It was over a year ago now that we took our Technical Leaders Indexing methodology—used to build the suite of PowerShares DWA Momentum ETFs—down to the sector level. On February 19, 2014 Dorsey Wright became the index provider for the following 9 sector ETFs:

Quick facts about these Momentum Sector ETFs:

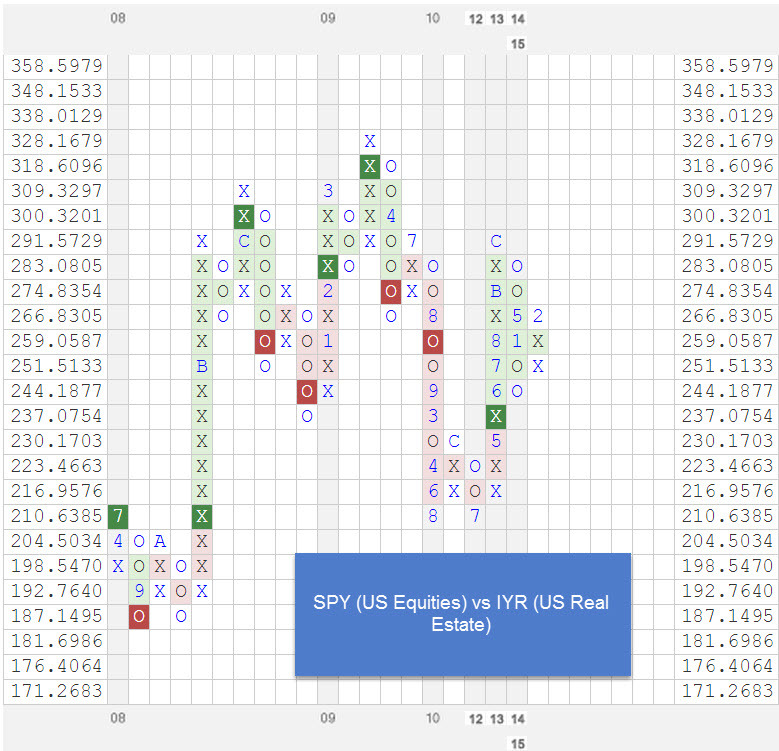

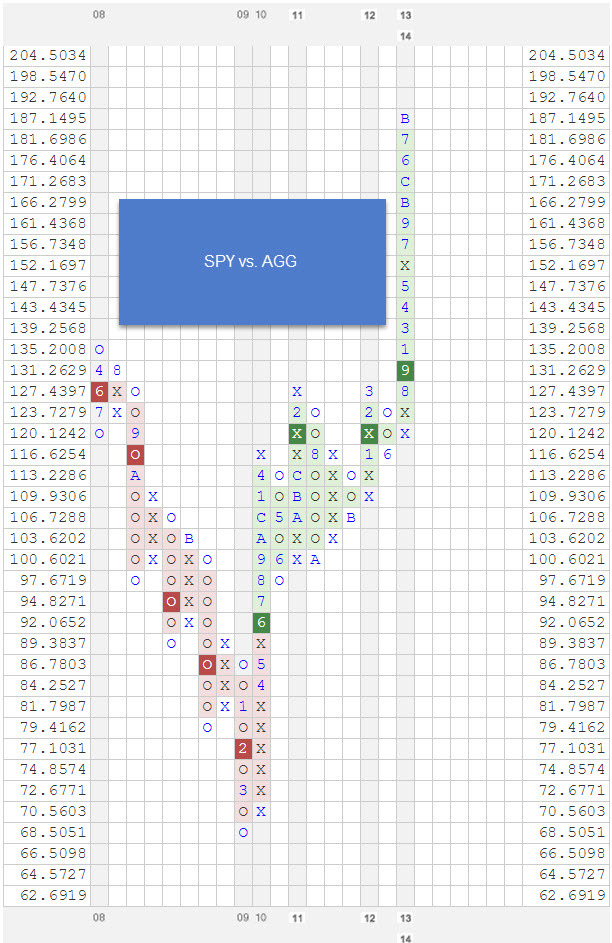

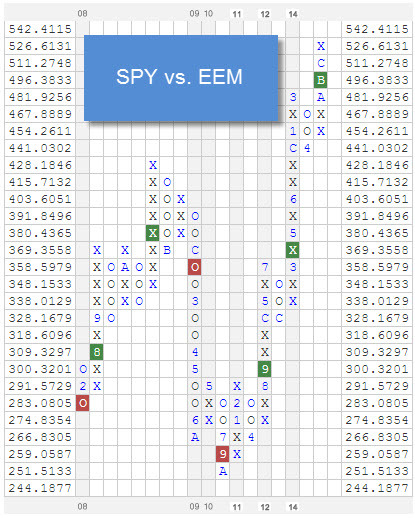

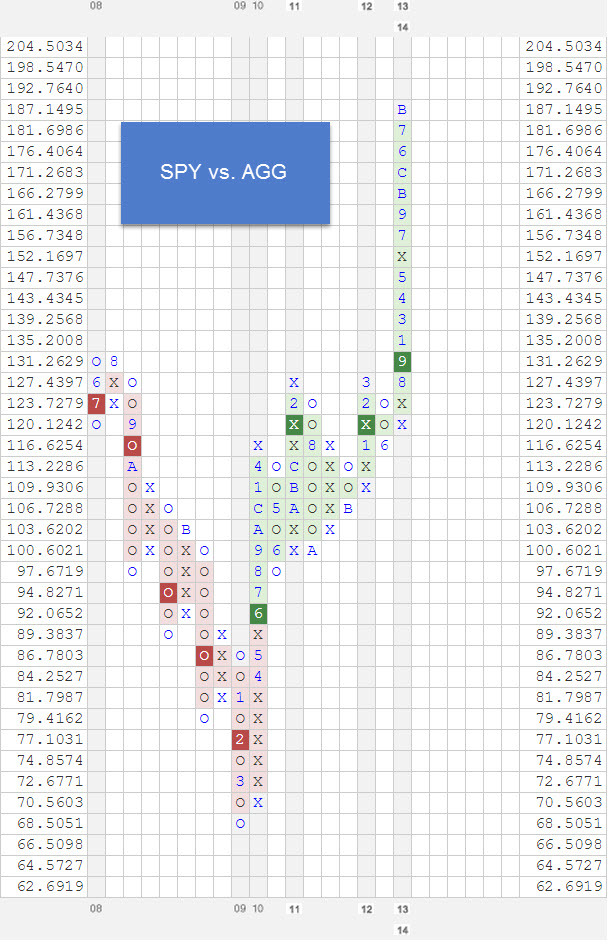

- PnF relative strength is used to select the holdings for these ETFs (click here for a white paper on PnF RS best practices)

- These ETFs can hold Small, Mid, and Large Cap U.S. stocks

- The number of holdings can range from 30-75. When Small and Mid caps have favorable relative strength, the number of holdings will tend to expand

- The indexes are rebalanced on a quarterly basis

- The members of the index are weighted by momentum so that the stocks with the best relative strength receive the most weight

With that background, we wanted to provide three ideas for how you might consider using these ETFs in your business.

- Invest in these PowerShares DWA Sector Momentum ETFs in the context of the Dorsey Wright Power 4 Model. This is a guided ETF model where we rank all the sectors on a monthly basis and buy the top 4 ranked ETFs. Right now, this model currently owns Consumer Discretionary (PEZ), Industrials (PRN), Consumer Staples (PSL), and Healthcare (PTH). This model is unique in that it also has the ability to invest in cash in increments of 25%, 50%, 75%, or even 100% if cash becomes relatively highly ranked in our monthly ranking. Click here for more details of the Power 4 Model. Trade signals for this model can be received by subscribing to Dorsey Wright research (see www.dorseywright.com) or by being on the Monday PowerShares distribution list for current model holdings.

- For those portfolio managers running their own sector rotation strategies, consider adding these 9 Momentum Sector ETFs to your existing universe. There are many subscribers to Dorsey Wright research who use our Matrix service to rank a universe of ETFs. Such a universe could include Cap-Weighted sectors as well as Momentum-Weighted sectors. Then, relative strength could be used to determine with which top 4-7 ETFs should be held and subsequently sold when they fall out of the top half/quartile of the ranks. An example is given below of taking the line-up of Vanguard sector ETFs and adding the PowerShares DWA Momentum Sectors.This example is presented for illustrative purposes only, and does not represent a past or present recommendation. Matrix as of 4/7/15.

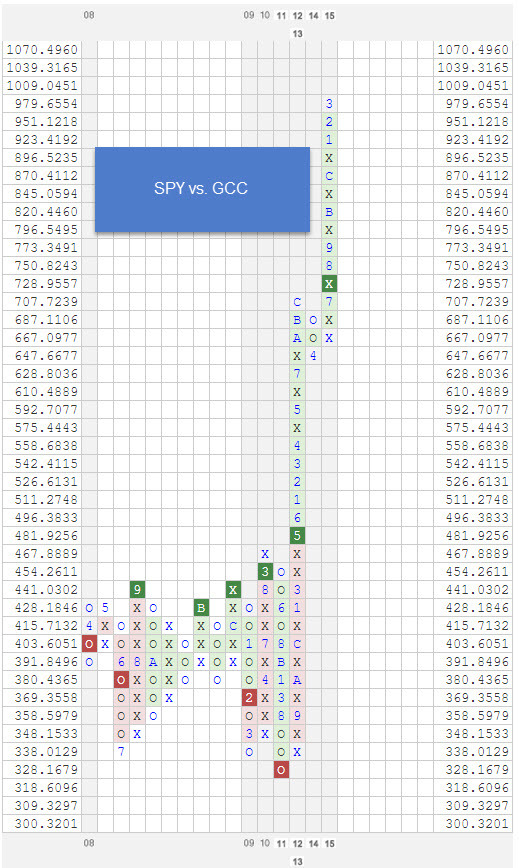

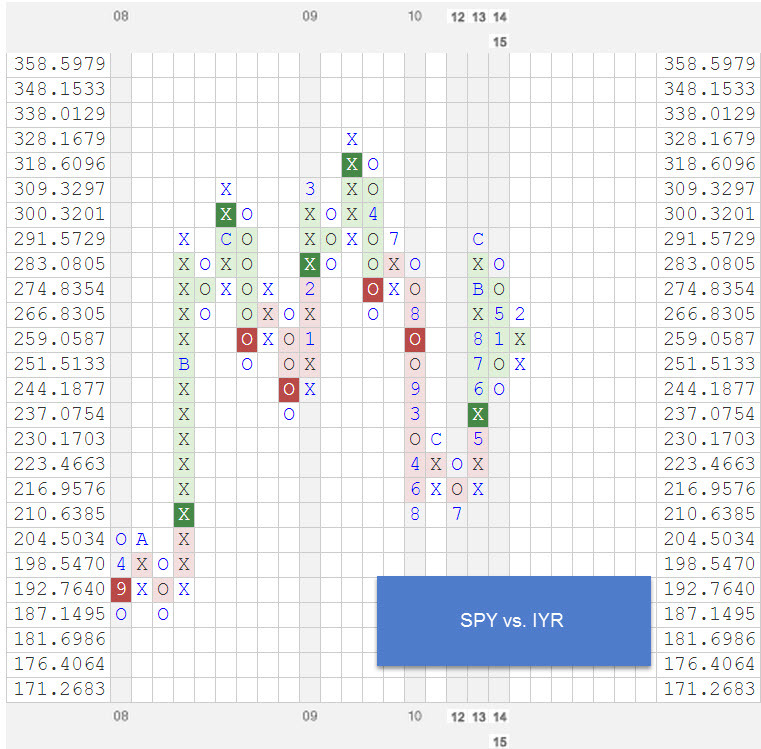

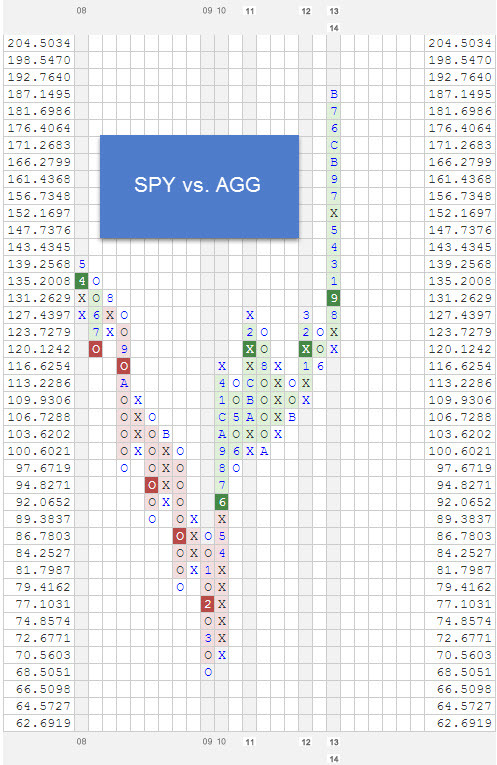

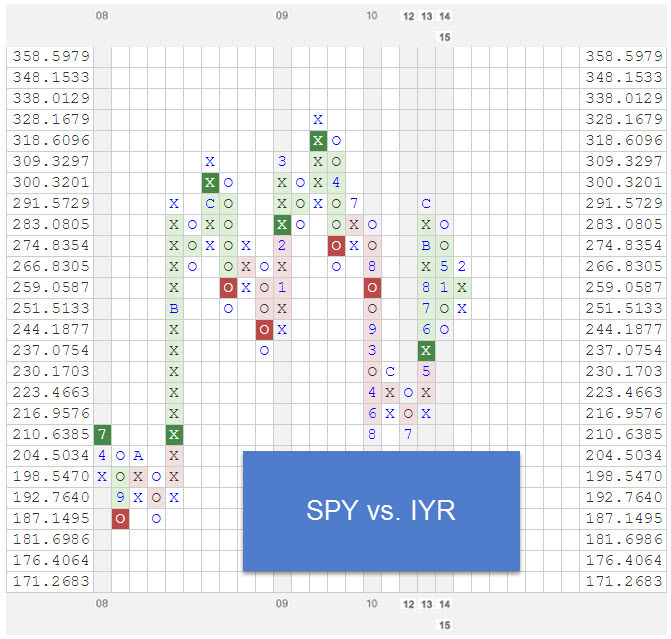

- Another way to consider using these sector ETFs is to technically evaluate them on a case-by-case basis. Current PnF charts are shown below for each of the PowerShares DWA Momentum Sector ETFs:

While the idea of sector rotation has been around for a very long time, the concept of doing that sector rotation with anything other than capitalization-weighted sectors is relatively new. We believe that incorporating Momentum sectors into the mix can open up new and effective ways to add value for your clients. It also provides a way for a financial advisor / portoflio manager to distinguish themselves from the competition.

The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Prior to Dorsey Wright becoming the index provider for this suite of sector ETFs on 2/19/14, the ETFs were managed using a different indexing methodology. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This article does not attempt to examine all the facts and circumstances which may be relevant to any product or security mentioned herein. We are not soliciting any action based on this article. It is for the general information of clients of Dorsey, Wright & Associates, LLC. This article does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice or recommendation in this article, clients should consider whether the security or strategy in question is suitable for their particular circumstances and, if necessary, seek professional advice.