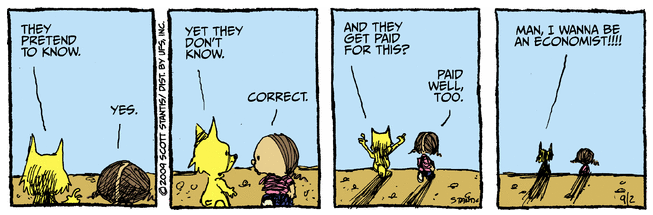

A funny take on market timing by J.J. Abodeely, echoing a similarly tongue-in-cheek assessment of whiskey by Noah Sweat in 1952. You can see the full article here. The relevant part on market timing follows.

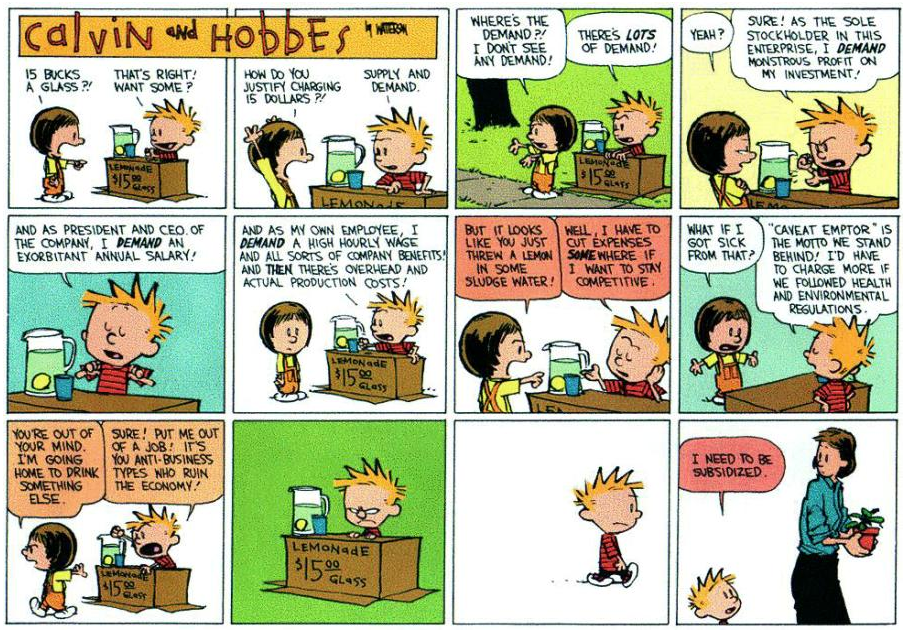

My friends, I had not intended to discuss this controversial subject at this particular time. However, I want you to know that I do not shun controversy. On the contrary, I will take a stand on any issue at any time, regardless of how fraught with controversy it might be. You have asked me how I feel about market timing. All right, here is how I feel about market timing: If when you say market timing you mean the loser’s game, the fool’s errand, the speculator’s effort that separates savers from their capital, turns investors into gamblers, lines the greedy pockets of brokers, strategists, and newsletter writers, challenges the irrefutable logic of efficient markets, yea, literally plunders the wealth from widows and retirees; if you mean the evil action that disrupts the well counseled man and woman from the pinnacle of appropriate strategic asset allocation, balanced objectives, long-term orientation into the bottomless pit of fear, and greed, and meaningless noise, high expenses, and tax inefficiency, and short-termism, then certainly I am against it.

But, if when you say market timing, you mean assessing fundamental value compared to price, favoring undervalued assets while avoiding overvalued ones, always demanding a margin of safety and being in cash when none exists; if you mean being opportunistic and forward looking, buying low and selling high; if you mean the activity which saves investors from catastrophic and permanent losses of capital, achieving positive absolute returns, the endeavor that avoids following the herd up the mountain of excess and over the cliff of despair, favoring instead consistent compounding of modest returns, and the ability to sleep well at night; if you mean that undertaking which has provided capital as the gasoline for the engines of economic growth and prosperity, protected purchasing power and met future liabilities, funded robust retirements, sustainable wealth transfer, and philanthropic endowments, then certainly I am for it.

This is my stand. I will not retreat from it. I will not compromise.

JJ Abodeely, 2011

I guess it’s all a matter of perspective!