Uncertainty is usually problematic for investors. If the economy is clearly good or decidedly bad, it’s often easier to figure out what to do. I’d argue that investors typically overreact anyway, but they at least feel like they are justified in swinging for the fence or crawling into a bomb shelter. But when there is a lot of uncertainty and things are on the cusp—and could go either way—it’s tough to figure out what to do.

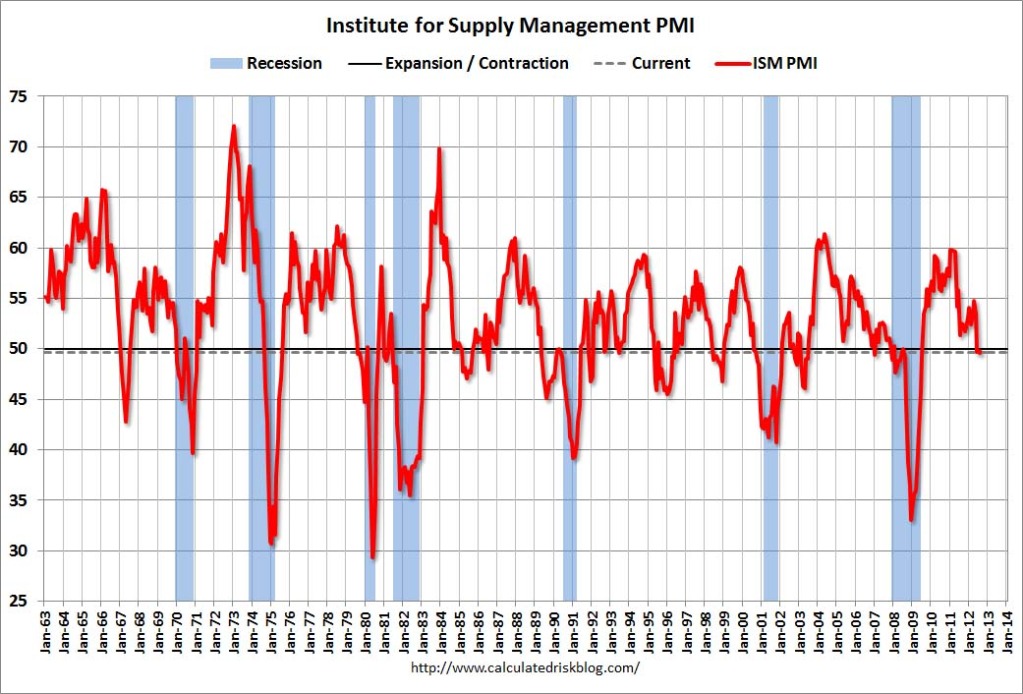

The chart below, from the wonderful Calculated Risk blog, demonstrates the point perfectly.

Source: Calculated Risk (click to enlarge)

You can see the problem. The Purchasing Managers’ Index is hovering right near the line that separates an expanding economy from a contracting one. There’s no slam dunk either way—there are numerous cases of the PMI dropping below 50 that didn’t result in a recession, but also a number that did have a nasty outcome.

So what’s an investor to do?

One possibility is an all-weather fund that has the ability to adapt to a wide variety of environments. The old-school version of this is the traditional 60/40 balanced fund. The idea was that the stocks would behave well when the economy was good and that the bonds would provide an offset when the economy was bad. There are a lot of 60/40 funds still around, largely because they’ve actually done a pretty reasonable job for investors.

The new-school version is the global tactical asset allocation fund. The flexibility inherent in a tactical fund allows it to tilt toward stocks when the market is doing well, or to tilt toward bonds if equities are having a rough go. Many funds also have the potential to invest across alternative asset classes like real estate, commodities, or foreign currencies.

For a client that is wary of the stock market—and that might include most clients these days—a balanced fund or a global tactical asset allocation fund might be just the way to get them to dip their toe in the water. They are going to need exposure to growth assets over the long run anyway and a flexible fund might make that necessary exposure more palatable.

Click here to visit ArrowFunds.com for a prospectus & disclosures. Click here for disclosures from Dorsey Wright Money Management.