Fuel for a bull market in the future in continuing to build up. Scott Grannis, former chief economist at Western Asset Management, recently wrote about how much cash is piling up. (His blog, Calafia Beach Pundit, is highly recommended for insight into the global economy.)

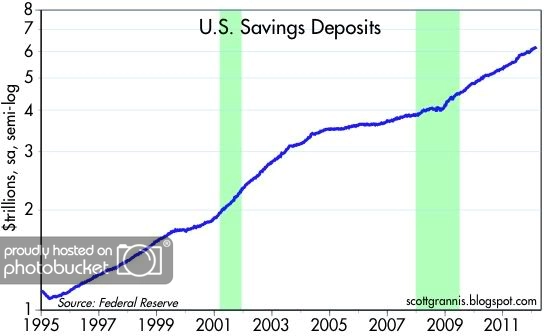

M2 is growing above its long-term average annual rate of 6%, even though the economy is 12-13% below its long-term trend. By far the biggest source of growth in M2 is savings deposits. These have increased by over $2 trillion since late 2008, and have grown at a blistering 15.7% annualized pace over the past three months. This is unusually strong growth that can only reflect great fear and caution on the part of investors everywhere, especially when one considers that savings deposits pay virtually no interest.

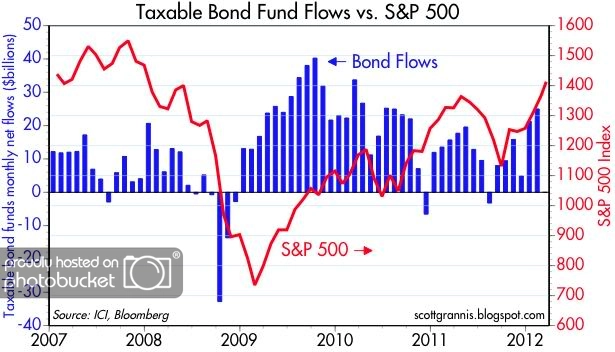

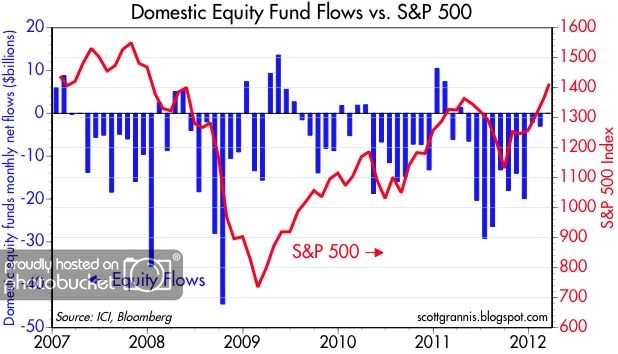

Mr. Grannis includes some charts that show both the rapid growth of savings deposits and the strong investor preference for bonds over stocks right now. We regularly detail the ICI numbers here as well, but his charts are a fantastic visual presentation.

Source: Calafia Beach Pundit (click on images to enlarge)

We all know what happens when a match finds the fuel; what we don’t know is when or how the match will be struck. Investors have pretty clearly been traumatized by 2008-2009. I’m not sure what it will take for investor sentiment to become less negative. It could be a variety of things: better employment data, less consumer leverage, or maybe some time just needs to pass so the memory of 2008 isn’t so sharp. This process could take weeks, months, or years.

Fuel, on the other hand, is abundant. Although struggling consumers and corporations are in the process of rebuilding their balance sheets, many successful companies and consumers with positive cash flow are squirreling the money away. They are perhaps not comfortable investing it yet, but the cash is building up quickly and could create a tsunami when it breaks loose.

At some point, investors will realize that they need equity-like returns to meet their savings and investment goals. Or perhaps they will simply become disssatisfied with such low returns from money market funds and CDs. A trickle of money will start to flow from cash and low-yielding bonds into the stock market, which will nudge the market higher. As the market begins to move up, investors will become more confident and yet more money will flow into stocks. The next thing you know, we could have another mega-bull market on our hands, although most probably won’t be willing to believe it. Plentiful fuel and public disbelief is how bull markets start and then extend themselves.

We’ve already had a more than 100% move from the 2009 lows over the last three years. The retail investor has not participated much so far. I don’t know how much longer they will be willing to sit on their hands when it is costing them big money, but if I had to guess, “forever” is probably not the right answer. We may be closer to an inflection point than it seems.