Stock market valuation is always a concern for investors. Presumably it always helps to buy when valuation is low. However, I’m no expert on stock market valuation. In the past, I’ve shown some bottom-up valuations constructed by Morningstar analysts. They suggest the market is fairly valued right now. Another way to look at it is top-down; that is, taking the big picture view of valuations.

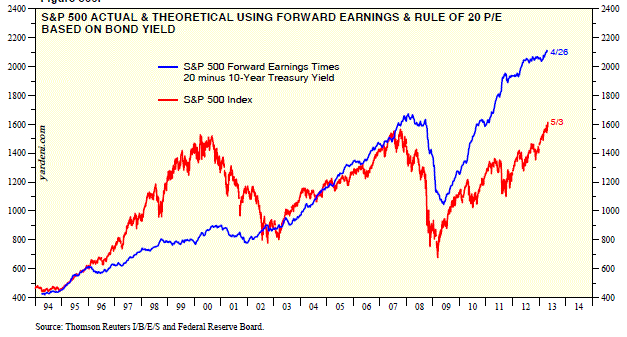

That’s what Ed Yardeni of Dr. Ed’s Blog does. From a big picture perspective, there are just two main variables in stock market valuation: earnings, and the multiple you put on those earnings. Lots of firms estimate aggregate S&P; 500 earnings. (Top-down estimates actually tend to be a little more accurate than bottom-up estimates.) In this version, he uses the Thomson Reuters IBES estimate. For his estimate of the appropriate multiple, he uses 20 minus the 10-year yield. That kind of thinking makes sense. With low interest rates, the market has typically traded at a higher multiple. When interest rates or inflation are high, the PE multiple tends to get compressed. He points out that other versions of this chart, like using a multiple of 20 minus CPI inflation come out in the same ballpark.

Here’s the chart from his recent article on valuation:

Source: Dr. Ed’s Blog (click on image to enlarge)

It’s an interesting chart, is it not? Based on earnings, it suggested the market was significantly overvalued in the late 1990s, and then fairly valued from 2002 to 2007 or so. The market dropped appropriately in response to weak earnings during the financial crisis, but is now about 30% undervalued, not having kept up with the rapid earnings growth we’ve seen since then. The suggestion is that if earnings hold up, current stock prices are not out of line with the past decade.

It’s well worth reading the rest of the article, as Dr. Yardeni also discusses the relative valuation of stocks versus bonds. (The whole blog is worth reading! He is one of the more practically grounded economists out there.)

My takeaway on this is simply that the current market may not warrant the incredible amount of hand-wringing that we’ve seen as the S&P; 500 has pushed to new highs. Given the powerful corporate earnings we’ve seen, coupled with very low interest rates, the market’s valuation may be reasonable. Yes, it feels scary because we are in new high ground, but the data looks different than we might feel emotionally.

If economy matters something and we assume that:

-FY13 earning will be around 105$ (I don’t understand why we should take operating earnings and not as reported earnings, but it’s ok)

-in this very bad economy rule could redefined as 18-10y TY

-10 year treasury yield (10y TY) will grow to 2.5% level (or cpi could as well rise to 2.5%)…

said that: market is well priced at 1625.

Valuable info. Fortunate me I discovered your website unintentionally, and I’m stunned why this accident did not came about in advance! I bookmarked it.