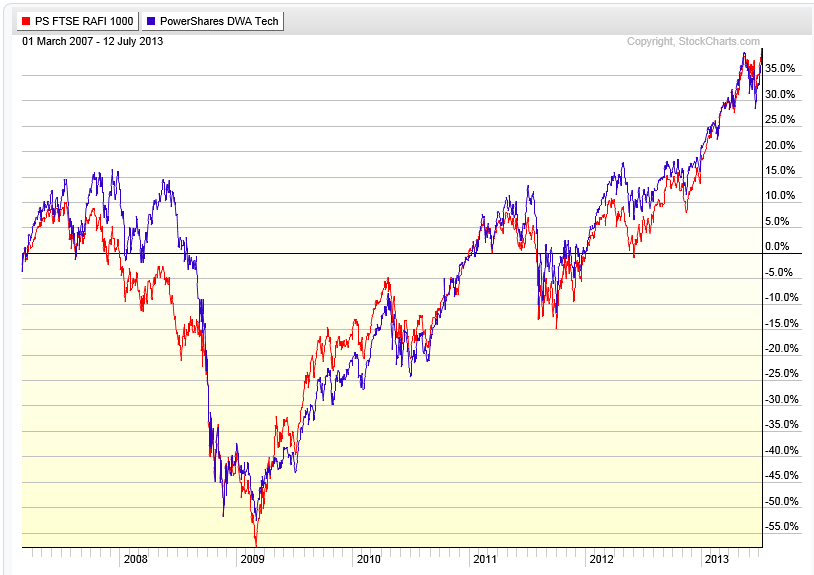

Modern portfolio theory imagines that you can construct an optimal portfolio, especially if you can find investments that are uncorrelated. There’s a problem from the correlation standpoint, though. As James Picerno of The Capital Spectator points out, correlations are rising:

A new study from the Bank of International Settlements (BIS) raises doubts about the value of commodities as a tool for enhancing portfolio diversification. The paper’s smoking gun, so to speak, is that “the correlation between commodity and equity returns has substantially increased after the onset of the recent financial crisis.”

Correlations are a key factor in the design and management of asset allocation, but they’re not the only factor. And even if we can find assets and strategies with reliably low/negative correlations with, say, equities, that alone isn’t enough, as I discussed last week. You also need to consider other factors, starting with expected return. It may be tempting to focus on one pair of assets and consider how the trailing correlation stacks up today. But that’s hardly the last word on making intelligent decisions on how to build a diversified portfolio.

As more investors pile into commodities, REITs, hedge funds, and other formerly obscure corners, the historical diversification benefits will likely fade. Granted, the outlook for expected diversification benefits fluctuates through time, and so what looks unattractive today may look considerably more compelling tomorrow (and vice versa). But as a general proposition, it’s reasonable to assume that correlations generally will inch closer to 1.0. That doesn’t mean that diversifying across asset classes is destined to become worthless, but the expected payoff is likely to dim with the passage of time.

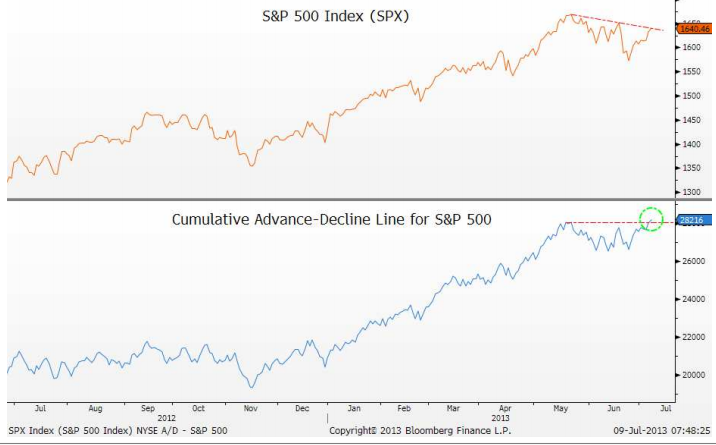

Mathematically, any two items that are not 100% correlated will reduce volatility when combined. But that doesn’t necessarily mean it’s a good addition to your portfolio—or that modern portfolio theory is a very good way to construct a portfolio. (We will set aside for now the MPT idea that volatility is necessarily a bad thing.) The article includes a nice graphic, reproduced below, that shows how highly correlated many asset classes are with the US market, especially if you keep in mind that these are 36-month rolling correlations. Many asset classes may not reduce portfolio volatility much at all.

Source: The Capital Spectator (click on image to enlarge)

As Mr. Picerno points out, optimal allocations are far more sensitive to returns than to correlations or volatility. So even if you find a wonderfully uncorrelated investment, if it has a lousy return it may not help the overall portfolio much. It would reduce volatility, but quite possibly at a big cost to overall returns. The biggest determinant of your returns, of course, is what assets you actually hold and when. The author puts this a slightly different way:

Your investment results also rely heavily on how and when you rebalance the mix.

Indeed they do. If you hold equities when they are doing well and switch to other assets when equities tail off, your returns will be quite different than an investor holding a static mix. And your returns will be way different than a scared investor that holds cash when stocks or other assets are doing well.

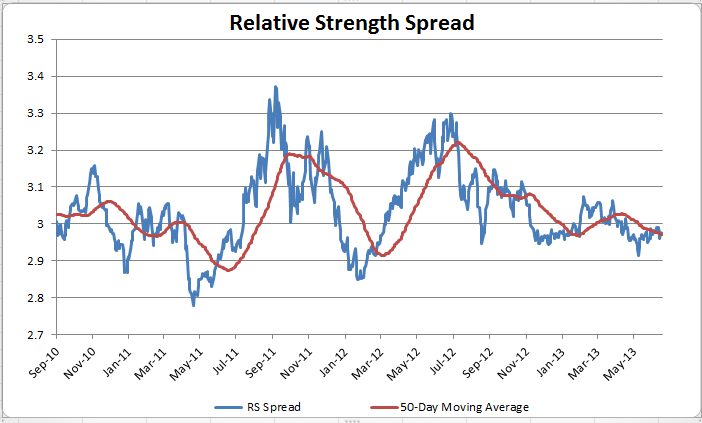

In other words, the return of your asset mix is what impacts your performance, not correlations or volatility. This seems obvious, but in the fog of equations about optimal portfolio construction, this simple fact is often overlooked. Since momentum (relative strength) is generally one of the best-performing and most reliable return factors, that’s what we use to drive our global tactical allocation process. The idea is to own asset classes as long as they are strong—and to replace them with a stronger asset class when they begin to weaken. In this context, diversification can be useful for reducing volatility, if you are comfortable with the potential reduction in return that it might entail. (We generally advocate diversifying by volatility, by asset class, and by strategy, although the specific portfolio mix might change with the preference of the individual investor.) If volatility is well-tolerated, maybe the only issue is trying to generate the strongest returns.

Portfolio construction can’t really be reduced to some “optimal” set of tradeoffs. It’s complicated because correlations change over time, and because investor preferences between return and volatility are in constant flux. There is nothing stable about the portfolio construction process because none of the variables can be definitively known; it’s always an educated approximation. Every investor gets to decide—on an ongoing basis—what is truly important: returns (real money you can spend) or volatility (potential emotional turmoil). I always figure I can afford Maalox with the extra returns, but you can easily see why portfolio management is overwhelming to so many individual investors. It can be torture.

Portfolio reality, with all of its messy approximations, bears little resemblance to the seeming exactitude of Modern Portfolio Theory.