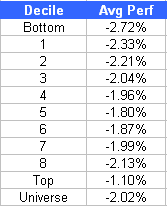

Today’s sell-off was broad based. Breaking out today’s performance by relative strength decile shows just about everything performed relatively close to the universe average….. except the highest and lowest deciles.

The top relative strength stocks did about twice as well as the equal weighted average of the universe, and the bottom ranked stocks did much worse than the average. The list of bottom decile stocks that dragged down performance is no surprise: GM (on the verge of bankruptcy) and a bunch of financials (SLG, MI, GNW, PL, CNB, SNV, DRE). Could we finally be seeing a turn in the RS spread? Only time will tell.

On a sector basis, Technology continued to outperform the universe averages. Energy stocks, which had underperformed the past couple of days, also performed well.