Mutual fund flow estimates are derived from data collected by The Investment Company Institute covering more than 95 percent of industry assets and are adjusted to represent industry totals.

High RS Diffusion Index

November 27, 2013The chart below measures the percentage of high relative strength stocks that are trading above their 50-day moving average (universe of mid and large cap stocks.) As of 11/26/13.

The 10-day moving average of this indicator is 85% and the one-day reading is also 85%.

Posted by: Andy Hyer

Warren Buffett and Charlie Munger’s Best Advice

November 26, 2013…talk about the best advice they have even gotten in a short piece from Fortune. I think it clarifies the difference between a blind value investor and an investor who is looking for good companies (not coincidentally, many of those good companies have good relative strength). Warren Buffett and Charlie Munger have made a fortune implementing this advice.

Buffett: I had been oriented toward cheap securities. Charlie said that was the wrong way to look at it. I had learned it from Ben Graham, a hero of mine. [Charlie] said that the way to make really big money over time is to invest in a good business and stick to it and then maybe add more good businesses to it. That was a big, big, big change for me. I didn’t make it immediately and would lapse back. But it had a huge effect on my results. He was dead right.

Munger: I have a habit in life. I observe what works and what doesn’t and why.

I highlighted the fun parts. Buffett started out as a Ben Graham value investor. Then Charlie wised him up.

Valuation has its place, obviously. All things being equal, it’s better to buy cheaply than to pay up. But Charlie Munger had observed that good businesses tended to keep on going. The same thing is typically true of strong stocks—and most often those are the stocks of strong businesses.

Buy strong businesses and stick with them as long as they remain strong.

Posted by: Mike Moody

Nasdaq 4000

November 26, 2013Why investing can be so frustrating (especially if you ignore the technicals):

Tech investors in 2000 were right about the possibilities of the Internet and mobile computing. But they were dead wrong about which companies would be in the vanguard and how long those advances would take.

And they paid the price.

Returning to 4000 — first crossed in December 1999 and last seen in September 2000 — is a symbolic end to more than a decade of pain. Legions of investors plunged into the tech-stock craze of the late 1990s in search of easy riches and ended up falling victim to the worst crash since the Great Depression.

The Nasdaq fell 78% in 2½ years. Many investors worried it might be a long time before they got their money back. But few could have imagined it would be this long.

“It’s taken 13 years to get back,” says Jack Ablin of BMO Private Bank. “It just shows the magnitude of that bubble we expanded back in 1999 and 2000.”

My emphasis added. It’s not enough to be generally right about the fundamental story. The technicals (i.e. trends of the stocks themselves) cannot be ignored.

Source: Yahoo! Finance

Posted by: Andy Hyer

Relative Strength Spread

November 26, 2013The chart below is the spread between the relative strength leaders and relative strength laggards (universe of mid and large cap stocks). When the chart is rising, relative strength leaders are performing better than relative strength laggards. As of 11/25/2013:

The RS Spread continues to trade above its 50 day moving average—reflecting a generally positive environment for relative strength strategies.

Posted by: Andy Hyer

PIZ In The News

November 25, 2013From “A Momentum ETF Searches for More Upside” by ETF Trends:

Exchange traded funds using intelligent indexing or so-called smart beta strategies have come into the limelight this year as investors have poured over $45 billion into such ETFs and that was as of the end of October.

While “smart beta” may appear to be a new buzz-phrase, many of the ETFs that subscribe to non-market capitalization-weighted strategies have been around for a while. The PowerShares DWA Developed Markets Momentum Portfolio (PIZ) is a prime example.

PIZ follows the same relative strength methodology as other well-known PowerShares ETFs that track Dorsey Wright indices, such as the PowerShares DWA Emerging Markets Momentum Portfolio (PIE) and the PowerShares DWA SmallCap Momentum Portfolio (DWAS) , one of this year’s most successful small-cap ETFs. [Use This ETF for Rising Rates Protection]

PIZ has already surged 26% this year, but this ex-U.S. developed markets play may have more upside to come.

Past performance is no guarantee of future returns. See www.powershares.com for more information.

Posted by: Andy Hyer

Reconciling Fundamentals and Technicals

November 25, 2013Another prominent bear throws in the towel. Last week, hedge fund manager Hugh Hendry said the following:

I can no longer say I am bearish. When markets become parabolic, the people who exist within them are trend followers, because the guys who are qualitative have got taken out,

I have been prepared to underperform for the fun of being proved right when markets crash. But that could be in three-and-a-half-years’ time.

I cannot look at myself in the mirror; everything I have believed in I have had to reject. This environment only makes sense through the prism of trends.

I may be providing a public utility here, as the last bear to capitulate. You are well within your rights to say ‘sell’. The S&P 500 is up 30% over the past year: I wish I had thought this last year.

Crashing is the least of my concerns. I can deal with that, but I cannot risk my reputation because we are in this virtuous loop where the market is trending.

Whether Hendry is correct in his theory that there is a disconnect between the fundamentals and the technicals or whether he is just not looking at the right fundamentals is up for debate. Pragmatists, like us, are more comfortable simply following the trends.

HT: The Reformed Broker and Abnormal Returns

Posted by: Andy Hyer

Weekly RS Recap

November 25, 2013The table below shows the performance of a universe of mid and large cap U.S. equities, broken down by relative strength decile and quartile and then compared to the universe return. Those at the top of the ranks are those stocks which have the best intermediate-term relative strength. Relative strength strategies buy securities that have strong intermediate-term relative strength and hold them as long as they remain strong.

Last week’s performance (11/18/13 – 11/22/13) is as follows:

The laggards had a particularly rough week last week as the bottom quartile of the ranks were down 0.48% while the universe was essentially flat.

Posted by: Andy Hyer

Quote of the Week

November 25, 2013At the top of the list of economic theories based on clearly false assumptions is that of Rational Expectations, in which humans are assumed to be machines programmed with rational responses. Although we all know – even economists – that this assumption does not fit the real world, it does allow for relatively simple conclusions, whereas the assumption of complicated, inconsistent, and emotional humanity does not. The folly of Rational Expectations resulted in five, six, or seven decades of economic mainstream work being largely thrown away. It did leave us, though, with perhaps the most laughable of all assumption-based theories, the Efficient Market Hypothesis (EMH).—-Jeremy Grantham, GMO

On the other hand, technical analysis assumes that investors are emotional and selectively irrational. I know what makes more sense to me.

HT to The Big Picture

Posted by: Mike Moody

Option Income Isn’t Really Income

November 22, 2013Fans of the free lunch will disappointed to find out that option income isn’t really income—it’s just part of the total return stream of an option income strategy. There’s nothing wrong with option income, but a buy-write strategy is just a way to slightly reduce the volatility of an equity portfolio by trading away some of the potential upside. I get concerned when I see articles promoting it as a way to generate extra income, especially when the trade-off is not fully explained.

According to a recent story in the Wall Street Journal, investors are increasingly turning to option income.

So far this year more than $3.4 billion in options contracts have changed hands on U.S. exchanges, according to the Options Industry Council in Chicago. That’s almost as much as 2008′s full-year volume and is on pace to be the second-best year in options trading history. The all-time record came in 2011 with $4.6 billion in contracts changing hands.

A buy-write strategy to generate option income might make sense if it is part of a total-return strategy. All too often, investors have the wrong idea.

How big of a dent can it make on a portfolio’s long-term prospects? A lot, says Philip Guziec, a Morningstar analyst who studies various options strategies. He recently looked at six years worth of performance data through April 2010 using the CBOE S&P 500 BuyWrite Index, which follows a strategy of selling call options on the S&P 500 Index every month and reinvesting premiums.

During that period, a covered-call strategy where premiums were reinvested would have increased the portfolio’s return by around 19%. By contrast, spending each month’s options payments resulted in reducing the options portfolio’s value by more than 50%, according to Mr. Guziec.

“Too many people sell covered calls to generate extra income to live on, not realizing how severely that type of a strategy can eat into a portfolio’s upside over time,” he says.

Many investors would be shocked to learn that their portfolio could take a 50% haircut in only six years if they spent the option income! As always, the bottom line is total return.

Posted by: Mike Moody

Sector Performance

November 22, 2013The chart below shows performance of US sectors and capitalizations over the trailing 12, 6, and 1 month(s). Performance updated through 11/21/2013.

Numbers shown are price returns only and are not inclusive of transaction costs. Source: iShares

Posted by: Andy Hyer

Fund Flows

November 21, 2013Mutual fund flow estimates are derived from data collected by The Investment Company Institute covering more than 95 percent of industry assets and are adjusted to represent industry totals.

Posted by: Andy Hyer

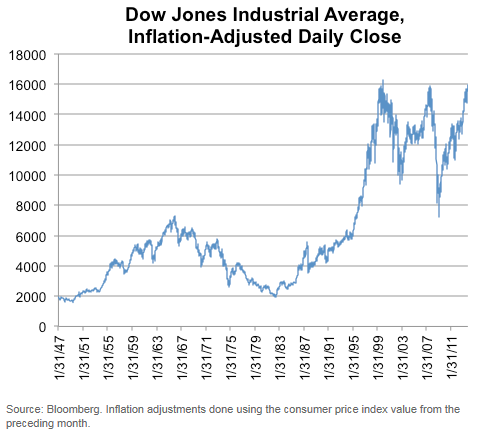

A Reminder About Real Return

November 20, 2013The main thing that should matter to a long-term investor is real return. Real return is return after inflation is factored in. When your real return is positive, you are actually increasing your purchasing power— and purchasing goods and services is the point of having a medium of exchange (money) in the first place.

A recent article in The New York Times serves as a useful reminder about real return.

The Dow Jones industrial average broke through 16,000 on Monday for the first time on record — well, at least in nominal terms. If you adjust for inflation, technically the highest level was on Jan. 14, 2000.

Adjusting for price changes, the Dow’s high today was still about 1.3 percent below its close on Jan. 14, 2000 (and about 1.6 percent below its intraday high from that date).

There’s a handy graphic as well, of the Dow Jones Industrial Average adjusted for inflation.

(click on image to enlarge)

This chart, I think, is a good reminder that buy-and-hold (known in our office as “sit-and-take-it”) is not always a good idea. In most market environments there are asset classes that are providing real return, but that asset class is not always the broad stock market. There is value in tactical asset allocation, market segmentation, strategy diversification, and other ways to expose yourself to assets that are appreciating fast enough to augment your purchasing power.

I’ve read a number of pieces recently that contend that “risk-adjusted” returns are the most important investment outcome. Really? This would be awesome if I could buy a risk-adjusted basket of groceries at my local supermarket, but strangely, they seem to prefer the actual dollars. Your client could have wonderful risk-adjusted returns rolling Treasury bills, but would then also get to have a lovely risk-adjusted retirement in a mud hut. If those dollars are growing more slowly than inflation, you’re just moving in reverse.

Real returns are where it’s at.

Posted by: Mike Moody

Andy Hyer on Money Truth with Michael Klonsky

November 20, 2013Click here for my recent appearance on the Money Truth radio show with Michael Klonsky.

Posted by: Andy Hyer

High RS Diffusion Index

November 20, 2013The chart below measures the percentage of high relative strength stocks that are trading above their 50-day moving average (universe of mid and large cap stocks.) As of 11/19/13.

The 10-day moving average of this indicator is 85% and the one-day reading is 82%.

Posted by: Andy Hyer

Stock Market Sentiment Review

November 19, 2013I’m still getting back into the swing of things after having the flu most of last week. In the midst of my stock market reading, I was struck by an article over the weekend from Abnormal Returns, a blog you should be reading, if you aren’t already. The editor had a selection of the blog posts that were most heavily trafficked from the prior week. Without further ado:

- Chilling signs of a market top. (The Reformed Broker)

- Ray Dalio thinks you shouldn’t bother trying to generate alpha. (The Tell)

- Ten laws of stock market bubbles. (Doug Kass)

- How to teach yourself to focus. (The Kirk Report)

- Are we in a bubble? (Crossing Wall Street)

- Josh Brown, “If the entities in control of trillions of dollars all want asset prices to be higher at the same time, what the hell else should you be positioning for?” (The Reformed Broker)

- Guess what stock has added the most points to the S&P 500 this year? (Businessweek)

- Everything you need to know about stock market crashes. (The Reformed Broker)

- Jim O’Neil is swapping BRICs for MINTs. (Bloomberg)

- How to survive a market crash. (Your Wealth Effect)

I count five of the top ten on the topic of market tops/bubbles/crashes!

Markets tend to top out when investors are feeling euphoric, not when they are tremendously concerned about the downside. In my opinion, investors are still quite nervous—and fairly far from euphoric right now.

Posted by: Mike Moody

Quote of the Week

November 19, 2013Anyone who cannot cope with mathematics is not fully human. At best he is a tolerable subhuman who has learned to wear shoes, bathe, and not make messes in the house. —-Robert A. Heinlein from The Notebooks of Lazarus Long

I know, kind of harsh but funny at the same time. The thing is that you need to have a rudimentary understanding of mathematics-percentages and so on-or at least not be afraid of math in order to make sense of finance. It would be difficult to do any kind of reasonable asset allocation, portfolio management, or everyday financial decision-making without some degree of mathematical literacy.

Posted by: Mike Moody

Upcoming Webinar: What’s Next For Relative Strength

November 19, 2013Upcoming Webinar: What’s Next for Relative Strength

Thursday, December 5th, 2013 at 12:00 PM EST

Dorsey, Wright and Associates has teamed up with Elkhorn Investments to bring to market two strategies in the form of structured products. In this upcoming webinar, you will have a chance to hear from Tom Dorsey, Co-founder and President of Dorsey Wright, and Ben Fulton, CEO of Elkhorn Invesments, on applying momentum strategies to structured products and managed accounts.

Listen as these two innovators weigh in on each of the following topics:

- The 2014 market outlook

- Tectonic shifts now underways in the ETF industry

- Accessing relative strength through managed accounts and structured products

- Applying the relative strength process to the MLP sector

Click here to register for the webinar today!

Posted by: Andy Hyer

Momentum in Rising Rate Environments

November 19, 2013The latest PowerShares Connection report is out. There is a nice writeup about the PowerShares DWA Small Cap Momentum ETF and what happens to high momentum securities during rising rate environments. You can view the report here.

Posted by: John Lewis

Relative Strength Spread

November 19, 2013The chart below is the spread between the relative strength leaders and relative strength laggards (universe of mid and large cap stocks). When the chart is rising, relative strength leaders are performing better than relative strength laggards. As of 11/18/2013:

Posted by: Andy Hyer

Weekly RS Recap

November 18, 2013The table below shows the performance of a universe of mid and large cap U.S. equities, broken down by relative strength decile and then compared to the universe return. Those at the top of the ranks are those stocks which have the best intermediate-term relative strength. Relative strength strategies buy securities that have strong intermediate-term relative strength and hold them as long as they remain strong.

Last week’s performance (11/11/13 – 11/15/13) is as follows:

It was generally a good week for high relative strength stocks—especially the top decile of our ranks.

Posted by: Andy Hyer

The Coach Who Never Punts

November 14, 2013Have you ever been to a football game and never seen a punt? Yeah, me neither. You would probably think that coach was crazy. I would have thought so too, but the numbers say otherwise.

It seems like most of the comparisons between advanced statistical metrics in sports and investing have revolved around baseball. This is the first example I have seen of a football coach really thinking outside of the box to give his team a statistical advantage every game. Sure, football coaches have used statistics to game plan and find tendencies, but what this coach is doing goes way beyond that.

How does this relate to investing? This coach has found an edge and relentless exploits the edge no matter what the cost. He knows that statistically he is better off never giving the ball to the other team. He never punts the ball to them. When he kicks off, it is always an onside kick. If the other team wants the ball they have to earn it. He readily admits they only have a 50% fourth down conversion rate so it isn’t like this is some sort of offensive juggernaut that can never be stopped. This coach is wrong a lot. He no doubt looks like a fool quite often. But he has done the math and knows his methods give him a clear statistical advantage to win games over time. It might not work on any given play, series, quarter, or half. Winning investment strategies don’t work every day, week, quarter, or even every year. But over time they do, and the only thing preventing you from realizing those gains buckling under the pressure and failing to execute the strategy. The edges are small, but they add up over time.

Posted by: John Lewis

Fund Flows

November 14, 2013Mutual fund flow estimates are derived from data collected by The Investment Company Institute covering more than 95 percent of industry assets and are adjusted to represent industry totals.

Posted by: Andy Hyer