Inflation has been a big fear in the investment community for a few years now, but so far nothing has happened. An article at AdvisorOne suggests that the onset of inflation can sometimes be rapid and unexpected.

Someday, in the possibly near future, you will suddenly be paying $10 for a gallon of milk and wondering how the heck it happened so fast.

That is the strange and terrible way of inflation, said State Street Global senior portfolio manager Chris Goolgasian in a panel talk on Thursday at Morningstar ETF Invest 2012. Inflation has a way of appearing to be a distant threat before it sneaks up suddenly and starts driving prices through the roof.

Quoting from Ernest Hemingway’s novel “The Sun Also Rises,” Goolgasian took note of a passage where a man is asked how he went bankrupt. “Two ways,” the man answered. “Gradually, then suddenly.”

“The danger is in the future, and it’s important to manage portfolios for the future,” Goolgasian concluded. “Real assets can give you some assurance against that chance.”

That’s good to know—but which real assets, and when? After all, Japanese investors have probably been waiting for the inflation bogeyman for the last two decades. This is one situation in which tactical asset allocation driven by relative strength can be a big help. If you monitor a large number of asset classes continuously, you can identify when any particular real asset starts to surge in relative performance.

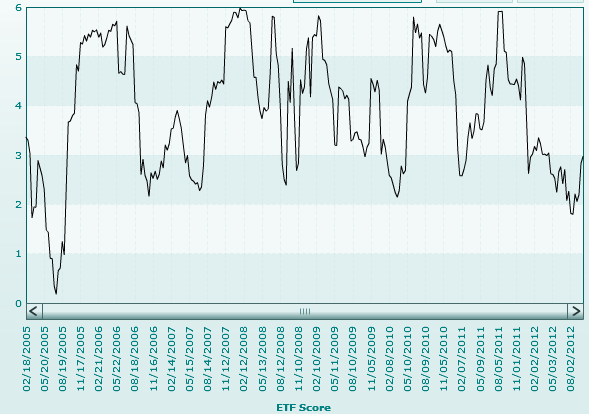

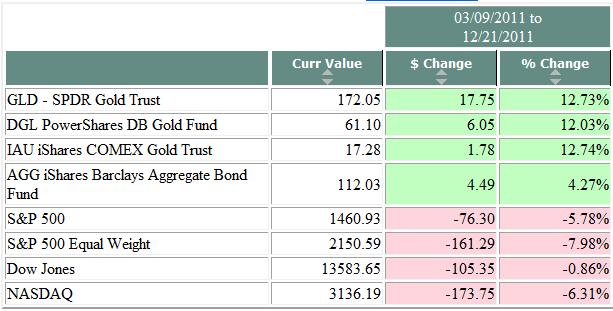

For example, on the Dorsey Wright database, the last extended run that gold had as a high relative strength asset class (ETF score > 3) was from 3/9/2011 to 12/21/2011. Below, I’ve got a picture of the ETF score chart, along with a performance snip during that same period. Perhaps because of investor concern about inflation—misplaced, as it turned out—gold outperformed fixed income over that stretch of time.

Source: Dorsey Wright (click on images to enlarge)

There’s no guarantee that gold will be an inflation hedge, of course. We never know what asset class will become strong when investors fear future inflation. Next time around it could be real estate, Swiss francs, TIPs, or energy stocks—or nothing. There are so many variables impacting performance that it is impractical (and impossible) to account for them all. However, relative strength has the simple virtue of pointing out—based on actual market performance—where the strength is appearing.

Investment history sometimes seems to be a never-ending cycle of discredited themes, but those themes can drive the market quite powerfully until they are discredited. (Remember the “new era” of the internet? Or how ”peak oil” was so compelling with crude at $140/barrel?) It’s helpful to know what those themes are, whether you are trying to take advantage of them or just trying to get out of the way.