Bill Bernstein is an asset allocation expert and the author of The Four Pillars of Investing. He happened to be at the current Morningstar Investment Conference and had an interview with Christine Benz, one of my favorite writers at Morningstar. She asked him about the purpose of fixed income in portfolios. I thought his answer was very revealing. It might not be controversial among financial advisors, but I doubt it is the thought process behind the retail public, which is currently pouring money into bond funds. (I’ve bolded the fun parts. You can read the whole transcript of the interview here.) I don’t agree with Mr. Bernstein’s view on a lot of things, but this seems pretty sensible to me.

Benz: Bill, I would like to focus on fixed income today. You are an expert on asset allocation, and I think that everywhere you go right now, you hear gloomy prognostications about the outlook for fixed income. I’m wondering if you can talk about how investors should approach that allocation right now given the prospective headwinds that could face fixed-income investors in the decades ahead?

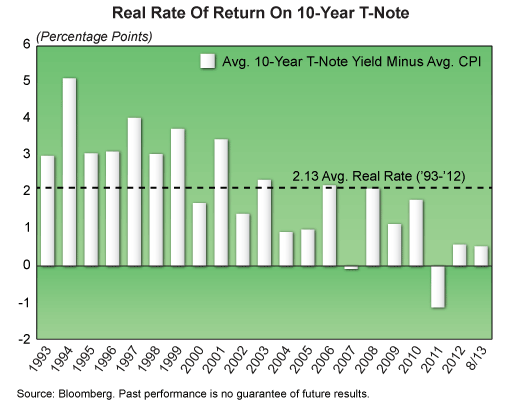

Bernstein: Well, first of all, there’s a lot of concern about fixed income as you’ve already alluded to. People are worried that the returns are going to be low, and I think that’s almost a mathematical certainty. If yields stay where they are you’re going to get a very low yield; that’s the best-case scenario. If yields rise from here, then you are going to achieve probably negative returns with any duration at all. Yields on Treasuries have fallen over the past 30 years from the midteens down to 0%, 1%, or 2%; they can’t fall another 14% from here. And I think unfortunately people are expecting that to happen. So you have to back up and ask yourself, what is the purpose of your fixed-income assets? Well, they’re for emergency needs. They’re to buy stocks when they are cheap, so you can sleep at night. And they’re to buy that corner lot from your impecunious neighbor who suddenly has a need of cash. It’s not to achieve a return.

In short, bonds are part of your portfolio as a placeholder. You buy bonds when you don’t want the money to evaporate because you will need it later for an emergency, or because you will use it to buy other productive assets at a favorable price. Mr. Bernstein doesn’t think you should buy bonds here and expect a return. Sure, they might cushion a portfolio’s overall volatility, but his main point is that bonds right now should be held tactically in favor of deploying into other assets when the time is right.

I’d say this is pretty close to our view on fixed income. It’s a risk-off asset class, but it doesn’t make sense to have a large allocation when risk assets are performing well. Individuals might want bonds to reduce their portfolio volatility to levels they deem acceptable, but the focus should always be on assets that can grow.