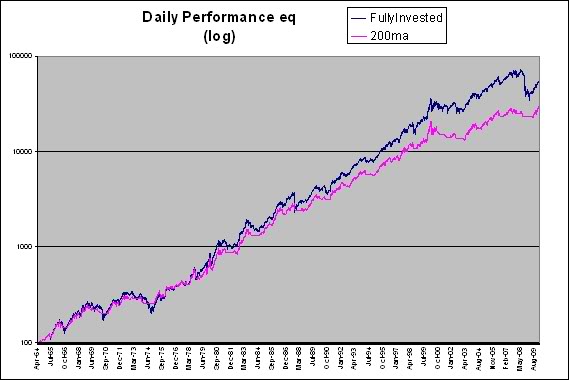

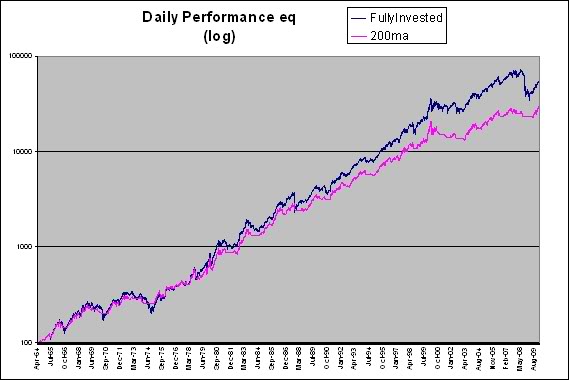

We’ve all seen numerous studies that purport to show how passive investing is the way to go because you don’t want to be out of the market for the 10 best days. No one ever mentions that the “best days” most often occur during the declines!

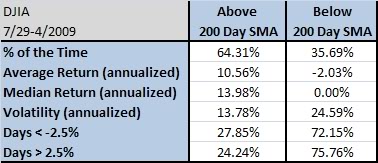

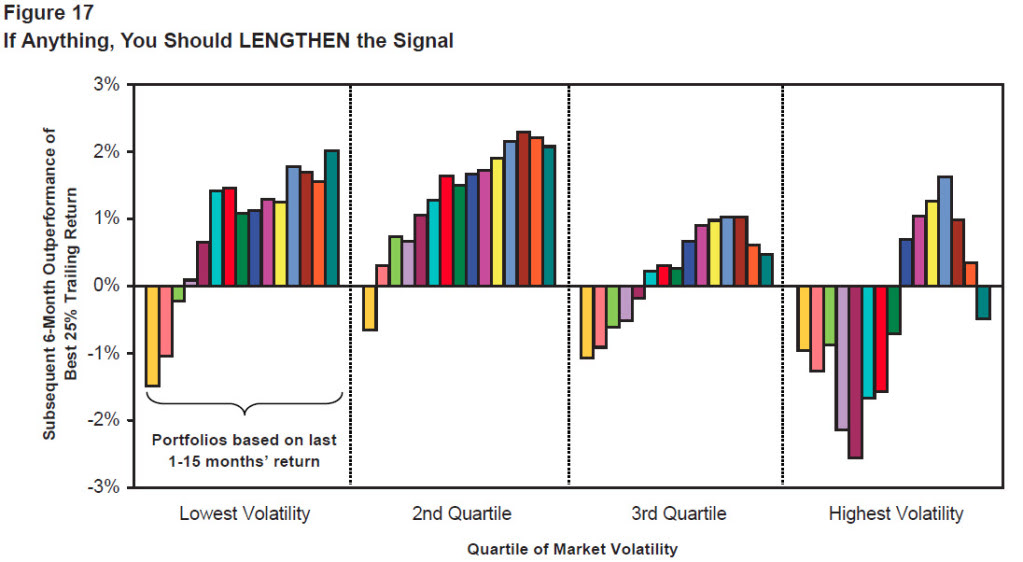

It turns out that the majority of the best days and the worst days occur near one another, during the declines. Why? Because the market is more volatile during declines. It is true that the market goes down 2-3x as fast as it goes up. (World Beta has a nice post on this topic of volatility clustering, which is where this handy-dandy table comes from.)

from World Beta

You can see how volatility increases and the number of days with daily moves greater than 2.5% really spikes when the market is in a downward trend. It would seem to be a very straightforward proposition to improve your returns simply by avoiding the market when it is in a downtrend.

However, not every strategy can be improved by going to cash. Think about the math: if your investing methodology makes enough extra money on the good days to offset the bad days, or if it can make money during a significant number of the declines, you might be better off just gritting your teeth during the declines and banking the higher returns. Although the table above suggests it should help, a simple strategy of exiting the market (i.e., going to cash) when it is below its 200-day moving average may not always live up to its theoretical billing.

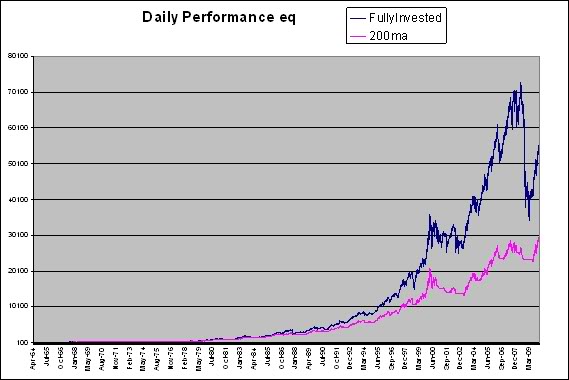

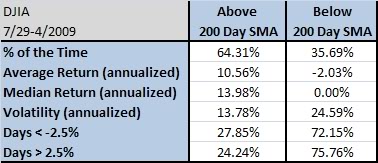

click to enlarge

Consider the graphs above. (The first graph uses linear scaling; the second uses logarithmic scaling for the exact same data.) This test uses Ken French’s database to get a long time horizon and shows the returns of two portfolios constructed with market cap above the NYSE median and in the top 1/3 for relative strength. In other words, the two portfolios are composed of mid- and large-cap stocks with good relative strength. The only difference between the two portfolios is that one (red line) goes to cash when it is below its 200-day moving average. One portfolio (blue line) stays fully invested. The fully invested portfolio turns $100 into $49,577, while the cash-raising portfolio yields only $26,550.

If you would rather forego the extra money in return for less volatility, go right ahead and make that choice. But first stack up 93 boxes of Diamond matches so that you can burn 23,027 $1 bills, one at a time, to represent the difference–and then make your decision.

The drawdowns are less with the 200-day moving average, but it’s not like they are tame–equities will be an inherently volatile asset class as long as human emotions are involved. There are still a couple of drawdowns that are greater than 20%. If an investor is willing to sit through that, they might as well go for the gusto.

As surprising as it may seem, the annualized return over a long period of time is significantly higher if you just stay in the market and bite the bullet during train wrecks–and even two severe bear markets in the last decade have not allowed the 200-day moving average timer to catch up.

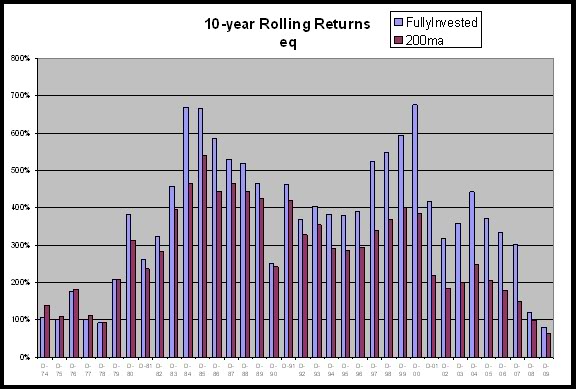

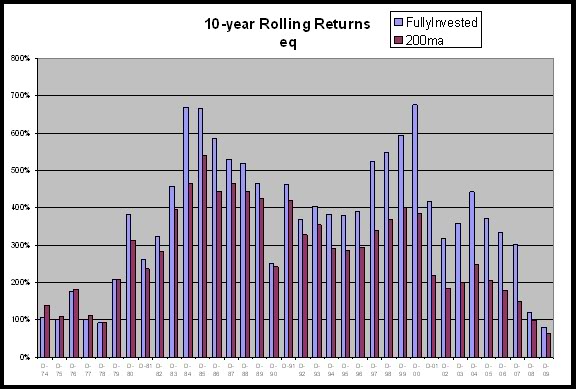

At the bottom of every bear market, of course, it certainly feels like it would have been a good idea (in hindsight) to have used the 200-day moving average to get out. In the long run, though, going to cash with a high-performing, high relative strength strategy might be counterproductive. When we looked at 10-year rolling returns, the fully invested high relative strength model has maintained an edge in returns for the last 30 years running.

click to enlarge

Surprising, isn’t it? Counterintuitive results like this are one of the reasons that we find testing so critical. It’s easy to fall in line with the accepted wisdom, but when it is actually put to the test, the accepted wisdom is often wrong. (We often find that even when shown the test data, many people refuse, on principle, to believe it! It is not in their worldview to accept that one of their cherished beliefs could be false.) Every managed portfolio in our Systematic RS lineup has been subjected to heavy testing, both for returns and–and more importantly–for robustness. We have a high degree of confidence that these portfolios will do well in the long run.

—-this article originally appeared 3/5/2010. We find that many investors continue to refuse, on principle, to believe the data! If you have a robust investment method, the idea that you can improve your returns by getting out of the market during downturns appears to be false. (Although it could certainly look true for small specific samples. And, to be clear, 100% invested in a volatile strategy is not the appropriate allocation for most investors.) Volatility can generally be reduced somewhat, but returns suffer. One of our most controversial posts ever—but the data is tough to dispute.

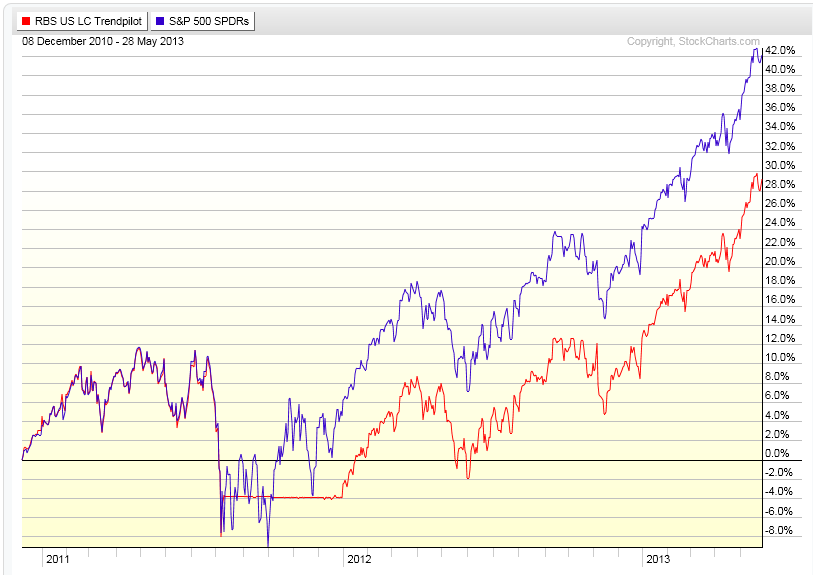

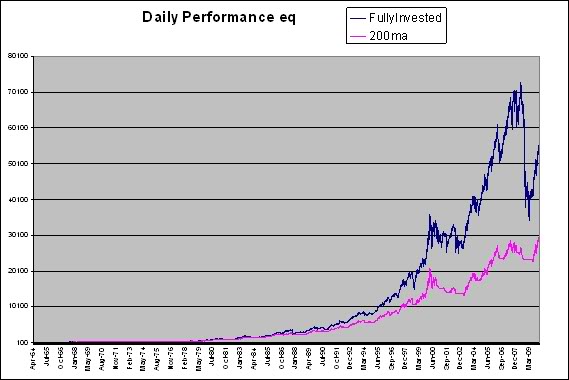

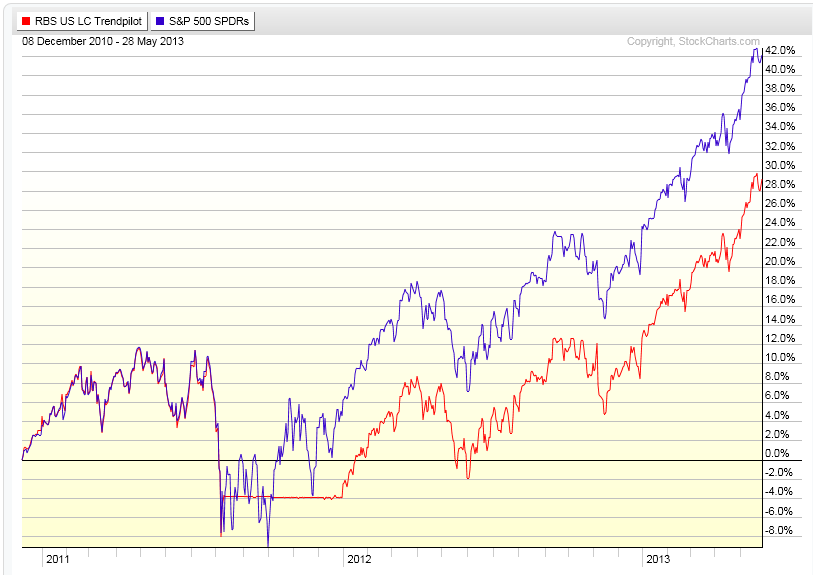

In more recent data, the effect can be seen in this comparison of an S&P 500 ETF and an ETN that switches between the S&P 500 and Treasury bills based on a 200-day moving average system. The volatility has been muted a little bit, but so have the returns.

(click on image to enlarge)