Ken French’s database is an unparalleled and *free* source of all types of stock market data. We’ve used this database to track high relative strength performance versus the broad market, other indices, against moving averages, and other return factors (like value).

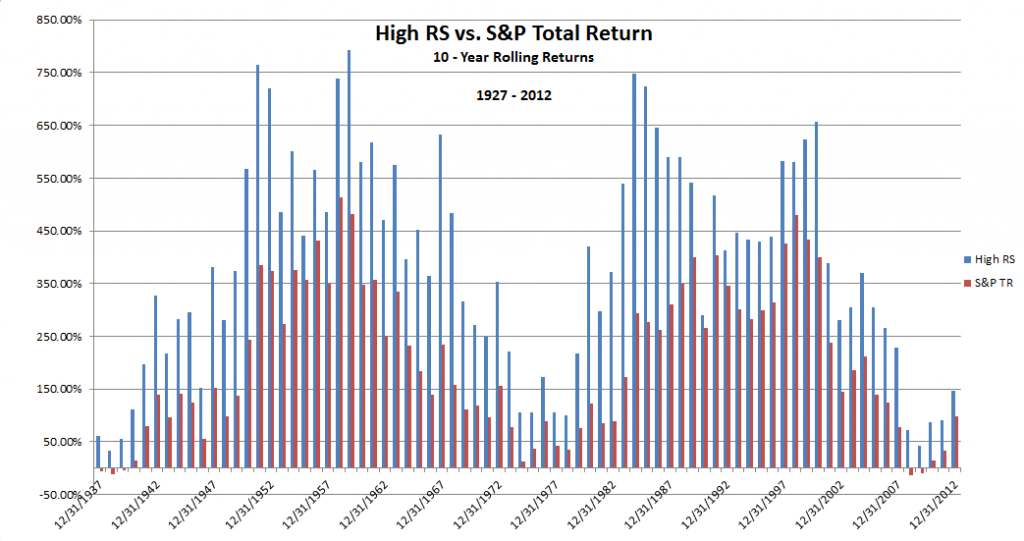

Let’s dip back into the well for another go-round. Today, we updated our database to account for the full year of 2012. The chart below shows the 10-year rolling return numbers for the High RS portfolio on the Ken French website. Click here to read the description of how this portfolio is constructed. In layman’s terms, it’s the biggest stocks by market capitalization (top half), and the best performing stocks by price performance (top third). The results speak for themselves. Since 1927, the 10-year rolling return of the High RS portfolio has outperformed the S&P 500 Total Return index an astonishing 100% of the time.

Source: Ken French Database, Global Financial Data, Click to enlarge

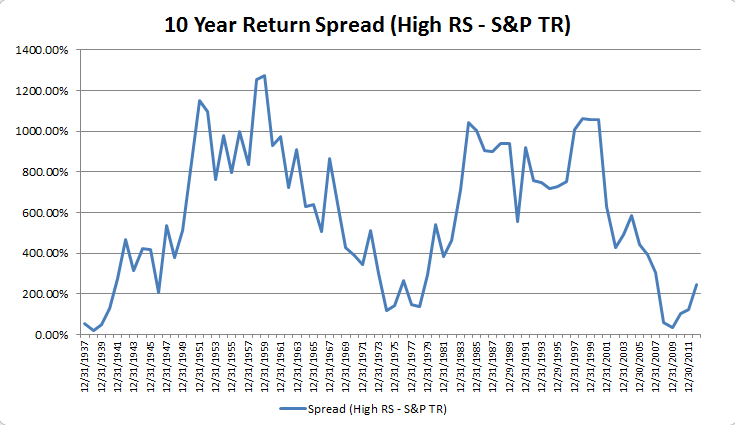

Using that data, we constructed a linear graph of the spread between the two indexes. The spread was constructed by subtracting the 10-year rolling return of the S&P Total Return from the returns of the High RS portfolio.

Source: Ken French Database, Click to enlarge

The spread looks to be exiting a recent low. Over the last near-century, these types of lows in the High RS Spread have led to extreme outperformance in the 10-year rolling numbers. Of course, there is no way to tell what will happen in the future. However, using the past as our guide, we believe that going forward, the relative strength factor will continue to be a source for outperformance in a constantly changing market.