The Wall Street Journal had a small piece on Americans’ retirement readiness. In general, they’re not saving enough. Here’s an excerpt:

A separate study released today by investment firm Edward Jones finds that 79% of 1,008 U.S. adults surveyed in February said that they have committed a money mistake – and of those, 26% reported not having saved enough for retirement as their No. 1 problem. Also on the list: not paying attention to spending and making bad investments.

The EBRI research found that Americans are coming to grips with the dramatic improvements they need to make in their saving habits, with 20% of workers saying they need to save between 20 and 29% of their income to achieve a financially secure retirement, and 23% saying they need to save 30% – or more.

I added the bold. If you are a financial advisor, it’s really worth reading the entire EBRI research brief. It is absolutely eye-opening. You will discover that only 23% of workers ever obtained investment advice in the first place.

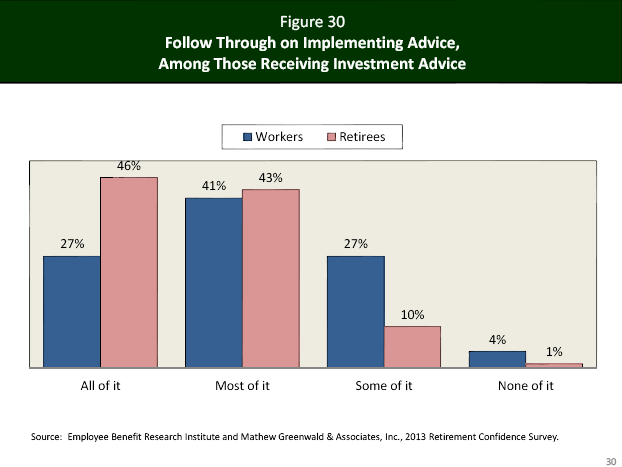

And, when they got advice, they ignored a lot of it! Here’s the graphic from EBRI on follow-through:

Only 27% fully implemented the advice. That makes about 6% of investors that got advice and followed it! (Elsewhere in the report, you will discover that a minority of investors have even tried to figure out what they might need in the way of retirement savings.) It seems obvious that you would have a large chance of falling short if you didn’t even have a goal.

As advisors, we often forget—as frustrated as we sometimes are with clients—that we are dealing with the cream of the crop. We work with investors who 1) have sought out professional advice and 2) follow all or most of it. We get cranky at anything less than 100% implementation, but many investors are doing less than that—if they bother to get advice at all.

So lighten up. Keep nudging your clients to save more, because you know it is their #1 problem. They might think you obnoxious, but they will thank you later. Help them construct a reasonable portfolio. And encourage them to get their friends and colleagues into some kind of planning and investment process. Their odds of success will be better if they get some help.