We’ve come a long way from the days of ”Wall Street is a random walk, and past price movements tell you nothing about the future,” as advocated by Efficient Market Hypothesis (EMH) proponents Burton Malkiel and Eugene Fama in the 1960s and 1970s. While practioners have been using relative strength strategies since at least the 1930s (Richard Wyckoff, H.M. Gartley, Robert Levy, George Chestnut, and many others), most academics stayed fairly loyal to the EMH until the early 1990s. Wesley Gray, PhD, of Turnkey Analyst, summarizes how academic studies on momentum in the early 1990s started to turn the tide in a academic community:

In the early 90s academics (e.g., Jagadeesh and Titman (1993) began to focus on the concept of “momentum,” which refers to the fact that, contrary to the EMH, past returns can predict future returns, via a trend effect. That is, if a stock has performed well in the recent past, it will continue to perform well in the future. EMH proponents were perplexed, but argued that momentum returns were likely related to additional risks borne: riskier smaller and cheaper companies drove the effect. Many researchers have responded with studies that find the effect persists even when controlling for company size and value factors. And the effect appears to hold across multiple asset classes, such as commodities, currencies and even bonds. (e.g., Check out Chris Geczy’s “World’s Longest Backtest”).

An EMH advocate reviews the momentum data

It seems that much of the research on momentum today is moving beyond the initial question of “Is it possible that momentum really does work?” to trying to better understand why it works.

Again, from Wesley Gray:

In short, it appears the evidence for momentum is only growing stronger (Gary Antonacci has some great research on the subject: http://optimalmomentum.blogspot.com/). Today researchers are going even farther by applying behavioral finance concepts in order to understand psychological factors that drive the momentum effect.

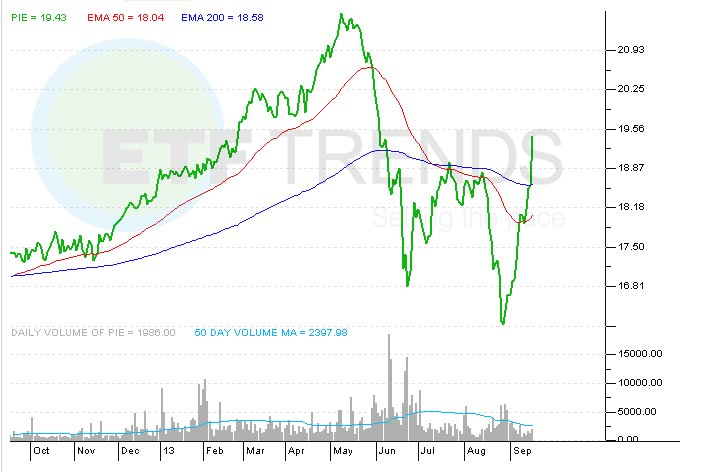

In “Demystifying Managed Futures,” by Brian Hurst, Yao Hua Ooi, and Lasse Heje Pedersen, the authors argue that the returns for even the largest and most successful Managed Futures Funds and CTAs can be attributed to momentum strategies. They also discuss a model for the lifecycle of a trend, and then draw on behavioral psychology to hypothesize the cognitive mechanisms that drive the underlying momentum effect. Below is a graph of a typical trend:

Note that there are several distinct components to the trend: 1) initial under-reaction, when market price is below fundamental value, 2) over-reaction, as the market price exceeds fundamental value, and 3) the end of the trend, when the price converges with fundamental value. There are several behavioral biases that may systematically contribute to these components.

Under-reaction phase:

Adjustment and Anchoring. This occurs when we consider a value for a quantity before estimating that quantity. Consider the following 2 questions posed by Kahneman: Was Gandhi more or less than 144 years old when he died? How old was Gandhi when he died? Your guess was affected by the suggestion of his advanced age, which led you to anchor on it and then insufficiently adjust from that starting point, similar to how people under-react to news about a security. (also, Gandhi died at 79)

The disposition effect. This is the tendency of investors to sell their winners too early and hold onto losers too long. Selling early creates selling pressure on a long in the under-reaction phase, and reduces selling pressure on a short in the under-reaction phase, thus delaying the price discovery process in both cases.

Over-reaction phase:

Feedback trading and the herd effect. Traders follow positive feedback strategies. For instance, George Soros has described his concept of “reflexivity,” which involves buying in anticipation of further buying by uninformed investors in a self-reinforcing process. Additionally, herding can be a defense mechanism occurring when an animal reduces its risk of being eaten by a predator by staying with the crowd. As Charles MacKay put it in 1841 in his book, Extraordinary Popular Delusions and Madness of Crowds, “Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.”

Gray concludes:

The growing academic body of work supporting the existence of the momentum effect, along with a sensible psychological framework that explains it, are a potent combination. Indeed, momentum may have come of age as an investment tool, as more and more investors incorporate it into their portfolios.

Dorsey Wright has been refining work on relative strength/momentum for decades and the recent milestone of the PowerShares DWA Momentum ETFs (PDP, PIZ, PIE, and DWAS) passing $2 billion in assets is further confirmation that “momentum is coming of age.” Furthermore, users of the Dorsey Wright research have a great number of relative strength-based tools (RS Matrix, Favored Sector, Dynamic Asset Level Investing, Technical Attributes…) at their fingertips to be able to customize relative strength-based strategies for their clients. It’s been a long time coming, and acceptance of momentum still has a long way to go, but it is encouraging to see this factor begin to get the recognition that I believe it is due.