Michael Santoli highlights the similarities between 2004 and 2010 in his Barron’s column over the weekend:

The year 2004 has served as a useful, if imperfect, touchstone here for at least a year. Some parallels are eerie, some are mere diverting coincidence. As 2004 opened, the Standard & Poor’s 500 index had rallied ferociously off a March bear-market low and sat at 1112; this year it began at 1115, having surged even further from its March 2009 bear-market trough.

In ’04, it knocked around a narrow path until a late-year rally carried it above 1200 to 1211. This year the ride was similar, if more dramatic, rallying into April and then dropping quickly by 17%, before the late-year rally carried it back above 1200, to a current 1243.

In both years, the consensus entering the year was that Treasury yields should rise and the market would remain volatile. In both years, the 10-year Treasury yield, while jumpy, hardly budged from start to finish, and market volatility plummeted all year, reflecting the numbing effects of heavy liquidity.

Then, as now, the market was up respectably, yet finished at a valuation lower than where it started, with corporate earnings advancing far more than share prices did, even as profit growth was about to decelerate sharply.

And the psychology on Wall Street now is pretty close to where it was a few years ago—mostly bullish, with a growing collective belief that things have turned for the better, after months of mass frustration over the unsatisfying pace of economic recovery.

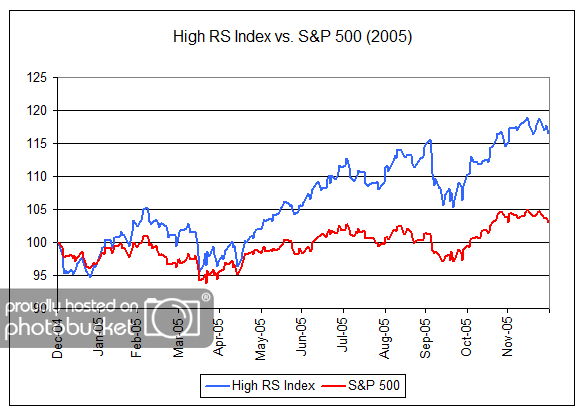

My boldface emphasis added. If the psychology of market participants today is similar to that seen at the end of 2004, it could bode well for relative strength strategies in 2011 as investors increasingly gain confidence in market leadership. As shown in the chart below, 2005 was a very good year for relative strength strategies with our High RS Index gaining 16% while the S&P 500 was up only 3%.

(Click to Enlarge)

“High RS Index” is a proprietary Dorsey, Wright Index composed of stocks that meet a high level of relative strength. The volatility of this index may be different than any product managed by Dorsey, Wright. The “High RS Index” does not represent the results of actual trading. Clients may have investment results different than the results portrayed in this index. Past performance is no guarantee of future results.

Posted by Andy Hyer

Posted by Andy Hyer