—-this was originally published 10/26/2009. Although the US dollar has recently held up relatively well versus the Euro (until today!), there is still significant concern about its long-term status.

From the Archives: Stops Degrade Performance

November 23, 2011Ok, I wrote that just to tweak you. But it is true–most of the time. Perry Kaufman, in his book Smarter Trading discusses (and provides evidence) stops and the effect they have on trading systems. Most of the time, they make your performance worse–but that doesn’t mean you can do without risk management entirely. At the very least, you need some kind of catastrophe insurance, whether it is a very wide stop loss or some kind of exposure regulation for an entire portfolio.

This graphic from our friend at Blackstar Funds, Eric Crittenden, by way of Michael Covel’s Trend Following website, shows that a lot more stocks go boom than academics would predict, making that catastrophe insurance quite handy. And they don’t always come back, by the way, a fact that makes bottom-fishing akin to running through a dynamite factory with a match. You might live, but you’re still an idiot.

—-this article was originally published 10/23/2011. Bottom-fishing is no less dangerous today. Using relative strength works counter to that strategy.

Posted by: Mike Moody

From the Archives: Performance Chasing

November 21, 2011Jason Zweig, in an interview with Morningstar, points out that performance chasing is seen in all parts of the investment world:

There was a beautiful study that was published in the The Journal of Finance a couple of years ago about the selection of institutional money managers. It basically found that the professionals who pick money managers, in this case it was pension funds, tend to buy high and fire low. They invest in whichever managers have the best trailing three-year performance and then sell whichever have the worst trailing three-year performance. The study showed that if they had flipped their decisions–if they had bought the ones with the worst three-year performance and sold the ones with the best–they actually would have gotten better returns. And of course if they had done nothing–if they had just put the portfolio on ice–they also would have done better. Performance-chasing, despite all the propaganda you hear in the financial industry, is not purely the province of retail investors. It’s not the so-called “dumb money” on Main Street that buys high and sells low. Everyone does it.

You have three choices: you can go with a manager when they are hot, you can go with a manager when they are cold, or you can do nothing. Investors, in aggregate, make the worst choice of the three! If you don’t have the emotional resilience to go against the grain, at least have the patience to sit on your hands.

—-this article originally appeared 10/23/2009. We’re a couple of DALBAR reports down the line and investors, in aggregate, continue to make the worst possible choice. Your best bet is to pick a sound strategy and add to it during periods of underperformance.

Posted by: Mike Moody

From the Archives: Entitlement Society

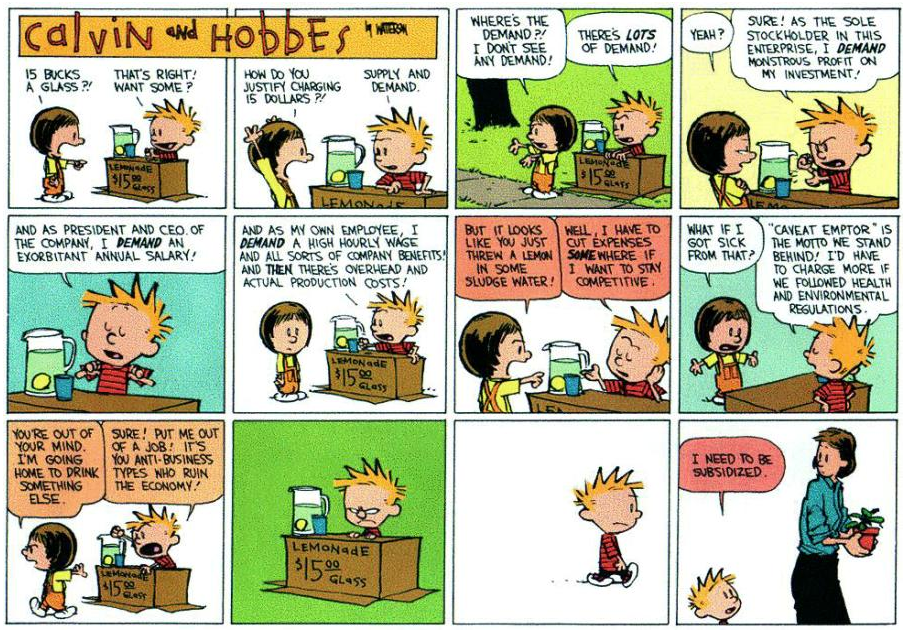

November 4, 2011Click to enlarge

—-this article was originally published 9/3/2009. Calvin and Hobbes demonstrate a keen understanding of economics as currently practiced by some companies.

Posted by: Mike Moody

From the Archives: Is the Endowment Model Dead?

November 3, 2011Mike Hennessy, co-founder and managing director of investments at $9 billion Morgan Creek Capital Management, doesn’t think so.

The “endowment model” practiced by most of the big university endowments and many big foundations (but also by some astute smaller endowments and foundations) has overwhelmingly outperformed virtually all other models over any reasonable time period, and has done so for a very long time now…The model employs the broadest asset allocation possible, literally encompassing all asset classes globally and virtually all strategies globally.

Hennessy’s comments also touch on the role that ETFs play in making this type of model available to all investors, not just the endowments.

One relatively new twist on the model is a result of the industry having evolved to make available a staggering array of efficient, inexpensive and highly liquid investment vehicles such as ETFs (Exchange Traded Funds) and other liquid investments which make it easier, more effective and less punitive than ever to infuse liquidity within the model.

The expansion of the ETF universe has made possible our Arrow DWA Balanced Fund (DWAFX) and Arrow DWA Tactical Fund (DWTFX). As a reminder, last month the Arrow DWA Tactical Fund (DWTFX) completed its conversion to a global macro style so that the strategy is now aligned with our Systematic RS Global Macro strategy which is available as a separately managed account.

Click here to visit ArrowFunds.com for a prospectus & disclosures. Click here for disclosures from Dorsey Wright Money Management.

—-this article was originally published 9/15/2009. Judging from the asset flow to our ETF funds, investors still find the endowment model fairly compelling!

Posted by: Mike Moody

From the Archives: The Global Flow of Business

November 2, 2011The Times Online reports that Brevan Howard, the UK’s largest hedge fund ($27 billion), is planning to relocate to Switzerland due to a new performance tax of 50% facing the firm. More firms are likely to follow.

Some politicians seem totally unfamiliar with the concept of elasticity, which is taught in every basics economics course. They seem to think that the imposition of higher taxes will simply result in more revenue without realizing that onerous taxes could have just the opposite impact on revenue. In economics, elasticity is the ratio of the percent change in one variable to the percent change in another variable. It is a tool for measuring the responsiveness of a function to changes in parameters in a relative way. A good or service is considered to be highly elastic if a slight change in price leads to a sharp change in the quantity demanded or supplied. On the other hand, an inelastic good or service is one in which changes in price witness only modest changes in the quantity demanded or supplied, if any at all. In the case of Brevan Howard, and many, many others, apparently the elasticity associated with this tax hike is greater than imagined by the politicians.

In our global economy, talent is willing to relocate to locations where business is treated more favorably. Therefore, an investment strategy should be able to do the same. We take great comfort in knowing that our global tactical asset allocation strategies are able to adapt to these changes in the flows of business from one part of the world to the other with great ease.

—-this article first appeared 9/28/2009. If anything, globalization has increased since this article was first published. Politics in Europe—or anywhere else—have the potential to impact economic growth in the US and other regions. The one thing that hasn’t changed is that money still goes wherever it is treated best. Your investment strategy should be elastic as well.

Posted by: Mike Moody

From the Archives: The Dilemma

October 25, 2011O’Shaughnessy has another insightful article discussing the flood of money out of equity funds and into bond funds this year. Click here to read. He shows the results from shifting allocations dramatically to fixed income after the last 14 recessions…not pretty.

This is quite the dilemma for investors. Their heart tells them to shun stocks. Their mind tells them that they should overweight stocks. I can’t think of a better reason to give serious consideration to a global tactical asset allocation fund, like our Global Macro strategy, that systematically allocates to different asset classes based on their relative strength.

Click here for disclosures from Dorsey Wright Money Management.

—-this article originally appeared 9/10/2009. The sluggish economy of the last several years has done nothing to resolve this dilemma for investors. Global Macro still makes a lot of sense.

Posted by: Mike Moody

From the Archives: The Truth About Rebalancing

October 20, 2011Among devotees of strategic asset allocation, rebalancing is considered to be a crucial tool for risk management. Jason Zweig of the Wall Street Journal does the math and points out that rebalancing sometimes just makes things worse.

The truth is that no investment method is magic. Every single method ever devised has advantages and disadvantages; thus there will always be alternating periods of outperformance and underperformance. Retail clients, by their performance-chasing behavior, obviously believe otherwise. Sorry to have to break this to them–you’re better off doing careful due diligence to find a strategy likely to outperform over the long run and then just sticking with it.

—-this was originally published 9/24/2009. There is still no magic investment method, but the pursuit of it continues unabated. Be especially wary of magic methods during difficult economic times. It’s much more appealing than thorough due diligence, but it may not serve you well in the end.

Posted by: Mike Moody

From the Archives: Bubble-nomics

October 18, 2011Alan Greenspan used to believe that bubbles did not exist. One group of economists thinks bubbles can’t be stopped, while others think they can be identified and should be deflated.

In reality, bubbles occur all the time and for all sorts of reasons, some rational and some not. Often bubbles have a fundamental basis originally, followed on by mob psychology at the end. Every bubble is a little different and a lot the same, as this insightful article from the International Herald Tribune points out.

The history of markets is one bubble after another, some large and some small. This is the main reason that we are not concerned about trends disappearing from the markets. Relative strength gives us a way to measure the strength of the trends, in order to pick out the trends we want to participate in—the strongest trends.

—-this article originally appeared 9/15/2009. Despite the very challenging environment lately, unless human nature somehow changes, I suspect trends will be with us forever.

Posted by: Mike Moody

From the Archives: Why Predictions Are Often Wrong

October 14, 2011We all know how difficult it is to get predictions right. And even when the forecaster is extremely knowledgeable about the topic—maybe even the world’s leading expert—the prediction is often wrong. Why does that happen?

In a great post about predictions, Phil Birnbaum notes, “The problem is that no matter how much you know about the price of oil, it’s random enough that the spread of outcomes is really, really wide: much wider than the effects of any knowledge you bring to the problem.” (The emphasis is mine.) In other words, the standard deviation around the mean is so huge that getting it right is simply a matter of luck.

Rather than rely on prediction (luck), we rely on our systematic process to guide our investment decisions. A systematic process is not always correct either, of course, but the decisions are made on the basis of data rather than relying on luck.

(Thanks to John Lewis for the article reference.)

—-this article originally appeared 9/23/2009. The spread of outcomes in any situation is really, really wide, and it seems especially so when politics are heavily involved in markets. The range of outcomes for the peripheral European debt problem, for example, is mind-boggling. You’re better off sticking to the data than going with an unreliable forecast.

Posted by: Mike Moody

From the Archives: Warren Buffett on the Dollar

August 12, 2011Buffet on the status of the fiscal predicament of the United States:

…Last fall, our financial system stood on the brink of a collapse that threatened a depression. The crisis required our government to display wisdom, courage and decisiveness. Fortunately, the Federal Reserve and key economic officials in both the Bush and Obama administrations responded more than ably to the need.

They made mistakes, of course. How could it have been otherwise when supposedly indestructible pillars of our economic structure were tumbling all around them? A meltdown, though, was avoided, with a gusher of federal money playing an essential role in the rescue.

The United States economy is now out of the emergency room and appears to be on a slow path to recovery. But enormous dosages of monetary medicine continue to be administered and, before long, we will need to deal with their side effects. For now, most of those effects are invisible and could indeed remain latent for a long time. Still, their threat may be as ominous as that posed by the financial crisis itself…

Buffet on the solution to the fiscal predicament of the United States:

…Legislators will correctly perceive that either raising taxes or cutting expenditures will threaten their re-election. To avoid this fate, they can opt for high rates of inflation, which never require a recorded vote and cannot be attributed to a specific action that any elected official takes. In fact, John Maynard Keynes long ago laid out a road map for political survival amid an economic disaster of just this sort: “By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens…. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose….”

Unchecked greenback emissions will certainly cause the purchasing power of currency to melt. The dollar’s destiny lies with Congress.

In case you don’t have faith in Congress to do the politically difficult things, like cutting expenditures, investors can find some solace in the fact that a weakening dollar will benefit your foreign investments immediately because it helps drive those international returns higher as international assets appreciate in value relative to the dollar.

For example, a U.S. investor in the MSCI EAFE Index over the past five years (8/18/04 – 8/18/09) is up 12.74%, while the European investor in the same index and over the same time period is down 1.74% – all thanks to a declining U.S. dollar.

Click here to read Buffet’s complete Op-Ed in today’s NYT.

—-this article originally appeared on 8/19/2009. Congress is making Warren Buffett look like a prophet.

Posted by: Mike Moody

From the Archives: Master of Disaster

July 29, 2011Ken Rogoff is just a brilliant guy. First of all, he is an International Grandmaster in chess and in the 1970s won the U.S. Under 21 Championship when he was only 16. After getting his Ph.D. in Economics from M.I.T., he served as the chief economist at the International Monetary Fund, where he had to deal with systemic banking failures in a number of nations. He and Carmen Reinhart have written insightfully on the banking crisis in the past. Mr. Rogoff might know more about how to solve banking crises than anyone, and certainly more than Congress or their lobbyists.

His latest piece is important reading. He concludes “within a few years, western governments will have to sharply raise taxes, inflate, partially default, or some combination of all three.” Possibly like the rest of us, he sees little prospect that Congress will ever actually cut spending.

Most western nations, and certainly the U.S., have not been in that position in the recent past. If Mr. Rogoff’s scenario comes to pass, having a Global Macro-type portfolio could be a lifesaver. The only way to protect hard-earned capital might be to have investment access to a wide range of asset classes around the globe.

Click here for disclosures from Dorsey Wright Money Management.

—-this article originally appeared 8/27/2009. We’re two years down the road now and it looks like all of these things are going to happen, or have already. As the saying goes, “There’s nothing new under the sun, just history you haven’t read yet.”

Posted by: Mike Moody

From the Archives: How to Level the Playing Field

June 2, 2011David Swensen is a legendary endowment manager at Yale University. In a recent interview with Consuelo Mack on Wealthtrack, the following exchange occurred. (You can read the full interview here.) Mr. Swensen is talking about the difficulty that individuals have succeeding in the market. It turns out that Yale outsources all of the management to firms who have found an edge they can exploit. It’s the only way to level the playing field because, as he points out, most people “have something they do with their lives other than studying financial markets.” We believe that relative strength has been proven to be just such an exploitable edge. He makes the point elsewhere in the interview that most firms do not have any kind of quantifiable edge. I was also struck by the fact that, although he is surrounded by talent at Yale, his group outsources all of the management. They focus on the overall asset allocation and spend their time trying to identify the managers that have an edge. Recommended reading.

CONSUELO MACK: It seems so unfair. So you think that individuals are always going to be, essentially, at a disadvantage, so the best that we can hope for is to have market returns and to have a portfolio that has some noncorrelated assets? Is that –

DAVID SWENSEN: Yeah, it seems unfair in a sense, but most everybody has something that they do with their lives other than studying financial markets.

CONSUELO MACK: Right.

DAVID SWENSEN: And I know how hard it is to beat the markets. They’re actually quite efficient. And so I’ve got an incredibly highly qualified, wonderfully motivated group of colleagues at Yale, and we work really, really hard to put together these market-beating portfolios.

CONSUELO MACK: And the market-beating portfolios, our viewers should know — you’re not investing the money yourself.

DAVID SWENSEN: No.

CONSUELO MACK: You outsource.

DAVID SWENSEN: With outside stock managers.

CONSUELO MACK: Right. So is there one or two things that you insist upon in choosing a manager? I mean, what are the things that you look for in choosing a good investment manager? Criteria.

DAVID SWENSEN: If we talked about this 20 years ago, I probably would have come up with a list of objective criteria.

CONSUELO MACK: And now?

DAVID SWENSEN: And now, I just say it’s all about the people. You want to have really high quality people, great integrity, very intelligent, hard-working, people that have found an edge that they can exploit.

CONSUELO MACK: In their particular niche.

DAVID SWENSEN: In their particular niche. And I would say it’s people first, people second, people third. You just want to be partners with great people.

—-this article was originally published July 30, 2009. The advice is timeless—outsource to great people. Everyone is great at something, but it usually isn’t portfolio management.

Posted by: Mike Moody

From the Archives: Birds of a Feather

May 16, 2011Economists have a lot of the same problems as believers in the Efficient Markets Hypothesis. (See article here.) It turns out that people are not completely rational in their economic choices—surprise, surprise. And it turns out that unfettered free markets do not allocate resources and rewards perfectly. There are always plenty of bubbles and artificial shortages. Now there is a new field of behavioral economics, not unlike behavioral finance, where they are trying to understand the impact of human behavior in economic systems.

Eventually, they may strip economics down once again to what really works: the basics of supply and demand. Technical analysis can be useful because it makes no assumption of rationality—and let’s face it: lots of times the rationale for either supply or demand is ridiculous. A technical analyst is willing to follow the trend until it ends, and then switch to another trend. Economists and EMH types are burdened with trying to justify why the rationale was sound.

—-this article was originally published July 17, 2009. We are a few years down the road now from the financial crisis and nothing has changed. There was originally a lot of discussion about whether efficient markets and modern portfolio theory were valid right after the crisis, but now things have blown over and it is still the dominant theory of financial markets. Amazing.

Posted by: Mike Moody

New Absolute Return Portfolio Product Launch

April 1, 2011Dorsey, Wright Money Management has completed work on a new portfolio management product, which we plan to use for separate accounts only. It combines a concentrated portfolio of high relative strength stocks with a collar hedging algorithm that responds to even very small declines. The net effect is that the portfolio will capture all of the upside gains, while avoiding the downside entirely. In testing, the product has been able to outperform and generate absolute returns every quarter, whether the market is up or down. The new account minimum will be our standard $200,000. If you would like marketing material on the new Absolute Return Portfolio product, please call our marketing director, Andy Hyer, at 626-535-0630.

Because the performance is so remarkable, we’ve spared no expense with the glossy, full-color marketing material we have prepared for the launch. We think your clients will be impressed with the material and amazed with the equity curve that can be generated. Losing money is a thing of the past.

Wouldn’t that be nice? It would be great if there were a fund that could capture all of the up and none of the down, but it’s just not going to happen. It’s unfortunate that some brokers and clients keep looking for a manager with those characteristics. I mean, c’mon! If such a fund existed, how hard do you think you would have to look for it? It would be plastered on every bus bench, billboard, and magazine cover! Do you think the manager would keep it a secret, so you actually had to search for it? Yet brokers and clients must believe they exist, because managers who can’t do the impossible consistently get terminated by clients who think they should be able to. [I'm sure it's apparent to you by now that this blog post is an April Fool's Day joke.]

Get real! There are no portfolios that generate market-beating returns consistently. In the Wall Street Journal’s Mutual Fund Monthly Review (March 5, 2007), they searched the Morningstar database for stock funds that finished in the top quartile for each of the past ten years. Although our mythical Absolute Return Portfolio might have made the cut, in real life zero funds did. It just doesn’t happen.

In fact, that’s not how good returns are generated. To get the highest returns requires volatility. Morningstar also screened for funds that had the highest ten-year returns—the average annual return, not the year-by-year returns. The top returning funds for the decade all had a standard deviation in the top quartile. In other words, the volatility goes along with the return. You can’t separate them.

Now, volatility is not the same thing as risk. Volatility just means you have an E-ticket ride, but the underlying slope may be powerfully positive. That’s how our Systematic Relative Strength separate accounts are designed to work. They are somewhat more volatile than the market, but much of the volatility over time should be to the upside.

Frankly, we like it that way. Equities aren’t for cupcakes. If your client can’t take the heat, buy CDs. We want to deliver the best performance to clients over the long term. If your client stays for the long term—and by that, we mean five years or ten years-we like our chances. After all, the only way you can get hurt on a roller coaster is if you jump out. And we are confident that the returns generated by high RS stocks will continue to be there because only a select number of clients will ever take advantage of them. Clients that are too scared to get on the ride at all, or clients that jump out early will have to watch from the sidelines.

Obviously, investing in stocks with high RS is not for everyone. Only an aggressive investor would make the Systematic Relative Strength strategy the bulk of their portfolio. But if your client has other, less volatile, assets in the portfolio, there is no reason that Systematic Relative Strength couldn’t be part—or even a big part—of their growth allocation.

Click here and here for disclosures. Past performance is no guarantee of future returns.

—-this article originally appeared in 2007, also as an April Fool’s Day prank. I regret to confess we got a number of calls from individuals who were very excited about the product!

Posted by: Mike Moody

From the Archives: Volatility and Personal Responsibility

February 23, 2011I have to confess that I am a little confused about this article. First, the author presents information from Morningstar that confirms the QAIB information that Dalbar has been pointing out for many years—that investors in funds do not do as well as the underlying funds themselves.

Then, he appears to blame volatility for making investors behave badly and suggests that funds with lower volatility will create better investor performance. After which he quotes Warren Buffett, who indicates the opposite—that he would rather have the higher return and accept the volatility than take the lower return. All of this is a little unclear to say the least.

Let me clear up a few things then. First, I’m not at all sure it is true that lower volatility enhances investor returns. Dalbar’s QAIB shows that bond fund investors lag bond funds by approximately the same margin as stock fund investors lag stock funds. Bonds are significantly less volatile, but that doesn’t seem to help at all. Dalbar shows only a marginally longer holding period for asset allocation funds than for stock funds, where again there is a significant difference in volatility. If volatility were really the determining factor in whether investors could hang in and perform well or not, these metrics should reflect it.

Second, I believe it is the investor and the advisor’s responsibility to do due diligence and know what they are buying. If you buy an emerging markets growth fund, for example, the fund is not exactly trying to hide that it may be volatile. You accept the volatility as your tradeoff for the potentially higher return. That’s the American way. To blame the volatility for poor returns, to me, is symptomatic of current, soft-headed American culture where no one is ever responsible for their own decisions. After all, wasn’t it that mortgage broker who made you buy a house you couldn’t afford?

No, Mr. Buffett has it right, I think. Ultimately, what makes you wealthy is the return. That means you have to deal with the volatility. And really, what is the big deal? The only ”investment acumen” a fund investor has to have to earn the NAV return is to sit like a slug! That’s it—you don’t really have to do anything clever. There is no magic trick involved, just patience. Research a strategy thoroughly, take a stand, and make a commitment, for goodness sake!

—-this article was originally published on July 7, 2009. Warren Buffett still has the right idea, I think: take the higher return and accept the volatility. Investors are still acting like sheep and running from volatility, or seaching for that holy grail of safe returns. Last year, investors bought bonds in record amounts. This year, muni bonds are already being dumped due to the volatility in that market. Now that we’ve had a couple of volatile days in the equity market, how will you react? Will you stick with a well-researched strategy, or will you bail out?

Posted by: Mike Moody

From the Archives: The Problem With Prediction

February 22, 2011Marketwatch ran a rare mea culpa today. They had originally written an article in December 2008 to tell readers what investments they should buy for the coming year. Like all crystal balls, theirs was apparently cracked. Almost every prediction they made turned out to be incorrect. I give them a heap of credit for running the follow-up article to discuss what actually happened and what went wrong with their predictions.

Unfortunately, this wouldn’t be so nice if you still owned all of these investments. Investors love hearing predictions, but they often believe the forecasters have actual ability to predict. Imagine a scenario where you are flipping a coin. Only one of two outcomes are possible—heads or tails. I am the wise forecaster who will tell you which of the two you are about to flip. Do you believe that I have forecasting ability in this case?

Probably not, since you know that coin flips are random. Yet at least the forecaster has 50% odds of being correct in the coin flip scenario. With thousands of economic and stock market variables, I would venture to say that the real odds of a correct prediction in financial markets are far lower than 50%—it is a vastly more complex system.

Our investment methodology does not involve prediction. We follow the trend until it ends. When it ends, we find a new strong trend to get involved with. Sometimes following trends leads us to surprising places, and it certainly is not always profitable every quarter, but we don’t have to make guesses about what to do. Trend following is something that can be rigorously tested and we think that puts it more than a few steps ahead of trying to use a crystal ball.

—-this article ran originally on July 6, 2009. I do have a couple of things to add though. As I mentioned, drawing attention to a batch of bad forecasts is rare. The perma-bears are not going out of their way to let you know that we’ve just had the fastest stock market double in history. And my intuition about the real odds of a correct prediction in the financial markets turned out to be correct. According to the Tetlock study, which I became aware of subsequently, forecasters are right far less than half the time. Markets are complex; trend following is simple. Simple is good.

Posted by: Mike Moody

From the Archives: Bill Gross to Policy Portfolio: Drop Dead!

January 4, 2011At the recent Morningstar Investment Conference, Bill Gross of Pimco laid out his “Seven Commandments” for investing in the current environment. At the top of the list was this: the policy portfolio (the standard 60% stocks/40% bonds) is dead.

Several of his other commandments stressed the importance of international markets and the dollar. All of these things are a little unfamiliar to domestic investors. We’ve gotten used to having the largest, more liquid, and best equity market in the world. We didn’t need to look anywhere else.

It turns out that this has been a narrow view. Investment management firms from small countries like the Netherlands or Scotland have been evaluating opportunities overseas and investing in them for centuries. Much of the world, in fact, has been explored and settled largely in the search for outside investment opportunities!

What is going to replace the now moribund policy portfolio? I suppose the jury is still out, but I suspect it will be a more global multi-asset portfolio that could bear a striking resemblance to our Systematic RS Global Macro portfolio or to the Arrow DWA Balanced Fund (DWAFX).

Click here to visit ArrowFunds.com for a prospectus & disclosures. Click here for disclosures from Dorsey Wright Money Management.

—-this was originally published 6/4/2009. Over the last year or so, the move away from the traditional 60/40 portfolio has done nothing but accelerate. Investors need to think about casting a wider net.

Posted by: Mike Moody

From the Archives: 4 Investment Rules to Ignore

December 28, 2010Christine Benz, the personal finance expert at Morningstar, has an excellent article about the four investment rules to ignore. These “rules” are in wide practice throughout the industry, but they don’t hold up under close inspection. In fact, they will destroy your long-term returns if you let them.

1. Consistency of returns is important in investment selection.

2. If an investment has been a laggard over the past three or five years, cut it loose.

3. Your risk tolerance should determine your asset allocation.

4. It’s ok to go to cash when you are nervous about the market.

This article is a must-read.

—-this article originally ran 6/25/2009. As is the case with all timeless investment wisdom, it’s still true. Ignoring them or pretending they are false doesn’t make them any less true! There are a lot of things in the investment industry that people wish were true, but that doesn’t make it so. Read this article carefully again and get a good start on 2011.

Posted by: Mike Moody

From the Archives: Static vs. Dynamic

December 9, 2010Neal Templin’s column in today’s WSJ, “Honey, I Shrunk the Nest Egg,” is an excellent illustration of the need for Tactical Asset Allocation—even though, on the surface, his column had nothing to do with Tactical Asset Allocation.

“For years, my wife and I have had an understanding. Clarissa would spend the money, and I would save it.

Well, Clarissa is still holding up her end of the bargain, but I’m an abject failure. My company retirement accounts, despite what I thought was a relatively conservative mix, were down close to 35% in early March from the fall of 2007. That, in turn, forced me to do some painful thinking about how much risk I can stomach on my family’s behalf, and how much money we can expect to have in retirement…

My conclusion: My longtime portfolio allocation of 50% stocks and 50% bonds wasn’t safe enough. I’ve already begun gradually trimming back my stock position each time the market rises. When I’m done with this transition — and it could take a couple of years — I will have a portfolio that can better ride out storms. But it will also be a portfolio less likely to produce a big nest egg.” —Neal Templin

I suspect that millions of investors have come to the same conclusion as Mr. Templin—they intend to move to an allocation that is dominated by fixed income so that they never again have to face devastating losses in their retirement savings. Mr. Templin, and many others, make asset allocation decisions in order to create the “ideal” allocation, given their risk tolerance. Up until this bear market, Mr. Templin’s asset allocation consisted of 50% stocks, 50% bonds. Now, he will dramatically overweight bonds.

A Tactical Asset Allocation approach address the issue of managing risk from a totally different perspective. Instead of creating a static asset allocation, a tactical approach shifts exposure to asset classes based on the relative strength of each of the asset classes. Tactical Asset Allocation will certainly experience losses along the way, but it is a much more dynamic approach. Instead of deciding to be either aggressive, moderate, or conservative, a tactical asset allocation simply says that we’ll let the markets determine the allocation.

—-this article originally ran 5/22/2009. Over the past year and a half, we’ve seen millions of investors pour into bonds like Mr. Templin, making the assumption that they were reducing their risk exposure. Now that premise is not so clear. As Andy points out, tactical asset allocation is dynamic and adjusts to the market situation.

Posted by: Mike Moody