Great insight from Ben Carlson at A Wealth of Common Sense:

Trying to knock it out of the park at all times can lead to poor habits in your investment process. I just finished the book The Power of Habit by Charles Duhigg, who explains why this is the case. The reason habits, both good and bad, exist is because the brain is constantly looking for ways to save energy. Habits allow our mind to rest more often because our actions become almost second nature. What gets people in trouble is that we usually default to poor habits.

My favorite example in the book tells the tale of former NFL coach Tony Dungy. When he was an assistant coach, Dungy was constantly passed over for head coaching jobs. In part this had to do with his philosophy, which was too simple for many organizations:

Part of the problem was Dungy’s coaching philosophy. In his job interviews, he would patiently explain his belief that the key to winning was changing players’ habits. He wanted to get players to stop making so many decisions during a game, he said. He wanted them to react automatically, habitually. If he could instill the right habits, his team would win. Period.

“Champions don’t do extraordinary things,” Dungy would explain. “They do ordinary things, but they do them without thinking, too fast for the other team to react. They follow the habit they’ve learned.”

Dungy was finally hired by the Tampa Bay Buccaneers and it only took him a few years to turn around what was once the laughing stock of the league. The players bought into his philosophy, but it seemed to breakdown in big games:

“We would practice, and everything would come together and then we’d get to a big game and it was like the training disappeared,” Dungy told me. “Afterward, my players would say, ‘Well it was a critical play and I went back to what I knew,’ or ‘I felt like I had to step it up.’ What they were really saying was they trusted our system most of the time, but when everything was on the line, that belief broke down.”

Dungy was fired by the Bucs after a few consecutive losses in the conference championship game (they won it all with Jon Gruden the very next year), but eventually went on to win a Super Bowl with the Indianapolis Colts, who finally trusted his philosophy in the big games.

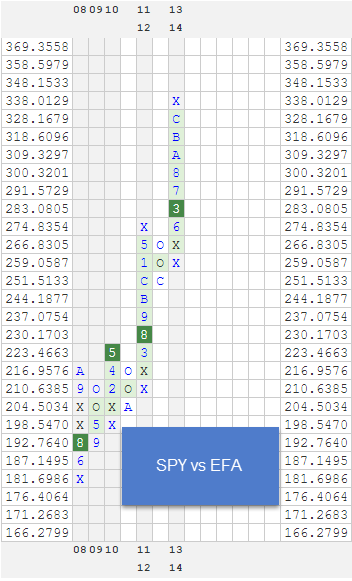

I had to smile at the part describing how Dungy was passed over for many head coaching jobs because his philosophy “was too simple for many organizations.” Part of my every day is explaining the concept of momentum investing to potential clients (either individuals, financial advisors, or managed accounts departments) and it is not uncommon for me to hear a similar response, “that’s it, it’s 100% based on relative strength?” Our investment process is essentially bringing Tony Dungy’s philosophy to portfolio management. We have built our investment strategies around a proven factor-relative strength—and we have systematized our models so that we don’t have to overthink things. Yet, many seem to feel more comfortable with something that sounds incredibly complex.

I’ve seen money run non-systematically and I’ve seen money run systematically. In my view, here are the key benefits to systematizing the investment process:

- In order to systematize a strategy, extensive research is required to understand what rules should be implemented. Such testing makes it clear what works and what doesn’t over time. Quiet confidence is a natural results of completing this research before the first dollar is invested.

- Stress goes way down. Simply systematizing an investment strategy does not remove periods of underperformance (unfortunately!). However, it does make us think much more about process than short-term outcome. The role of luck becomes greatly minimized and we are much better prepared to weather the inevitable rough patches without making hasty changes to our model.

- Better results for our clients. I firmly believe that our client’s lives will be better off because we employ a systematic process. I believe they will have more money than they would otherwise have and I believe that they are more likely to become comfortable with our investment process and and stay with the strategy for longer periods of time.

So why don’t more people systematize their investment strategies? Lack of computer programming ability, lack of access to data to do proper testing, lack of self-discipline to refrain from constantly tweaking a good model, and perhaps most of all, searching for the perfect rather than acceptance of the good. However, if you can overcome those obstacles I believe you will put yourself in a position to be in very select company over time.

A relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value.