In a recent interview, Jim O’Shaughnessy made the case for following quantitative strategies that have performed well over multiple market cycles:

The average investor does significantly worse than a simple index … It’s literally because of the way our brains are wired. As [neuro-finance researchers] look at super-fast scans of the brain making decisions under uncertainty, we see that even with a so-called professional investor making the choice, it is not the rational centres of the brain that fire when they’re making those choices. It is the emotional centres of the brain.

That’s one of the reasons why finding good strategies that have performed well over multiple market cycles – and then having the ability to stick with them through thick and thin, even when they’re not working for you – is the key to good long-term success.

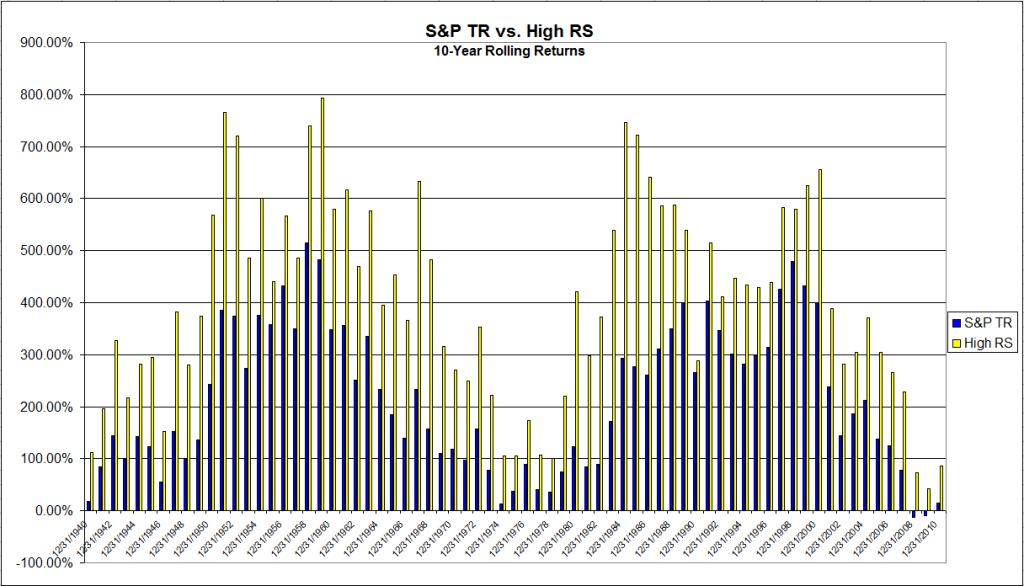

Which brings me to the long-term performance of relative strength strategies. We tracked down total return data for the S&P 500 going back to 1930 and compared it to the momentum series on the website of Ken French at Dartmouth (top half in market cap, top 1/3 in momentum). The chart below shows 10-year rolling returns, which is why it starts in 1940. The average ten-year returns? 405% for relative strength and 216% for the S&P 500, a near doubling! That’s without the momentum series getting any credit for dividends. Even more impressive, the ten-year rolling return of the relative strength series outperformed in 100% of the time periods.

Click to enlarge

Source: J.P. Lee, Dorsey, Wright Money Management

Results such as these should provide more than enough confidence to stick with relative strength through the thick and thin.