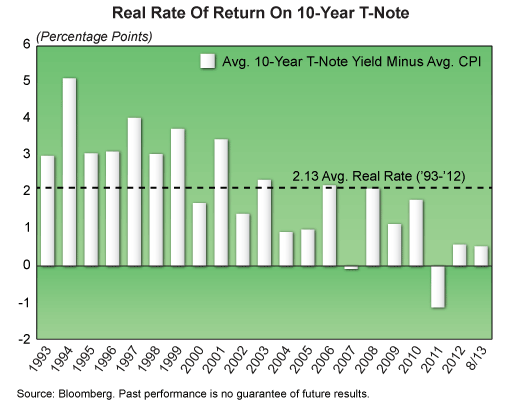

First Trust’s Bob Carey had a blog post of couple of months ago that examined the real return on bonds. (I encourage you to read the whole post because he also had some interesting comments.) Bonds, I think, are a pretty good diversifier because they can often reduce overall portfolio volatility. But there’s not much real return—return after inflation—in bonds right now.

Source: First Trust (click on image to enlarge)

In 2011, in fact, you have evidence of a bond bubble. Even in the TIPs market, expected real returns were negative for a period of time. When investors are willing to buy an asset expecting to lose purchasing power, well, that seems a little crazy. Right now, expected real returns are still quite low.

If inflation drops from here, maybe things will work out. If the stock market has a significant decline, holding bonds might turn out to be the better alternative. But if real returns go back to their historic norms, there may be more turmoil ahead in the bond market. There’s no way to know what will happen going forward, of course, but it’s probably a good idea to know where you stand relative to history.