Kuwait must have very constituent-friendly legislators. Apparently their populace is tired of paying off their consumer credit, so the legislature has introduced a bill to have the government reschedule everyone’s debts. On the other hand, this might be cheaper than having the government pay off the debts of the entire banking system like the U.S. did!

Dear Santa

December 24, 2009[As it is of general interest this time of year, we opted to include one of our client letters, with the client's permission, of course. Although we have many notable clients, this particular client is both unique and well-known. My comments are in brackets.]

Annual Managed Account Review for the Trustees of North Pole Inc. and Elf Ltd. Pension Plan

Dear Nick, [we're on a first name basis]

As always, we appreciate your business. It’s quite a feather in our cap to have a client such as yourself. It was great to talk to you periodically this year [unlisted number, sorry], especially since you were always of good cheer in what was quite a turbulent year in the financial markets.

Probably no one else on the planet has as good a view of the global recession as you and your elves. I was surprised to find out that even business at the North Pole was affected when you mentioned to me that you had to cut back the reindeer, except for Rudolph, to seasonal employment and reduce their hourly earnings this year. [This year was just tough all around--when there is a bull market in coal, I can tell there were a lot of bad little boys and girls. Indicted politicians and Bernie Madoff come to mind.] As you know, consumer spending is still weak, but there are some very hopeful signs for the market and economy in 2010.

In terms of the economy, the yield curve is very steep right now. The market is suggesting that economic growth next year could surprise on the upside. That might provide a nice lift for the market as well.

The best sign of all, though, particularly for your pension plan is-finally!-an indication that relative strength could be returning to favor as a return factor in 2010. The spread between the leaders and laggards had been very weak for most of the year, but has now flattened out. Very recently, there are even signs that the relative strength spread could be moving in a favorable direction once again. We expect that most investors will not notice or take advantage of the trend until it is in place for a year or so, which is part of the reason we appreciate your patience and steadfast good cheer. It’s quite possible that you and the elves will have a lot to celebrate next holiday season. [And we hope the reindeer will be back at work full-time.]

Say hello to Mrs. Claus for us, and good luck with your upcoming journey.

Yours truly,

Dorsey, Wright Money Management

Posted by: Mike Moody

Unlikely Converts to Capitalism

December 18, 2009Everyone in China is getting in on the new fad: capitalism. The Shaolin monks are going public. I didn’t even know they had a CEO or had bikini pageants.

Posted by: Mike Moody

Santa in Trouble For Trade Infractions

December 18, 2009What good is Christmas if Santa can’t get in trouble with the World Trade Organization?

Posted by: Mike Moody

Data Obsession

December 15, 2009Wow. We thought we were data geeks… Wired Science reports that some parents are taking baby development tracking to the extreme.

With the help of the Trixie Tracker website, they know they’ve changed exactly 7,367 diapers for their three-year-old son and 969 for their three-month-old daughter. They also have a graph of precisely how many minutes each of their children slept on nearly every day since birth. During their daughter’s first month, the data shows she averaged 15 hours of sleep a day, which is two hours more than her brother at the same age and well above average for other Trixie Tracker babies.

Posted by: Andy Hyer

Shiver Me Timbers!

December 1, 2009Pirates set up an exchange. In a nod to the power of capitalism to organize and fund economic growth, 72 “maritime companies” are available for investors to get involved with.

Apparently there is a shortage of other viable investment opportunities around the horn of Africa. I would hate to run afoul of a “regulator” on that exchange.

Posted by: Mike Moody

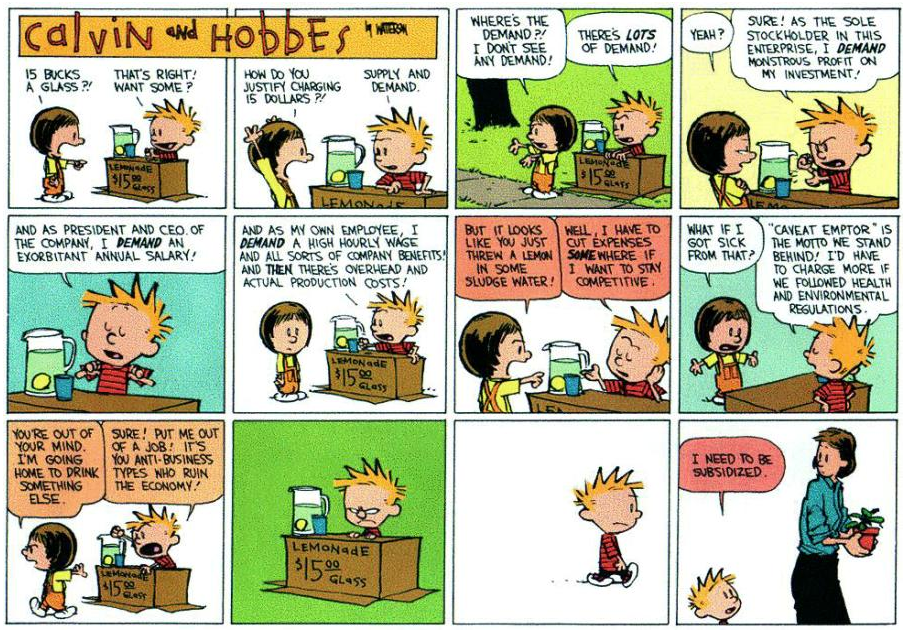

Supply and Demand is Everywhere

November 12, 2009NPR has a great story about monkey economics and how special skills in short supply translate into higher monkey income. I first saw this on Greg Mankiw’s blog. Even monkeys bow down to supply and demand!

Posted by: Mike Moody

We Are All Bankers Now

November 10, 2009Back in May, the WSJ ran a piece about the “vanishing millionaires” of Maryland. In a nutshell, the state government of Maryland mandated an additional tax on households in the highest tax brackets, in an effort to raise state tax revenues. Surprise! There were a few thousand LESS millionaires living in the state come tax time, and tax revenues fell drastically.

And today we have “Praying for Big Bank Bonuses.”

File this under “I” for Irony. All those big, bad bonuses are actually good for something…tax revenues for state governments running massive deficits. The article approximates that “one in five New York state tax dollars come from Wall Street.” In New Jersey, the incumbent governor was just booted out, in part because of his inability to wrestle a deficit projected to reach $5 Billion by the next year. The numbers just aren’t adding up.

There are plenty of ways to spin this story. Here’s mine!

From Wikipedia: “Sometimes unintended consequences can far outweigh the intended effect.”

Posted by: JP Lee

Prediction Time

November 5, 2009The chart below is the spread between the relative strength leaders and relative strength laggards (universe of mid and large cap stocks). When the chart is rising, relative strength leaders are performing better than relative strength laggards. Relative strength strategies buy securities that have strong intermediate-term relative strength and hold them as long as they remain strong.

(Click to Enlarge)

As you can see, the relative strength leaders have had much better performance than the relative strength laggards over time. However, the last 8 months have been brutal for most relative strength strategies. Although none of us know what will come next for relative strength strategies, let’s have a little fun and take a guess. It is important to point out that due to differences in holdings, some relative strength strategies may perform well even when the relative strength spread is declining (and the opposite is also true.)

Posted by: Andy Hyer

Building Bridges

October 27, 2009In article entitled “Mentor Your Boss,” in the WSJ, the author briefly examines new ways that younger employers are contributing at work. A lot of the commentary surrounding the United States’ newest generation of workers has focused on the negative aspects of this ADD-addled group. No deep motivation to get the job done, wanting a raise right off the bat, the need for immediate recognition and ego-stroking. These characteristics have been broadly attributed to an entire generation of young adults, who are entering the job market in record numbers during a deep recession.

Employers are finding out that these whipper-snappers have a huge edge in figuring out how to maximize exposure & efficiency on social networking sites like Facebook and Twitter. Managers are turning to younger employees for new-media marketing solutions.

It’s a brief article, but worth the quick read. To me, the most important concept here is for younger employees to establish a “real” connection with their managers. A CEO who was interviewed for the article said, “Usually, I’m mentoring [younger] employees. This gives them this…powerful opportunity to mentor me so that I get to know them and to respect the talent that they have.”

Ultimately, the Olds are going to catch up with the Youngs in certain respects. How hard is it to set up a blog or a Facebook page? Not very. What’s important here is that bridges are being built between the generations to facilitate learning, improvement and a mutual understanding.

The Youngs and the Olds are going to need those communication bridges for the great Social Security Debates coming soon to a Town Hall near you!

Posted by: JP Lee

Coincidence? I think not!

October 26, 2009The WSJ reports that weekday circulation for the largest U.S. newspapers dropped 10.6%, based on a cumulative average for the six months ended Sept. 30 compared to a year earlier. It was the sharpest falloff in more than a decade.

In related news, Dorsey Wright’s blog was launched in early 2009!

Posted by: Andy Hyer

Drudge Did It

October 21, 2009The real reason for the dollar’s decline: Drudge did it.

Posted by: Andy Hyer

Warren Buffett: My Cellphone is Too Complicated

September 17, 2009Instead of listening to Lehman retrospectives and what we haven’t learned from the market collapse over the past year, according to this article from Time, it’s possible Lehman could have been saved if only Warren Buffett knew how to retrieve a voicemail from his cellphone!

Posted by: Mike Moody

The Demi-Ashton Ratio

September 2, 2009I have no idea whether this strategist is on to anything or not, but this is the best indicator name I have seen for a long time!

Posted by: Mike Moody

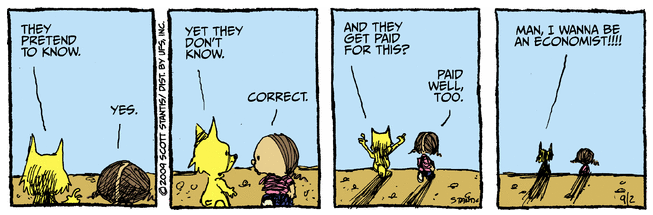

Dr. Doom Stumbles

August 28, 2009Prophecy: two bull’s eyes out of a possible million.

—Mark Twain

It seems there is always an active market for doomsayers, but apparently Nouriel Roubini’s recent forecasts haven’t worked out so well. I’m sure ours wouldn’t be any better, but that’s why we are trend followers.

Posted by: Mike Moody

Markets and Politics Don’t Mix

July 29, 2009I first saw this study presented at a conference of the Market Technicians Association in 1990 or so by the brilliant Jim Bianco of Bianco Research. Now it looks like a couple of academics have picked up on it. Mark Hulbert reports that the stock market does worse when Congress is in session. Thank goodness Congress will be in recess shortly!

Posted by: Mike Moody