The WSJ reports on the resurgent demand for European equities:

U.S. fund managers are rediscovering their passion for Europe—and not just as a vacation destination.

Since the start of the year, American investors have ramped up their bets on European stocks, spurred on by a brightening economic outlook and low interest rates.

The continent’s stock markets became a favored destination last year as the region emerged from a bruising recession. This year, with U.S. stock indexes treading water after a rip-roaring 2013, interest in European stocks has grown further, fund managers say.

Investors have sent $24.3 billion into European equity funds this year through Feb. 19, according to fund tracker EPFR Global. U.S. stock funds have seen $5 billion in outflows.

In the exchange-traded-fund world, three of the top four stock-based funds in terms of investor inflows in 2014 are the Vanguard FTSE Europe, the iShares MSCI EMU and the Vanguard FTSE Developed Markets ETFs—all of which have heavy exposure to Europe. The three have seen a combined $4.23 billion in new money this year, while $19.1 billion has flowed out of the largest U.S. stock ETF, the SPDR S&P 500 fund.

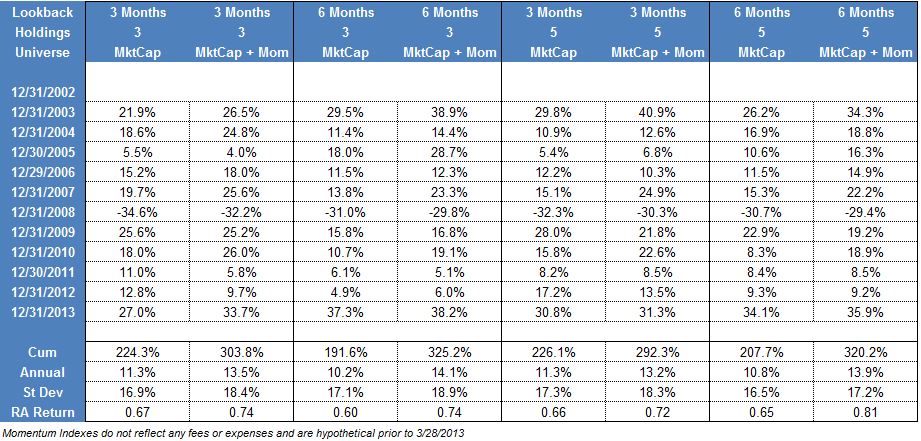

My emphasis added. All three of the ETFs referenced above are cap-weighted ETFs. To those three, I have added the PowerShares DWA Developed Markets Momentum ETF (PIZ), which had better performance in 2013 and is also ahead of those three so far in 2014:

(click to enlarge)

Source: Dorsey Wright; YTD performance through 2/21/14; Performance does not included dividends or any transaction costs

While PIZ is not exclusively focused on Europe, it is certainly heavily weighted to that region:

(click to enlarge)

Source: PowerShares

PIZ has had inflows of $360 million over the past year and now has $671 million in assets.

Past performance is no guarantee of future returns. Dorsey Wright is the index provider for PIZ. Dorsey Wright also currently owns EZU. All past holdings for the trailing 12 months is available upon request.