This is the foreword to a stock market book published in 1938. Citizens now want the same thing-economic improvement and security against a repetition of disaster. Then, like now, most are willing to be flexible about the methods as long as the desired outcome is achieved. There is no way to know if we are really heading down the same path as the 1930s, but it is comforting to reflect on the fact that relative strength will continue to adapt regardless of the market circumstances. Ken French’s studies of a simple relative strength model showed that it was able to adapt effectively even during the 1930s. If we ever head into uncharted territory, it’s good to know that our guide is likely to be reliable.

Timing: When to Buy and Sell in Today’s Markets, by John Durand, Copyright 1938.

There are only two kinds of economic systems. In one, private initiative, however circumscribed, is the dominant force. In the other the State is master.

In the year 1929 the American capitalist system seemed secure. Capping a long record of high achievement, it had produced our greatest era of prosperity. It appeared to be a “sound” prosperity—until the dream suddenly blew up before our startled eyes. Then came nearly three years of grinding deflation and rising unrest, out of which was born the political overturn of 1932. A frightened and despairing people turned to the Federal Government for economic guidance.

The New Deal Government had no coherent plan at hand for remaking our economic and social order. Its instinctive leanings were to the Left, but the election had given no mandate on a clear-cut issue between capitalism and collectivism. The people wanted economic improvement and security against a repetition of disaster. They had no composite opinion as to methods.

The Government turned promptly to inflationary measures, threw the full force of its credit into the breach and began launching a series of hastily improvised reforms. For more than three years it pumped deficit-financed purchasing power into the economic system at a rate of some $4,000,000,000 a year. Throughout that period it was the

assumption of the New Dealers and of a majority of the American people that the measures taken were guiding us toward some kind of a modified, reformed and regulated capitalist system—neither the pre-1929 capitalist system nor full collectivism, but a democratic compromise between the two. It was further assumed that this modified system would take over and carry on economic expansion when the time came for tapering off Federal “reflation.”

That time came late in 1936. The Government turned its emphasis from stimulation to control. It believed we were on the verge of a private credit boom, although up to that time the Government itself had been the sole expander of bank credit and private loans had actually declined. Nevertheless, the brakes were set against potential private credit expansion, and the President took public issue with the validity of prevailing price levels.

What followed is painful history now familiar to all. By the fourth quarter of 1937 we were skidding down in the fasted depression of all time. The prestige of political “monetary management” and “economic planning” had suffered a major blow. It became clear that the 1933-1937 recovery cycle was the temporary creation of New Deal spending; that our modified and reformed capitalism was not prepared to carry on when the oxygen of Federal pump-priming was cut off; and that in reality the New Deal had succeeded in paralyzing our former capitalist system without at the same time establishing any effective substitute for it. This brief record is of vital significance to the investor, for the trends therein sketched inevitably imply that 1938 and 1939 will be years of politico-economic transition vastly affecting the future of American business, of profits, of values. Within the space of seven years we have had a depression under private management and a depression under government management. To what will we turn now?

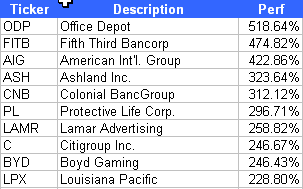

What would you have had to own to get the out-sized returns from the laggards? A bunch of stuff that everyone thought was about to go out of business. Here is a list of the top 10 gainers from our bottom decile:

What would you have had to own to get the out-sized returns from the laggards? A bunch of stuff that everyone thought was about to go out of business. Here is a list of the top 10 gainers from our bottom decile: