Evidence of long-term outperformance is the first and foremost reason to invest in any actively managed strategy. There is no need to guess which strategies are likely to deliver outperformance over the long-term when empirical data is so readily accessible.

On our website, we have archived nearly 20 research papers that present the evidence for relative strength investing, including the following.

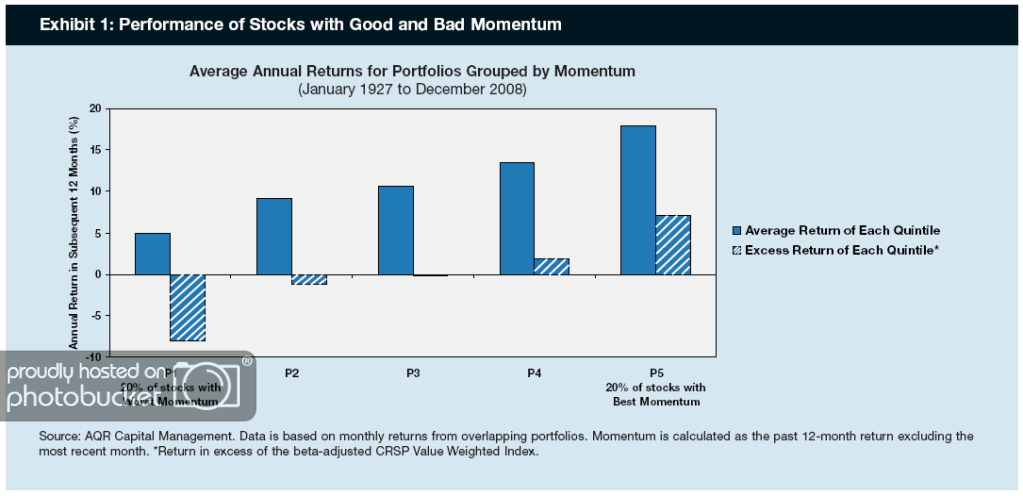

AQR Capital Management recently published a paper in which they present the results of a momentum strategy (as defined by trailing 12 month price return) from 1927 to 2008. They compared the performance of U.S. stocks, broken into quintiles as defined by momentum.

(Click to Enlarge)

The top two quintiles were able to generate significant excess return over time. A proper understanding of the historical nature of relative strength investing is a critical factor in being able to commit to the strategy for the long run.

—-This article was originally posted on July 27, 2009. There is still no need to guess which strategies might generate long-term outperformance. Empirical data is still readily available!