A really nice how-to article from Morningstar on how to implement the bucket approach for retirees. I think they get most of this right in terms of implementation, and agree with them that the approach resonates with actual retirees. Here’s an excerpt on implementation:

1. Determine the Paycheck You Need From Your Portfolio

If you’re attempting to create the equivalent of a paycheck from your portfolio, the first step is to gauge your income needs during retirement, either on an annual or a monthly basis. Start by tallying your total expenditures, then subtract steady sources of income that you can rely on, including Social Security and pension income. What’s left over is the amount that you’ll need to extract from your portfolio each month or each year.

2. Make Sure Your Withdrawal Rate Is Sustainable

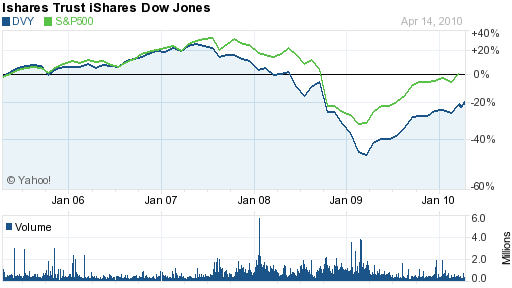

The next step is to evaluate whether your desired portfolio withdrawal amount is too large or just about right. Most financial planners consider a 4% annual withdrawal rate, combined with annual upward adjustments to accommodate inflation, a safe withdrawal amount. For another check, ![]() Morningstar’s Asset Allocator tool can help you determine whether your current portfolio puts you on track to meet your retirement-income needs. (Just bear in mind that it’s using fairly rosy return expectations for stocks.)

Morningstar’s Asset Allocator tool can help you determine whether your current portfolio puts you on track to meet your retirement-income needs. (Just bear in mind that it’s using fairly rosy return expectations for stocks.)

3. Put in Place a Short-Term Bucket Holding of at Least Two Years’ Worth of Living Expenses

Assuming your desired withdrawal rate is sustainable, set up a short-term bucket consisting of at least two years’ worth of living expenses set aside in highly liquid (that is, checking, savings, money market, and certificate of deposit) investments.

Where you hold these assets depends on where you are in retirement as well as where you’re holding the bulk of your retirement savings. Being strategic about where you take withdrawals from can help you stretch out the tax-savings benefits from your tax-sheltered accounts. This article provides more detail on sequencing withdrawals to maximize your long-term tax savings, but here’s a quick overview:

- If you’re older than 70 1/2 and taking required minimum distributions from your IRA or the retirement plan of your former employer, some or all of your near-term paycheck should come from those accounts. (Bear in mind that the amount of your RMD will vary from year to year, based on your account balances as well as your age.)

- If you’re not 70 1/2 or your RMDs won’t cover your cash needs, turn to your taxable accounts to see if they will cover your cash needs during the next two years.

- If your RMDs and taxable accounts won’t cover at least two years’ worth of living expenses, carve out any additional amount of living expenses from your IRA or company retirement plan assets using the sequence outlined above. Save Roth accounts for last because they offer the most flexibility and long-term tax-savings benefits.

4. Put It on Autopilot

Once you’ve identified where your cash will be coming from during the next few years, contact your financial-service provider to see if it can help automate your withdrawals, sending you the equivalent of a paycheck at preset intervals. (Better yet, your firm should be able to deposit the paycheck directly into your account.) The larger your fund company or brokerage firm, the more likely it is to offer such an option.

5. Other Important Tasks

In addition to getting your paycheck plan up and running, it’s important to periodically replenish your cash assets as they become depleted. Once you’ve set aside your cash position, put in place a plan to periodically refill your cash stake so that it always will cover at least two years’ worth of living expenses. Plan to incorporate this step into your rebalancing process. Ideally, you’d fill up your most liquid bucket with proceeds from rebalancing-related sales or with money from your next most liquid pool of assets (for example, intermediate-term bonds).

Bravo, Morningstar! I think there is some wiggle room about how many buckets to use, and what assets go into what buckets, but the general approach is sound. From my point of view, the psychological advantage of using buckets is that you might have a better shot at getting retirees to leave the capital growth portion of the account alone. I think it’s also important to make sure that the buckets cover the entire risk spectrum. If you use three buckets, but they are all fairly conservative, your client is not going to end up with enough growth over time. Mentally, you might want to think of the buckets as 1) generally stable, 2) somewhat balanced, and 3)growth-y. That gives you a lot of latitude to customize the buckets for individual clients. For example, a client who has an existing pension and a healthy retirement account balance might be able to use short-term bonds for the first bucket, something like the Arrow DWA Balanced Fund for the second bucket, and a 50/50 blend of a value manager and the Systematic RS Aggressive portfolio for the growth segment. You can change the volatility of the overall account by dialing the volatility level of the individual buckets up and down. And, keep in mind that there is no functional difference between a total return approach and the bucket approach if the overall allocation is the same. The only difference is in the mind of the client—but if a bucket approach helps the client to behave better, it’s a big plus.

Posted by Mike Moody

Posted by Mike Moody