Mutual fund flow estimates are derived from data collected by The Investment Company Institute covering more than 95 percent of industry assets and are adjusted to represent industry totals.

DWAS (PowerShares DWA SmallCap TL Index) Passes One-Year Mark

July 24, 2013And what a year it was:

CHICAGO, IL-(Marketwired - Jul 24, 2013) - Invesco PowerShares Capital Management LLC, a leading global provider of exchange-traded funds (ETFs), today celebrates the one-year anniversary of the PowerShares DWA SmallCap Technical Leaders™ Portfolio (DWAS). Listed July 19, 2012, the PowerShares DWA SmallCap Technical Leaders Portfolio is part of the broad suite of DWA Technical Leaders™ ETFs covering US, developed and emerging market segments.

Since inception, the PowerShares DWA SmallCap Technical Leaders Portfolio (DWAS) has outperformed the Russell 2000 Index market-cap weighted benchmark by a margin of 9.44%. For the one-year period ending July 19, 2013, DWAS achieved a total return of 41.84% based on NAV, outperforming the Russell 2000 Index which had a total return of 32.40% during the same period. (Note:total return figures include all dividends).1

“The PowerShares DWA SmallCap Technical Leaders Portfolio (DWAS) is the small-cap complement to the PowerShares DWA Technical Leaders Portfolio (PDP),” said Andrew Schlossberg, head of global ETFs. “Together with the PowerShares DWA Emerging Markets Technical Leaders Portfolio (PIE), and PowerShares DWA Developed Markets Technical Leaders Portfolio (PIZ) investors can efficiently tap the alpha-seeking potential of momentum factor-based ETFs globally.2As the leading provider in smart beta ETFs,3 we see a lot of potential for focused factor-based strategies to help investors achieve their goals, whether it’s seeking to enhance returns, reduce risk, or both.”

“We are proud to partner with Invesco PowerShares on momentum factor-based ETFs, and look forward to a long lasting relationship as we expand our global presence,” said Tom Dorsey, president and CEO of Dorsey, Wright & Associates, LLC.

See www.powershares.com for more information. The Dorsey Wright SmallCap Technical Leaders Index is calculated by Dow Jones, the marketing name and a licensed trademark of CME Group Index Services LLC (“CME Indexes”). “Dow Jones Indexes” is a service mark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Products based on the Dorsey Wright SmallCap Technical Leaders IndexSM, are not sponsored, endorsed, sold or promoted by CME Indexes, Dow Jones and their respective affiliates make no representation regarding the advisability of investing in such product(s). Past performance is no guarantee of future returns.

Posted by: Andy Hyer

212 Years of Price Momentum

July 23, 2013Christopher Geczy, University of Pennsylvania, and Mikhail Samonov, Octoquant.com, recently published the world’s longest backtest on momentum (1801 - 2012). This is a truly fascinating white paper. So much of the testing on momentum has been done on the CRSP database of U.S. Securities which goes back to 1926. Now, we can get a much longer-term perspective on the performance of momentum investing.

Abstract:

We assemble a dataset of U.S. security prices between 1801 and 1926, and create an out-of-sample test of the price momentum strategy, discovered in the post-1927 data. The pre-1927 momentum profits remain positive and statistically significant. Additional time series data strengthens the evidence that momentum is dynamically exposed to market beta, conditional on the sign and duration of the tailing market state. In the beginning of each market state, momentum’s beta is opposite from the new market direction, generating a negative contribution to momentum profits around market turning points. A dynamically hedged momentum strategy significantly outperforms the un-hedged strategy.

Yep, momentum worked then too! As pointed out in the white paper, those looking for a return factor that outperforms every single year will not find it with price momentum (or any other factor), but momentum has a long track record of generating excess returns.

So much for the theory that ideas in investing tend to streak, get overinvested, then die. Some, like momentum (or value), go in an out of favor, but they have generated very robust returns over long periods of time.

HT: Abnormal Returns and Turnkey Analyst

Past performance is no guarantee of future returns.

Posted by: Andy Hyer

How to Pick a Winner

July 23, 2013Scientific American takes a look at the best way to select a winner:

Given the prevalence of betting and the money at stake, it is worth considering how we pick sides. What is the best method for predicting a winner? One might expect that, for the average person, an accurate forecast depends on the careful analysis of specific, detailed information. For example, focusing on the nitty-gritty knowledge about competing teams (e.g., batting averages, recent player injuries, coaching staff) should allow one to predict the winner of a game more effectively than relying on global impressions (e.g., overall performance of the teams in recent years). But it doesn’t.

In fact, recent research by Song-Oh Yoon and colleagues at the Korea University Business School suggests that when you zero in on the details of a team or event (e.g., RBIs, unforced errors, home runs), you may weigh one of those details too heavily. For example, you might consider the number of games won by a team in a recent streak, and lose sight of the total games won this season. As a result, your judgment of the likely winner of the game is skewed, and you are less accurate in predicting the outcome of the game than someone who takes a big picture approach. In other words, it is easy to lose sight of the forest for the trees.

So often people that consider employing relative strength strategies, which measure overall relative price performance of securities rather than delving into the weeds with various accounting level details, feel like they must not be doing an adequate job of analyzing the merits of a given security. As pointed out in this research, the best results came from focusing on less data, not more.

Whether trying to select a winner in sports or in the stock market, it is important to remember that “detailed analysis fog the future.”

Posted by: Andy Hyer

Alternative Beta

July 22, 2013…has been discovered by the Wall Street Journal. Recently, they wrote an article about better ways to index—alternative beta—and referenced a study by Cass Business School. (We wrote about this study here in April.)

Here’s the WSJ’s take on the Cass Business School study:

The Cass Business School researchers examined how 13 alternative index methodologies would have performed for the 1,000 largest U.S. stocks from 1968 to 2011.

All 13 of the alternative indexes produced higher returns than a theoretical market-cap index the researchers created. While the market-cap index generated a 9.4% annualized return over the full period, the other indexes delivered between 9.8% and 11.4%. The market-cap-weighted index was the weakest performer in every decade except the 1990s.

The most interesting part of the article, to me, was the discussion of the growing acceptance of alternative beta. This is truly exciting.

Indeed, a bevy of funds tracking alternative indexes have been launched in recent years. And their popularity is soaring: 43% of inflows into U.S.-listed equity exchange-traded products in the first five months of 2013 went to products that aren’t weighted by market capitalization, up from 20% for all of last year, according to asset manager BlackRock Inc.

And then there was one mystifying thing: although one of the best-performing alternative beta measures is relative strength (“momentum” to academics), relative strength was not mentioned in the WSJ article at all!

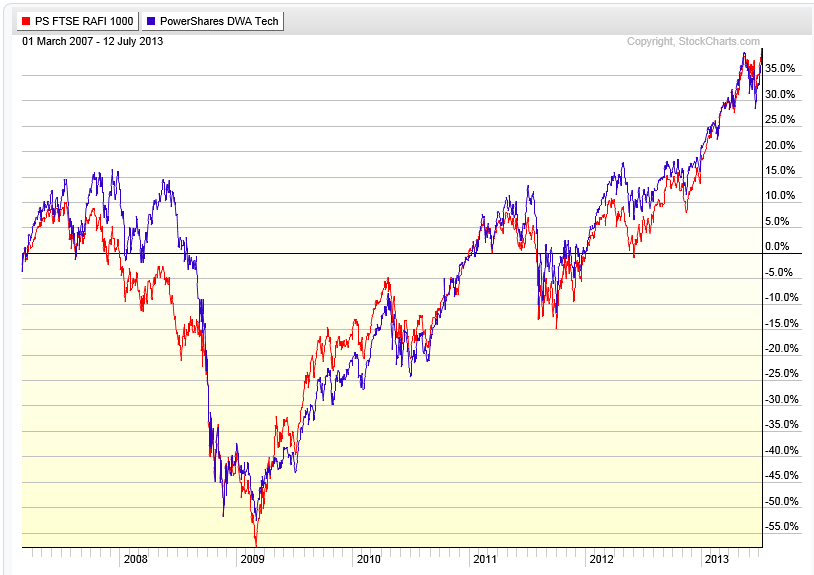

Instead there was significant championing of fundamental indexes. Fundamental indexes are obviously a valid form of alternative beta, but I am always amazed how relative strength flies under the radar. (See The #1 Investment Return Factor No One Wants to Talk About.) Indeed, as you can see from the graphic below, the returns of two representative ETFs, PRF and PDP are virtually indistinguishable. One can only hope that relative strength will eventually gets its due.

The performance numbers above are pure price returns, based on the applicable index not inclusive of dividends, fees, commissions, or other expenses. Past performance not indicative of future results. Potential for profits accompanied by possibility of loss. See www.powershares.com for more information.

Posted by: Andy Hyer

Relative Strength Dividend Investing

July 22, 2013Dividend investing is all the rage these days. It can be a valuable investment strategy if it is done well—and a very negative experience if it is done poorly. The editor of Morningstar’s DividendInvestor, Josh Peters, recently penned a great column after his model portfolio collected its 1000th dividend payment. The article involves the lessons he learned in his foray into dividend investing. It is a must-read for all dividend investors.

One interesting thing, to me, was that many of the dividend investing problems that he experienced could have been avoided with a relative strength screen. (We use just such a screeen for the First Trust dividend UITs we specify the portfolios for.) Allow me to explain what I mean.

Morningstar’s first lesson was that quality was important in dividend investing. Mr. Peters writes:

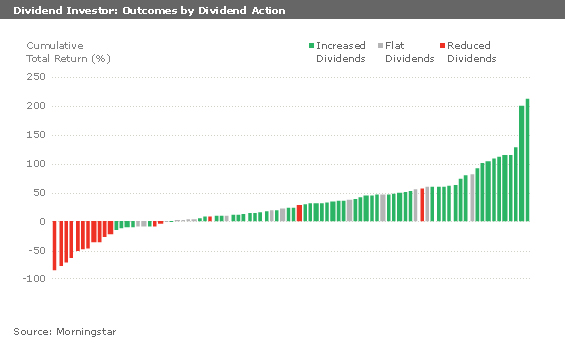

The dividend cutters occupy a land of agony: We lost money on 13 of the 16 portfolio holdings that cut their dividends, and the 3 that have been profitable-General Electric (GE), U.S. Bancorp (USB), and Wells Fargo (WFC)-only pulled into the black long after their dividends began to recover.

One of the first things we noticed when screening the dividend investing universe by relative strength was this: companies that cut their dividends overwhelmingly had negative relative strength. In fact, when I looked through the list of S&P Dividend Aristocrats that cut their dividends in the middle of the Great Recession, I discovered that all but two of them had negative relative strength before the dividend cut. Some had had poor relative strength for many years. Pitney Bowes (PBI) is just the most recent example. You can see from Morningstar’s chart below that most of their losses came from dividend cutters.

Source: Morningstar (click on image to enlarge)

In other words, screening for good relative strength is a pretty good insurance policy to avoid the land of agony.

Morningstar’s second lesson was that many of the best dividend stocks were not fundamentally cheap.

I’ve always believed dividends were the most important aspect of our investment strategy, but I’ve always been something of a cheapskate, too. I don’t like paying full price for anything if I can help it. In the first year or two of DividendInvestor’s run, I brought this impulse to my stock-picking, but I was often disappointed. In the banking industry, for example, I originally passed on top performers like M&T (MTB) and gravitated toward statistically cheaper names like National City and First Horizon (FHN).

Guess what top performers have in common? You guessed it—good relative strength. A relative strength screen is also a useful way to avoid slugs that are cheap and never perform well.

The third lesson is just that time is important. If you are doing dividend investing, a lot of the benefit can come from compounding over time, or perhaps from reinvesting all of the yield.

If you choose to use the Dorsey Wright-managed First Trust UITs, we always recommend that you buy a series of four UITs and just keep rolling them over time. That way you always have a current portfolio of strong performers, screened to try to avoid some of the dividend cutters. If the portfolio appreciates over the holding period—beyond just paying out the dividend yield—it might make sense when you roll it over to use the capital gains to buy additional units, in an effort to have the payout level increase over time.

Even if you never use our products, you might want to consider some basic relative strength screening of your dividend stock purchases.

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. See http://www.ftportfolios.com for more information.

Posted by: Andy Hyer

Weekly RS Recap

July 22, 2013The table below shows the performance of a universe of mid and large cap U.S. equities, broken down by relative strength decile and then compared to the universe return. Those at the top of the ranks are those stocks which have the best intermediate-term relative strength. Relative strength strategies buy securities that have strong intermediate-term relative strength and hold them as long as they remain strong.

Last week’s performance (7/15/13 – 7/19/13) is as follows:

Posted by: Andy Hyer

Early Take on How Boomers Are Faring

July 10, 2013All those dire predictions about the level of retirement readiness of the Baby Boomers may be incorrect, says Mary Beth Franklin in Investment News.

One of the most closely watched areas focused on retirement readiness as boomers navigated a changing labor market that saw the demise of traditional pensions and the rise of the 401(k). Now many of the oldest boomers — those born in 1946 — have moved into retirement. Despite the dire predictions of their dismal retirement prospects, many of them are doing just fine.

Premature assessment, isn’t it? Yes, of course they are doing just fine now (just a few years into retirement)! The test comes in if they have saved enough money to be doing just fine in 20 years. To be fair to the author of the article, she does present some studies that discuss the varying levels of retirement preparedness of the Baby Boomers.

The reality is that some of the Baby Boomers saved adequately and will be just fine and many will be struggling and relying on others for help. I have great confidence in humanity so the vast majority of those in need will find help from children, churches, or the government, but many will probably wish they had put more thought and action into a disciplined savings and investment plan.

Posted by: Andy Hyer

High RS Diffusion Index

July 10, 2013The chart below measures the percentage of high relative strength stocks that are trading above their 50-day moving average (universe of mid and large cap stocks.) As of 7/9/13.

The 10-day moving average of this indicator is 68% and the one-day reading is 85%.

Posted by: Andy Hyer

Relative Strength Spread

July 9, 2013The chart below is the spread between the relative strength leaders and relative strength laggards (universe of mid and large cap stocks). When the chart is rising, relative strength leaders are performing better than relative strength laggards. As of 7/8/2013:

Posted by: Andy Hyer

The Rise of Smart Beta

July 8, 2013The Economist weighs in on one of our favorite trends:

INVESTORS face a quandary. Cash offers a return of virtually zero in many developed countries; government-bond yields may have risen in recent weeks but they are still unattractive. Equities have suffered two big bear markets since 2000 and are wobbling again. It is hardly surprising that pension funds, insurers and endowments are searching for new sources of return.

Step forward “smart beta”, the latest bit of jargon from the fund-management industry. “Alpha” is the skill required to choose individual assets that will outperform the market; “beta” is the return achieved from exposure to the overall market, for example via an index fund. “Smart beta” is an approach that tries to enhance the return from tracking an asset class by deviating from the traditional “cap-weighted” approach, in which investors simply buy shares or bonds in proportion to their market value.

The sector is still small: there is just $142 billion in smart-beta funds, compared with more than $2 trillion stashed in hedge funds. But the concept is catching on. According to State Street Global Advisors, smart-beta funds received inflows of $15 billion in the first quarter of 2013, up by 45% on the same period a year earlier.

Such enthusiasm is another sign that the quants are taking over. Traditional fund managers were able to charge a fee for their alleged skill and judgment. The quants are showing that when such managers did outperform, the excess return was driven by factors that can be identified and commoditised. Fees for smart-beta funds tend to be higher than those charged by cap-weighted index funds but far lower than those charged by other managers.

There is a variety of smart-beta approaches. The simplest is to give each market constituent equal weight. If there are 100 stocks, then each would have a weighting of 1%. A second approach, dubbed “fundamental indexing”, is to weight each company by its financial characteristics—sales, dividends, assets or cashflow. A third is to weight the index in terms of the volatility of the stocks, with the least volatile being favoured. A fourth is to use the “momentum effect” to buy stocks that have recently risen in price. That’s just for starters.

Posted by: Andy Hyer

Weekly RS Recap

July 8, 2013The table below shows the performance of a universe of mid and large cap U.S. equities, broken down by relative strength decile and then compared to the universe return. Those at the top of the ranks are those stocks which have the best intermediate-term relative strength. Relative strength strategies buy securities that have strong intermediate-term relative strength and hold them as long as they remain strong.

Last week’s performance (7/1/13 – 7/5/13) is as follows:

Posted by: Andy Hyer

Fund Flows

July 5, 2013Mutual fund flow estimates are derived from data collected by The Investment Company Institute covering more than 95 percent of industry assets and are adjusted to represent industry totals.

Posted by: Andy Hyer

June Arrow DWA Funds Review

July 3, 20136/30/2013

The Arrow DWA Balanced Fund (DWAFX)

At the end of June, the fund had approximately 46% in U.S. Equities, 26% in Fixed Income, 16% in International Equities, and 12% in Alternatives. The U.S. equity markets pulled back in for the first couple weeks of June as the market continues to digest the likelihood of the eventual “tapering” of the Federal Reserve’s quantitative easing program which has served to hold interest rates down. However, the equity markets showed signs of stabilizing towards the end of the month. Most of our U.S. equity holdings held up relatively well in June, with some areas (Consumer Cyclicals) actually showing a small gain for the month. Small and mid-caps, which we own, also held up relatively well and continued to show positive relative strength compared to large caps for the year. U.S. equities continue to be an overweight in the fund. International equities pulled back even more sharply than U.S. equities in June. Developed international markets have been performing better than emerging markets this year and now all five of our current international equity positions are in developed markets (Mexico was replaced with Japan in June). Japanese equities pulled back sharply in May, but were actually positive in June and remain among the strongest international equity markets for the year. We had relatively weak performance in our alternatives (real estate and the currency carry trade). Our exposure to alternatives remains near its lower constraint of 10% of the fund. Interest rates made a pretty strong move higher in June and most sectors of fixed income declined. About half of our fixed income exposure is in short-term U.S. Treasurys and held up relatively well.

DWAFX lost 2.06% in June, but remains up 5.39% through 6/30/13.

We believe that a real strength of this strategy is its balance between remaining diversified, while also adapting to market leadership. When an asset class is weak its exposure will tend to be towards the lower end of the exposure constraints, and when an asset class is strong its exposure in the fund will trend toward the upper end of its exposure constraints. Relative strength provides an effective means of determining the appropriate weights of the strategy.

The Arrow DWA Tactical Fund (DWTFX)

At the end of June, the fund had approximately 90% in U.S. Equities and 9% in International Equities. Historically, it has been pretty rare to have this much exposure to U.S. equities in this strategy. The fact that U.S. equities have had the best relative strength compared to other asset classes is certainly a different picture that we saw for most of the last decade. It has become “normal” to say that the U.S. equity markets are in a structural bear market, but with the breakout to new highs this year it is quite possible that we may have transitioned to more of a structural bull market. Of course, one never knows how long any trend will persist and our methodology is designed to adapt regardless of how the future ultimately plays out. There was a pullback in the equity markets in the first couple weeks of June. Our U.S. equity holdings held up relatively well with Consumer Cyclicals actually showing a small gain for the month and a number of our other positions, including small and mid-caps, holding up better than large caps. We did remove a position to international real estate in June and it was replaced with more U.S. equity exposure. The rise in interest rates has not helped the performance of real estate and fixed income. Although this fund also has the ability to invest in commodities, we currently have no exposure to this asset class due to its weakness. Japanese equities pulled back sharply in May, but were actually positive in June and remain among the strongest international equity markets for the year.

DWTFX was down 0.67% in June and has gained 10.16% through 6/30/13.

This strategy is a go-anywhere strategy with very few constraints in terms of exposure to different asset classes. The strategy can invest in domestic equities, international equities, inverse equities, currencies, commodities, real estate, and fixed income. Market history clearly shows that asset classes go through secular bull and bear markets and we believe this strategy is ideally designed to capitalize on those trends. Additionally, we believe that this strategy can provide important risk diversification for a client’s overall portfolio.

See www.arrowfunds.com for more information.

Posted by: Andy Hyer

June Review of Systematic RS Portfolios

July 3, 2013Click here (financial professionals only) for the monthly review of our Systematic Relative Strength portfolios.

Posted by: Andy Hyer

High RS Diffusion Index

July 3, 2013The chart below measures the percentage of high relative strength stocks that are trading above their 50-day moving average (universe of mid and large cap stocks.) As of 7/2/13.

The 10-day moving average of this indicator is 57% and the one-day reading is 68%.

Posted by: Andy Hyer

Academic Perspective on Momentum-Based Investing Webinar

July 2, 2013Come listen to an academic perspectives as to why momentum-based investing makes sense, and how you may be able to take advantage of it, from one of the pioneers in momentum and relative strength investing, Dorsey Wright & Associates. This webinar features Tom Dorsey and Andy Hyer.

Click here for a replay of the webinar.

Posted by: Andy Hyer

The Rising Cost of Long-Term-Care Insurance

July 2, 2013Today’s WSJ article “Long-Term-Care Insurance Gap Hits Seniors” should provide plenty of motivation for anyone who may be inclined to skimp on their savings.

The long-term-insurance industry now is shrinking, premiums are soaring and there is no fix in sight. At the same time, government safety-net programs, already under cost-cutting pressure, are bracing for demand from more of the 77 million aging baby boomers.

Currently, Medicare pays for only short stays in nursing homes or in-home care under limited conditions. For the most part, seniors who need care have to burn through their savings to pay for it. Only after they are impoverished will Medicaid—the government health program for poor people—pay for a basic level of care.

Insurers have been aware of this gap for decades, and many began selling long-term-care policies in the 1980s and 1990s. They vowed to provide policyholders with better access to high-quality nursing homes and home-based health care than Medicaid.

But insurers underestimated how fast medical costs would rise, and how many seniors would actually use the benefits. And they underpriced the insurance premiums. Making matters worse, some insurers that were “hungry for market share” charged too little at first and planned to increase premiums later, says Joseph M. Belth, editor of the Insurance Forum newsletter and professor emeritus of insurance at Indiana University.

Posted by: Andy Hyer

Relative Strength Spread

July 2, 2013The chart below is the spread between the relative strength leaders and relative strength laggards (universe of mid and large cap stocks). When the chart is rising, relative strength leaders are performing better than relative strength laggards. As of 7/1/2013:

Posted by: Andy Hyer

Q3 2013 Technical Leaders ETFs

July 1, 2013Each quarter, the PowerShares DWA Technical Leaders Indexes are reconstituted. These indexes are designed to evaluate their respective investment universes (U.S equities, Emerging Market equities, Developed International Market equities, and U.S. Small-Cap equities) and build an index of stocks with superior relative strength characteristics. This quarter’s allocations are as follows:

Source: PowerShares, MSCI, and Standard & Poor’s

There is now over $1.6 billion in asset under management and licensing in PDP, PIE, PIZ, and DWAS. YTD performance is shown below:

*The performance numbers above are pure price returns, based on the applicable index not inclusive of dividends, fees, commissions, or other expenses. Past performance not indicative of future results. Potential for profits accompanied by possibility of loss. Performance 1/1/13 - 6/30/13

See www.powershares.com for more information. The Dorsey Wright SmallCap Technical Leaders Index is calculated by Dow Jones, the marketing name and a licensed trademark of CME Group Index Services LLC (“CME Indexes”). “Dow Jones Indexes” is a service mark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Products based on the Dorsey Wright SmallCap Technical Leaders IndexSM, are not sponsored, endorsed, sold or promoted by CME Indexes, Dow Jones and their respective affiliates make no representation regarding the advisability of investing in such product(s).

Posted by: Andy Hyer

Weekly RS Recap

July 1, 2013The table below shows the performance of a universe of mid and large cap U.S. equities, broken down by relative strength decile and then compared to the universe return. Those at the top of the ranks are those stocks which have the best intermediate-term relative strength. Relative strength strategies buy securities that have strong intermediate-term relative strength and hold them as long as they remain strong.

Last week’s performance (6/24/13 – 6/28/13) is as follows:

Posted by: Andy Hyer

Sector and Capitalization Performance

June 28, 2013The chart below shows performance of US sectors and capitalizations over the trailing 12, 6, and 1 month(s). Performance updated through 6/27/2013.

Numbers shown are price returns only and are not inclusive of transaction costs. Source: iShares

Posted by: Andy Hyer

Fund Flows

June 27, 2013Mutual fund flow estimates are derived from data collected by The Investment Company Institute covering more than 95 percent of industry assets and are adjusted to represent industry totals.

Posted by: Andy Hyer

Small Caps Leading the Way in 2013

June 26, 2013One of the tools on the Dorsey Wright research database that I check regularly is called the Asset Class Matrix which takes a broad universe of asset classes and ranks them by their relative strength. Current ranks are shown below. For this particular matrix, the Vanguard Small-Cap ETF (VB) is used as a proxy for U.S. small-cap stocks. You will notice that small caps are currently ranked near the top, reflecting their superior relative strength.

Source: Dorsey Wright, 6/25/2013 (Click to enlarge)

However, a cap-weighted small cap ETF like VB is not the only option in the small-cap space. I referred to Stock-Encyclopedia.com to get a broader list of available small-cap ETFs. In the table below, you will find growth, value, equal-weighted, fundamentally-weighted, and last but certainly not least, relative strength or momentum-weighted small-cap ETFs. So far this year, small caps have put up some impressive numbers, but the best performer of them all is our PowerShares DWA Small Cap Technical Leaders ETF (DWAS).

Source: Dorsey Wright, Updated through 6/25/2013 (Click to enlarge)

A description of the index methodology for this small-cap momentum ETF (DWAS) is as follows:

The PowerShares DWA SmallCap Technical Leaders™ Portfolio (the “Fund”) seeks investment results that generally correspond (before fees and expenses) to the price and yield of the Dorsey Wright SmallCap Technical Leaders™ Index (the “Underlying Index”). The Fund generally will invest at least 90% of its total assets in equity securities of small capitalization companies that comprise the Underlying Index. The Index includes securities pursuant to a Dorsey Wright & Associates (“Dorsey Wright” or the “Index Provider”) proprietary selection methodology that is designed to identify companies that demonstrate powerful relative strength characteristics. The Index Provider determines a company’s relative strength characteristics based on that company’s market performance. The Index Provider selects approximately 200 companies for inclusion in the Underlying Index from a small-cap universe of approximately 2,000 of the smallest U.S. companies selected from a broader set of 3,000 companies. The Fund and the Index are rebalanced and reconstituted quarterly.

The Dorsey Wright SmallCap Technical Leaders Index is calculated by Dow Jones, the marketing name and a licensed trademark of CME Group Index Services LLC (“CME Indexes”). “Dow Jones Indexes” is a service mark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Products based on the Dorsey Wright SmallCap Technical Leaders IndexSM, are not sponsored, endorsed, sold or promoted by CME Indexes, Dow Jones and their respective affiliates make no representation regarding the advisability of investing in such product(s).

Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. You should consider this strategy’s investment objectives, risks, charges and expenses before investing. The examples and information presented do not take into consideration commissions, tax implications, dividends, or other transaction costs.

Posted by: Andy Hyer

High RS Diffusion Index

June 26, 2013The chart below measures the percentage of high relative strength stocks that are trading above their 50-day moving average (universe of mid and large cap stocks.) As of 6/25/13.

The 10-day moving average of this indicator is 62% and the one-day reading is 45%. Dips in this indicator have often provided good opportunities to add money to relative strength strategies.

Posted by: Andy Hyer