Our latest sentiment survey was open from 7/20/12 to 7/27/12. The Dorsey, Wright Polo Shirt Raffle continues to drive advisor participation, and we greatly appreciate your support! We will announce the winner early next week. This round, we had 49 advisors participate in the survey. If you believe, as we do, that markets are driven by supply and demand, client behavior is important. We’re not asking what you think of the market—since most of our blog readers are financial advisors, we’re asking instead about the behavior of your clients. Then we’re aggregating responses exclusively for our readership. Your privacy will not be compromised in any way.

After the first 30 or so responses, the established pattern was simply magnified, so we are fairly comfortable about the statistical validity of our sample. Some statistical uncertainty this round comes from the fact that we only had four investors say that thier clients are more afraid of missing a stock upturn than being caught in a downdraft. Most of the responses were from the U.S., but we also had multiple advisors respond from at least two other countries. Let’s get down to an analysis of the data! Note: You can click on any of the charts to enlarge them.

Question 1. Based on their behavior, are your clients currently more afraid of: a) getting caught in a stock market downdraft, or b) missing a stock market upturn?

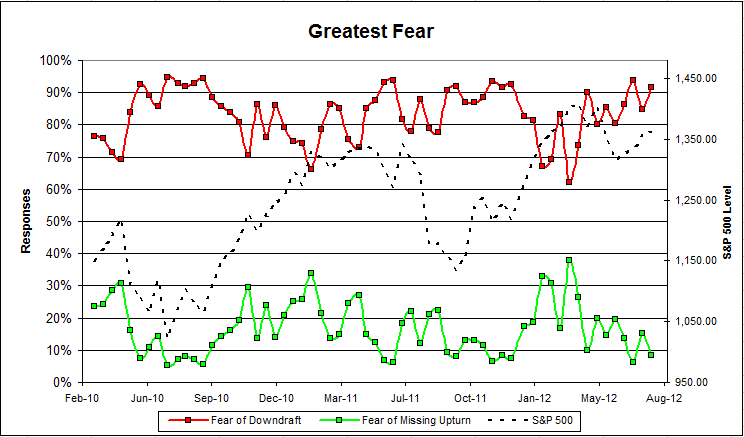

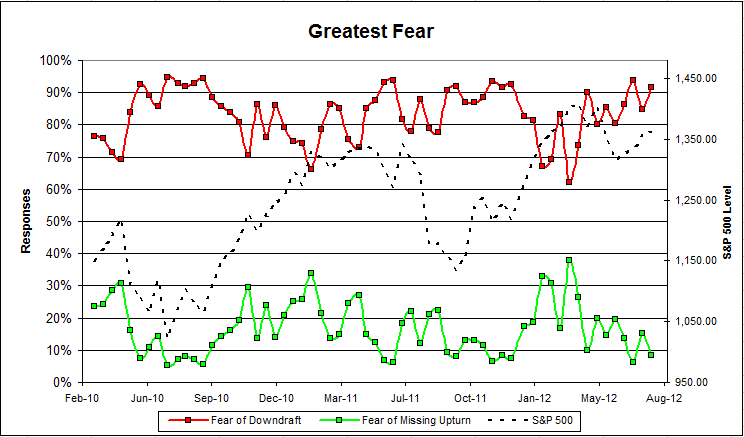

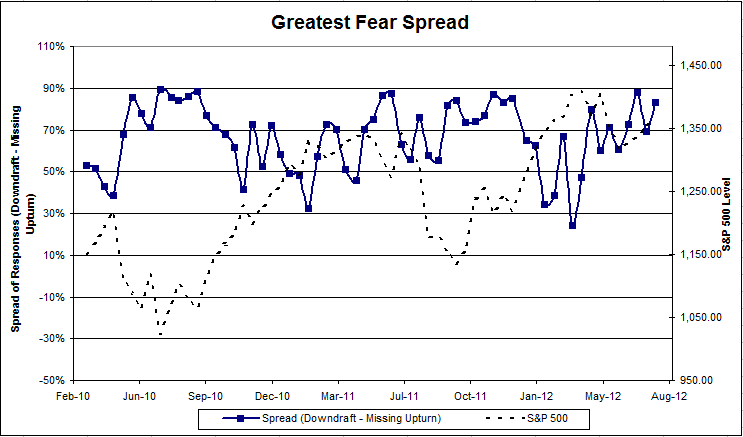

Chart 1: Greatest Fear. From survey to survey, the S&P; 500 rose 1.5%, but the greatest fear numbers did not perform as expected. The size of the fear of downturn group increased 85% to 91%, while fear of a missed upturn fell from 15% to 9%. Client sentiment remains poor even as the S&P; has risen.

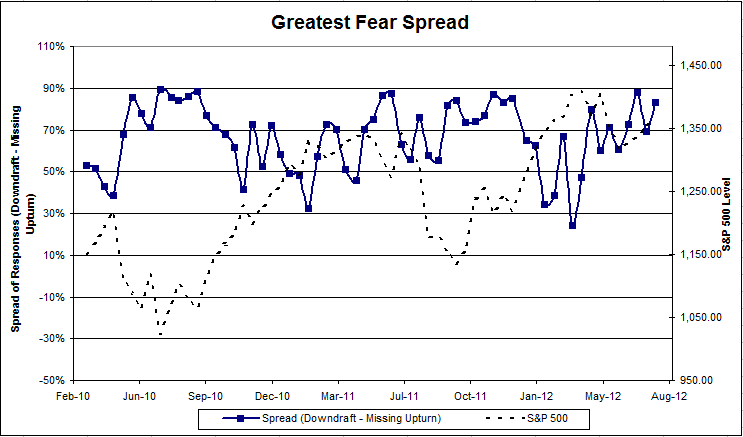

Chart 2: Greatest Fear Spread. Another way to look at this data is to examine the spread between the two groups. The spread increased from 69% to 83%.

Question 2. Based on their behavior, how would you rate your clients’ current appetite for risk?

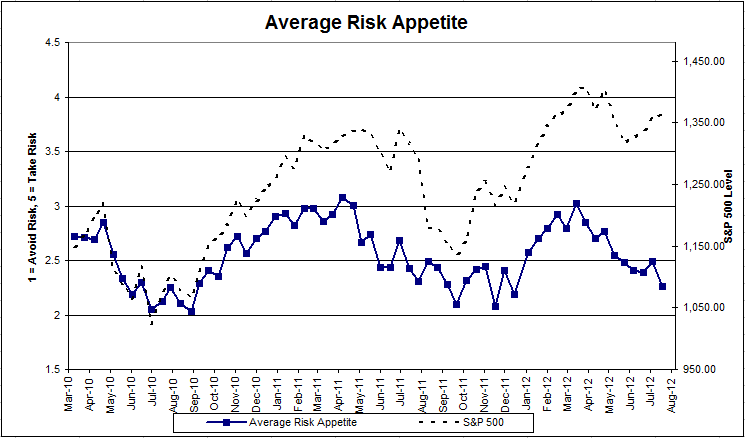

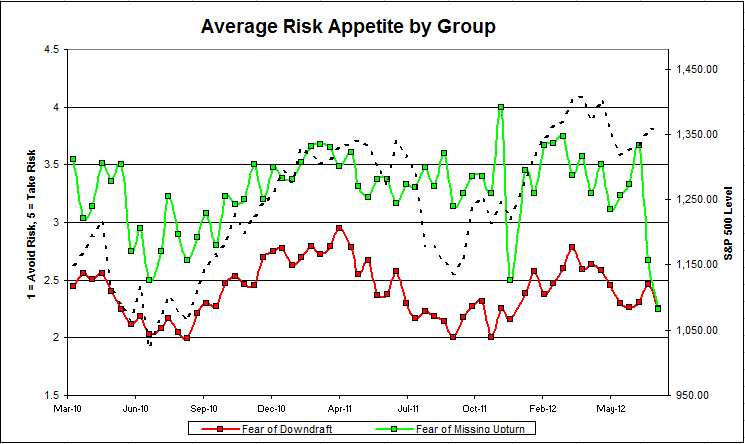

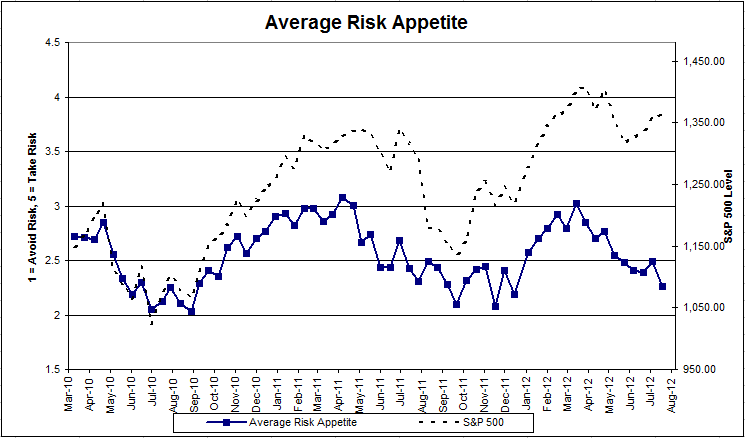

Chart 3: Average Risk Appetite. Average risk appetite usually falls in line with the market, but this week it did not. As the S&P; rose, average risk appetite fell from 2.49 to2.27.

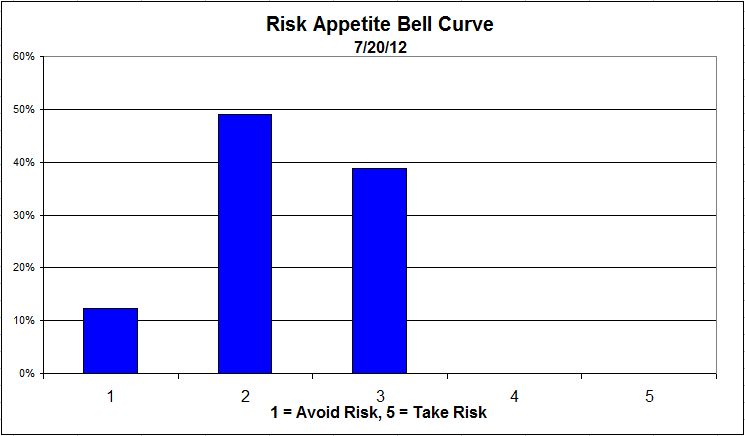

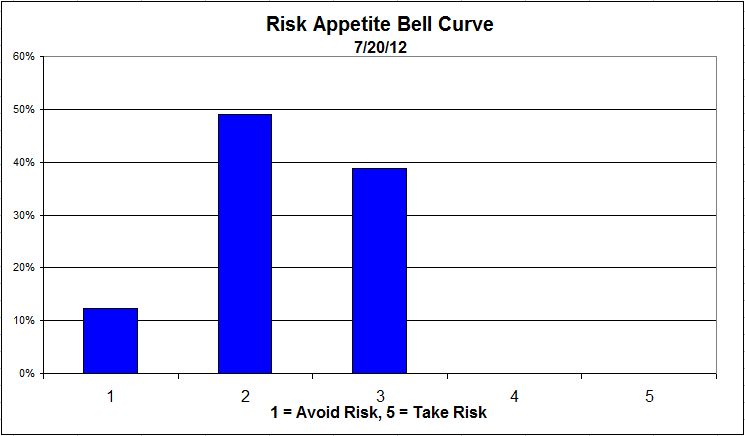

Chart 4: Risk Appetite Bell Curve. This chart uses a bell curve to break out the percentage of respondents at each risk appetite level. We are still seeing low risk appetites, with most clients having a risk appetite of 2 or 3. We had zero advisers say that their clients were looking for high risk investments this week.

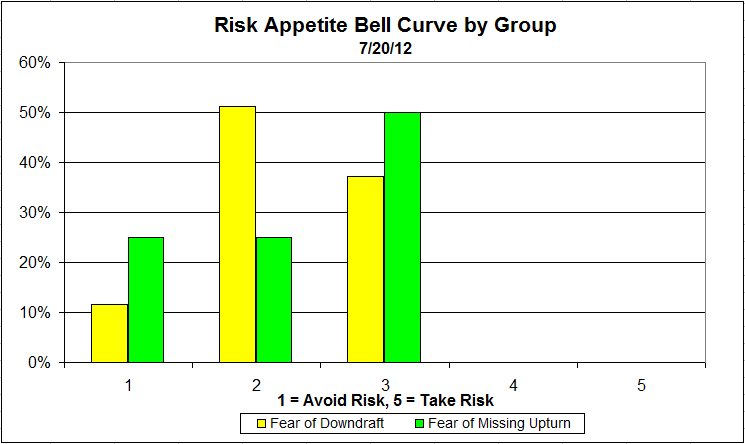

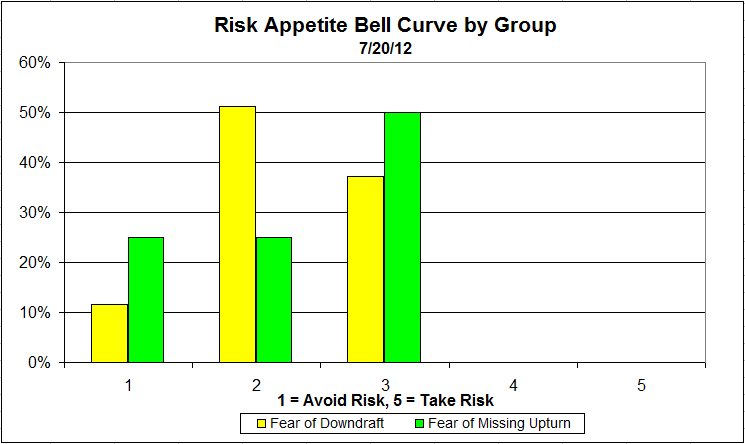

Chart 5: Risk appetite Bell Curve by Group. The next three charts use cross-sectional data. The chat plots the reported client risk appetite separately for the fear of downdraft and for the fear of missing upturn groups. This chart performs partially as expected. A higher percentage of the fear of missing an upturn respondents have a risk appetite of 3. However, a higher percentage of the upturn respondents have a risk appetite of 1. Both groups prefer a relatively low amount of risk.

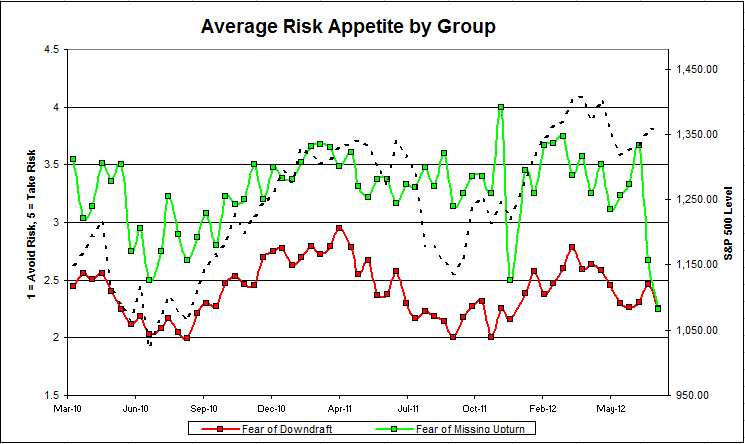

Chart 6: Average Risk Appetite by Group. The average risk appetite of both groups decreased this week, even as the market did well. The average risk appetite for the fear of missing an upturn group dropped to the lowest it has been since we started the survey. In fact, it converged with the average risk appetite of the fear of downdraft group.

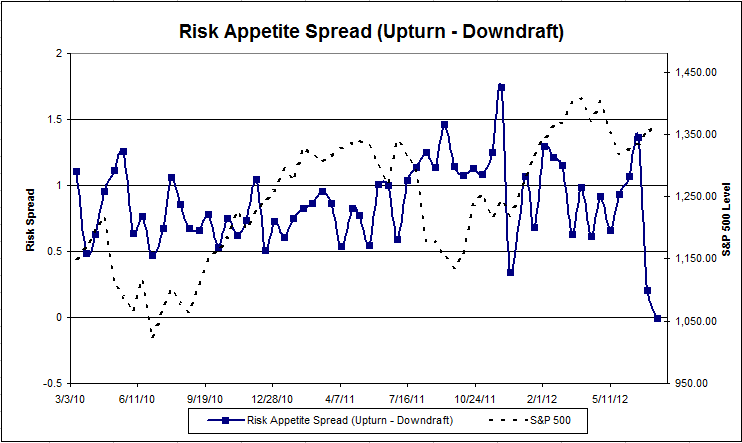

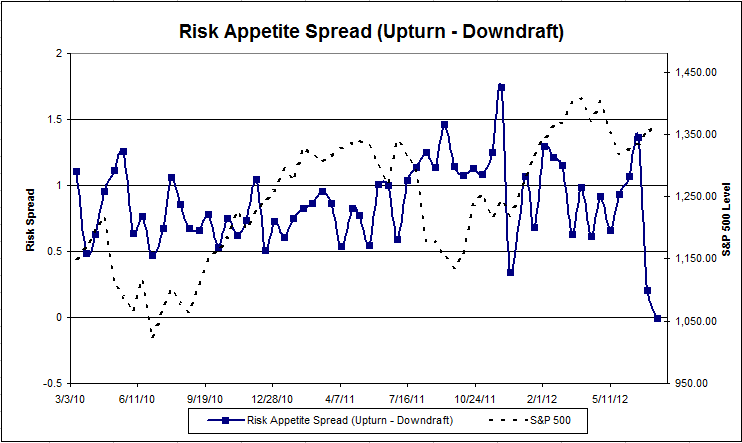

Chart 7: Risk Appetite Spread. This is a chart constructed from the data in Chart 6, where the average risk appetite of the downdraft group is subtracted from the average risk appetite of the missing upturn group. The spread decreased this round, and is the smallest spread we’ve seen yet.

The S&P; 500 rose by 0.59% from survey to survey, but most of our indicators did not respond accordingly. Average risk appetite fell, and more people feared a downturn. We’re not sure what caused such strange results this round.

No one can predict the future, as we all know, so instead of prognosticating, we will sit back and enjoy the ride. A rigorously tested, systematic investment process provides a great deal of comfort for clients during these types of fearful, highly uncertain market environments. Until next time, good trading and thank you for participating.