Mutual fund flow estimates are derived from data collected by The Investment Company Institute covering more than 95 percent of industry assets and are adjusted to represent industry totals.

High RS Diffusion Index

October 30, 2013The chart below measures the percentage of high relative strength stocks that are trading above their 50-day moving average (universe of mid and large cap stocks.) As of 10/29/13.

The 10-day moving average of this indicator is 89% and the one-day reading is also 89%.

Posted by: Andy Hyer

Relative Strength Spread

October 29, 2013The chart below is the spread between the relative strength leaders and relative strength laggards (universe of mid and large cap stocks). When the chart is rising, relative strength leaders are performing better than relative strength laggards. As of 10/28/2013:

Posted by: Andy Hyer

Relative Strength Spread

October 22, 2013The chart below is the spread between the relative strength leaders and relative strength laggards (universe of mid and large cap stocks). When the chart is rising, relative strength leaders are performing better than relative strength laggards. As of 10/21/2013:

The RS Spread has broken out to its highest levels of the year and is trending strongly above its 50 day moving average.

Posted by: Andy Hyer

Weekly RS Recap

October 21, 2013The table below shows the performance of a universe of mid and large cap U.S. equities, broken down by relative strength decile and then compared to the universe return. Those at the top of the ranks are those stocks which have the best intermediate-term relative strength. Relative strength strategies buy securities that have strong intermediate-term relative strength and hold them as long as they remain strong.

Last week’s performance (10/14/13 – 10/18/13) is as follows:

Posted by: Andy Hyer

Quote of the Week

October 20, 2013The race is not always to the swift, nor the battle to the strong, but that’s the way to bet.—-Damon Runyon

There is a great deal of value in a systematic investment process—specifically, the systematic part!

Posted by: Mike Moody

More on Systematic Process

October 18, 2013We use a systematic process for investment because we think that’s the best way to go. Our systematic process also happens to be adaptive because we think adaptation to the current market environment is also an important consideration. (If you don’t adapt you die.) Our decision to use a systematic process is grounded in evidence that, over time, systematic processes tend to win out over inconsistent human decision making. (See here, for example.)

The latest instance of this was an interesting article on Quartz about the coming wave of full-service coffee machines that may have the potential to replace baristas. Consider, for example, what this particular quotation says about the power of a systematic process:

In 2012, Julian Baggini, a British philosophy writer and coffee aficionado, wondered why dozens of Europe’s Michelin-starred restaurants were serving guests coffee that came out of vacuum-sealed plastic capsules manufactured by Nespresso. So he conducted a taste test on a small group of experts. A barista using the best, freshly-roasted beans went head to head with a Nespresso capsule coffee brewing machine. It’s the tale of John Henry all over again, only now it was a question of skill and grace rather than brute strength.

As the chefs at countless restaurants could have predicted, the Nespresso beat the barista.

Suffice it to say that most manufacturing nowadays is done by machine because it is usually faster, less expensive, and more accurate than a human. Perhaps you will miss terribly your nose-ringed, pink-haired, tatooed barista, but then again, maybe not so much.

Systematic investing has its problems—sometimes the adaptation seems too slow or too fast. Sometimes your process is just out of favor. But like a manufacturing process, a systematic investment process holds the promise of consistency and potential improvement as technology and new techniques are incorporated over time. While it may seem less romantic than the lone stock picker, systematic investment could well be the wave of the future.

HT to Abnormal Returns

Posted by: Mike Moody

YTD Factor Performance

October 15, 2013From The Leuthold Group’s October Green Book:

For quants employing the traditional metrics shown in the chart above, the only noteworthy factor during 2013 has been Momentum. We’ve consistently said that ever since most investors left this approach for dead in 2009 it was likely to be the best factor going forward, which is what’s happened.

Posted by: Andy Hyer

September Arrow DWA Funds Review

October 15, 20139/30/2013

The Arrow DWA Balanced Fund (DWAFX)

At the end of August, the fund had approximately 46% in U.S. Equities, 26% in Fixed Income, 17% in International Equities, and 11% in Alternatives. Our best performing holdings in September were international equities. The Eurozone economy continues to recover. While unemployment is still excruciatingly high in many parts of Europe, there are signs of growth, and the borrowing costs for many of the countries who were most at risk just a few years ago have declined. The U.S. equity markets also added to their gains for the year. Our small and mid-cap exposure performed especially well in September. U.S. equities continue to be our biggest overweight. Our fixed income exposure remains near the lower end of its constraints, yet bond prices did rise in September as interest rates declined. The Federal Reserve continues its quantitative easing program of buying $85 billion worth of bonds each month. Although, there was speculation that the Fed would begin to taper its monetary stimulus, that appears to now be on hold.

We did make one change to the holdings in September. We removed our position in real estate and added a position in a bearish dollar fund. Real-estate investment trusts posted negative returns in the third quarter and continue to trail the broader stock market. Although interest rates pulled back in September, the overall trend of interest rates remains higher. REITs, which pay little or no corporate income tax and usually pay steep dividends, are sensitive to rising interest rates because they depend on borrowed money to expand their business. The U.S. dollar has declined relative to many other currencies since the middle of the year, perhaps partly as a result of the continued aggressive monetary policy.

DWAFX rose 3.68% in September, and is up 9.51% through 9/30/13.

We believe that a real strength of this strategy is its balance between remaining diversified, while also adapting to market leadership. When an asset class is weak its exposure will tend to be towards the lower end of the exposure constraints, and when an asset class is strong its exposure in the fund will trend toward the upper end of its exposure constraints. Relative strength provides an effective means of determining the appropriate weights of the strategy.

The Arrow DWA Tactical Fund (DWTFX)

At the end of September, the fund had approximately 90% in U.S. Equities and 9% in International equities. This largely unconstrained tactical asset allocation strategy tends to perform best when there are stable trends and 2013 has provided plenty of such trends. Sectors like Consumer Cyclical and Healthcare came into the year strong and have remained strong. Our international equity holdings, benefiting in part from weak dollar, generated our strongest gains in September. Our U.S. small and mid-cap exposure also performed well, outpacing large-caps. There are no shortages of headline risks, such as Syria or the government shutdown, but the U.S. equity markets continue their impressive performance.

Although this strategy has the ability to invest in many different asset classes, including commodities, real estate, currencies, and fixed income, the fund has been focused on equities this year as that is where the dominant relative strength has been. Commodities, particularly precious metals, have been weak for the last couple of years. Real estate, which generated strong gains for most of the last several years, appears to have run out of steam for the time being. Fixed income has generally produced modest gains over the last couple of years, but most sectors of fixed income are negative this year as the trend in interest rates has generally been higher.

DWTFX was up 4.42% in September, and has gained 15.54% through 9/30/13.

This strategy is a go-anywhere strategy with very few constraints in terms of exposure to different asset classes. The strategy can invest in domestic equities, international equities, inverse equities, currencies, commodities, real estate, and fixed income. Market history clearly shows that asset classes go through secular bull and bear markets and we believe this strategy is ideally designed to capitalize on those trends. Additionally, we believe that this strategy can provide important risk diversification for a client’s overall portfolio.

See www.arrowfunds.com for more information.

Posted by: Andy Hyer

Momentum and Dividends in Rising Rate Environments

October 14, 2013In a low-interest rate environment, investors have naturally turned their attention to stocks paying high dividends as a way to generate income. Momentum, as a return factor, has not been in the spotlight. However, as interest rates have moved higher from their lows of last summer (On October 10, 2013 the 10-year US Treasury yield was 2.71% compared to 1.43% on July 25, 2012.), you might wonder how high dividend paying stocks tend to perform in rising rate environments over time. A current trend chart of the 10-year U.S. Treasury Yield Index, shows that yields are trending higher.

Source: Dorsey Wright

A longer-term chart of the 10-year US Treasury Yield Index is shown below:

Jim O’Shaughnessy’s What Works On Wall Street says this about high-yielders:

The high-yielders from Large Stocks do best in market environments in which value is outperforming growth, winning 74 percent of the time. They also do well in markets in which bonds are outperforming stocks, winning 65 percent of the time in those environments.

O’Shaughnessy’s book lays out the performance of portfolios formed by a number of return factors since the 1920s. His book includes the performance of portfolios formed by market capitalization, price-to-earnings ratios, EBITDA, price-to-cash flow ratios, price-to-sales ratios, price-to book ratios, dividend yields, relative strength (momentum), and many other factors.

In the rising interest rate environment of the 1960s and 1970s, O’Shaughessy shows the performance for the portfolio of the highest yielders as follows:

Source: What Works On Wall Street

Not bad—the dividend-focused portfolio was still able to generate modest outperformance. However, a portfolio formed by price momentum was clearly able to generate much higher returns in a rising rate environment. While this may not be the best environment for portfolios of high dividend payers to really stand out, investors may find that momentum can excel in rising-rate periods.

Past performance is no guarantee of future returns.

Posted by: Andy Hyer

DWAS: “Soaring Small-Cap ETF”

October 14, 2013Tom Lydon at ETF Trends takes note of the PowerShares DWA Small-Cap Momentum Portfolio:

The PowerShares DWA SmallCap Momentum Portfolio (DWAS) is one of this year’s top-performing small-cap ETFs and that is saying something because 2013 has been kind to smaller stocks.

DWAS is 16 months old and in that time has accumulated over $410 million in assets under management while returning 40.2%. Over that time, the Dorsey Wright SmallCap Technical Leaders Index has handily outpaced rival benchmarks.

See www.powershares.com for more information. The Dorsey Wright SmallCap Momentum Index is calculated by Dow Jones, the marketing name and a licensed trademark of CME Group Index Services LLC (“CME Indexes”). “Dow Jones Indexes” is a service mark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Products based on the Dorsey Wright SmallCap Momentum IndexSM, are not sponsored, endorsed, sold or promoted by CME Indexes, Dow Jones and their respective affiliates make no representation regarding the advisability of investing in such product(s). Past performance is no guarantee of future returns.

Posted by: Andy Hyer

Quote of the Week

October 13, 2013Markets are fundamentally volatile. No way around it. Your problem is not in the math. There is no math to get you out of having to experience uncertainty.—-Ed Seykota

As long as humans are involved this is probably not going to change! It makes sense to use an adaptive investment strategy.

Posted by: Mike Moody

Rats, Humans, and Probability

October 9, 2013Investors—or people generally—find it difficult to think in terms of probability. A quote from a recent ThinkAdvisor article on probability is instructive:

In multiple studies (most prominently those by Edwards and Estes, as reported by Philip Tetlock in his book Expert Political Judgment), subjects were asked to predict which side of a “T-maze” held food for a rat. The maze was rigged such that the food was randomly placed (no pattern), but 60% of the time on one side and 40% on the other. The rat quickly “gets it” and waits at the “60% side” every time and is thus correct 60% of the time. Human observers keep looking for patterns and choose sides in rough proportion to recent results. As a consequence, the humans were right only 52% of the time—they (we!) are much dumber than rats. We routinely misinterpret probabilistic strategies that accept the inevitability of randomness and error.

Even rats get probability better than people! It is for this reason that a systematic investing process can be so valuable. Away from the pressure and hubbub of the markets, strategies can be researched and probabilities investigated and calculated. Decisions can be made on the basis of probability because a systematic process incorporates the notion that there is a certain amount of randomness that cannot be overcome with clever decision-making.

Ironically, because humans have sophisticated pattern recognition skills built in, we see patterns in probability where there are none. A systematic investment process can reduce or eliminate the “overinterpretation” inherent in our own cleverness. When we can base our decisions only on the actual probabilities embedded in the data, those decisions will be much better over a large number of trials.

Good investing is never easy, but a systematic investing process can eliminate at least one barrier to good performance.

Posted by: Mike Moody

Dumb Talk About Smart Beta?

October 7, 2013John Rekenthaler at Morningstar, who usually has some pretty smart stuff to say, took on the topic of smart beta in a recent article. Specifically, he examined a variety of smart beta factors with an eye to determining which ones were real and might persist. He also thought some factors might be fool’s gold.

Here’s what he had to say about value:

The value premium has long been known and continues to persist.

And here’s what he had to say about relative strength (momentum):

I have trouble seeing how momentum can succeed now that its existence is well documented.

The italics are mine. I didn’t take logic in college, but it seems disingenuous to argue that one factor will continue to work after it is well-known, while becoming well-known will cause the other factor to fail! (If you are biased in favor of value, just say so, but don’t use the same argument to reach two opposite conclusions.)

There are a variety of explanations about why momentum works, but just because academics can’t agree on which one is correct doesn’t mean it won’t continue to work. It is certainly possible that any anomaly could be arbitraged away, but Robert Levy’s relative strength work has been known since the 1960s and our 2005 paper in Technical Analysis of Stocks & Commodities showed it continued to work just fine just the way he published it. Academics under the spell of efficient markets trashed his work at the time too, but 40 years of subsequent returns shows the professors got it wrong.

However, I do have a background in psychology and I can hazard a guess as to why both the value and momentum factors will continue to persist—they are both uncomfortable to implement. It is very uncomfortable to buy deep value. There is a terrific fear that you are buying a value trap and that the impairment that created the value will continue or get worse. It also goes against human nature to buy momentum stocks after they have already outperformed significantly. There is a great fear that the stock will top and collapse right after you add it to your portfolio. Investors and clients are quite resistant to buying stocks after they have already doubled, for example, because there is a possibility of looking really dumb.

Here’s the reason I think both factors are psychological in origin: it is absurdly easy to screen for either value or momentum. Any idiot can implement either strategy with any free screener on the web. Pick your value metric or your momentum lookback period and away you go. In fact, this is pretty much exactly what James O’Shaughnessy did in What Works on Wall Street. Both factors worked well—and continue to work despite plenty of publicity. So the barrier is not that there is some secret formula, it’s just that investors are unwilling to implement either strategy in a systematic way-because of the psychological discomfort.

If I were to make an argument—the behavioral finance version—about which smart beta factor could potentially be arbitraged away over time, I would have to guess low volatility. If you ask clients whether they would prefer to buy stocks that a) had already dropped 50%, b) had already gone up 50%, or c) had low volatility, I think most of them would go with “c!” (Although I think it’s also possible that aversion to leverage will keep this factor going.)

Value and momentum also happen to work very well together. Value is a mean reversion factor, while momentum is a trend continuation factor. As AQR has shown, the excess returns of these two factors (unsurprisingly, once you understand how they are philosophical opposites) are uncorrelated. Combining them may have the potential to smooth out an equity return stream a little bit. Regardless, two good return factors are better than one!

Posted by: Mike Moody

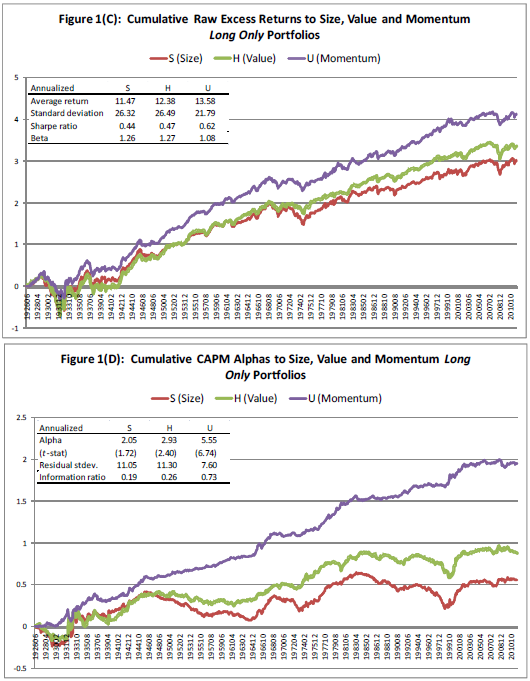

Long-Only Momentum

October 4, 2013Gary Antonacci has a very nice article at Optimal Momentum regarding long-only momentum. Most academic studies look at long-short momentum, while most practitioners (like us) use long-only momentum (also known as relative strength). Partly this is because it is somewhat impractical to short across hundreds of managed accounts, and partly because clients don’t usually want to have short positions. The article has another good reason, quoting from an Israel & Moskowitz paper:

Using data over the last 86 years in the U.S. stock market (from 1926 to 2011) and over the last four decades in international stockmarkets and other asset classes (from 1972 to 2011), we find that the importance of shorting is inconsequential for all strategies when looking at raw returns. For an investor who cares only about raw returns, the return premia to size, value, and momentum are dominated by the contribution from long positions.

In other words, most of your return comes from the long positions anyway.

The Israel & Moskowitz paper looks at raw long-only returns from capitalization, value, and momentum. Perhaps even more importantly, at least for the Modern Portfolio Theory crowd, it looks at CAPM alphas from these same segments on a long-only basis. The CAPM alpha, in theory, is the amount of excess return available after adjusting for each factor. Here’s the chart:

(click on image to enlarge)

From the Antonacci article, here’s what you are looking at and the results:

I&M charts and tables show the top 30% of long-only momentum US stocks from 1927 through 2011 based on the past 12-month return skipping the most recent month. They also show the top 30% of value stocks using the standard book-to-market equity ratio, BE/ME, and the smallest 30% of US stocks based on market capitalization.

Long-only momentum produces an annual information ratio almost three times larger than value or size. Long-only versions of size, value, and momentum produce positive alphas, but those of size and value are statistically weak and only exist in the second half of the data. Momentum delivers significant abnormal performance relative to the market and does so consistently across all the data.

Looking at market alphas across decile spreads in the table above, there are no significant abnormal returns for size or value decile spreads over the entire 1926 to 2011 time period. Alphas for momentum decile portfolio spread returns, on the other hand, are statistically and economically large.

Mind-boggling right? On a long-only basis, momentum smokes both value and capitalization!

Israel & Moskowitz’s article is also quoted in the post, and here is what they say about their results:

Looking at these finer time slices, there is no significant size premium in any sub period after adjusting for the market. The value premium is positive in every sub period but is only statistically significant at the 5% level in one of the four 20-year periods, from 1970 to 1989. The momentum premium, however, is positive and statistically significant in every sub period, producing reliable alphas that range from 8.9 to 10.3% per year over the four sub periods.

Looking across different sized firms, we find that the momentum premium is present and stable across all size groups—there is little evidence that momentum is substantially stronger among small cap stocks over the entire 86-year U.S. sample period. The value premium, on the other hand, is largely concentrated only among small stocks and is insignificant among the largest two quintiles of stocks (largest 40% of NYSE stocks). Our smallest size groupings of stocks contain mostly micro-cap stocks that may be difficult to trade and implement in a real-world portfolio. The smallest two groupings of stocks contain firms that are much smaller than firms in the Russell 2000 universe.

What is this saying? Well, the value premium doesn’t appear to exist in the biggest NYSE stocks (the stuff your firm’s research covers). You can find value in micro-caps, but the effect is still not very significant relative to momentum in long-only portfolios. And momentum works across all cap levels, not just in the small cap area.

All of this is quite important if you are running long-only portfolios for clients, which is what most of the industry does. Relative strength (momentum) is a practical tool because it appears to generate excess return over many time periods and across all capitalizations.

Posted by: Mike Moody

Income-Producing Securities

October 3, 2013According to Morningstar, the whole idea of income-producing securities is flawed—and I think they are right. In an article entitled “Option Selling Is Not Income,” author Philip Guziec points out that option income is not mysterious free money. Option selling can modify the risk-reward tradeoff for a portfolio, but the income is part of the total return, not some extra money that happens to be lying around.

By way of explanation, he shows a chart of an option income portfolio without the reinvestment of the income. As you can see below, it’s pretty grim.

(click on image to enlarge)

Why is that? Well, the plummeting line is the one where you spend the income instead of reinvesting it in the portfolio. So much for an income-producing security that has “free” income. In this graphic context, it is very clear that the income is just one part of the total return. (You can read the whole article—the link is above—if you want more information on the specifics of an option income portfolio.)

However, I thought the article was great for another reason. Mr. Guziec generalizes the case of option income funds to all income securities. He writes:

In fact, the very concept of an income-producing security is a fallacy. A dollar of return is a dollar of return, whether that return comes from capital gains, coupons, dividends, or option premium.

I put the whole thing in bold because 1) I think it is important, and 2) most investors do not understand this apparently simple point. This can be generalized to investors who refuse to buy certain stocks because they don’t “have enough yield” or who prefer high-yield bonds to investment-grade bonds simply because they “have more yield.” In both cases, income is just part of the total return—and may also move you to a different part of the risk-return spectrum. There is nothing magic about income-producing securities, whether they are MLPs, dividend stocks, bonds, or anything else. What matters is the total return.

From a mathematical standpoint, shaving 25 basis points off of your portfolio every month to spend is no different than spending a 3% dividend yield. Once you can wrap your head around this concept, it’s easy to pursue the best opportunities in the market because you aren’t wearing blinders or forcing investments through a certain screen or set of filters. If your portfolio grows, that 25 basis points keeps getting to be a bigger number and that’s really what matters.

Posted by: Mike Moody

High RS Diffusion Index

October 2, 2013The chart below measures the percentage of high relative strength stocks that are trading above their 50-day moving average (universe of mid and large cap stocks.) As of 10/1/13.

The 10-day moving average of this indicator is 78% and the one-day reading is 85%.

Posted by: Andy Hyer

Q4 2013 DWA Momentum ETFs

October 1, 2013Each quarter, the PowerShares DWA Momentum Indexes are reconstituted. These indexes are designed to evaluate their respective investment universes (U.S Mid and Large-Cap equities, U.S. Small-Cap equities, Developed International Market equities, and Emerging Market equities) and build an index of stocks with superior relative strength characteristics. This quarter’s allocations are shown below. The two largest increases and the two largest decreases in sector/country exposure for the Q4 rebalance are also shown.

Source: PowerShares, MSCI, and Standard & Poor’s

There is now over $2 billion in asset under management and licensing in PDP, PIE, PIZ, and DWAS. YTD performance is shown below:

See www.powershares.com for more information. The Dorsey Wright SmallCap Momentum Index is calculated by Dow Jones, the marketing name and a licensed trademark of CME Group Index Services LLC (“CME Indexes”). “Dow Jones Indexes” is a service mark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Products based on the Dorsey Wright SmallCap Momentum IndexSM, are not sponsored, endorsed, sold or promoted by CME Indexes, Dow Jones and their respective affiliates make no representation regarding the advisability of investing in such product(s).

Posted by: Andy Hyer

Relative Strength Spread

October 1, 2013The chart below is the spread between the relative strength leaders and relative strength laggards (universe of mid and large cap stocks). When the chart is rising, relative strength leaders are performing better than relative strength laggards. As of 9/30/2013:

Posted by: Andy Hyer