Our latest sentiment survey was open from 4/27/12 to 5/4/12. The Dorsey, Wright Polo Shirt Raffle continues to drive advisor participation, and we greatly appreciate your support! This round, we had 55 advisors participate in the survey. If you believe, as we do, that markets are driven by supply and demand, client behavior is important. We’re not asking what you think of the market—since most of our blog readers are financial advisors, we’re asking instead about the behavior of your clients. Then we’re aggregating responses exclusively for our readership. Your privacy will not be compromised in any way.

After the first 30 or so responses, the established pattern was simply magnified, so we are comfortable about the statistical validity of our sample. Most of the responses were from the U.S., but we also had multiple advisors respond from at least three other countries. Let’s get down to an analysis of the data! Note: You can click on any of the charts to enlarge them.

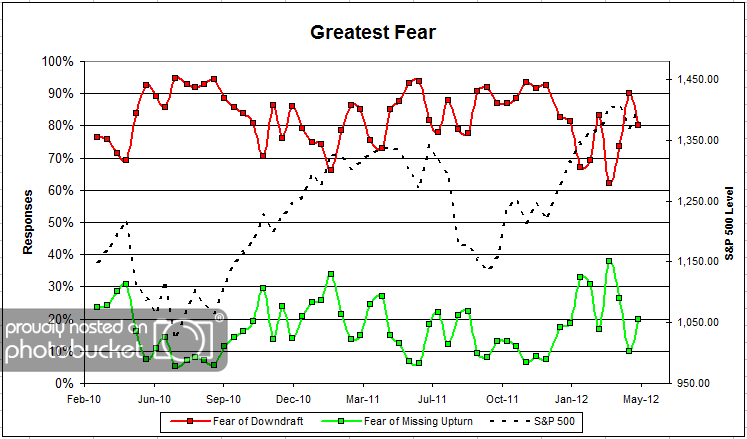

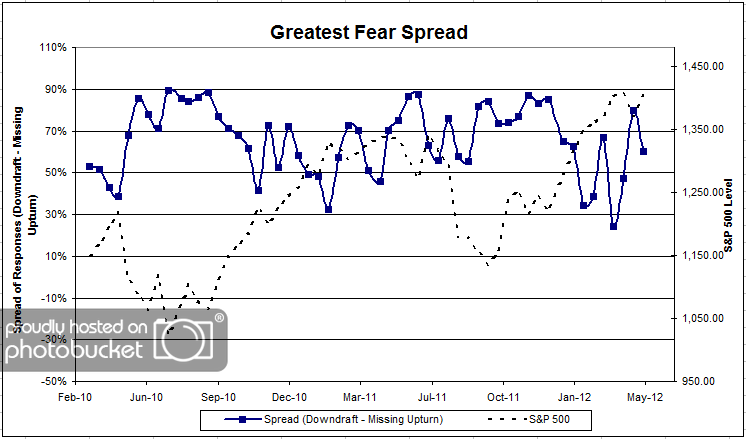

Question 1. Based on their behavior, are your clients currently more afraid of: a) getting caught in a stock market downdraft, or b) missing a stock market upturn?

Chart 1: Greatest Fear. From survey to survey, the S&P 500 rose +2.4%, and client sentiment improved as a result. The fear of downturn group fell from 90% to 80%, while the upturn group rose from 10% to 20%. Client sentiment is still poor overall, but it’s nice to see a rally have some effect.

Chart 2. Greatest Fear Spread. Another way to look at this data is to examine the spread between the two groups. The spread dipped lower this round, from 80% to 60%.

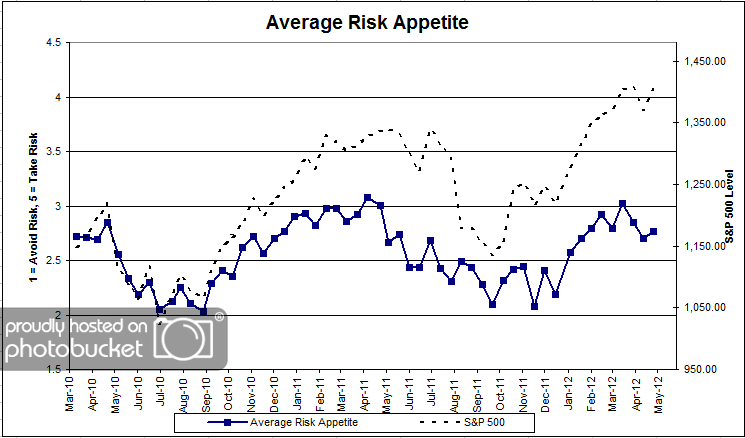

Question 2. Based on their behavior, how would you rate your clients’ current appetite for risk?

Chart 3: Average Risk Appetite. After falling for two straight surveys, the overall risk appetite bounced back this round (barely), from 2.70 to 2.77.

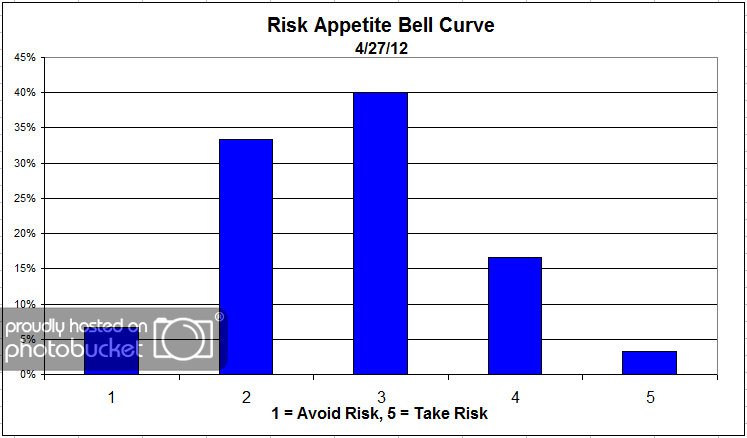

Chart 4: Risk Appetite Bell Curve. This chart uses a bell curve to break out the percentage of respondents at each risk appetite level. We saw a more even distribution this round, though tilted towards less risk.

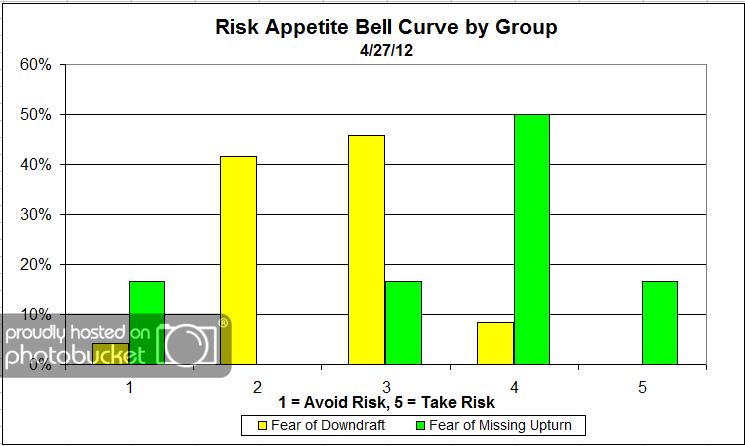

Chart 5: Risk Appetite Bell Curve by Group. The next three charts use cross-sectional data. This chart plots the reported client risk appetite separately for the fear of downdraft and for the fear of missing upturn groups. This chart sorts out mostly as expected, with the upturn group wanting more risk than the downturn group.

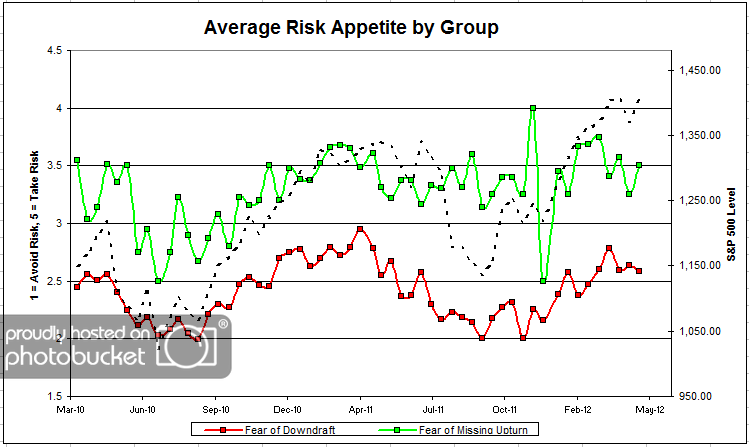

Chart 6: Average Risk Appetite by Group. This round, the upturn group’s average shot higher, while the downturn group’s average fell slightly. Keep in mind that overall risk ticked slightly higher with the market.

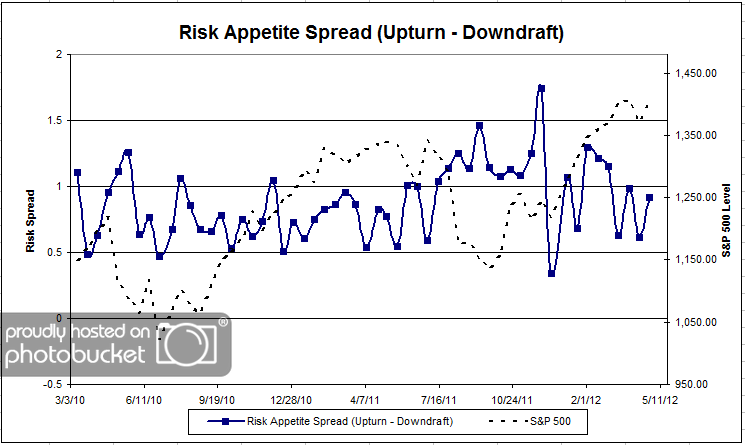

Chart 7: Risk Appetite Spread. This is a spread chart constructed from the data in Chart 6, where the average risk appetite of the downdraft group is subtracted from the average risk appetite of the missing upturn group. The spread moved higher this round and seems to be settled into a new range.

From survey to survey, the S&P rallied over +2%, and our client sentiment indicators responded as they should. The fear of a downturn group moved lower, while risk appetite moved higher. All in all, it was a pretty standard client sentiment reaction to market behavior.

No one can predict the future, as we all know, so instead of prognosticating, we will sit back and enjoy the ride. A rigorously tested, systematic investment process provides a great deal of comfort for clients during these types of fearful, highly uncertain market environments. Until next time, good trading and thank you for participating.

Posted by JP Lee

Posted by JP Lee