From Barron’s, an interesting insight into the alternative space:

Investor interest in hedge-fund strategies has never been higher—but it’s the mutual-fund industry that seems to be benefiting.

Financial advisors and institutions are increasingly turning to alternative strategies to manage portfolio risk, though the flood of money into that area tapered off a bit last year, according to an about-to-be-released survey of financial advisors and institutional managers conducted by Morningstar and Barron’s. Many of them are finding the best vehicle for those strategies to be mutual funds.

Very intriguing, no? There are quite a few ways now, through ETFs or mutual funds, to get exposure to alternatives. We’ve discussed the Arrow DWA Tactical Fund (DWTFX) as a hedge fund alternative in the past as well. Tactical asset allocation is one way to go, but there are also multi-strategy hedge fund trackers, macro fund trackers, and absolute-return fund trackers, to say nothing of managed futures.

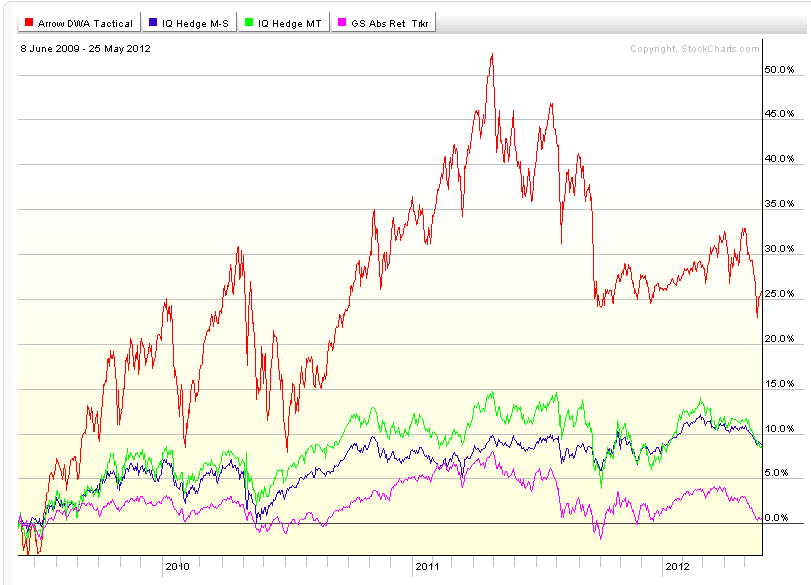

Each of these options has a different set of trade-offs in terms of potential return and volatility. For example, the chart below shows the Arrow DWA Tactical Fund, the IQ Hedge Macro Tracker, the IQ Hedge Multi-Strategy Tracker, and the Goldman Sachs Absolute Return Fund for the maximum period of time that all of the funds have overlapped.

(click on image to enlarge)

You can see that each of these funds moves differently. For example, the Arrow DWA Tactical Fund, which is definitely directional, has a very different profile than the Goldman Sachs Absolute Return Fund, which presumably is not (as) directional.

Very few of these options were even available to retail investors ten years ago. Now they are numerous, giving individuals the opportunity to diversify like never before. With proper due diligence, it’s quite possible you will find an alternative strategy that can improve your overall portfolio.

Posted by Mike Moody

Posted by Mike Moody