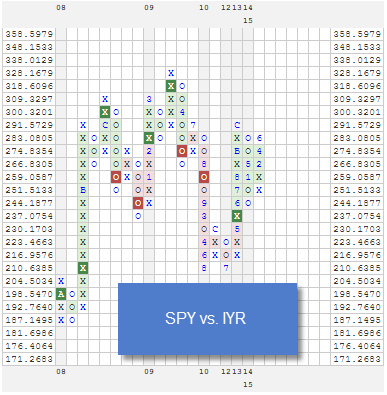

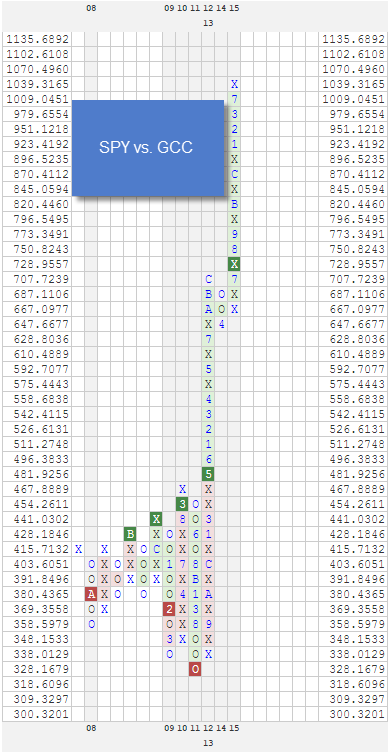

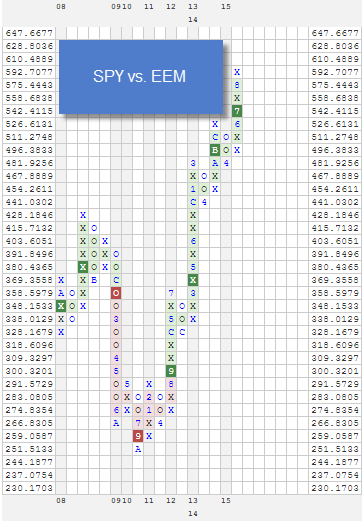

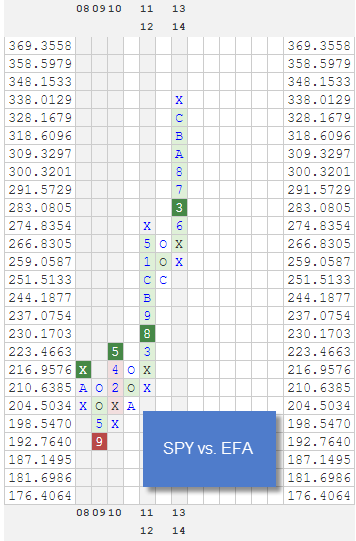

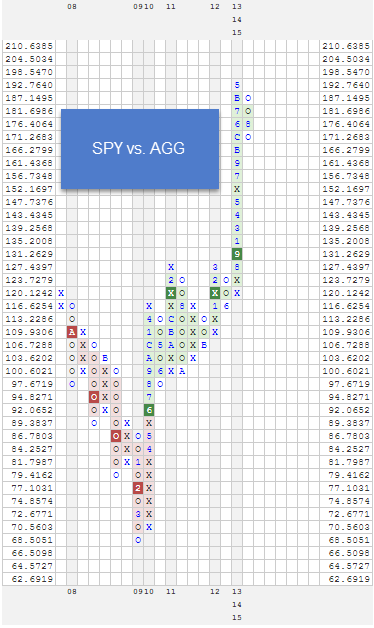

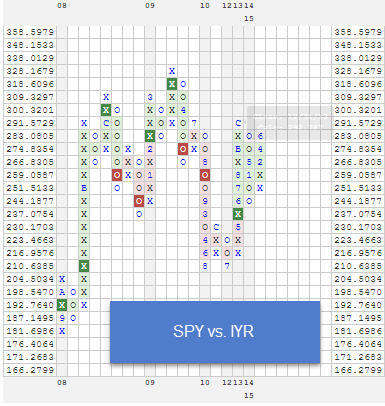

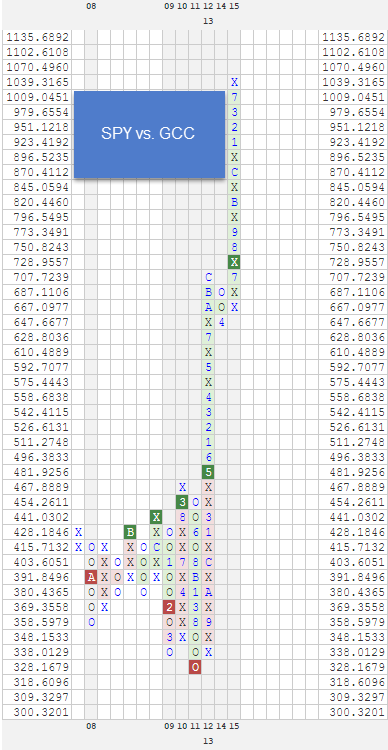

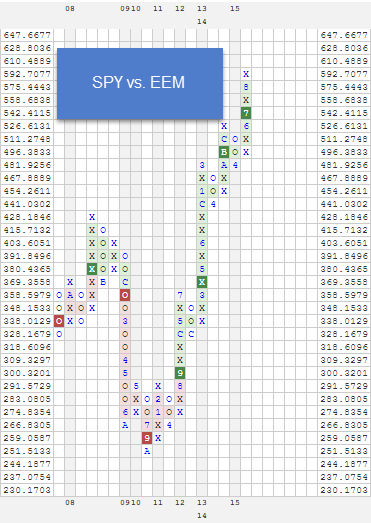

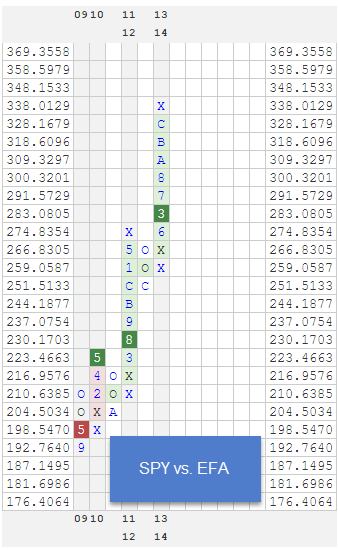

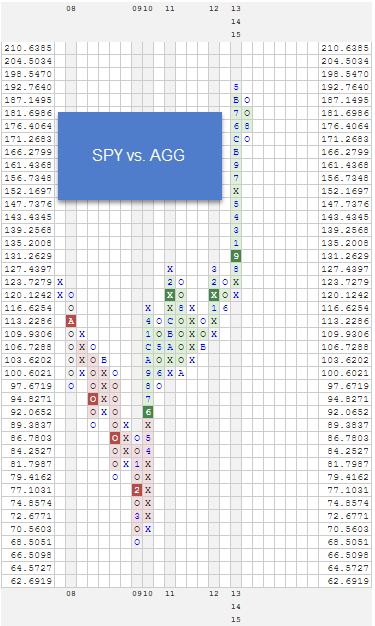

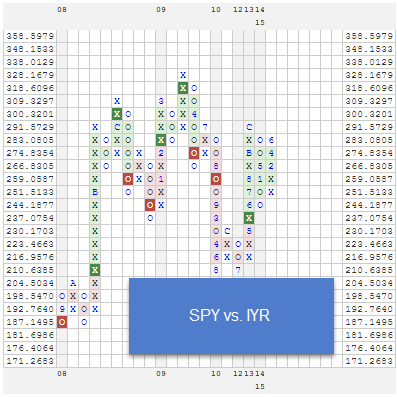

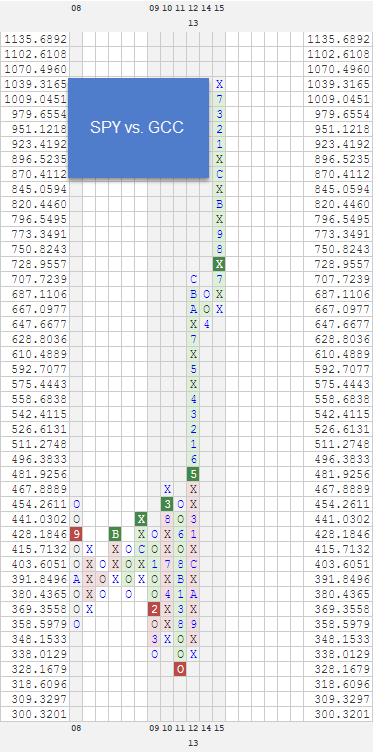

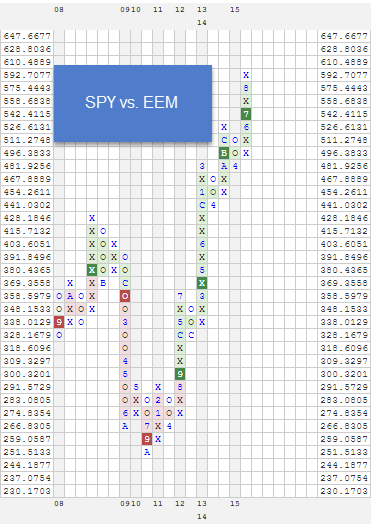

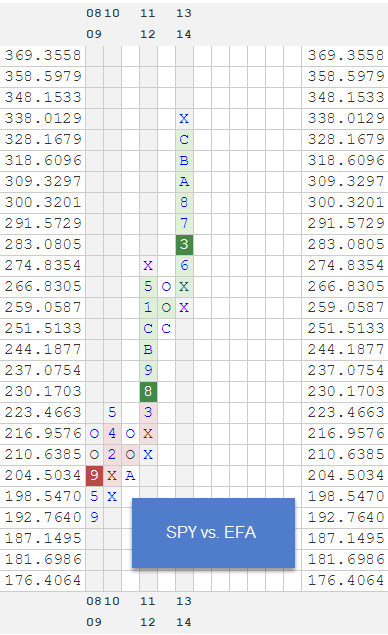

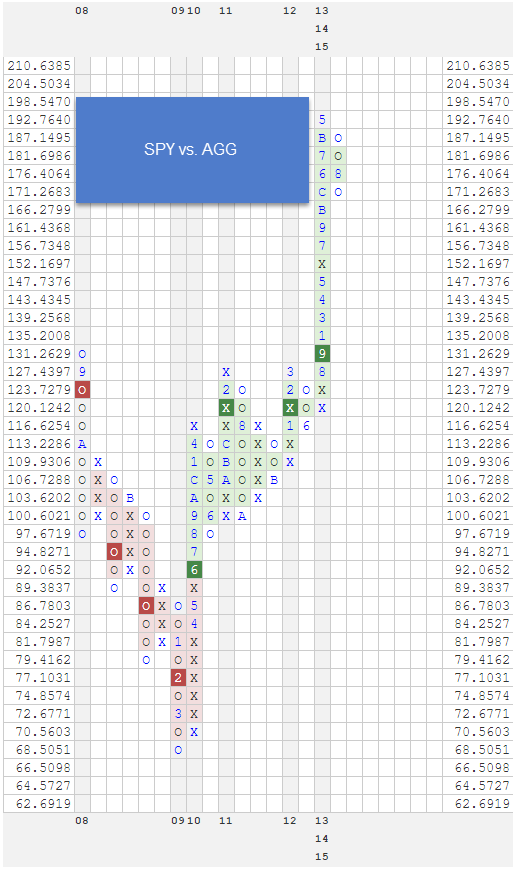

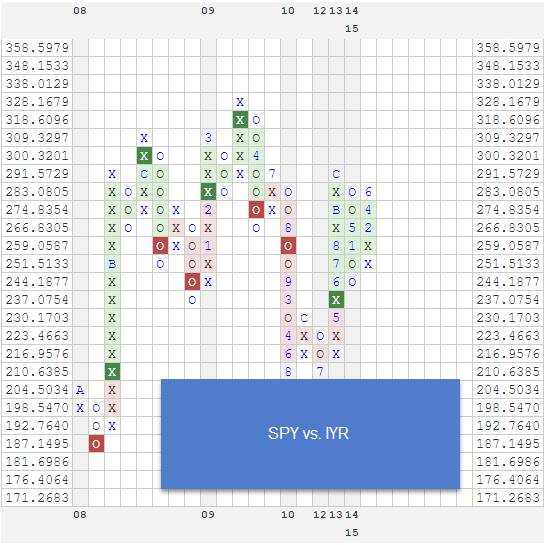

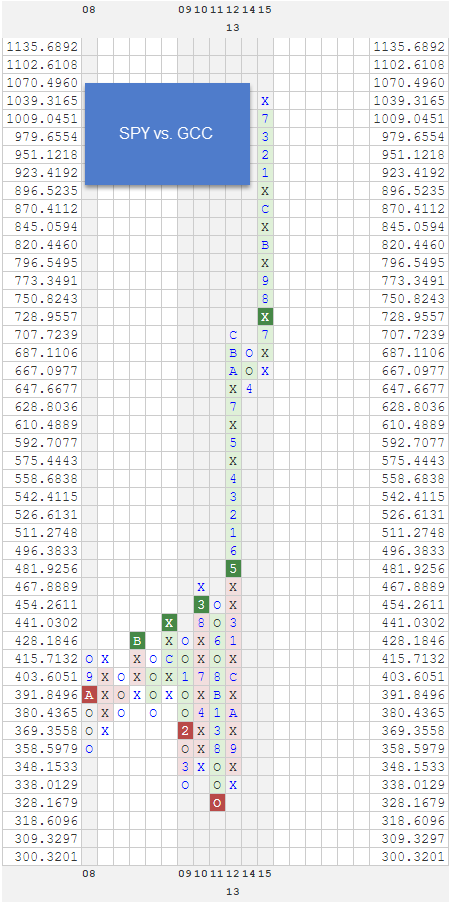

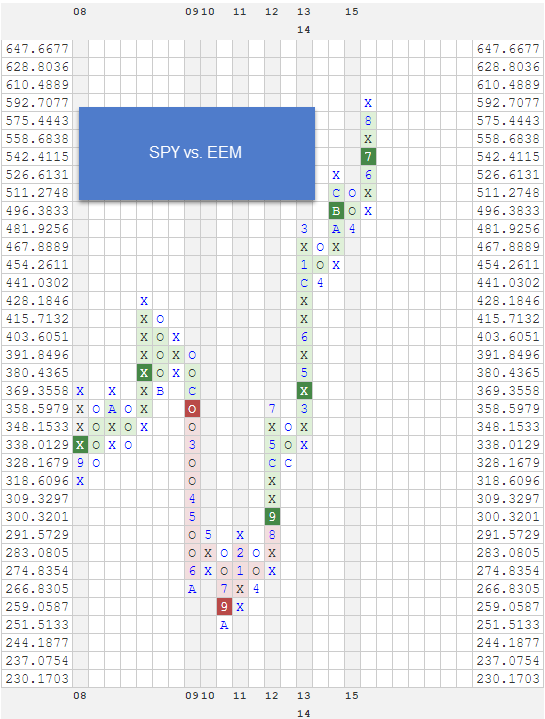

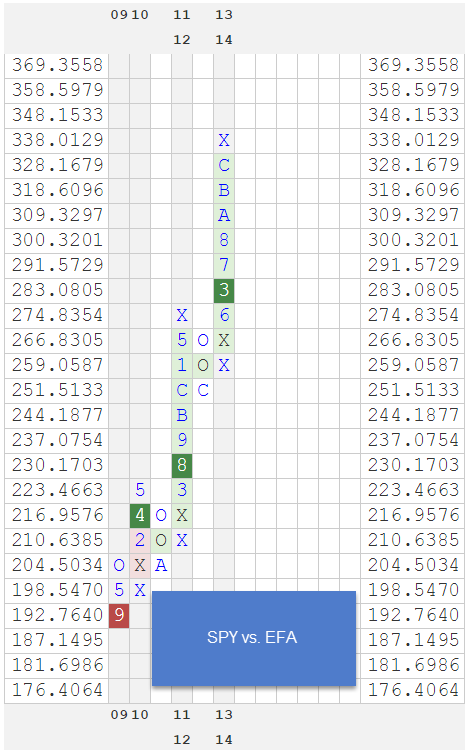

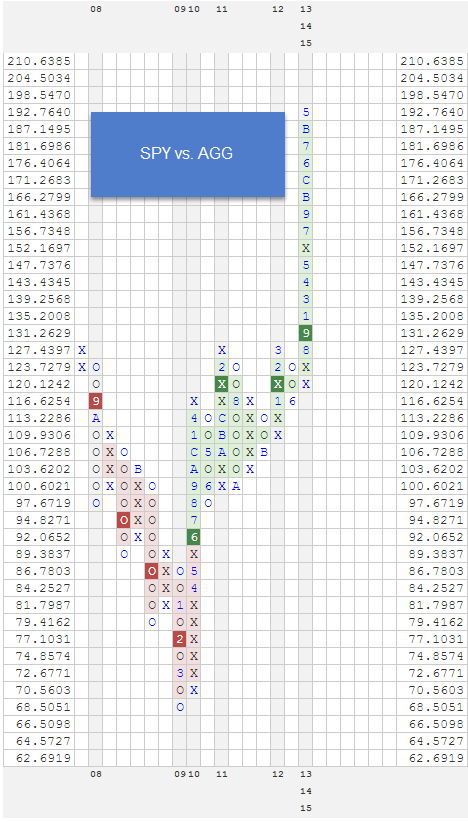

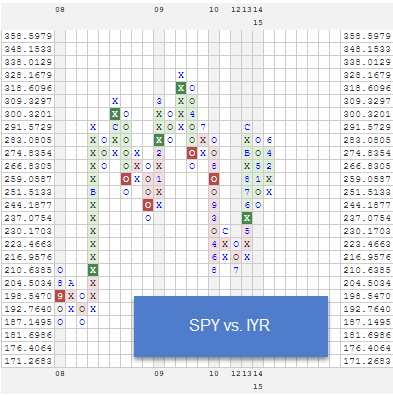

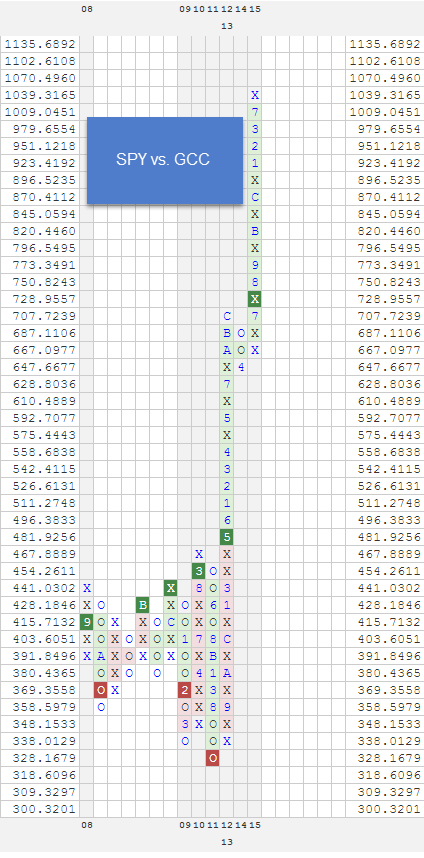

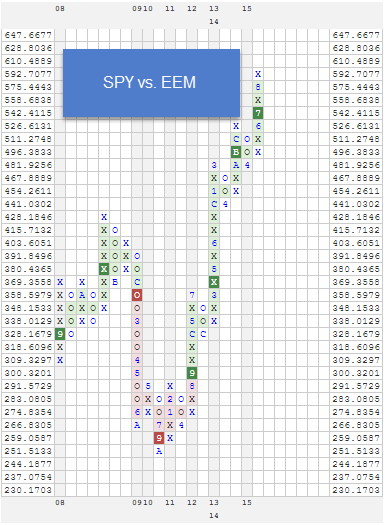

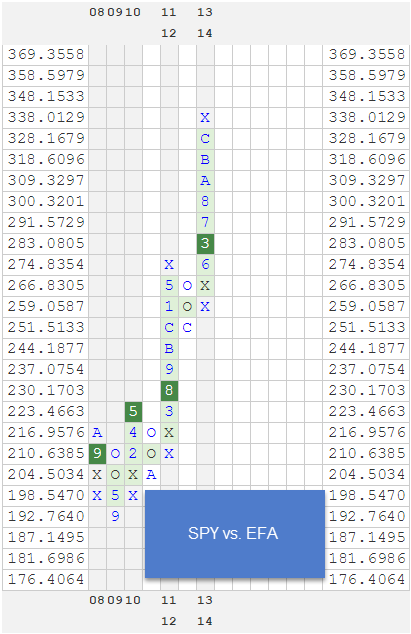

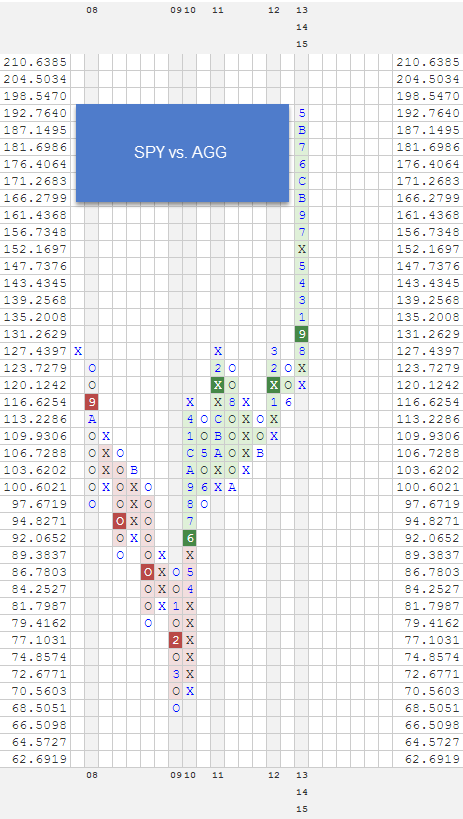

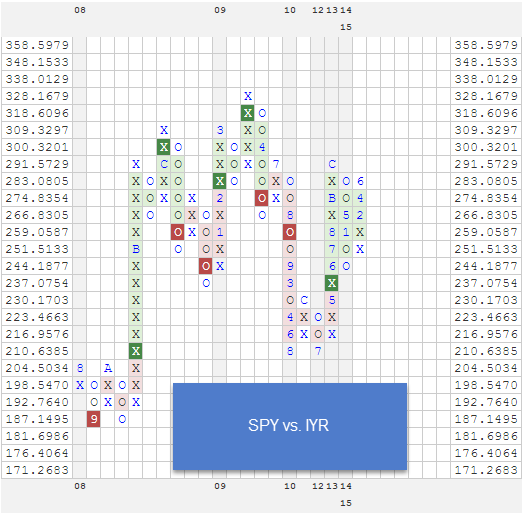

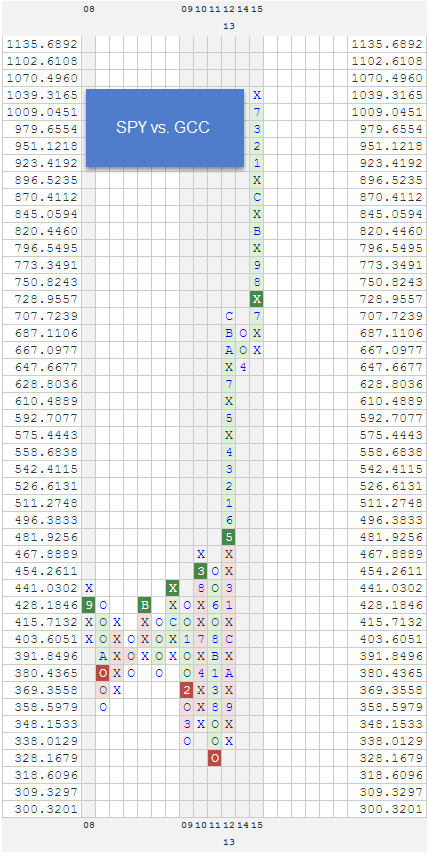

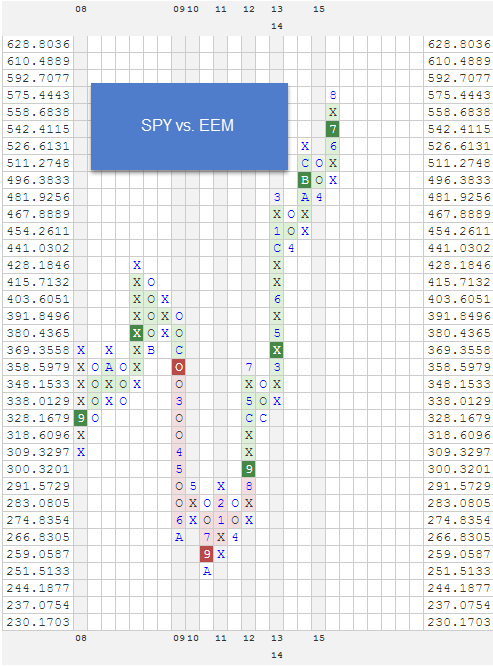

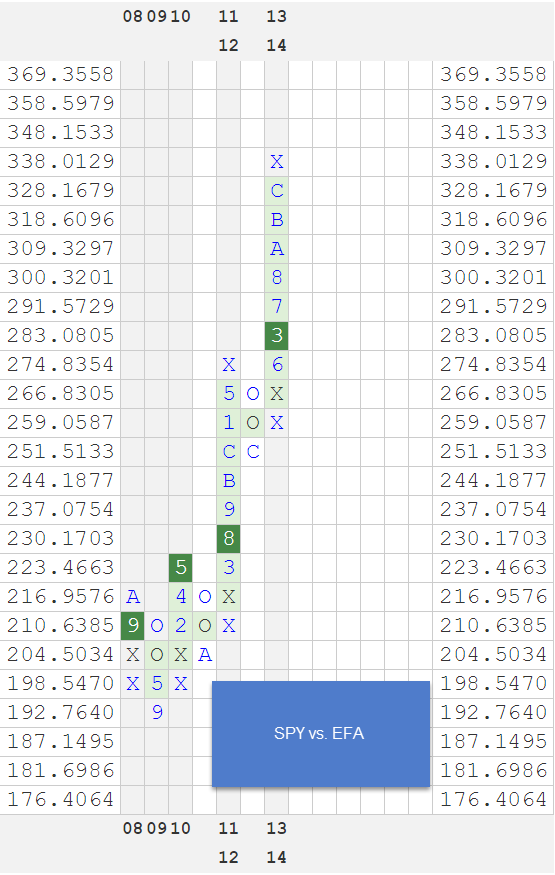

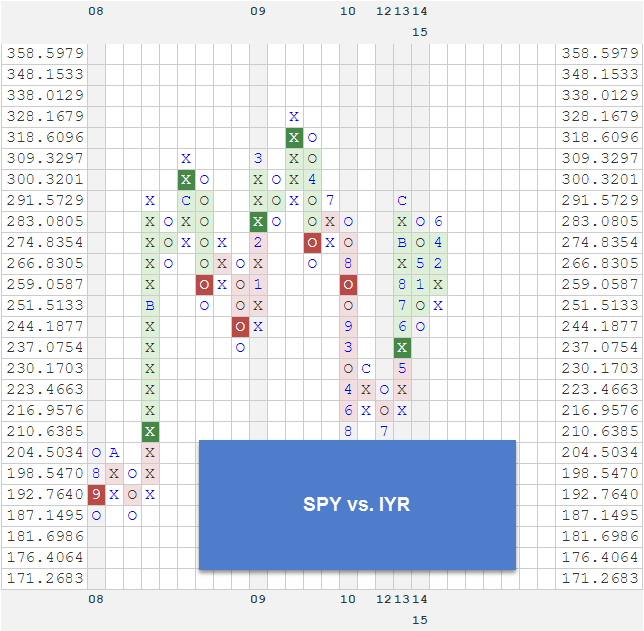

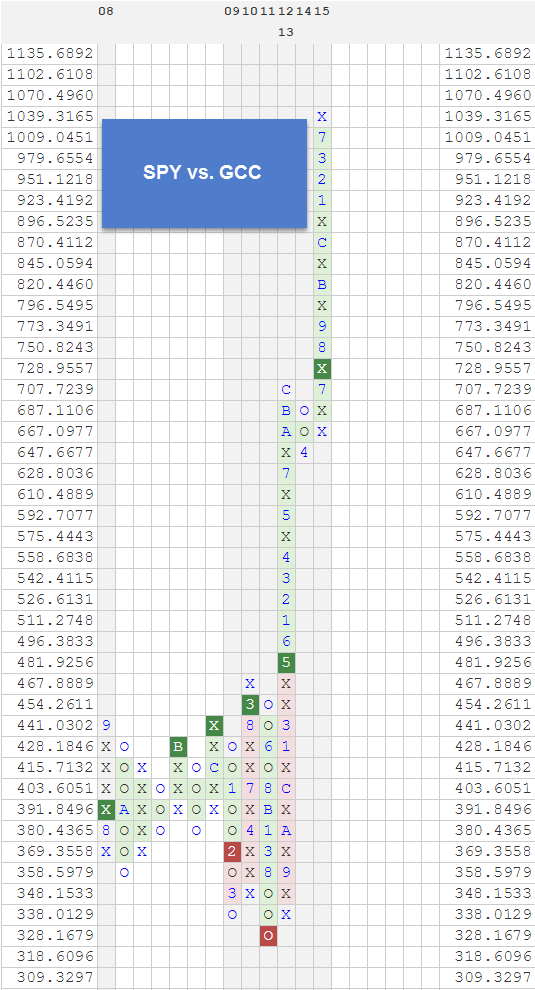

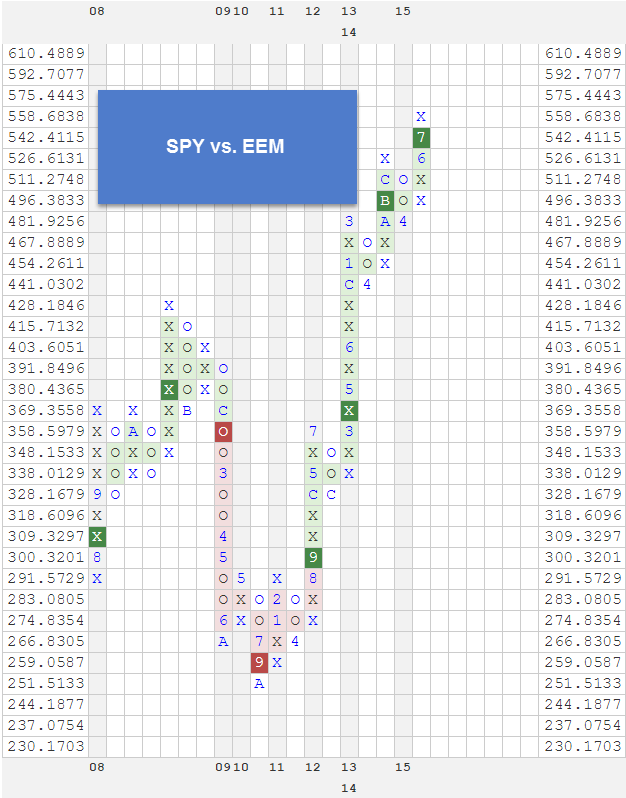

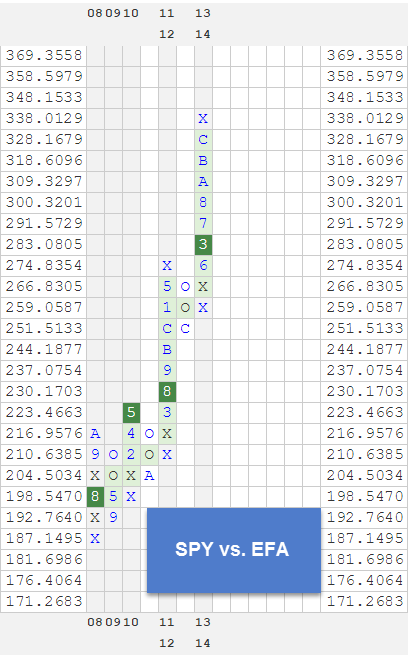

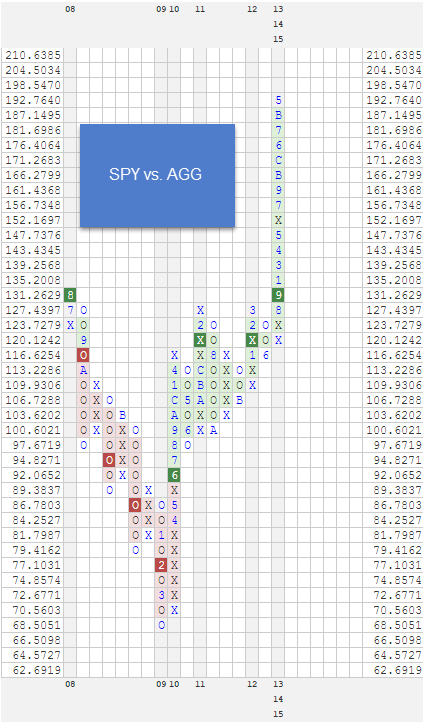

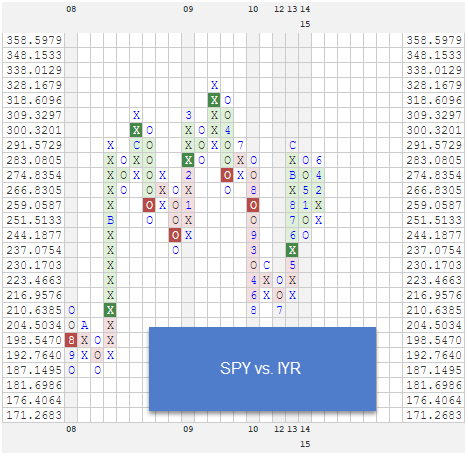

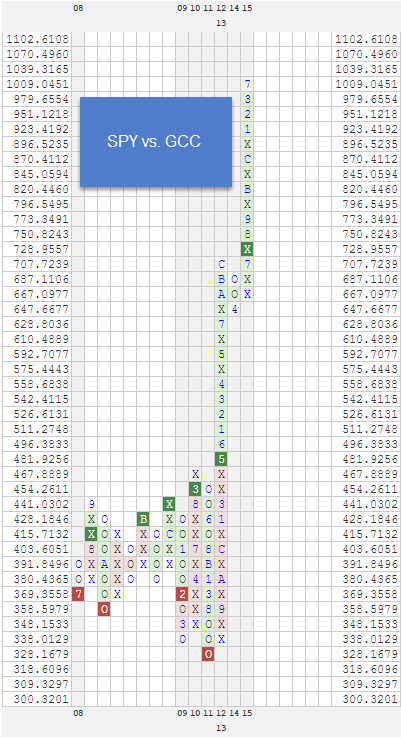

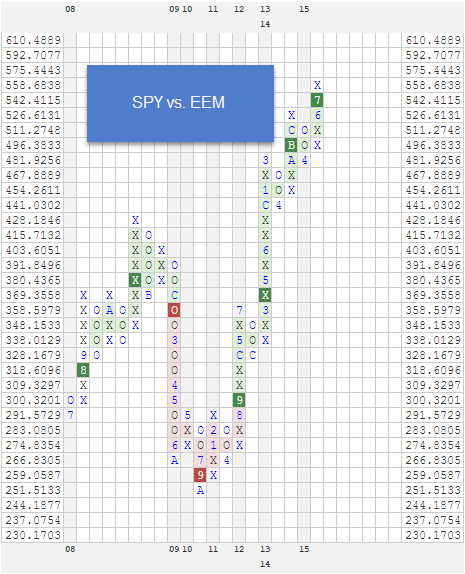

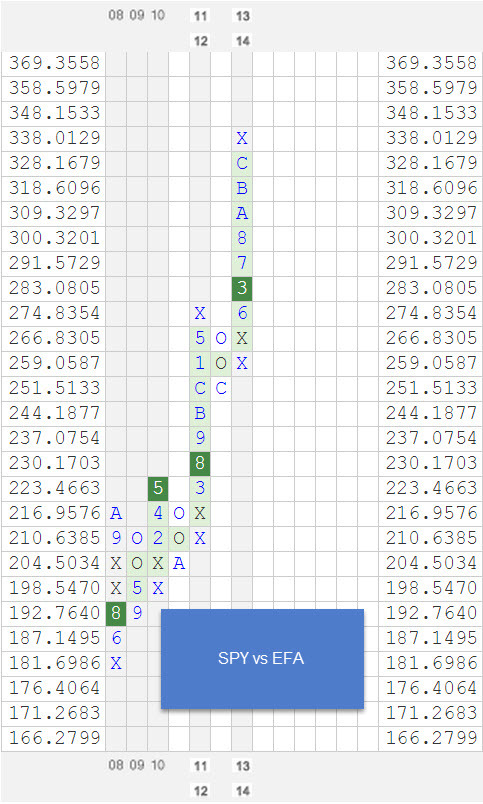

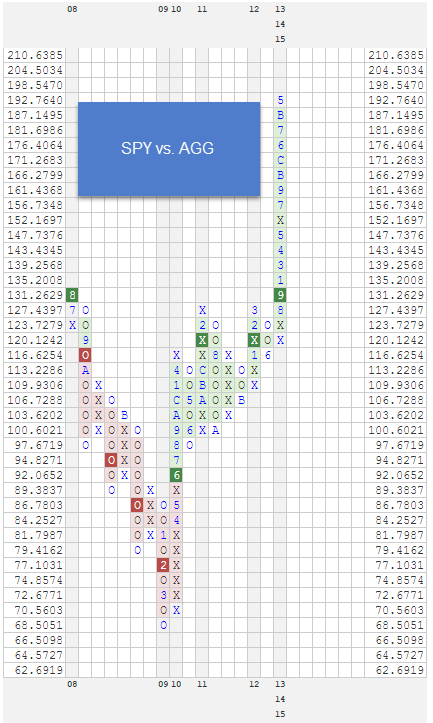

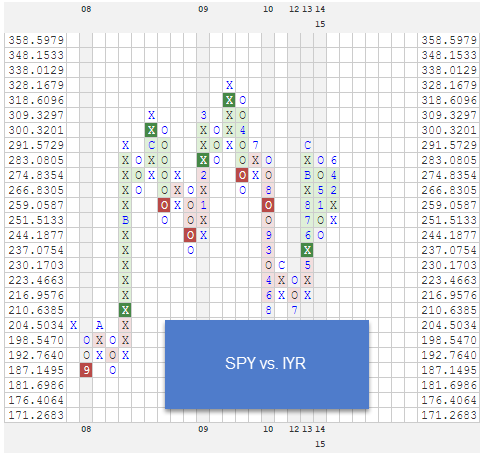

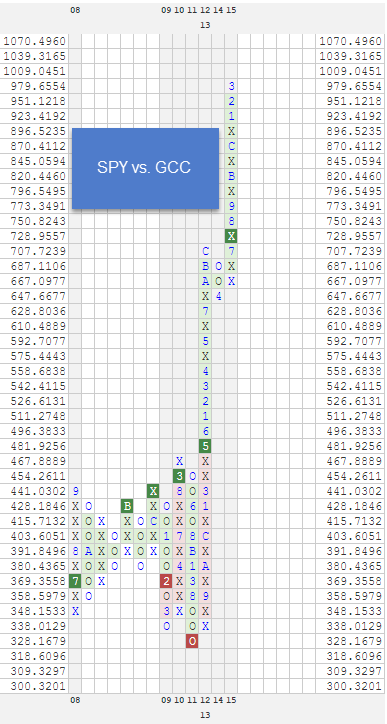

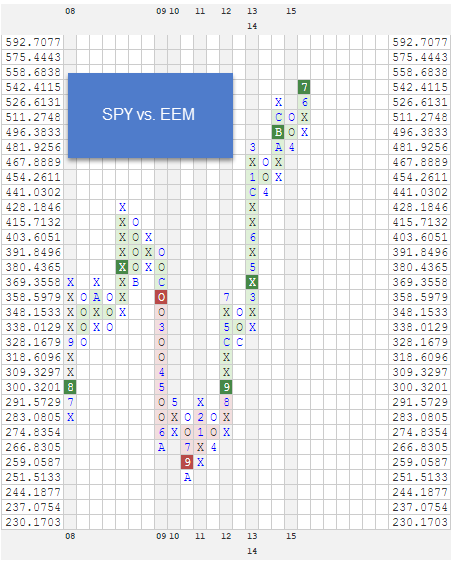

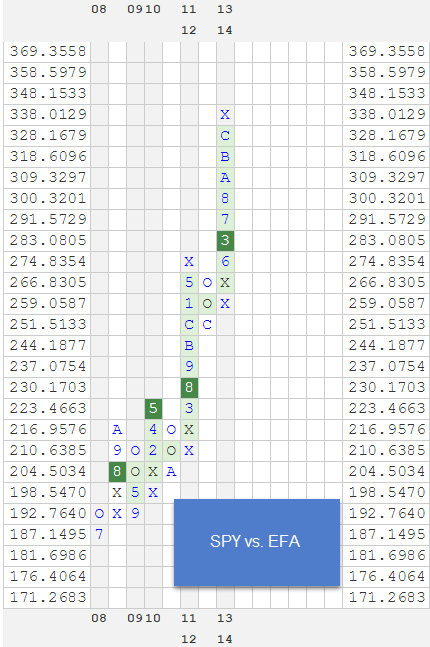

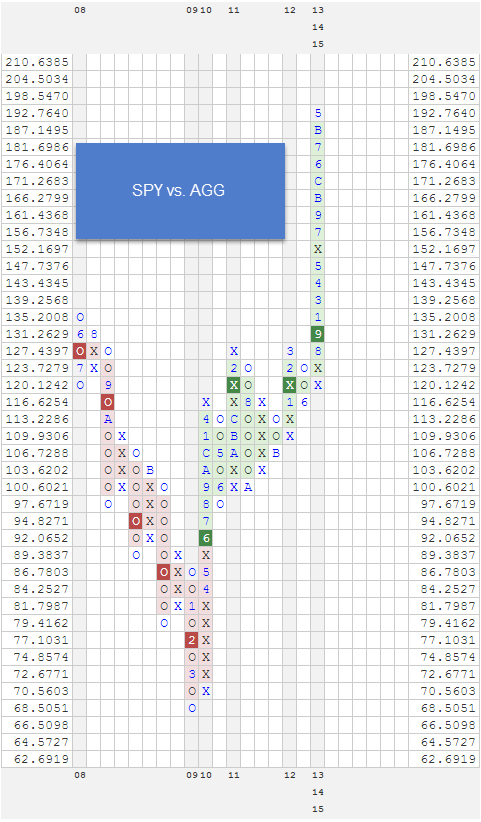

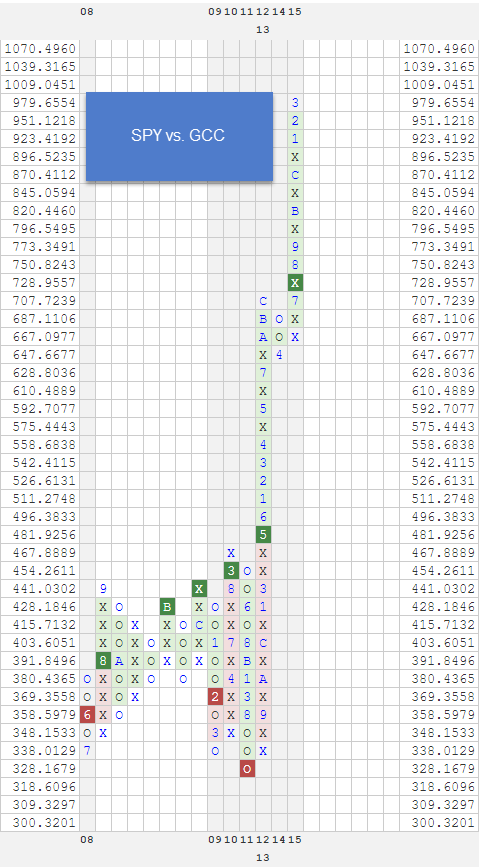

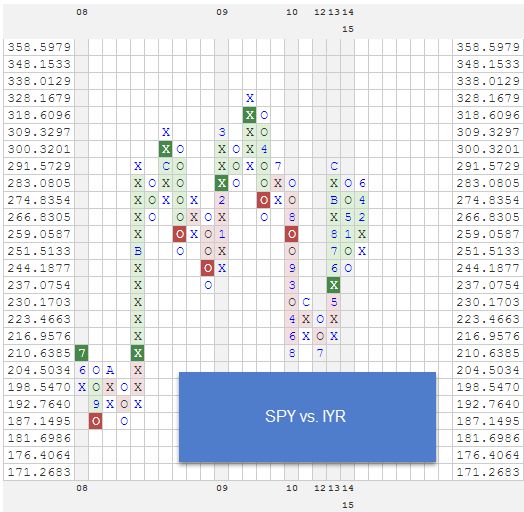

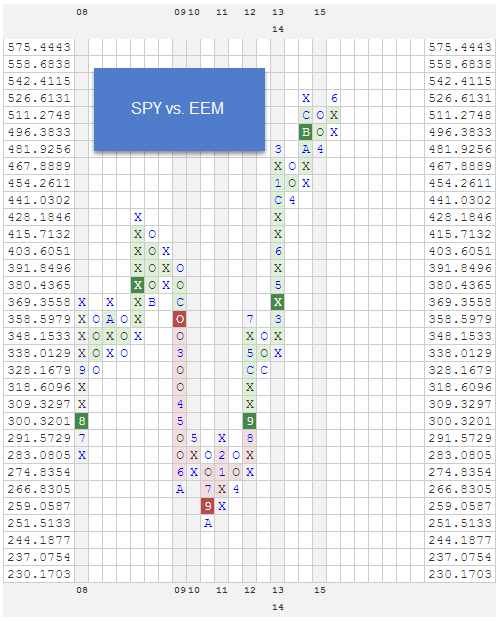

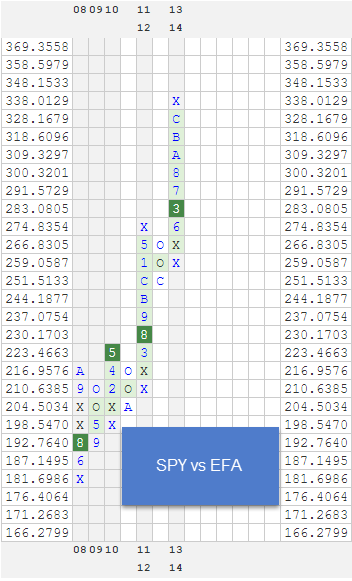

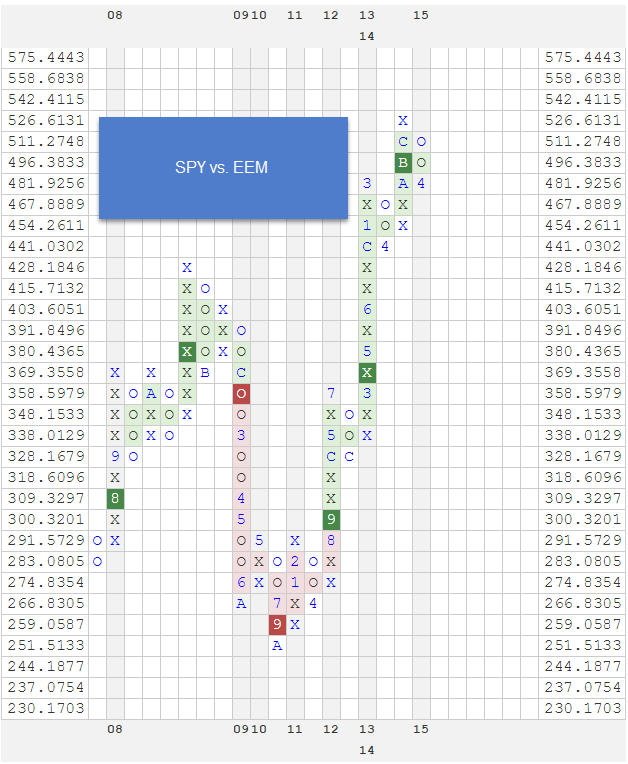

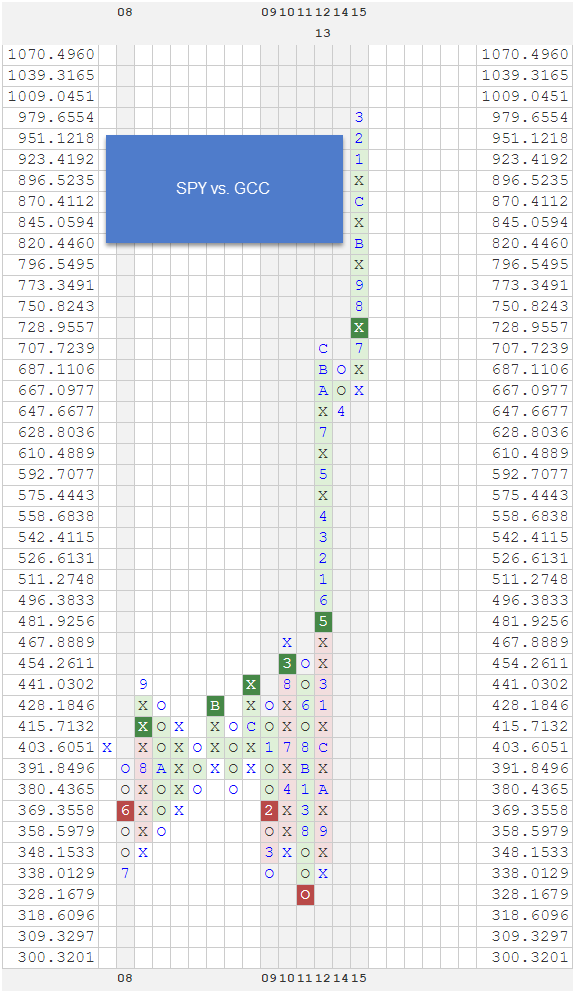

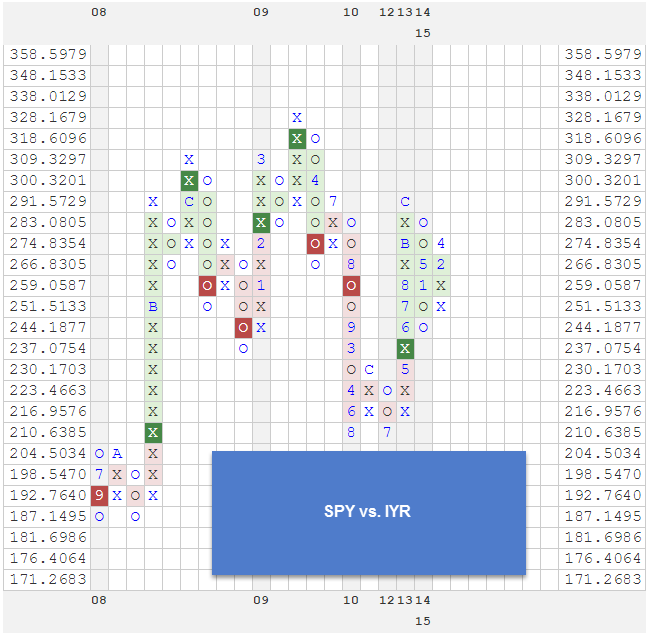

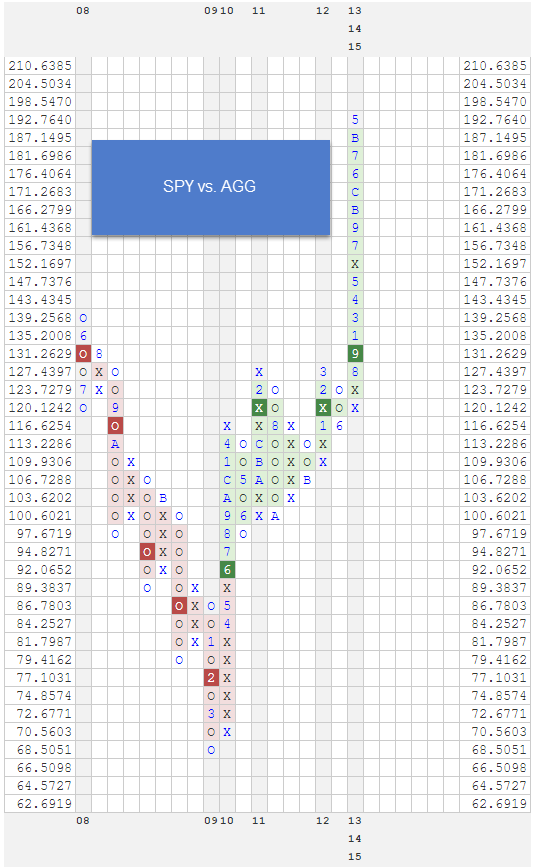

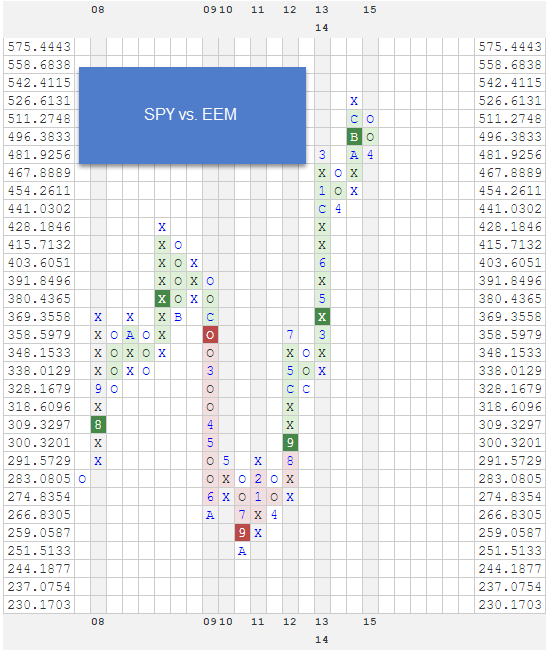

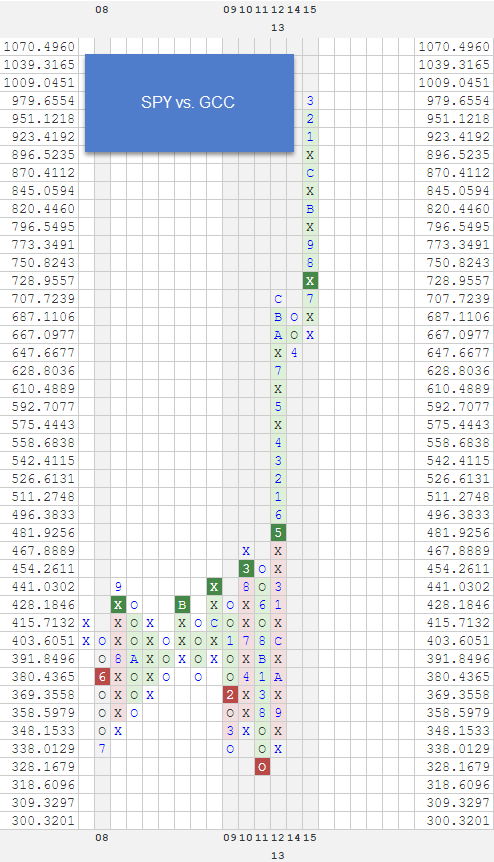

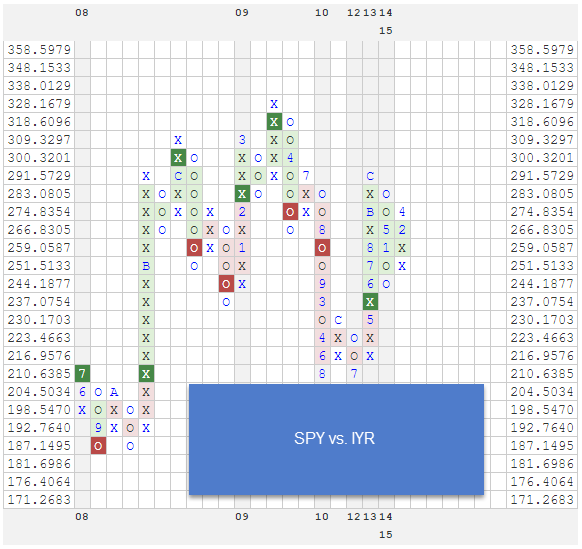

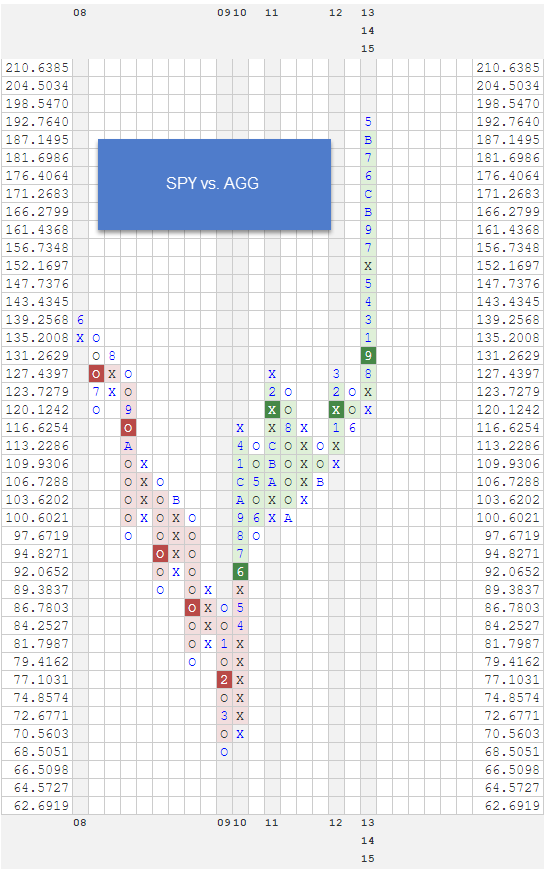

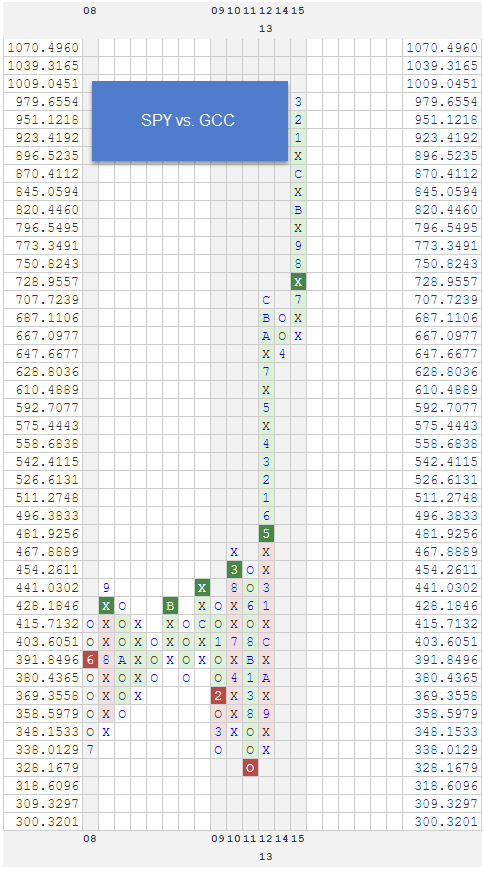

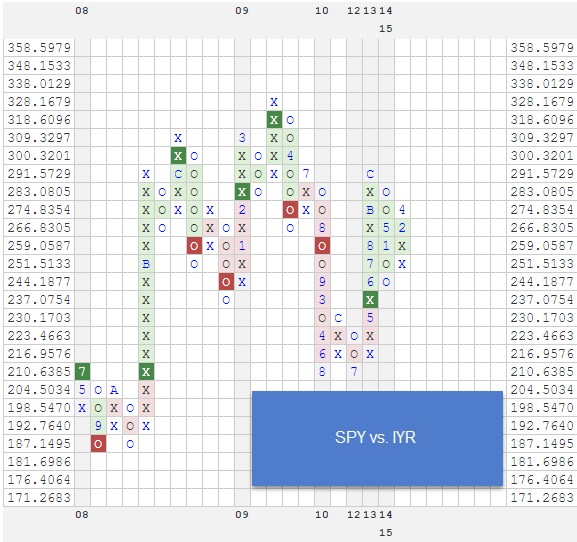

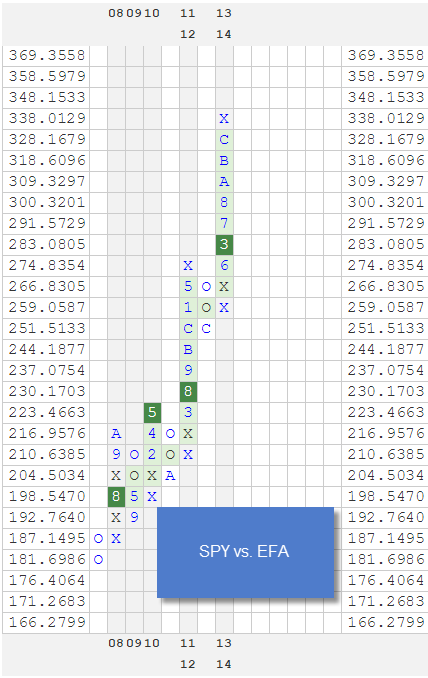

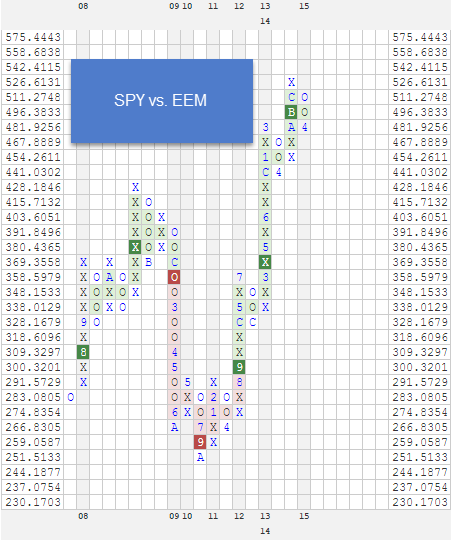

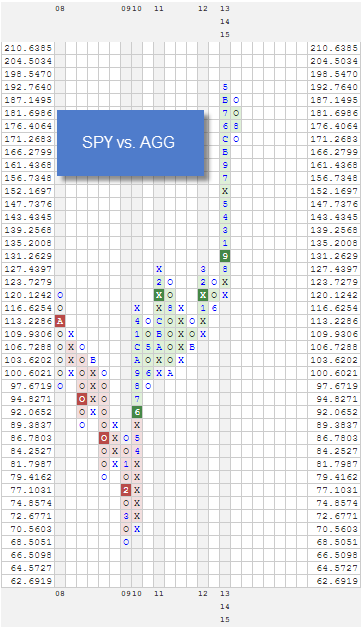

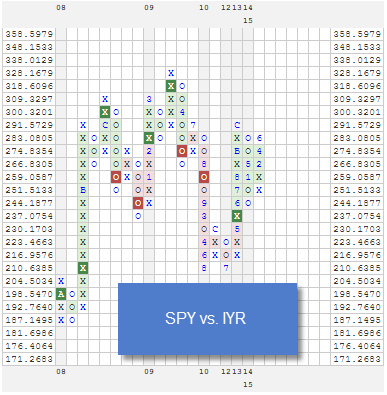

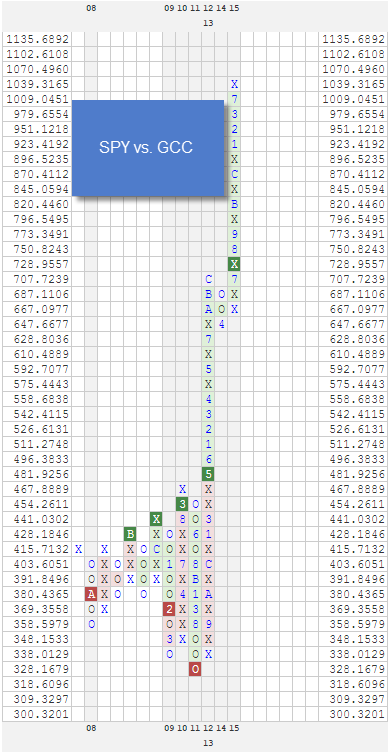

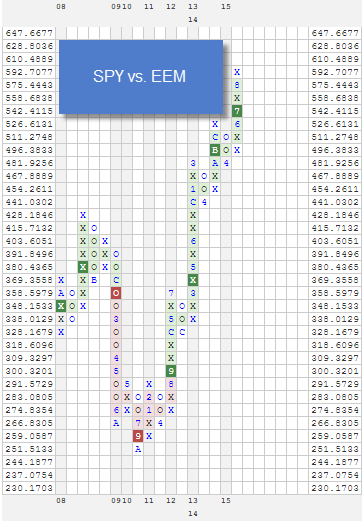

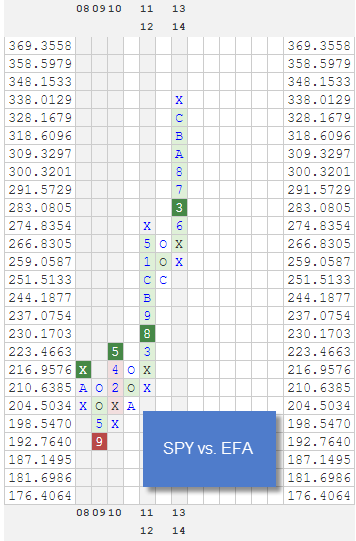

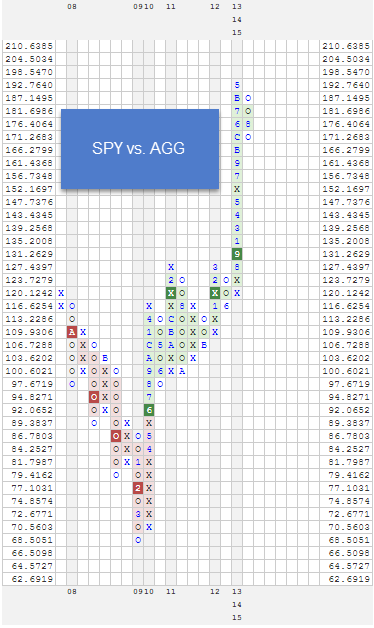

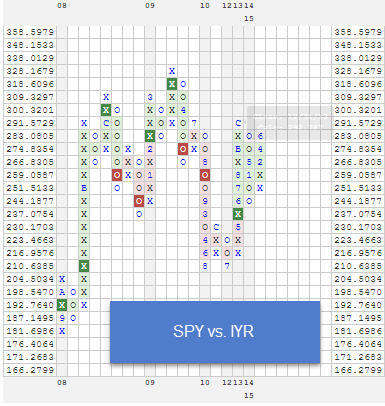

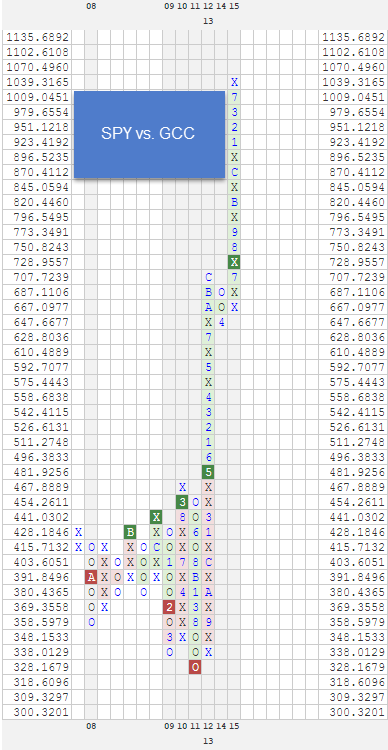

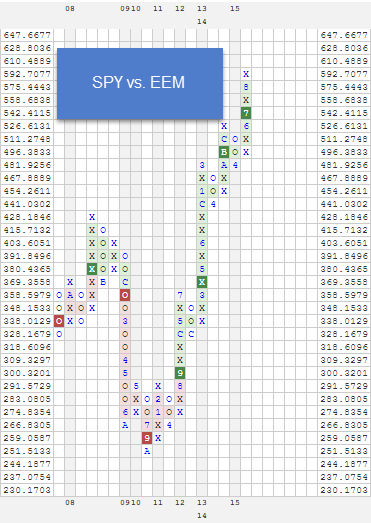

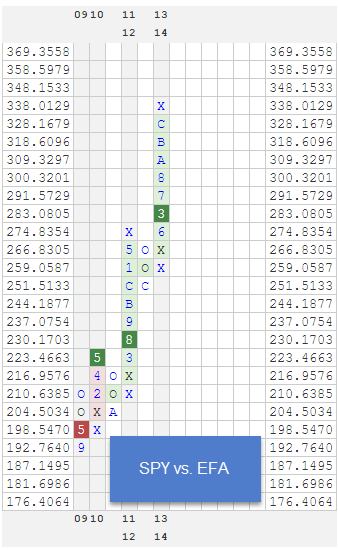

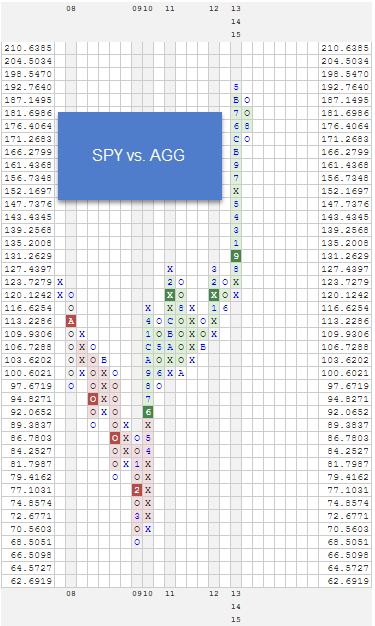

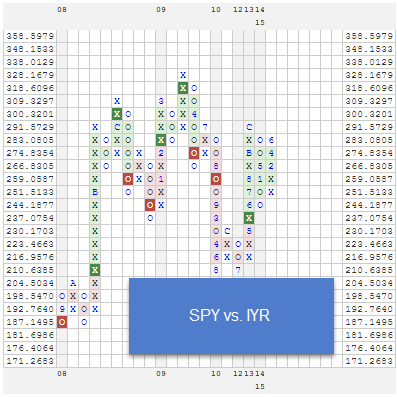

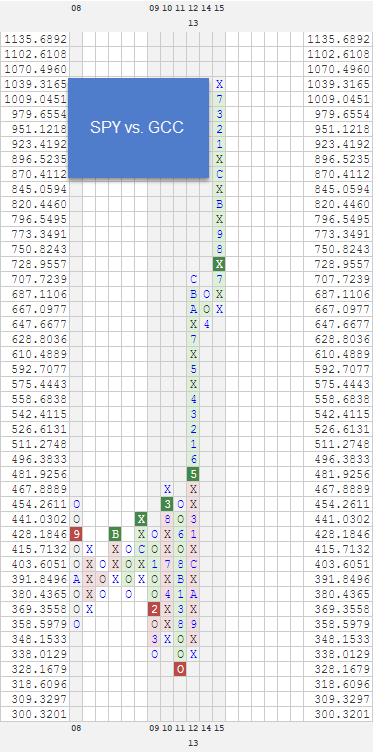

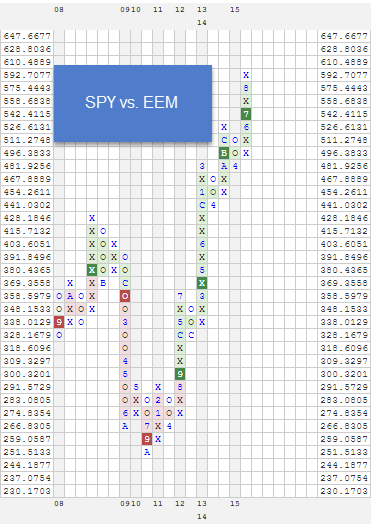

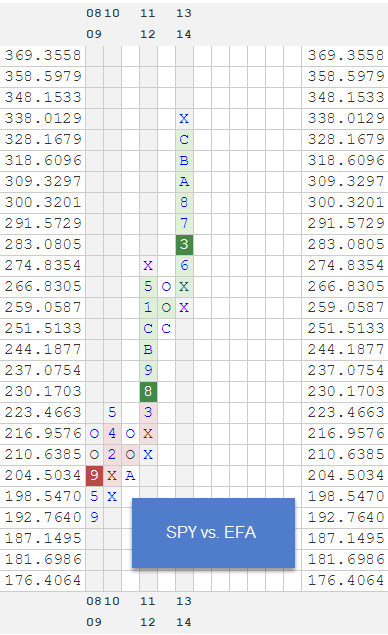

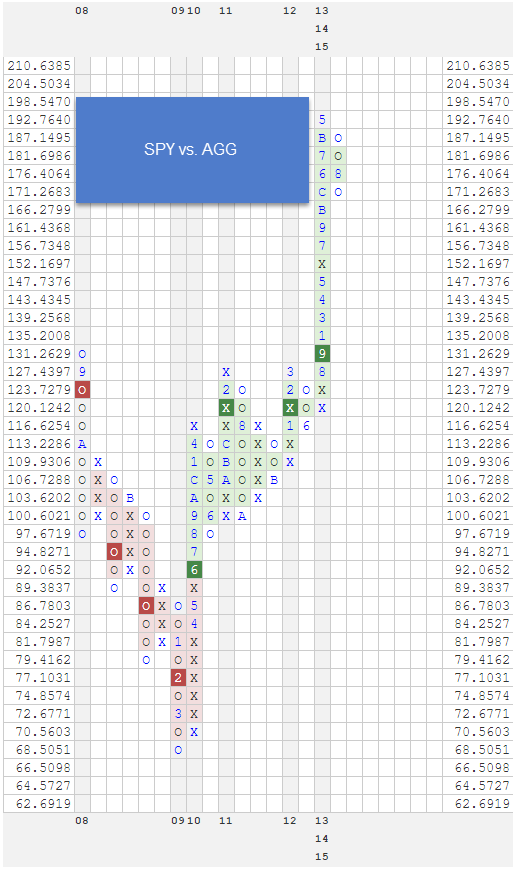

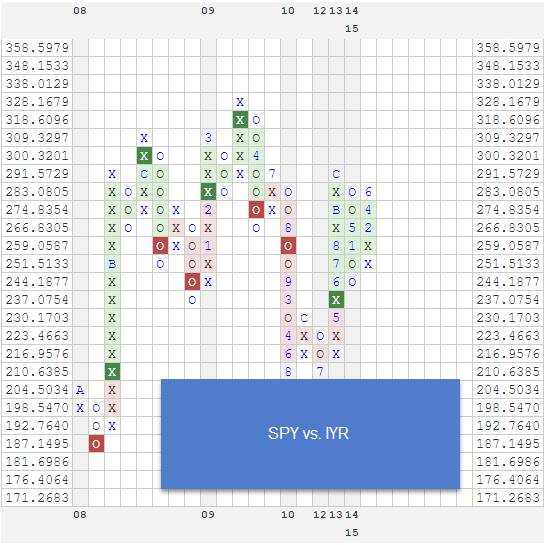

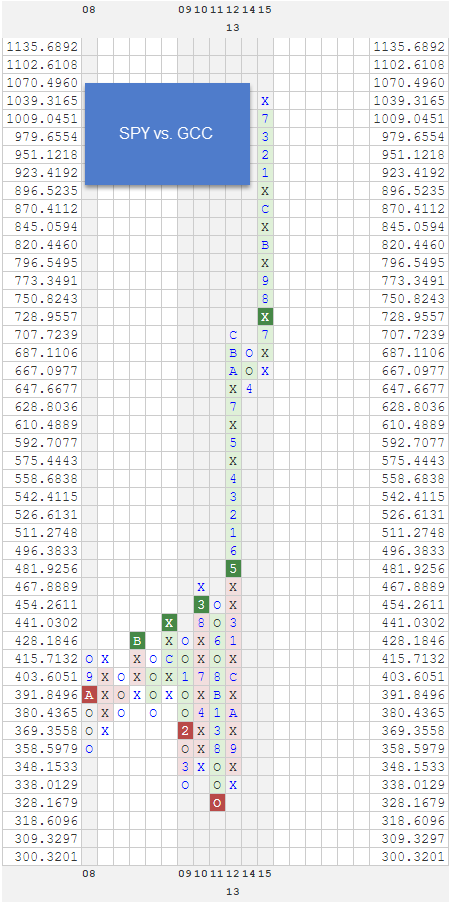

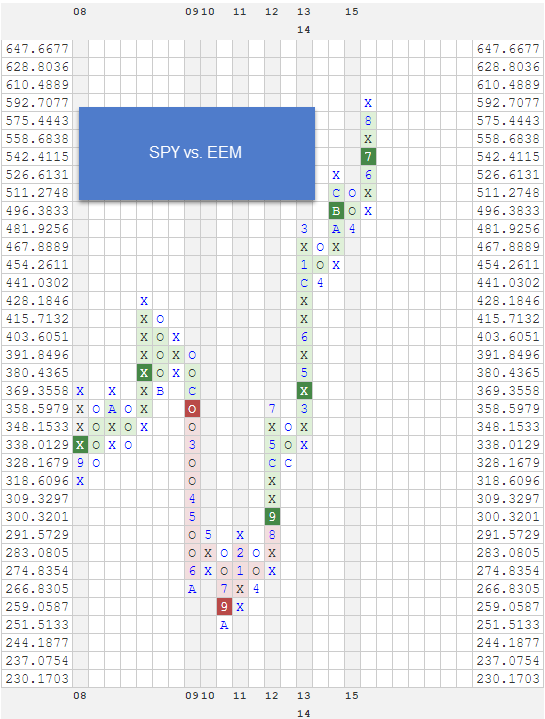

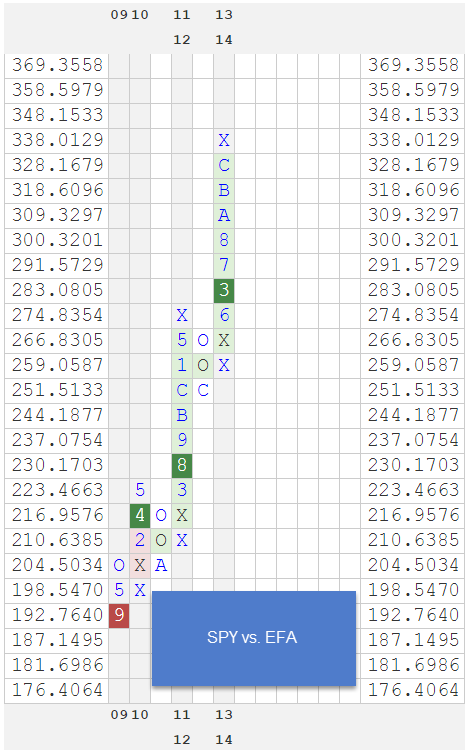

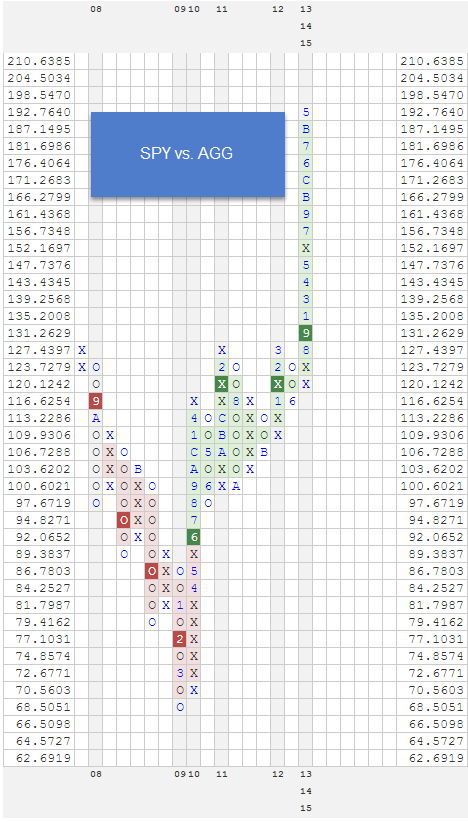

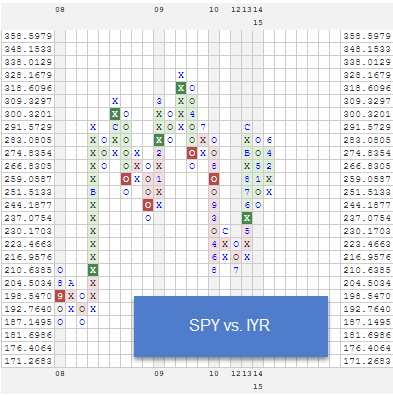

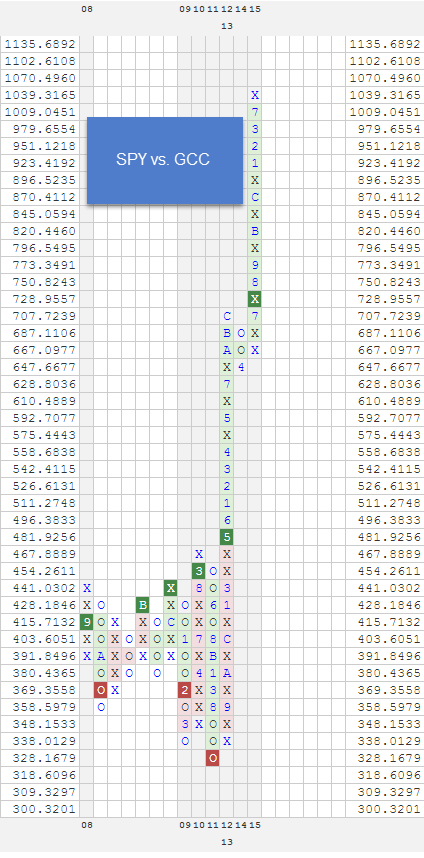

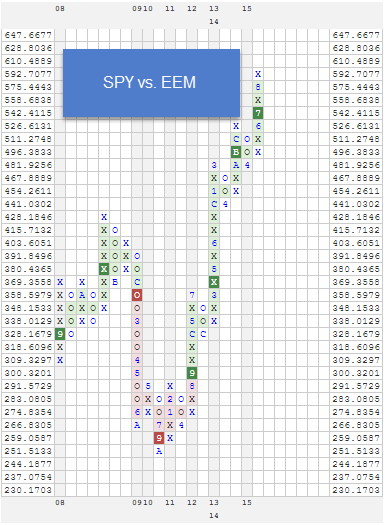

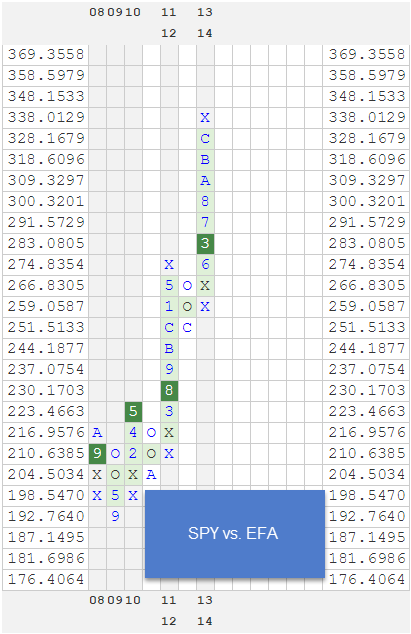

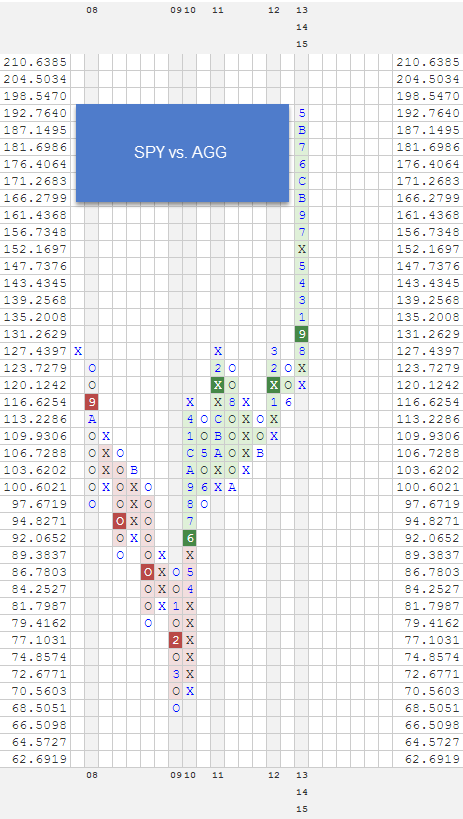

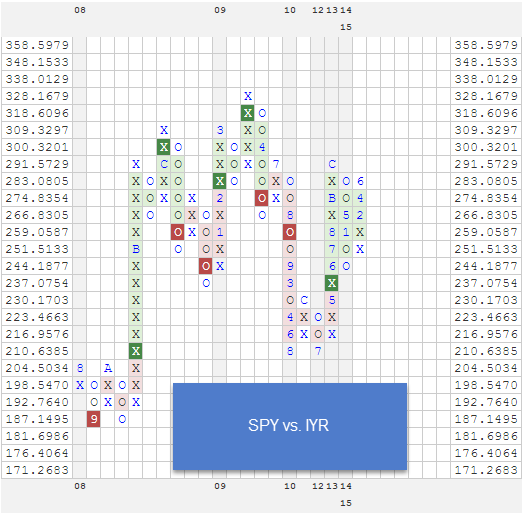

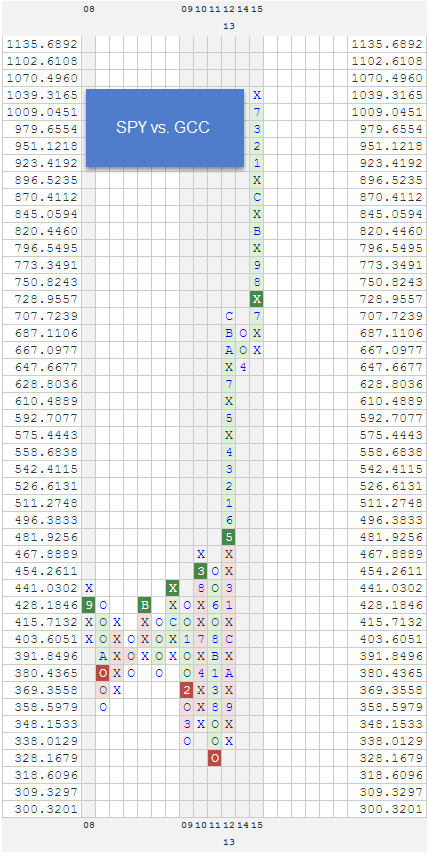

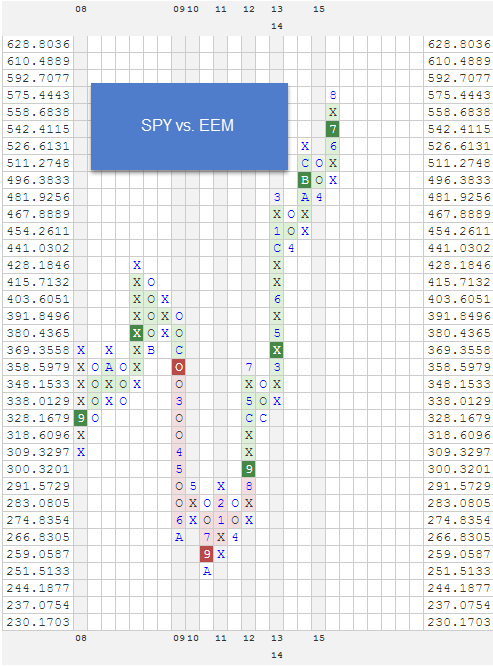

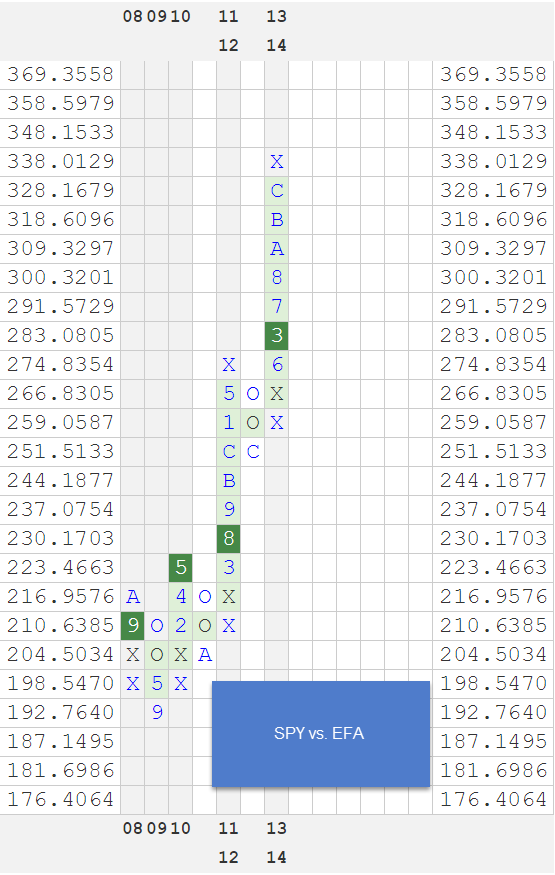

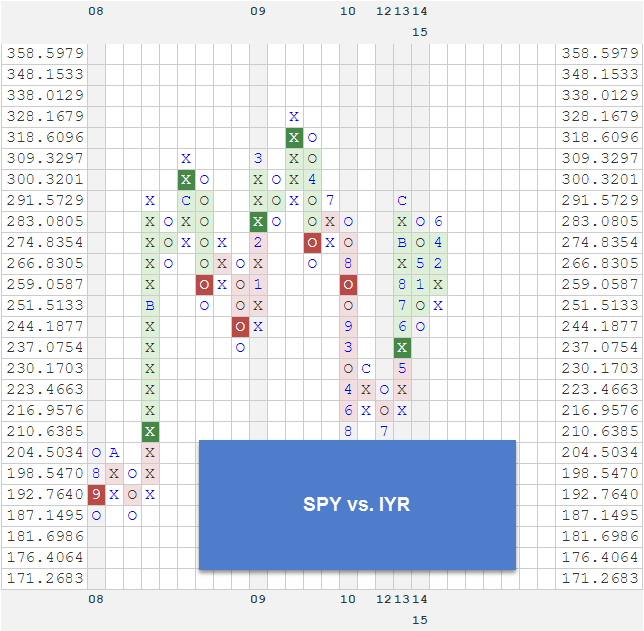

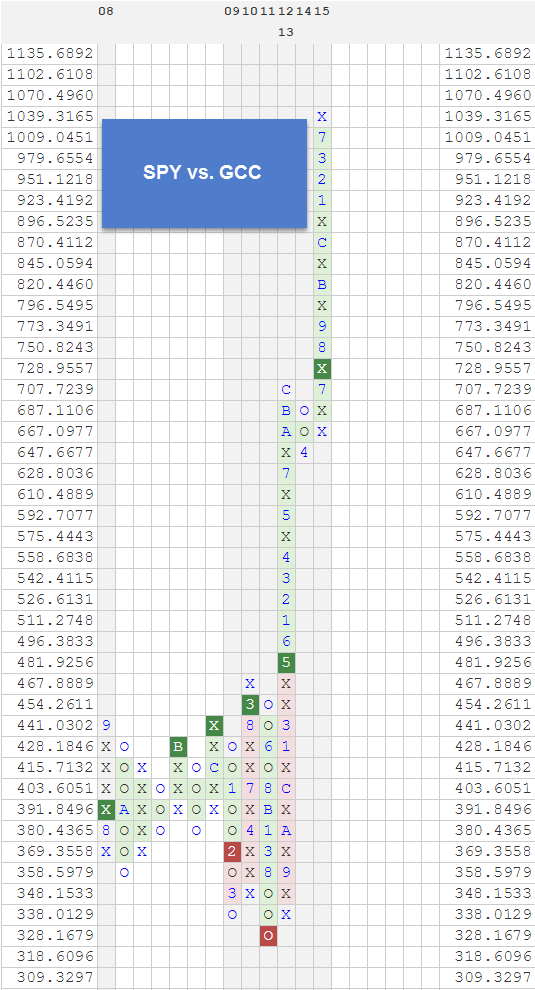

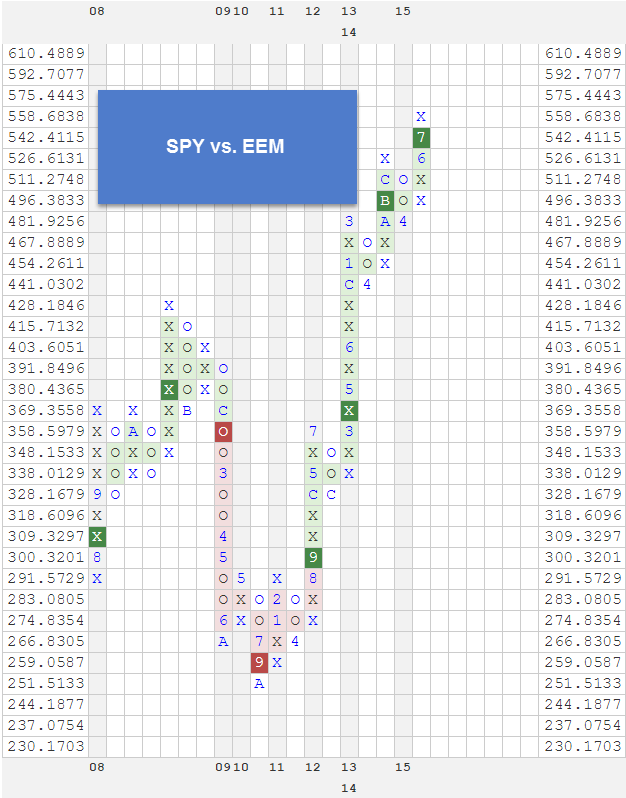

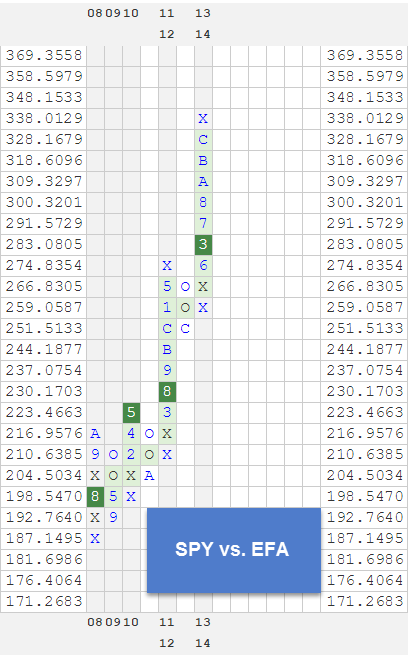

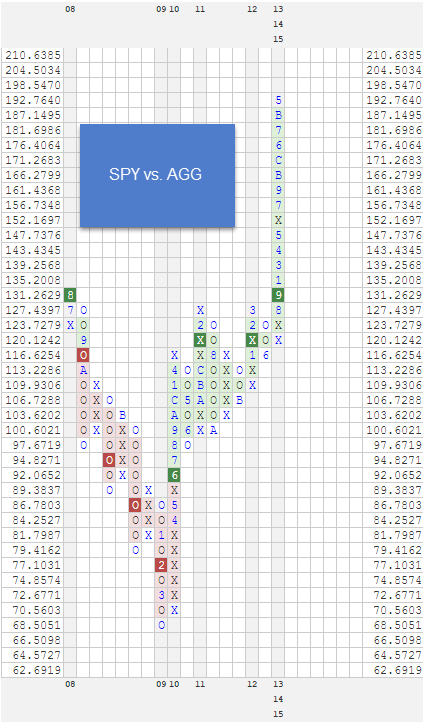

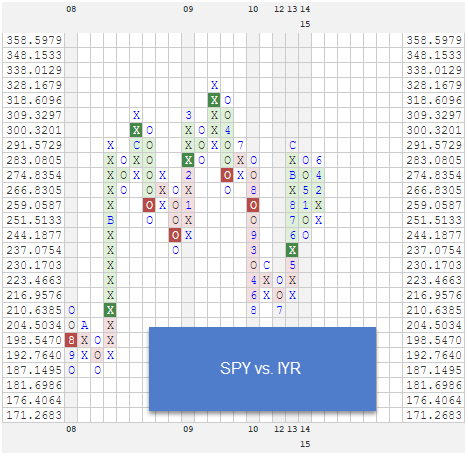

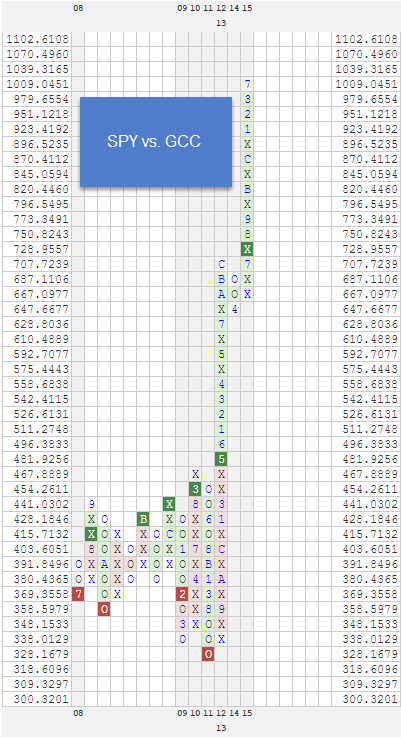

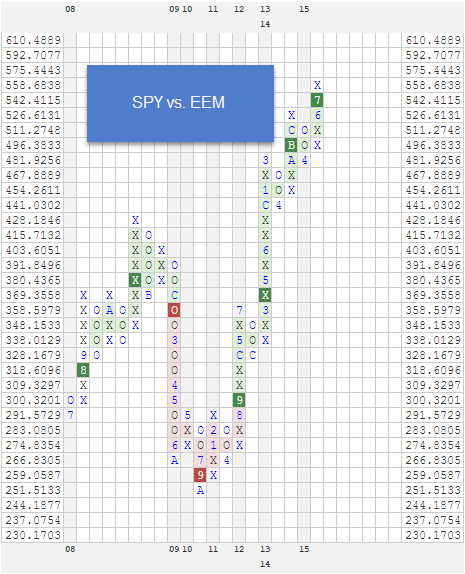

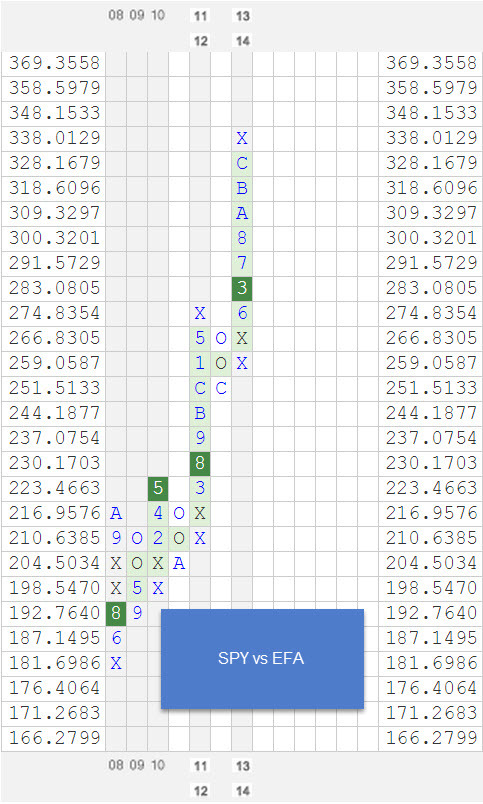

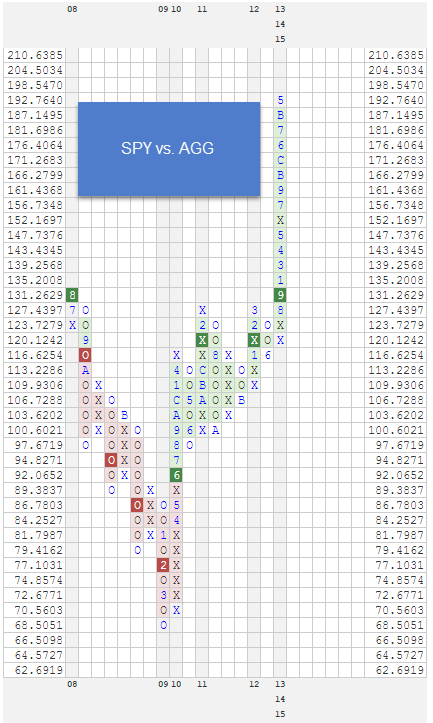

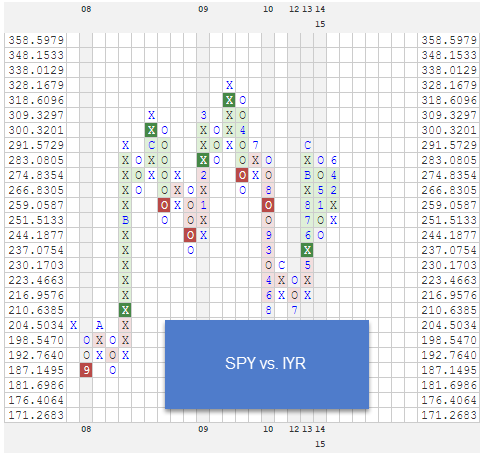

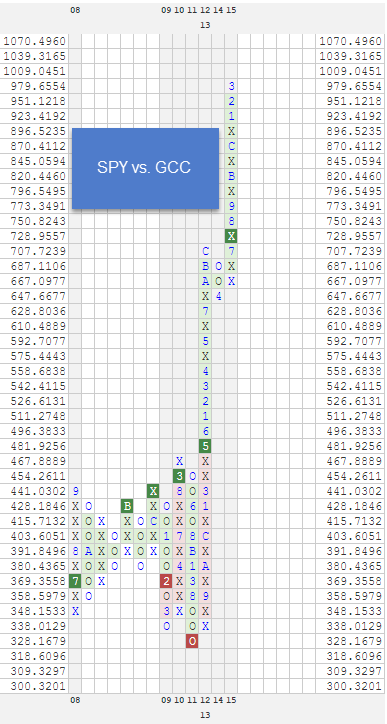

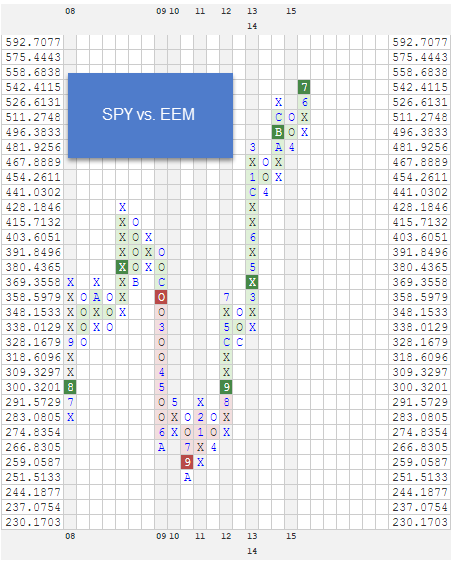

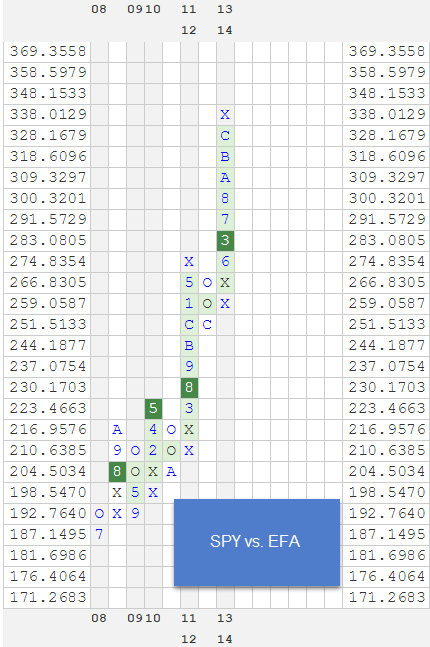

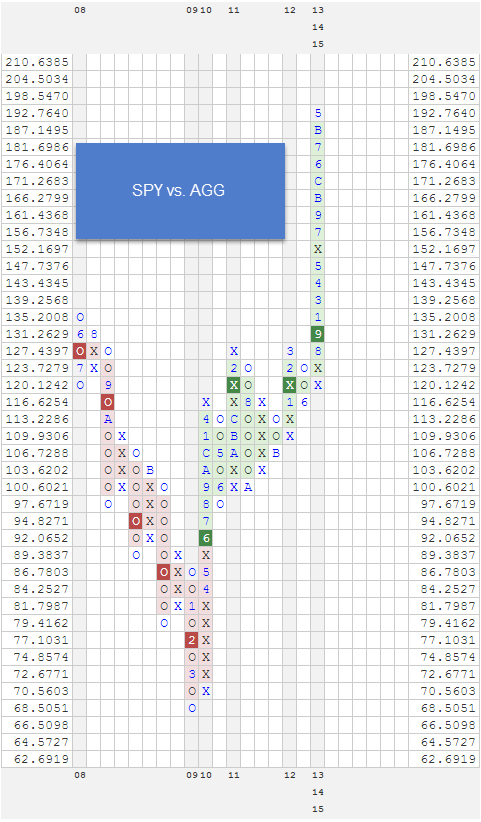

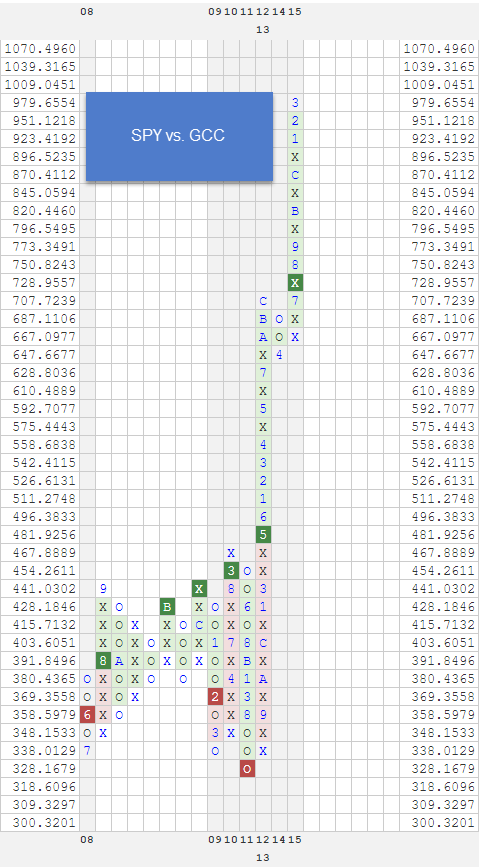

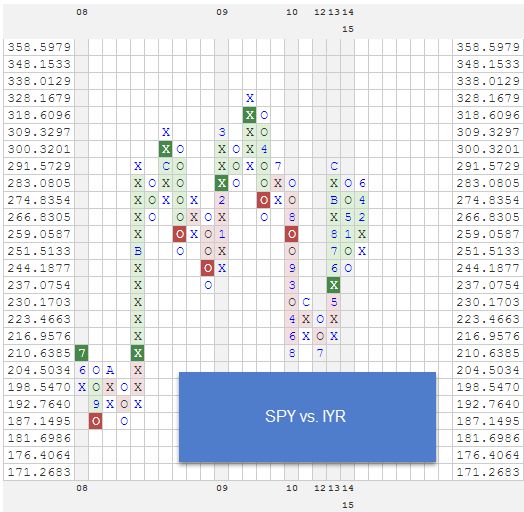

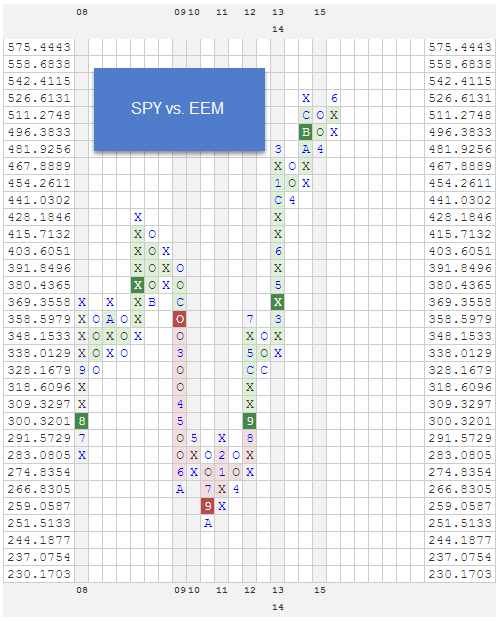

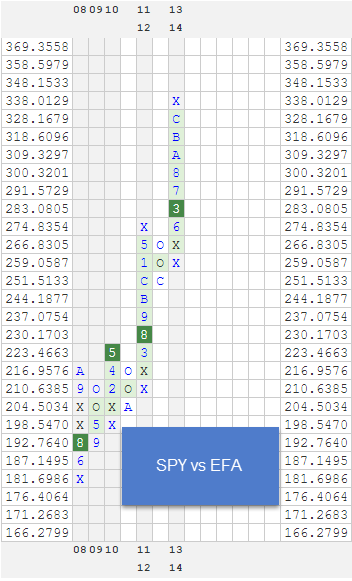

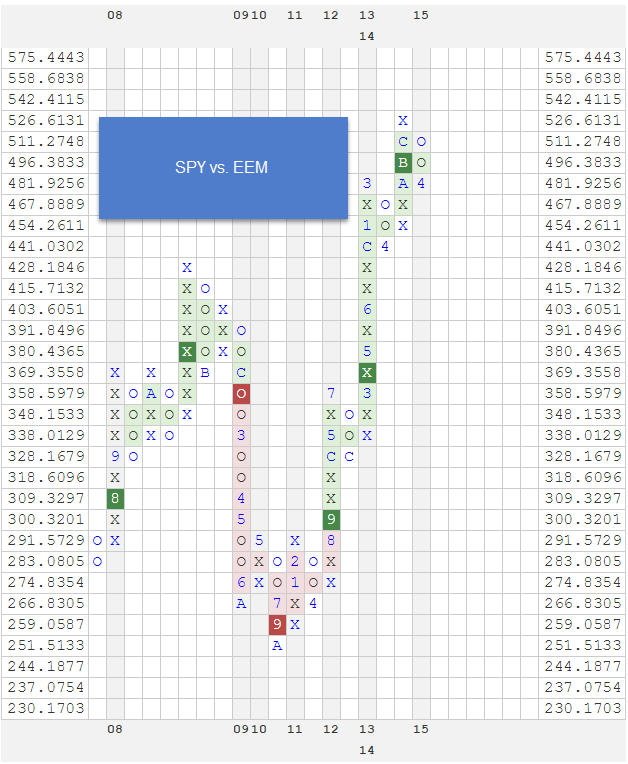

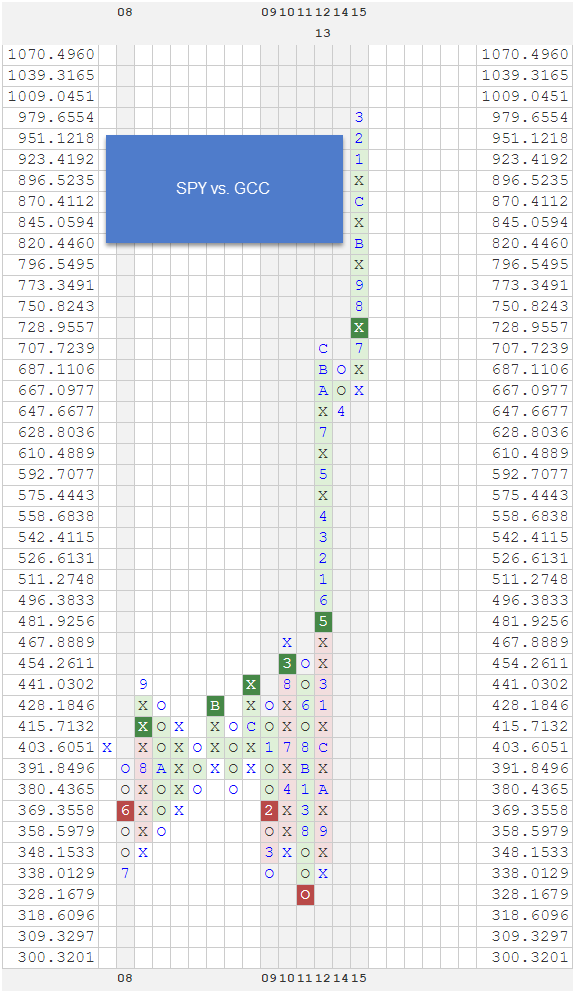

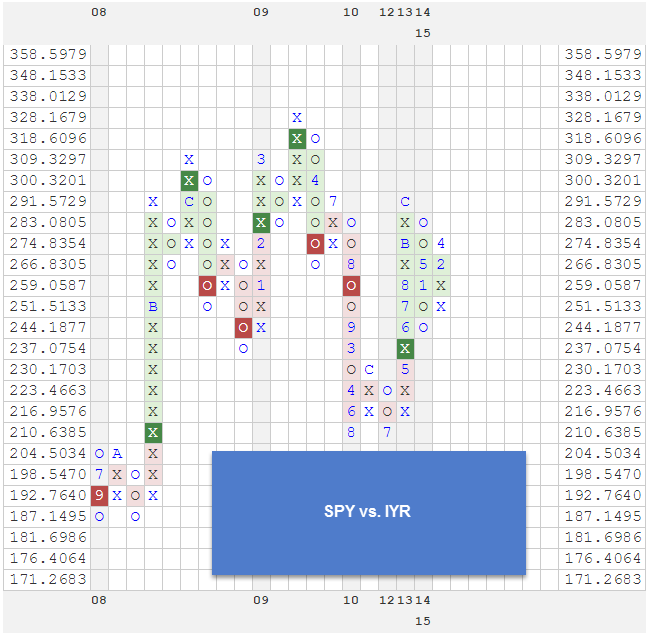

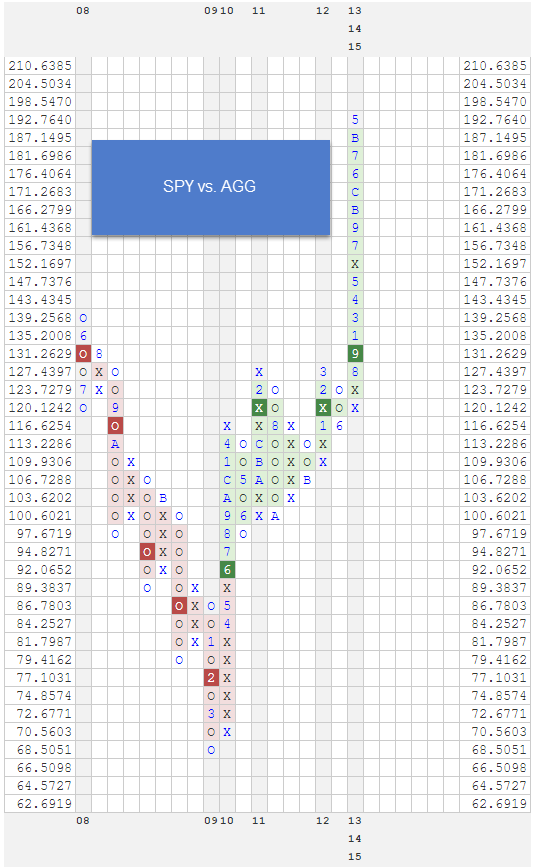

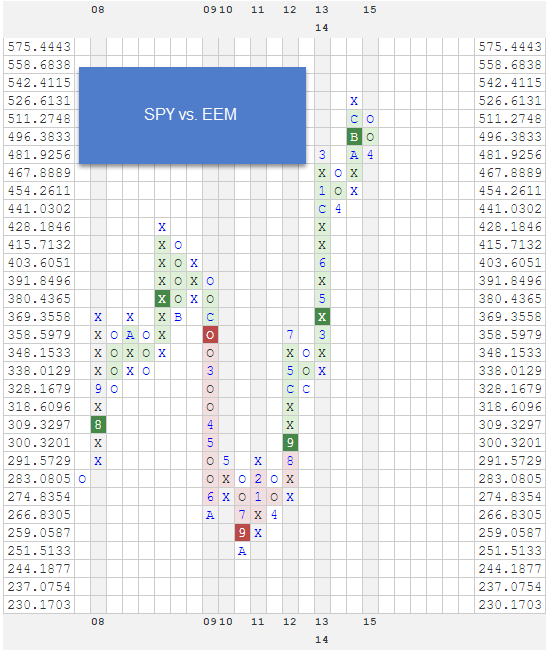

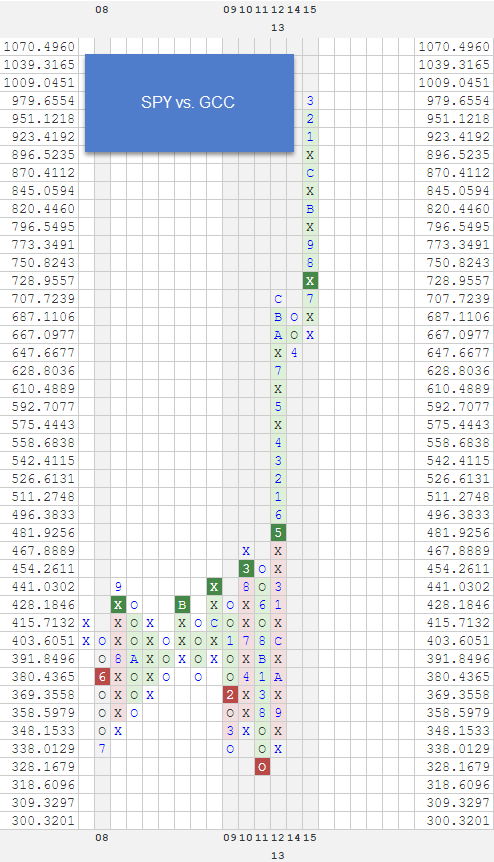

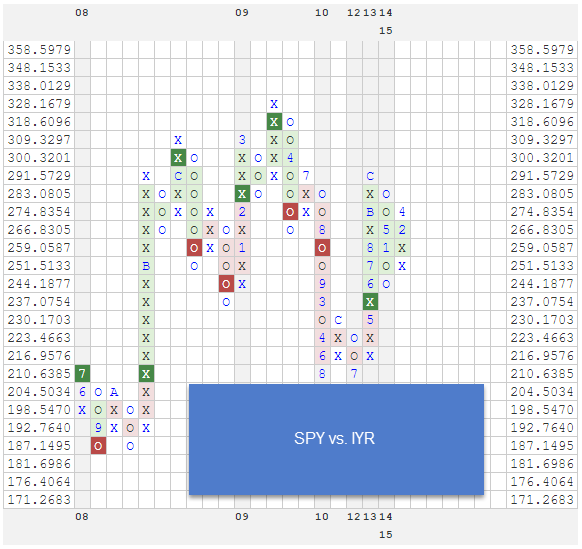

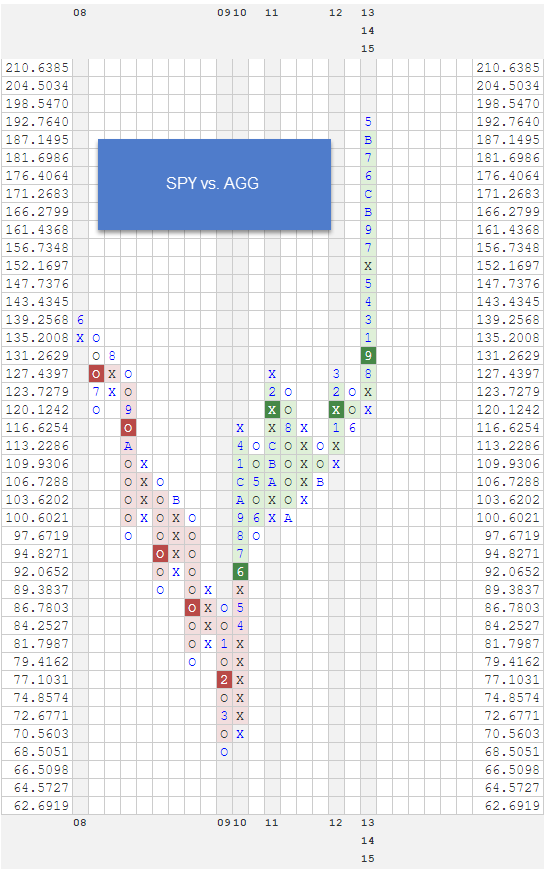

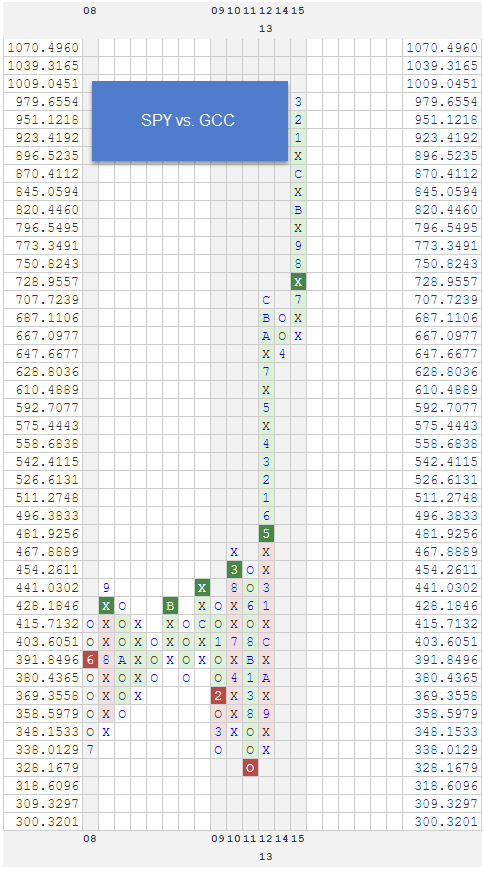

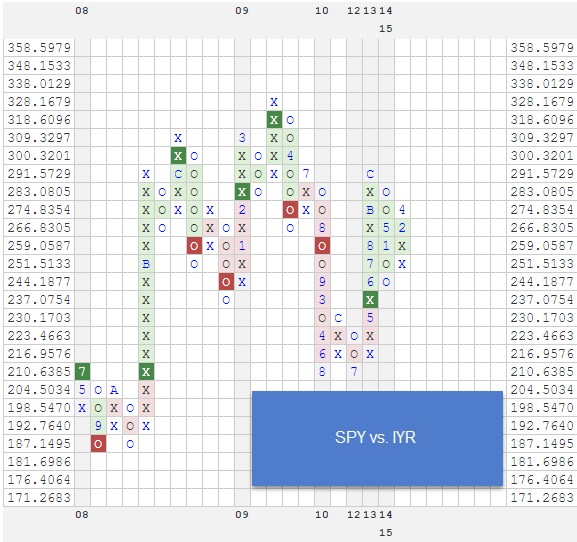

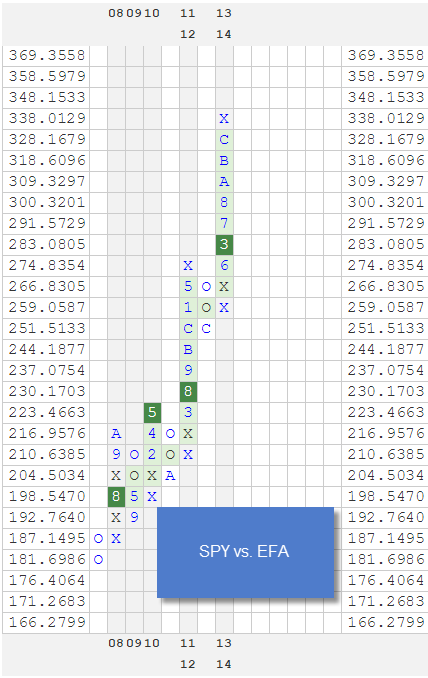

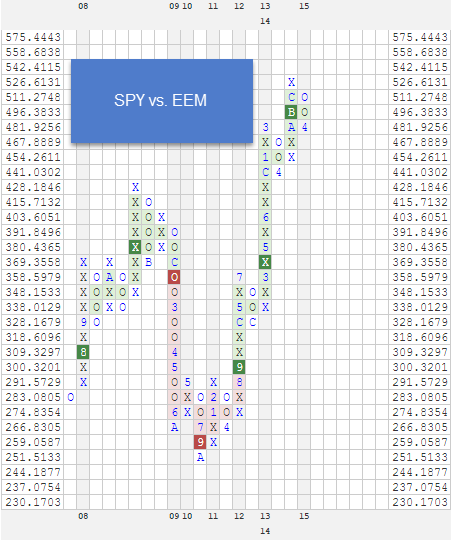

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

1 Comment |

1 Comment |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

September 18, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

3 Comments |

3 Comments |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

September 11, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

Leave a Comment » |

Leave a Comment » |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

August 28, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

Leave a Comment » |

Leave a Comment » |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

August 21, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

1 Comment |

1 Comment |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

August 14, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

Leave a Comment » |

Leave a Comment » |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

July 31, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice

Leave a Comment » |

Leave a Comment » |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

July 24, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

Leave a Comment » |

Leave a Comment » |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

July 17, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

Leave a Comment » |

Leave a Comment » |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

July 10, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

Leave a Comment » |

Leave a Comment » |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

June 19, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

Leave a Comment » |

Leave a Comment » |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

June 11, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

http://Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

Leave a Comment » |

Leave a Comment » |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

June 4, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

Leave a Comment » |

Leave a Comment » |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

June 3, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

25 Comments |

25 Comments |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

June 2, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

2 Comments |

2 Comments |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

June 1, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

Leave a Comment » |

Leave a Comment » |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

May 29, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

Leave a Comment » |

Leave a Comment » |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

May 28, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

1 Comment |

1 Comment |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

May 27, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

Leave a Comment » |

Leave a Comment » |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

May 26, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

Leave a Comment » |

Leave a Comment » |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

May 20, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

Leave a Comment » |

Leave a Comment » |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

May 19, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

Leave a Comment » |

Leave a Comment » |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

May 18, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

Leave a Comment » |

Leave a Comment » |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

May 15, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

Leave a Comment » |

Leave a Comment » |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer

May 14, 2015

Point and Figure RS Charts are calculated by dividing one security by another and plotting the ratio on a PnF chart. When the ratio is rising, it is plotted in a column of X’s and reflects the numerator outperforming the denominator. Likewise, when the relative strength ratio is declining, it is plotted in a column of O’s and reflects the outperformance of the denominator.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. This example is presented for illustrative purposes only and does not represent a past recommendation. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This post does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Dorsey, Wright & Associates, LLC (“Dorsey, Wright & Associates”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this document, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.

Leave a Comment » |

Leave a Comment » |  Markets, Momentum |

Markets, Momentum |  Permalink

Permalink

Posted by:

Chris Moyer