One of the most difficult things for investors to understand is the stock market - economy disconnect. New investors almost always assume that if the economy is doing well, the stock market will perform well also. In fact, it is usually the other way around!

Liz Ann Sonders, the market strategist at Charles Schwab & Co., has an interesting piece on this apparent disconnect. She writes:

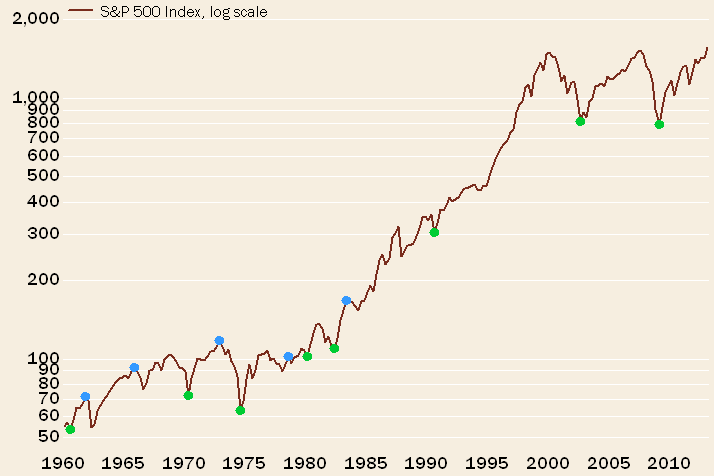

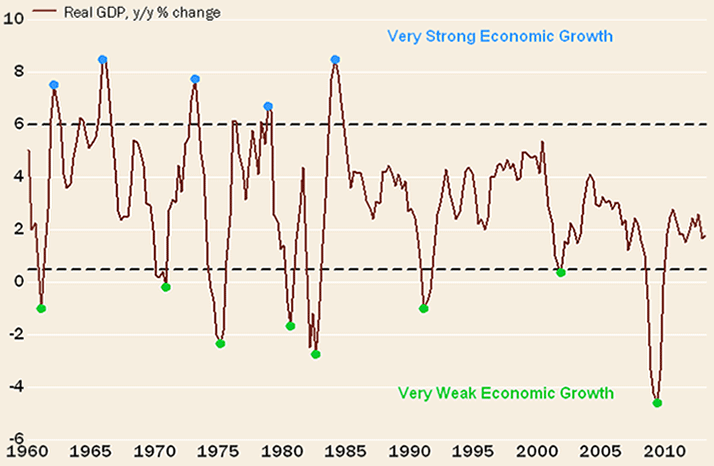

Remember, the stock market (as measured by the S&P 500) is one of 10 sub-indexes in the Conference Board’s Index of Leading Indicators. Many investors assume it’s the opposite—that economic growth is a leading indicator of the stock market. For a compelling visual of the relationship, see the following pair of charts, which I’ll explain below.

The most compelling part of her article follow, in the form of her charts that show the GDP growth rate and peaks and troughs in the stock market.

Source: Charles Schwab & Co. (click on images to enlarge)

More often than not, poor economic growth corresponds with a trough in the market. Super-heated economic growth is usually a sign that someone is about to take away the punch bowl.

In truth, there is really no disconnect if you accept that the stock market usually leads the economy. As Ms. Sonders points out, the S&P 500 is part of the Index of Leading Indicators. A lot of investors have trouble wrapping their heads around that concept—and it continues to cost them money.

The contrast to economic forecasting (i.e., guessing) is trend following. The trend follower is usually fairly safe in believing that if the market is continuing up that is economy is probably ok for the time being. When the trend becomes uncertain or tilts down, it might be time to look for clues that the economy is softening. You’re not going to be right all the time either way, but at least you’ve got the odds on your side if you let the market lead.