Warren Buffett reiterated at his recent “Woodstock for Capitalists,” otherwise known as Berkshire Hathaway’s annual meeting, that he much preferred productive assets to gold. Charlie Munger agreed. For the record, I’ve got nothing against productive assets. They produce earnings and sometimes dividends and that’s nice. However, a global tactical asset allocator should not be too eager to count out gold.

Gold has had good relative strength for much of the last decade—and as a result it has dramatically outperformed Warren Buffett. Bespoke took up this exact issue and had this to say:

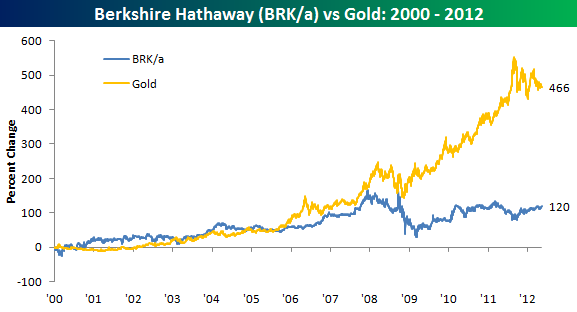

Given the fact that BRK/A does not pay a dividend, no matter how much a holder ‘fondles’ or looks at their holdings, one share of BRK/A stock purchased twelve years ago is still one share today. Sure, you can sell it for more now than you bought it then, but the same is true of gold. In fact, your gain on gold is considerably more than your gain would be on BRK/A. Looking at the performance of the two assets since the start of 2000 shows that the value of gold has increased considerably more than the value of Berkshire Hathaway. In fact, with a gain of 466% since the start of 2000, gold’s gain has been nearly four times the return of BKR/A (466% vs 120%).

Their nifty graphic follows:

Source: Bespoke (click on image to enlarge)

Relative strength has no axe to grind. One of the great benefits of using relative strength to drive tactical asset allocation is that it is objective and adaptive. Relative strength does not have a philosophical bias in favor of, or against, gold. If relative strength is high, perhaps it should be included in the portfolio. If relative strength is low, it’s out—period.

The point of investing is not to serve our biases, but to own the best-performing assets that we can identify.

Posted by Mike Moody

Posted by Mike Moody