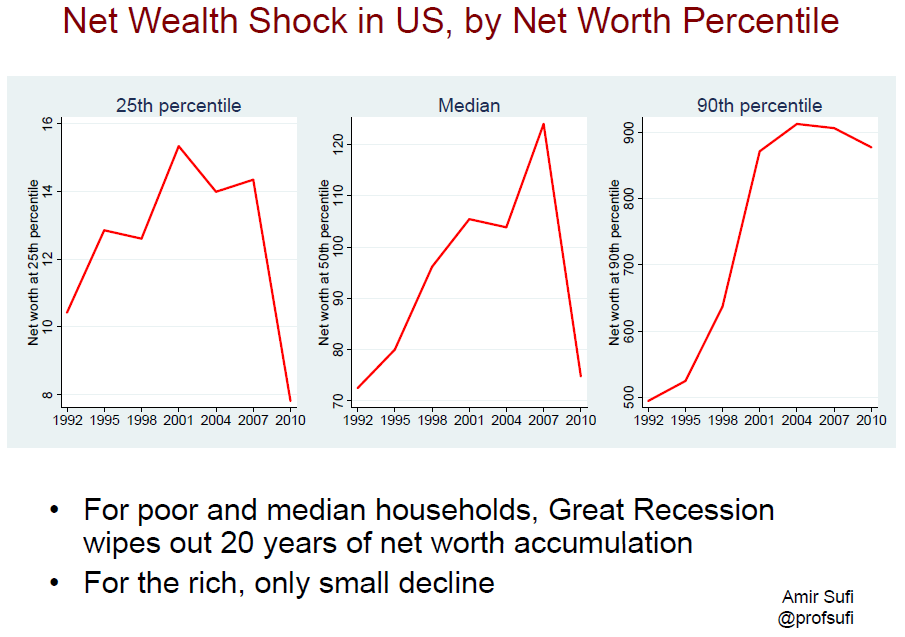

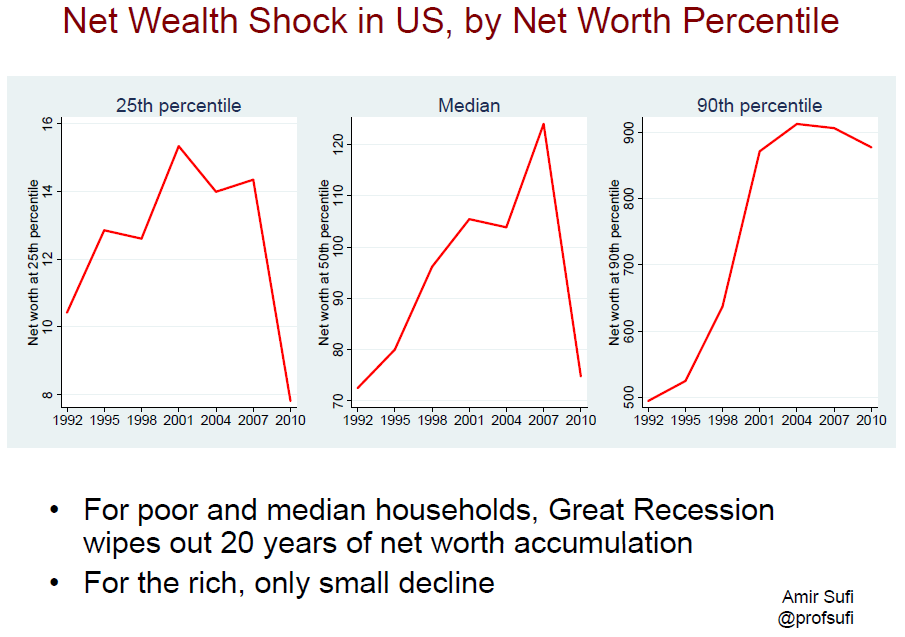

Professor Amir Sufi (University of Chicago Booth School of Business) is an interesting researcher. He recently tweeted a picture of what he called “net wealth shock” to show how the recession had affected various families. It’s reproduced below, but in effect, it shows that low and median net worth families have had a large negative impact from the recession while high net worth families have been impacted much less. I think portfolio diversification has everything to do with it.

The Effect of Buying One Stock on Margin

Source: Amir Sufi (click on image to enlarge)

For clues to why this happened, consider an earlier paper that Dr. Sufi co-wrote on household balance sheets. I’ve linked to the entire paper here (you should read it for insight into very clever experimental design), but here’s the front end of the abstract:

The large accumulation of household debt prior to the recession in combination with the decline in house prices has been the primary explanation for the onset, severity, and length of the subsequent consumption collapse.

Later in the paper, he reiterates that it is the combination of these two things that is deadly.

The household balance sheet shock in high leverage counties came from two sources: high ex ante debt levels and a large decline in house prices. One natural question to ask is: could the decline in house prices alone explain the collapse in consumption in these areas?

Our answer to this question is a definitive no-it was the combination of house price declines and high debt levels that drove the consumption decline.

And he and his co-authors, through clever data analysis, proceed to explain why they believe that to be the case.

Now consider what this is saying from a portfolio management point of view: why was the impact of falling home prices so devastating to low and median net worth households?

The negative impact came primarily from lack of diversification. Low and median net worth households had essentially one stock on margin. I know people don’t think they are buying their house on margin, but the net effect of a home loan—magnifying gains and losses—is the same. When that stock (their house) went south, their net worth went right along with it.

High net worth households were simply better diversified. It’s not that their houses didn’t decline in value also; it’s just that their house was not their only asset. In addition, they were less leveraged.

There are probably a couple of things to take away from this.

- Diversify broadly. It’s no fun to have everything in one asset when things go wrong, whether it’s your house or Enron stock in your pension plan.

- Debt kills. Having a single asset that nosedives is bad, but having it on margin is disastrous. There’s no room for error with leverage—and no way to wait things out.

Perhaps high net worth families are more diversified simply because they have greater wealth. Maybe they took the same path as everyone else and just got lucky not to have a recession in the middle of their journey. However, I think it’s also worth contemplating the converse: maybe those families achieved greater wealth because they diversified more broadly and opted to use less leverage.