Gary Antonacci has a very nice article at Optimal Momentum regarding long-only momentum. Most academic studies look at long-short momentum, while most practitioners (like us) use long-only momentum (also known as relative strength). Partly this is because it is somewhat impractical to short across hundreds of managed accounts, and partly because clients don’t usually want to have short positions. The article has another good reason, quoting from an Israel & Moskowitz paper:

Using data over the last 86 years in the U.S. stock market (from 1926 to 2011) and over the last four decades in international stockmarkets and other asset classes (from 1972 to 2011), we find that the importance of shorting is inconsequential for all strategies when looking at raw returns. For an investor who cares only about raw returns, the return premia to size, value, and momentum are dominated by the contribution from long positions.

In other words, most of your return comes from the long positions anyway.

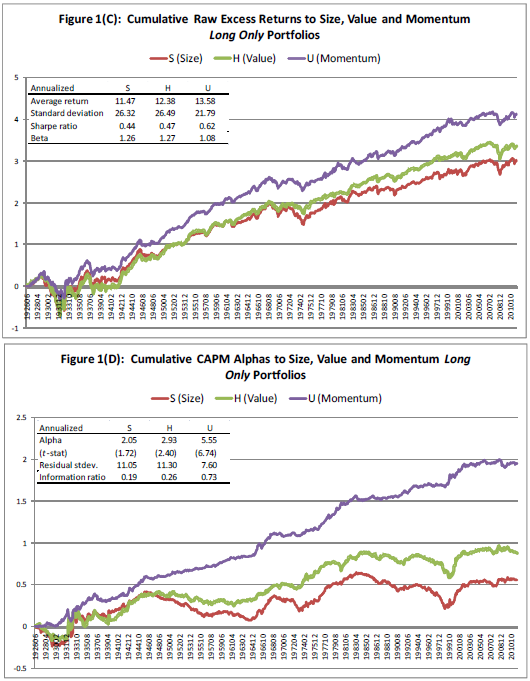

The Israel & Moskowitz paper looks at raw long-only returns from capitalization, value, and momentum. Perhaps even more importantly, at least for the Modern Portfolio Theory crowd, it looks at CAPM alphas from these same segments on a long-only basis. The CAPM alpha, in theory, is the amount of excess return available after adjusting for each factor. Here’s the chart:

(click on image to enlarge)

From the Antonacci article, here’s what you are looking at and the results:

I&M charts and tables show the top 30% of long-only momentum US stocks from 1927 through 2011 based on the past 12-month return skipping the most recent month. They also show the top 30% of value stocks using the standard book-to-market equity ratio, BE/ME, and the smallest 30% of US stocks based on market capitalization.

Long-only momentum produces an annual information ratio almost three times larger than value or size. Long-only versions of size, value, and momentum produce positive alphas, but those of size and value are statistically weak and only exist in the second half of the data. Momentum delivers significant abnormal performance relative to the market and does so consistently across all the data.

Looking at market alphas across decile spreads in the table above, there are no significant abnormal returns for size or value decile spreads over the entire 1926 to 2011 time period. Alphas for momentum decile portfolio spread returns, on the other hand, are statistically and economically large.

Mind-boggling right? On a long-only basis, momentum smokes both value and capitalization!

Israel & Moskowitz’s article is also quoted in the post, and here is what they say about their results:

Looking at these finer time slices, there is no significant size premium in any sub period after adjusting for the market. The value premium is positive in every sub period but is only statistically significant at the 5% level in one of the four 20-year periods, from 1970 to 1989. The momentum premium, however, is positive and statistically significant in every sub period, producing reliable alphas that range from 8.9 to 10.3% per year over the four sub periods.

Looking across different sized firms, we find that the momentum premium is present and stable across all size groups—there is little evidence that momentum is substantially stronger among small cap stocks over the entire 86-year U.S. sample period. The value premium, on the other hand, is largely concentrated only among small stocks and is insignificant among the largest two quintiles of stocks (largest 40% of NYSE stocks). Our smallest size groupings of stocks contain mostly micro-cap stocks that may be difficult to trade and implement in a real-world portfolio. The smallest two groupings of stocks contain firms that are much smaller than firms in the Russell 2000 universe.

What is this saying? Well, the value premium doesn’t appear to exist in the biggest NYSE stocks (the stuff your firm’s research covers). You can find value in micro-caps, but the effect is still not very significant relative to momentum in long-only portfolios. And momentum works across all cap levels, not just in the small cap area.

All of this is quite important if you are running long-only portfolios for clients, which is what most of the industry does. Relative strength (momentum) is a practical tool because it appears to generate excess return over many time periods and across all capitalizations.