The year got off to a rocky start. After the holidays ended and everyone returned to work, the stock market had a sharp selloff that left it in negative territory for January. The market would eventually bottom out in mid-February and continue to recover through the end of the quarter. Despite the early selloff, the S&P; 500 actually finished up 1.3% for the quarter. Small cap and International stocks didn’t fare as well as both of those categories finished in negative territory for the first three months of the year. Fixed Income and interest rate sensitive securities were some of the best performing areas during the first quarter with broad bond market indexes finishing up about 3%. Commodities also finished the quarter in negative territory, but did stop the relentless slide they had been on since last year.

Looking at the summary numbers for the first quarter might lead you to believe it was a ho-hum first three months of the year, but that was certainly not the case. We saw a tremendous amount of rotation under the surface that had a big impact on all of our strategies. In this piece, we normally like to update you on some big picture items that are affecting the markets and economy, but we felt it was more appropriate to go into greater detail about the specifics of the rotation we saw and how it affected our strategies.

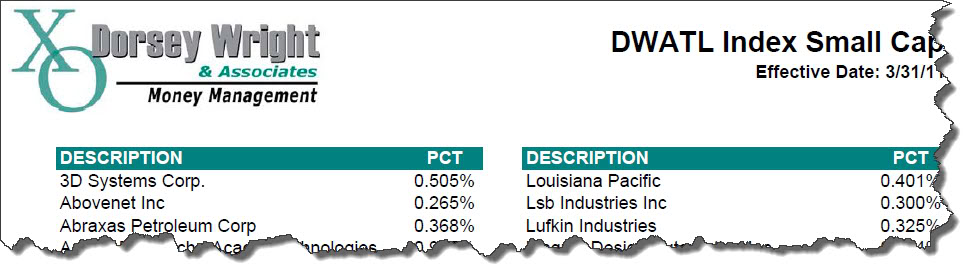

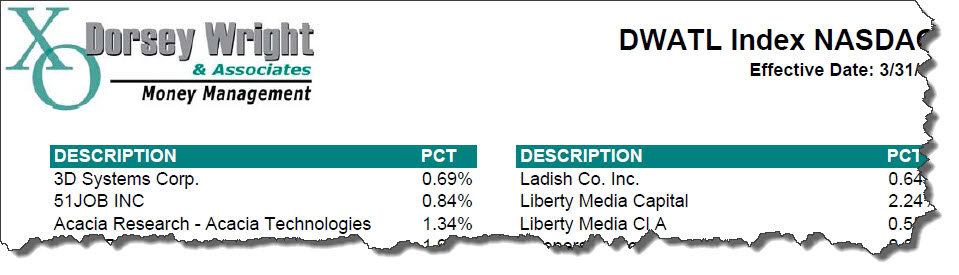

The overarching theme for our investing style was that the laggards finally had their day in the sun. Simply put, the stocks and asset classes that had been leading the market lower since last summer finally stopped going down and actually went up a lot from the lows. This is known as a laggard rally, and is never a time when we perform well. These laggard rallies come along every so often so we are used to them by now. Everyone realizes the leaders can’t lead forever so we view these periods as an opportunity to refresh the portfolios and find new leadership. More importantly, they don’t cause a change in our strategy, but they do cause trading activity to pick up as the old leadership is removed from the portfolios and our process tries to find the emerging leadership. So, if you have noticed a lot more trading in your account recently, that is the reason why.

The changes we have made in the portfolios really changed the characteristics of some of the strategies. One example of this was the weakening U.S. Dollar. The Dollar had been strong for quite some time, and finally exhibited enough weakness that we needed to remove it from the portfolios. We saw a weak dollar asset, Gold, added to many of the strategies. The strong Dollar had caused quite a headwind for assets such as international equities and commodities, which generally do better in a weak dollar environment. If the dollar continues to weaken, we expect to see more of these types of assets come into the strategies. That would actually be a welcome change as it would allow our strategies to do what they do best: find bull markets anywhere around the globe (and in places many people are overlooking).

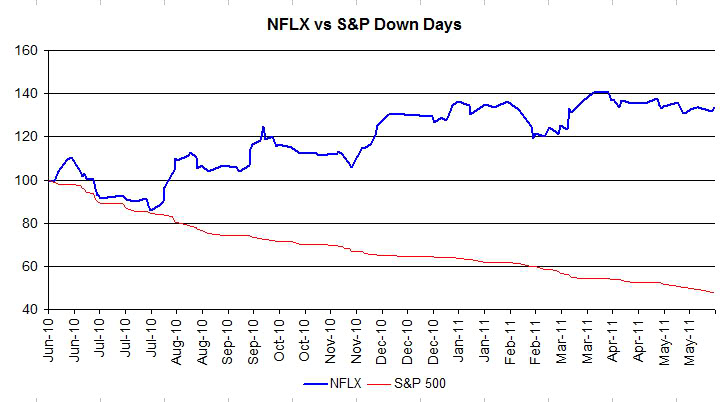

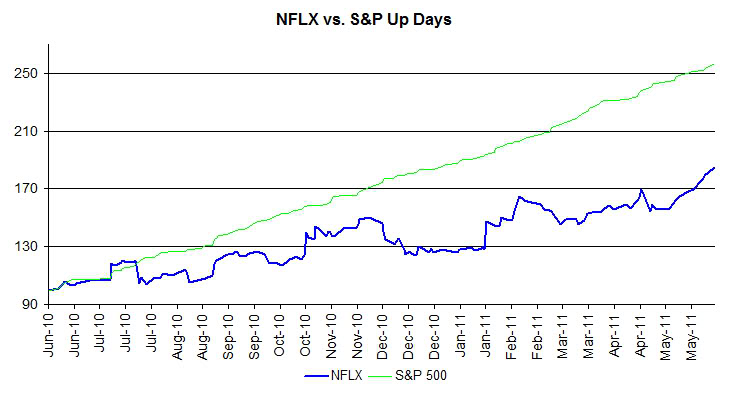

On the individual equity side, it was much the same as the asset class side. The so-called FANGs (Facebook, Amazon, Netflix, and Google) were stellar performers last year, but had a difficult start to the year. What really performed well were the things like energy and basic materials that had such dreadful performance last year. In some of our other writing we touched on these issues during the quarter. One example of this is when we look at the S&P; 500 industry groups. The worst relative strength groups outperformed the best performing group by more than 12% during the first quarter! That was completely opposite from last year when just avoiding the worst groups was the key to outperformance. Whether these groups can continue to perform is anyone’s guess, but often times they have a large rally off the bottom and then settle in as average performers while they work out their issues.

We are 100% sure (which you almost never hear in this business!) that some of the changes we made to the portfolios won’t work out and we will have to continue to search for leadership. That is totally normal, and we expect that to be the case over the coming months. If you have any questions, please don’t hesitate to call us.

Performance numbers provided are the performance of indexes that are not available for direct investment and do not include dividends or transaction costs. Past performance is not indicative of future results and there is no assurance that any forecasts mentioned in this report will be attained. Stocks offer growth potential but are subject to market fluctuations. Dividends are not guaranteed; companies can reduce or eliminate their dividend at any time. There are special risks associated with an investment in real estate, including credit risk, interest rate fluctuations and the impact of varied economic conditions. Technical analysis is just one form of analysis. You may also want to consider quantitative and fundamental analysis before making any investment decisions. The information contained herein has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any recommendation (express or implied) or information in this material without obtaining specific advice from their financial advisors and should not rely on information herein as the primary basis for their investment decisions. Information contained herein is based on data obtained from recognized statistical services, issuer reports or communications, or other sources believed to be reliable (“information providers”). However, such information has not been verified by Dorsey, Wright & Associates, LLC (DWA) or the information provider and DWA and the information providers make no representations or warranties or take any responsibility as to the accuracy or completeness of any recommendation or information contained herein. DWA and the information provider accept no liability to the recipient whatsoever whether in contract, in tort, for negligence, or otherwise for any direct, indirect, consequential, or special loss of any kind arising out of the use of this document or its contents or of the recipient relying on any such recommendation or information (except insofar as any statutory liability cannot be excluded). Any statements nonfactual in nature constitute only current opinions, which are subject to change without notice. Neither the information nor any opinion expressed shall constitute an offer to sell or a solicitation or an offer to buy any securities, commodities or exchange traded products. This document does not purport to be complete description of the securities or commodities, markets or developments to which reference is made. Potential for profits is accompanied by possibility of loss. You should consider this strategy’s investment objectives, risks, charges and expenses before investing. The examples and information presented do not take into consideration commissions, tax implications, or other transaction costs. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy.