…has been discovered by the Wall Street Journal. Recently, they wrote an article about better ways to index—alternative beta—and referenced a study by Cass Business School. (We wrote about this study here in April.)

Here’s the WSJ’s take on the Cass Business School study:

The Cass Business School researchers examined how 13 alternative index methodologies would have performed for the 1,000 largest U.S. stocks from 1968 to 2011.

All 13 of the alternative indexes produced higher returns than a theoretical market-cap index the researchers created. While the market-cap index generated a 9.4% annualized return over the full period, the other indexes delivered between 9.8% and 11.4%. The market-cap-weighted index was the weakest performer in every decade except the 1990s.

The most interesting part of the article, to me, was the discussion of the growing acceptance of alternative beta. This is truly exciting.

Indeed, a bevy of funds tracking alternative indexes have been launched in recent years. And their popularity is soaring: 43% of inflows into U.S.-listed equity exchange-traded products in the first five months of 2013 went to products that aren’t weighted by market capitalization, up from 20% for all of last year, according to asset manager BlackRock Inc.

And then there was one mystifying thing: although one of the best-performing alternative beta measures is relative strength (“momentum” to academics), relative strength was not mentioned in the WSJ article at all!

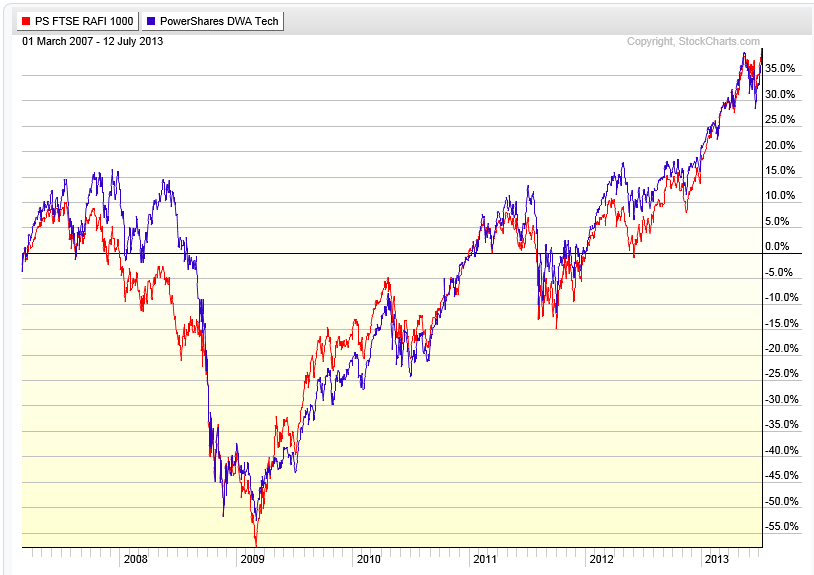

Instead there was significant championing of fundamental indexes. Fundamental indexes are obviously a valid form of alternative beta, but I am always amazed how relative strength flies under the radar. (See The #1 Investment Return Factor No One Wants to Talk About.) Indeed, as you can see from the graphic below, the returns of two representative ETFs, PRF and PDP are virtually indistinguishable. One can only hope that relative strength will eventually gets its due.

The performance numbers above are pure price returns, based on the applicable index not inclusive of dividends, fees, commissions, or other expenses. Past performance not indicative of future results. Potential for profits accompanied by possibility of loss. See www.powershares.com for more information.