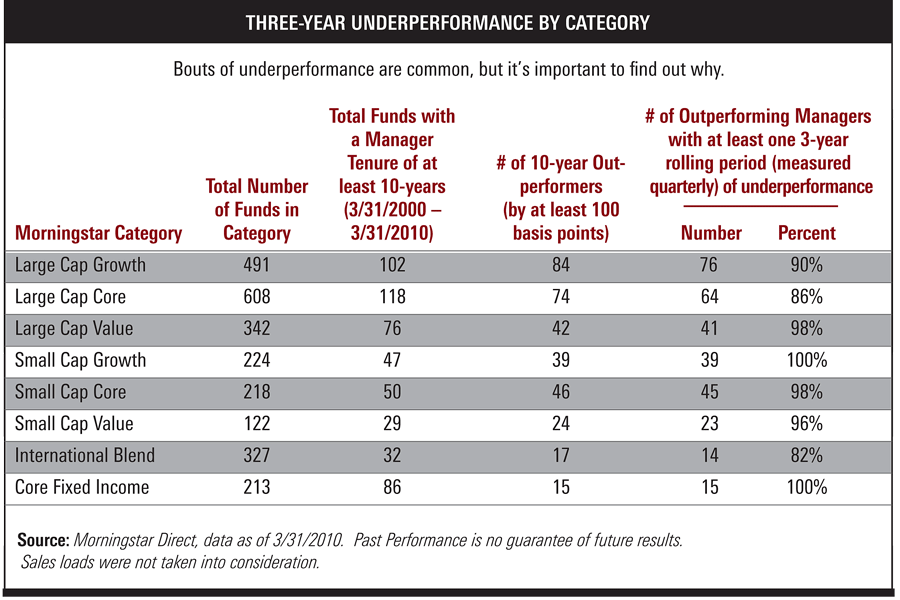

Whether you are an investment manager or a client, underperformance is a fact of life, no matter what strategy or methodology you subscribe to. If you don’t believe me, take a look at this chart from an article at ThinkAdvisor.

Source: Morningstar, ThinkAdvisor (click on image to enlarge)

Now, this chart is a little biased because it is looking at long periods of underperformance—3-year rolling periods—from managers that had top 10-year track records. In other words, these are exactly the kinds of managers you would hope to hire, and even they have long stretches of underperformance. When things are going well, clients are euphoric. Clients, though, often feel like even short periods of underperformance mean something is horribly wrong.

The entire article, written by Envestnet’s J. Gibson Watson, is worth reading because it makes the point that simply knowing about the underperformance is not very helpful until you know why the underperformance is occurring. Some underperformance may simply be a style temporarily out of favor, while other causes of underperformance might suggest an intervention is in order.

It’s quite possible to have a poor experience with a good manager if you bail out when you should hang in. Investing well can be simple, but that doesn’t mean it will be easy!