Mutual fund flow estimates are derived from data collected by The Investment Company Institute covering more than 95 percent of industry assets and are adjusted to represent industry totals.

High RS Diffusion Index

January 29, 2014The chart below measures the percentage of high relative strength stocks that are trading above their 50-day moving average (universe of mid and large cap stocks.) As of 1/28/14.

The one-day reading of this index recently hit a low of 41% on 1/27/14. The 10-day moving average is 72% and the one-day reading is 49%. Dips in this index have often provided good opportunities to add to relative strength strategies.

Posted by: Andy Hyer

Dorsey Wright Managed Accounts

January 27, 2014Our Systematic Relative Strength portfolios are available as managed accounts at a large and growing number of firms.

- Wells Fargo Advisors (Global Macro available on the Masters/DMA Platforms)

- Morgan Stanley (IMS Platform)

- TD Ameritrade Institutional

- UBS Financial Services (Aggressive and Core are available on the MAC Platform)

- RBC Wealth Management (MAP Platform)

- Raymond James (Outside Manager Platform)

- Stifel Nicolaus

- Kovack Securities

- Deutsche Bank

- Charles Schwab Institutional

- Sterne Agee

- Scott & Stringfellow

- Envestnet

- Placemark

- Scottrade Institutional

- Janney Montgomery Scott

- Robert W. Baird

- Wedbush Morgan

- Prospera

- Oppenheimer (Star Platform)

- SunTrust

- Lockwood

Different Portfolios for Different Objectives: Descriptions of our seven managed accounts strategies are shown below. All managed accounts use relative strength as the primary investment selection factor.

Aggressive: This Mid and Large Cap U.S. equity strategy seeks to achieve long-term capital appreciation. It invests in securities that demonstrate powerful relative strength characteristics and requires that the securities maintain strong relative strength in order to remain in the portfolio.

Core: This Mid and Large Cap U.S. equity strategy seeks to achieve long-term capital appreciation. This portfolio invests in securities that demonstrate powerful relative strength characteristics and requires that the securities maintain strong relative strength in order to remain in the portfolio. This strategy tends to have lower turnover and higher tax efficiency than our Aggressive strategy.

Growth: This Mid and Large Cap U.S. equity strategy seeks to achieve long-term capital appreciation with some degree of risk mitigation. This portfolio invests in securities that demonstrate powerful relative strength characteristics and requires that the securities maintain strong relative strength in order to remain in the portfolio. This portfolio also has an equity exposure overlay that, when activated, allows the account to hold up to 50% cash if necessary.

International: This All-Cap International equity strategy seeks to achieve long-term capital appreciation through a portfolio of international companies in both developed and emerging markets. This portfolio invests in those securities with powerful relative strength characteristics and requires that the securities maintain strong relative strength in order to remain in the portfolio. Exposure to international markets is achieved through American Depository Receipts (ADRs).

Global Macro: This global tactical asset allocation strategy seeks to achieve meaningful risk diversification and investment returns. The strategy invests across multiple asset classes: Domestic Equities (long & inverse), International Equities (long & inverse), Fixed Income, Real Estate, Currencies, and Commodities. Exposure to each of these areas is achieved through exchange-traded funds (ETFs).

Balanced: This strategy includes equities from our Core strategy (see above) and high-quality U.S. fixed income in approximately a 60% equity / 40% fixed income mix. This strategy seeks to provide long-term capital appreciation and income with moderate volatility.

Tactical Fixed Income: This strategy seeks to provide current income and strong risk-adjusted fixed income returns. The strategy invests across multiple sectors of the fixed income market: U.S. government bonds, investment grade corporate bonds, high yield bonds, Treasury inflation protected securities (TIPS), convertible bonds, and international bonds. Exposure to each of these areas is achieved through exchange-traded funds (ETFs).

To receive fact sheets for any of the strategies above, please e-mail Andy Hyer at [email protected] or call 626-535-0630. Past performance is no guarantee of future returns. An investor should carefully review our brochure and consult with their financial advisor before making any investments.

Posted by: Andy Hyer

Optimal Allocation Between Stocks and Bonds

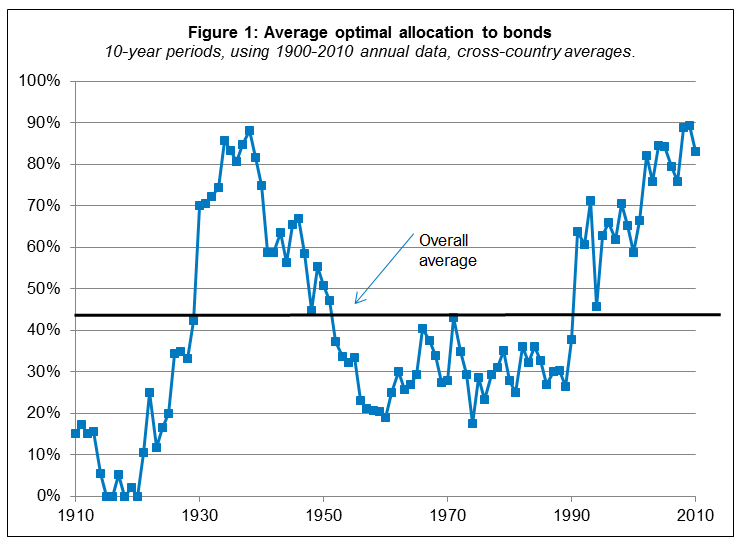

January 27, 2014Daniel Morillo of BlackRock looks to see if the 60/40 allocation is the optimal mix of bonds and equities over time:

Since my last post on the merits of using equities to balance the risk of rising rates, I’ve been asked well, what is the right mix of equities and fixed income? Almost everyone’s top-of-mind answer is, of course, 60/40. It’s a portfolio that holds 60% equities and 40% bonds, and it’s widely used as a benchmark for numerous multi-asset or “balanced” allocation products. Financial professionals tend to use it as a reference point during portfolio allocation discussions with clients, and it’s widely quoted in the media.

So, does 60/40 hold up? I decided to sift through the numbers to see. What I found is that while, in general, a 60/40 portfolio may be a reasonable bet for long term investors, it might not always be the way to go for investors who hold strong convictions.

To come to this conclusion, I took equity and government bond returns from the DMS database[1], which includes annual return data for 19 countries since 1900. For each possible 10-year period in each country, I constructed the allocation that, over that particular 10-year period, would have delivered the best ratio of excess return to risk, aka the allocation with the best or “optimal” Sharpe ratio.

Figure 1 shows the average optimal bond allocation for each country, averaged across countries. Guess what? The overall average across countries and time is about 43% bonds (so, the remaining 57% would be in equities) — eerily close to the 60/40 rule.

(click on the image to enlarge)

So the answer is that, yes, since 1900 the optimal mix of equities and bonds is approximately 60/40.

However, note the variability in the optimal allocation to bonds in the chart above. In some 10-year periods it was best to have 90% allocation to bonds and in other 10-year periods it was best to have 0% allocation to bonds! While some may look at this study and conclude that there is no need to be tactical, I look at this study and come to the exact opposite conclusion. Relative strength offers an effective tool for making macro asset allocation decisions, as explored in this white paper by John Lewis.

HT: Abnormal Returns

Posted by: Andy Hyer

Weekly RS Recap

January 27, 2014The table below shows the performance of a universe of mid and large cap U.S. equities, broken down by relative strength decile and quartile and then compared to the universe return. Those at the top of the ranks are those stocks which have the best intermediate-term relative strength. Relative strength strategies buy securities that have strong intermediate-term relative strength and hold them as long as they remain strong.

Last week’s performance (1/21/14 – 1/24/14) is as follows:

Posted by: Andy Hyer

Sector Performance

January 24, 2014The chart below shows performance of US sectors and capitalizations over the trailing 12, 6, and 1 month(s). Performance updated through 1/23/2014.

Numbers shown are price returns only and are not inclusive of transaction costs. Source: iShares

Posted by: Andy Hyer

Improving Sector Rotation With Momentum Indexes

January 21, 2014Sector has been a popular investment strategy for many years. The proliferation of sector based exchange traded funds has made it quick and easy to implement sector bets, but has also added a level of complexity to the process. There are now many different flavors of ETF’s for each macro sector ranging from simple capitalization weightings to semi-active quantitative models to construct the sector index. The vast array of choices in each sector allows investors to potentially add additional performance over time versus a simple capitalization based model.

Dorsey, Wright has a suite of sector indexes based on our Technical Leaders Momentum factor. These indexes are designed to give exposure to the securities with the best momentum characteristics in each of the 9 broad macro sectors (Telecomm is split between Technology and Utilities depending on the industry group). Long time readers of our blog should be aware of all of the research that demonstrates how effective the momentum factor has been over time providing returns above a broad market benchmark. Using indexes constructed with the momentum factor have the potential to add incremental returns above a simple capitalization weighted sector rotation strategy just like they do on the individual stock side.

The sector SPDRs are the most popular sector suite of exchange traded products. When investors make sector bets using this suite of products they are making a distinct sector bet and also making a bet on large capitalization stocks since the sector SPDRs are capitalization weighted. There are times when large cap stocks outperform, but there are also times when the strength might be in small cap, value, momentum, or some other factor. By not considering other weighting methodologies investors are potentially leaving money on the table.

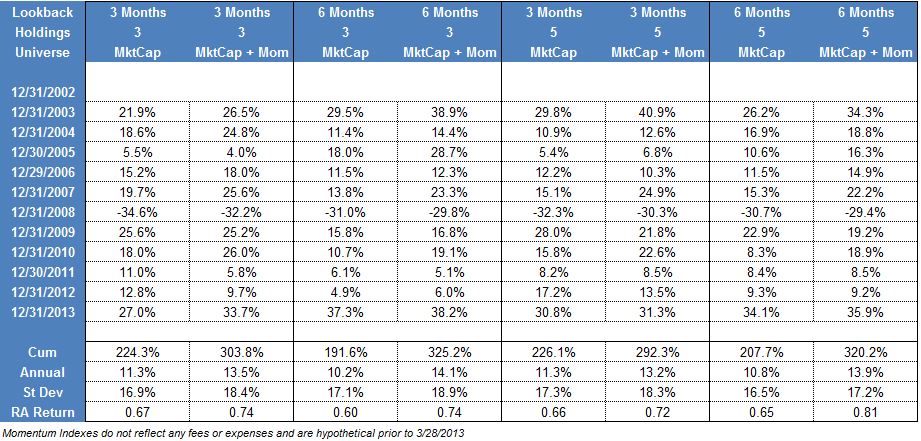

We constructed several very simple sector rotation models to determine how returns might be enhanced by implementing a sector rotation strategy with indexes based on momentum. The base models were created with either 3 or 5 holdings from the sector SPDR universe. Each month a trailing 3 or 6 month return was calculated (based on the model specification) and the top n holdings were included in equal weights in the portfolio. Each month the portfolio was rebalanced with the top 3 or 5 sector SPDRs based on the trailing return. This is an extremely simple way to implement a momentum based sector rotation strategy, but one that proves to be surprisingly effective.

The second group of portfolios expanded the universe of securities we considered to implement the strategy. All of the momentum rankings were still based on the trailing returns of the sector SPDRs, but we made one small change in what was purchased. If, for example, the model selected Healthcare as one of the holdings we would buy either the sector SPDR or our Healthcare Momentum Index. The way we determined which version of the sector to buy was simple: whichever of the two had the best trailing return (the window was the same as the ranking window) was included in the portfolio for the month. In a market where momentum stocks were performing poorly the model would gravitate to the cap weighted SPDRs, but when momentum was performing well the model would tend to buy momentum based sectors. Making that one small change allowed us to determine how important implementing the sector bet actually was.

(Click Image To Enlarge)

The table above shows the results of the tests. Trials were run using either 3 or 6 month look back windows to rank the sectors and also with either 3 or 5 holdings. In each case, allowing the model to buy a sector composed of high momentum securities was materially better than its cap weighted counterpart. Standard deviation also increased, but the returns justified the increased volatility as the risk adjusted return increased in each case.

This is one simple case illustrating how implementing your sector bests with different sector construction philosophies can be additive to investment returns. The momentum factor is one of the premier investment anomalies out there, and using a basket of high momentum stocks in a specific sector has shown to increase returns in the testing we have done.

The performance numbers are not inclusive of any commissions or trading costs . The Momentum Indexes are hypothetical prior to 3/28/2013 and do not reflect any fees or expenses. Past performance is no guarantee of future returns. Potential for profit is accompanied by potential for loss. The models described above are for illustrative purposes only and should not be taken as a recommendation to buy or sell any security or strategy mentioned above. Click here for additional disclosures.

Posted by: John Lewis

DWA Technical Leaders Webinar: Q1 Updates

January 20, 2014On Wednesday, January 16th, Tom Dorsey, Founder and President of DWA, Tammy DeRosier, Chief Operating Officer, and John Lewis, Senior Vice President and Portfolio Manager, conducted a webinar around the most recent quarterly rebalances across the DWA Technical Leaders Indexes, as well as practical implementation ideas for using the four Momentum ETFs that track these indexes.

Follow this link for a replay of this webinar.

Posted by: Andy Hyer

Is Sector Rotation a Crowded Trade?

January 16, 2014As sector ETFs have proliferated, more and more investors have been attracted to sector rotation and tactical asset allocation strategies using ETFs, whether self-managed or implemented by an advisor. Mark Hulbert commented on sector rotation strategies in a recent article on Marketwatch that highlighted newsletters using Fidelity sector funds. All of the newsletters had good returns, but there was one surprising twist:

…you might think that these advisers each recommended more or less the same basket of funds. But you would be wrong. In fact, more often than not, each of these advisers has tended to recommend funds that are not recommended by any other of the top five sector strategies.

That’s amazing, since there are only 44 actively managed Fidelity sector funds and these advisers’ model portfolios hold an average of between five and 10 funds each.

This suggests that there is more than one way of playing the sector rotation game, which is good news. If there were only one profitable sector strategy, it would quickly become so overused as to stop working.

This is even true among those advisers who recommend sectors based on their relative strength or momentum. Because there are so many ways of defining these characteristics, two different sector momentum strategies will often end up recommending two different Fidelity sector funds.

Another way of appreciating the divergent recommendations of these top performing advisers is this: Of the 44 actively managed sector funds that Fidelity currently offers, no fewer than 22 are recommended by at least one of these top five advisers. That’s one of every two, on average, which hardly seems very selective on the advisers’ part.

Amazing, isn’t it? It just shows that there are many ways to skin a cat.

Even with a very limited menu of Fidelity sector funds, there was surprisingly little overlap. Imagine how little overlap there would be within the ETF universe, which is much, much larger! In short, you can safely pursue a sector rotation strategy (and, by extension, tactical asset allocation) with little concern that everyone else will be plowing into the same ETFs.

Posted by: Mike Moody

Weekly RS Recap

January 13, 2014The table below shows the performance of a universe of mid and large cap U.S. equities, broken down by relative strength decile and then compared to the universe return. Those at the top of the ranks are those stocks which have the best intermediate-term relative strength. Relative strength strategies buy securities that have strong intermediate-term relative strength and hold them as long as they remain strong.

Last week’s performance (1/6/14 – 1/10/14) is as follows:

Very strong showing for high relative strength stocks last week.

Posted by: Andy Hyer

Price Persistence At the Asset Class Level

January 9, 2014Leuthold’s January Green Book includes a simple, yet compelling study about applying momentum at the asset class level:

While even academics now acknowledge the existence of a “price persistence” effect at the stock and industry group level, it is less well known that the phenomenon exists at the broad asset class level. We’ve examined a few simple approaches in which allocation decisions are based purely on the prior year’s total return performance of seven asset classes: Large Caps, Small Caps, Foreign Stocks, REITs, Commodities, Gold and U.S. Treasury Bonds. Contrarians might be surprised to learn that a turnaround strategy of buying last year’s laggards (the #5, #6 and #7 performers), has been a consistently poor approach for the last 40 years. Meanwhile, a naive, momentum-surfing strategy of buying last year’s #1 or #2 performer (or both) has soundly beaten the S&P 500 since 1973. (We suspect these results are especially humbling to those who spend the rest of the year building and monitoring elaborate tools that track valuations, the economic cycle, investor sentiment, etc.)

(printed with permission from Leuthold)

Bottom line: momentum also works well at the asset class level. Click here for a white paper written by John Lewis that also confirms that momentum can be successfully applied to a group of asset classes.

Posted by: Andy Hyer

December Arrow DWA Funds Review

January 8, 201412/31/2013

The Arrow DWA Balanced Fund (DWAFX)

At the end of December, the fund had approximately 46% in U.S. Equities, 25% in Fixed Income, 17% in International Equities, and 12% in Alternatives.

DWAFX rose 1.39% in December, and finished 2013 up 15.53%.

The fund produced positive returns in 10 out of 12 months in 2013, a year characterized by relatively low volatility. Asset class leadership remained fairly steady throughout the year with domestic equities remaining the asset class with the best relative strength and is the area where we continue to have the most exposure. However, we are seeing some relative strength improvement in the international equity sleeve. Germany and the Netherlands were among our best performing holdings in December and the overall exposure of the fund to international equities has increased in recent months.

Interest rates rose in December and our position in the iShares Barclays 7-10 year Treasury Bond ETF was among our worst performers. Our other fixed income position is the Vanguard Short-Term Bond ETF and that position was flat for the month. Our fixed income exposure is at the lower end of its exposure constraint.

We believe that a real strength of this strategy is its balance between remaining diversified, while also adapting to market leadership. When an asset class is weak its exposure will tend to be towards the lower end of the exposure constraints, and when an asset class is strong its exposure in the fund will trend toward the upper end of its exposure constraints. Relative strength provides an effective means of determining the appropriate weights of the strategy.

The Arrow DWA Tactical Fund (DWTFX)

At the end of December, the fund had approximately 90% in U.S. equities and 9% in International equities.

DWTFX was up 2.38% in December, and finished 2013 up 25.83%.

All of our holdings produced gains in December, led by our Industrial sector position, U.S. Mid Caps, and our European equity position. According to Morningstar, DWTFX outperformed 95% of its peers in the Tactical Allocation category in 2013. Although, this fund also has the flexibility to invest in asset classes like commodities and fixed income, those areas remain weak from a relative strength perspective.

Although the financial media spend much of 2013 hyperventilating about the fiscal cliff, the sequester, a partial government shutdown, a debt ceiling debate, tapering, and Obamacare, the equity markets largely seemed unfazed and marched higher throughout the year. Relative strength did an excellent job of keeping us on the right side of that trend.

This strategy is a go-anywhere strategy with very few constraints in terms of exposure to different asset classes. The strategy can invest in domestic equities, international equities, inverse equities, currencies, commodities, real estate, and fixed income. Market history clearly shows that asset classes go through secular bull and bear markets and we believe this strategy is ideally designed to capitalize on those trends. Additionally, we believe that this strategy can provide important risk diversification for a client’s overall portfolio.

A list of all holdings for the trailing 12 months is available upon request. See www.arrowfunds.com for more information.

Posted by: Andy Hyer

Systematic Relative Strength Portfolios: Q4 Manager Insights

January 7, 2014Fourth Quarter Review

After a short dip to start the fourth quarter, the stock market moved strongly higher through the end of November. The marked moved sideways during December, never giving up any substantial ground. What a remarkable year for the stock market! Despite some choppiness, every quarter this year has had positive equity returns!

The S&P 500 finished up over 30% for the year. The last time the S&P accomplished that feat was all the way back in 1997. That was quite a while ago. In fact, it was the longest streak without a 30% up year since the drought from 1959 to 1974. The 10.5% return in the fourth quarter made that possible.

Other asset classes didn’t fare as well as equities in 2013. Continuing to fear tapering by the Federal Reserve, the bond market was lackluster during the final three months of the year. Many broad fixed income indexes finished 2013 with losses. Other asset classes, like commodities, performed poorly as well. Gold, in particular, had a very difficult year after being a darling of the fear mongers for many years. Diversification, which provided improved returns over the past few years, was definitely not the way to go in 2013. It was all about equities.

Economic growth may be starting to pick up. The final estimate for Q3 GDP growth is now 4.1%. That’s stronger annual growth than we’ve seen for at least six quarters. Another positive is the Conference Board’s Leading Economic Index, which is up 3.1% over the past six months. Industrial capacity utilization is still slack and employment still fairly weak, suggesting that there will be little pressure on consumer prices for now.

Although there was some political wrangling about the government healthcare website, the big story for the market this quarter was the December Fed meeting. Would the Fed taper or not? The stock and bond markets both seemed apprehensive that the Fed would decide to reduce bond purchases, especially given the negative market reaction in May. In the end, the Fed decided to taper slightly—and the stock market vaulted upward.

Part of the explanation may have been that the taper was more modest than expected, but a bigger factor was likely the Federal Reserve making it clear that its low interest rate policy would continue even after employment begins to pick up. Although a new Fed chair, Janet Yellen, is scheduled to be installed in January, observers don’t expect significant policy changes. The stock market seems to like quantitative easing and there is no end in sight.

While all of this is good news for equities some people are beginning to wonder if we have reached the end of the bull market. The S&P 500 closed the year at an all-time high. It has only done that five times since 1929, so it is a rare event. The good news is that, according to Standard and Poor’s, equities were up an average of 8.5% in the years following a close at an all-time high. The base rates were also good with equities being up four out of those five years.

We also aren’t seeing the type of euphoria from retail investors that often accompanies major market tops. In a recent survey, Blackrock found that affluent investors were holding 48% of their investable assets in cash! This despite expressing greater confidence about their financial futures. Their allocation to equities was only 18% in the survey. During the late 1990’s stock assets were closer to 40%, so despite reaching all-time highs equities are still not universally loved.

We are heading into the part of the cycle that tends to be very good for relative strength. We believe equities can continue to deliver solid returns, and as the market narrows that should be a major positive for our methodology. As always, we continue to focus on implementing our process in the most disciplined way possible, and if you have any questions we are always happy to speak with you about them.

Posted by: Andy Hyer

Quote of the Week

January 7, 2014The term bubble should indicate a price that no reasonable future outcome can justify.—-Clifford Asness, AQR Capital

Valuation gurus come to different conclusions about this market, but most do not think stocks are in a bubble. The consensus is that stocks are slightly above long-term average valuations. Whether those valuations turn out to be reasonable or not will depend on future earnings, but bubble does not seem to describe the current situation, at least by the definition proposed by Mr. Asness. The “bubble” word, it seems, is mainly used to scare people—or to compensate for missing the market last year. The trend is your friend, until it ends.

Posted by: Mike Moody

Relative Strength Spread

January 7, 2014The chart below is the spread between the relative strength leaders and relative strength laggards (universe of mid and large cap stocks). When the chart is rising, relative strength leaders are performing better than relative strength laggards. As of 1/6/2013:

Posted by: Andy Hyer

The 1%

January 6, 2014“The 1%” phrase has been used a lot to decry income inequality, but I’m using it here in an entirely different context. I’m thinking about the 1% in relation to a recent article by Motley Fool’s Morgan Housel. Here’s an excerpt from his article:

Building wealth over a lifetime doesn’t require a lifetime of superior skill. It requires pretty mediocre skills — basic arithmetic and a grasp of investing fundamentals — practiced consistently throughout your entire lifetime, especially during times of mania and panic. Most of what matters as a long-term investor is how you behave during the 1% of the time everyone else is losing their cool.

That puts a little different spin on it. Maybe your behavior during 1% of the time is how you get to be part of the 1%. (The bold in Mr. Housel’s quotation above is mine.)

In his article, Housel demonstrates how consistency—in this case, dollar-cost averaging—beats a couple of risk avoiders who try to miss recessions. We’ve harped on having some kind of systematic investment process here, so consistency is certainly a big part of success.

But also consider what might happen if you can capitalize on those periods of panic and add to your holdings. Imagine that kind of program practiced consistently over a lifetime! Warren Buffett’s article in the New York Times, “Buy American. I Am.” from October 2008 comes to mind. Here is a brief excerpt of Mr. Buffett’s thinking during the financial crisis:

THE financial world is a mess, both in the United States and abroad. Its problems, moreover, have been leaking into the general economy, and the leaks are now turning into a gusher. In the near term, unemployment will rise, business activity will falter and headlines will continue to be scary.

So … I’ve been buying American stocks.

If prices keep looking attractive, my non-Berkshire net worth will soon be 100 percent in United States equities.

A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful. And most certainly, fear is now widespread, gripping even seasoned investors. To be sure, investors are right to be wary of highly leveraged entities or businesses in weak competitive positions. But fears regarding the long-term prosperity of the nation’s many sound companies make no sense. These businesses will indeed suffer earnings hiccups, as they always have. But most major companies will be setting new profit records 5, 10 and 20 years from now.

Let me be clear on one point: I can’t predict the short-term movements of the stock market. I haven’t the faintest idea as to whether stocks will be higher or lower a month — or a year — from now. What is likely, however, is that the market will move higher, perhaps substantially so, well before either sentiment or the economy turns up. So if you wait for the robins, spring will be over.

Gee, I wonder how that worked out for him? It’s no mystery why Warren Buffett has $60 billion—he is as skilled a psychological arbitrageur as there is and he has been at it for a very long time.

As Mr. Housel points out, even with mediocre investing skills, just consistency can go a long way toward building wealth—and the ability to be greedy when others are fearful has the potential to compound success.

Posted by: Mike Moody

DWA Technical Leaders Index Trade Profiles

January 6, 2014The Dorsey, Wright Technical Leaders Index is composed of a basket of 100 mid and large cap securities that have strong relative strength (momentum) characteristics. Each quarter we reconstitute the index by selling stocks that have underperformed and by adding new securities that score better in our ranking system. We began calculating the index in real-time at the end of 2006. Over the last seven years there have been quite a few deletions and additions as the index has adapted to some very dynamic market conditions.

Any relative strength or momentum-based investment strategy is a trend following strategy. Trend following has worked for many years in financial markets (although not every year). These systems are characterized by a several common attributes: 1) Losing trades are cut quickly and winners are allowed to run, 2) there are generally a lot of small losing trades, and 3) all of the money is made by the large outliers on the upside. When we look at the underlying trades inside of the index over the years we find exactly that pattern of results. There is a lot going on behind the scenes at each rebalance that is designed to eliminate losing positions quickly and maintain large allocations to the true winners that drive the returns.

We pulled constituent level data for the DWATL Index going back to the 12/31/2006 rebalance. For each security we calculated the return relative to the S&P 500 and how many consecutive quarters it was held in the index. (Note: stocks can be added, removed, and re-added to the index so any individual stock might have several entries in our data.) The table below shows summary statistics for all the trades inside of the index over the last seven years:

The data shows our underlying strategy is doing exactly what a trend following system is designed to accomplish. Stocks that aren’t held very long (1 to 2 quarters), on average, are underperforming trades. But when we are able to find a security that can be held for several quarters, those trades are outperformers on average. The whole goal of a relative strength process is to ruthlessly cut out losing positions and to replace them with positions that have better ranks. Any investor makes tons of mistakes, but the system we use to reconstitute the DWATL Index is very good at identifying our mistakes and taking care of them. At the same time, the process is also good at identifying winning positions and allowing them to remain in the index.

Here is the same data from the table shown graphically:

You can easily see the upward tilt to the data showing how relative performance on a trade-level basis improves with the time held in the index. For the last seven years, each additional consecutive quarter we have been able to keep a security in the Index has led to an average relative performance improvement of about 920 basis points. That should give you a pretty good idea about what drives the returns: the big multi-year winners.

We often speak to the overall performance of the Index, but we sometimes forget what is going on behind the scenes to generate that return. The process that is used to constitute the index has all of the characteristics of a trend following system. Underperforming positions are quickly removed and the big winning trades are allowed to remain in the index as long as they continue to outperform. It’s a lot like fishing: you just keep throwing the small ones back until you catch a large one. Sometimes it takes a couple of tries to get a keeper, but if you got a big fish on the first try all the time it would be called “catching” not “fishing.” I believe part of what has made this index so successful over the years is there is zero human bias that enters the reconstitution process. When a security needs to go, it goes. If it starts to perform well again, it comes back. It has no good or bad memories. There are just numbers.

The performance numbers are pure price return, not inclusive of fees, dividends, or other expenses. Past performance is no guarantee of future returns. Potential for profit is accompanied by potential for loss. A list of all holdings for the trailing 12 months is available upon request.

Posted by: John Lewis

Weekly RS Recap

January 6, 2014The table below shows the performance of a universe of mid and large cap U.S. equities, broken down by relative strength decile and quartile and then compared to the universe return. Those at the top of the ranks are those stocks which have the best intermediate-term relative strength. Relative strength strategies buy securities that have strong intermediate-term relative strength and hold them as long as they remain strong.

Last week’s performance (12/30/13 –1/3/14) is as follows:

Posted by: Andy Hyer

Investor Behavior

January 6, 2014Marshall Jaffe, in a recent article for ThinkAdvisor, made an outstanding observation:

In a world where almost nothing can be predicted with any accuracy, investor behavior is one of the rare exceptions. You can take it to the bank that investors will continue to be driven by impatience, social conformity, conventional wisdom, fear, greed and a confusion of volatility with risk. By standing apart and being driven solely by the facts, the value investor can take advantage of the opportunities caused by those behaviors—and be in the optimal position to create and preserve wealth.

His article was focused on value investing, but I think it is equally applicable to relative strength investing. In fact, maybe even more so, as value investors often differ about what they consider a good value, while relative strength is just a mathematical calculation with little room for interpretation.

Mr. Jaffe’s main point—that investors are driven by all sorts of irrational and incorrect cognitive forces—is quite valid. Dozens of studies point it out and there is a shocking lack of studies (i.e., none!) that show the average investor to be a patient, independent thinker devoid of fear and greed.

What’s the best way to take advantage of this observation about investor behavior? I think salvation may lie in using a systematic investment process. If you start with an investment methodology likely to outperform over time, like relative strength or value, and construct a rules-based systematic process to follow for entry and exit, you’ve got a decent chance to avoid some of the cognitive errors that will assail everyone else.

Of course, you will construct your rules during a period of calm and contemplation—but that’s never when rules are difficult to apply! The real test is sticking to your rules during the periods of fear and greed that occur routinely in financial markets. Devising the rules may be relatively simple, but following them in trying circumstances never is! As with most things, the harder it is to do, the bigger the potential payoff usually is.

Posted by: Mike Moody

Equity as the Way to Wealth

January 3, 2014According to a recent Gallup Poll, most Americans don’t think much of the stock market as a way to build wealth. I find that quite distressing, and not just because stocks are my business. Stocks are equity—and equity is ownership. If things are being done right, the owner should end up making more than the employee as the business grows. I’ve reproduced a table from Gallup’s article below.

Source: Gallup (click on image to enlarge)

You can see that only 37% felt that the stock market was a good way to build wealth—and only 50% among investors with more than $100,000 in assets.

Perhaps investors will reconsider after reading an article from the Wall Street Journal, here republished on Yahoo! Finance. In the article, they asked 40 prominent people about the best financial advice they’d ever received. (Obviously you should read the whole thing!) Two of the comments that struck me most are below:

Charles Schwab, chairman of Charles Schwab Corp.

A friend said to me, Chuck, you’re better off being an owner. Go out and start your own business.

Richard Sylla, professor of the history of financial institutions and markets at New York University

The best financial advice I ever received was advice that I also provided, both to myself and to Edith, my wife. It was more than 40 years ago when I was a young professor of economics and she was a young professor of the history of science. I based the advice on what were then relatively new developments in modern finance theory and empirical findings that supported the theory.

The advice was to stash every penny of our university retirement contributions in the stock market.

As new professors we were offered a retirement plan with TIAA-CREF in which our own pretax contributions would be matched by the university. Contributions were made with before-tax dollars, and they would accumulate untaxed until retirement, when they could be withdrawn with ordinary income taxes due on the withdrawals.

We could put all of the contributions into fixed income or all of it into equities, or something in between. Conventional wisdom said to do 50-50, or if one could not stomach the ups and downs of the stock market, to put 100% into bonds, with their “guaranteed return.”

Only a fool would opt for 100% stocks and be at the mercies of fickle Wall Street. What made the decision to be a fool easy was that in those paternalistic days the university and TIAA-CREF told us that we couldn’t touch the money until we retired, presumably about four decades later when we hit 65.

Aware of modern finance theory’s findings that long-term returns on stocks should be higher than returns on fixed-income investments because stocks were riskier—people had to be compensated to bear greater risk—I concluded that the foolishly sensible thing to do was to put all the money that couldn’t be touched for 40 years into equities.

At the time (the early 1970s) the Dow was under 1000. Now it is around 16000. I’m now a well-compensated professor, but when I retire in a couple of years and have to take minimum required distributions from my retirement accounts, I’m pretty sure my income will be higher than it is now. Edith retired recently, and that is what she has discovered.

Not everyone has the means to start their own business, but they can participate in thousands of existing great businesses through the stock market! Richard Sylla’s story is fascinating in that he put 100% of his retirement assets into stocks and has seen them grow 16-fold! I’m sure he had to deal with plenty of volatility along the way, but it is remarkable how effective equity can be in creating wealth. His wife discovered that her income in retirement—taking the required minimum distribution!—was greater than when she was working! (The italics in the quote above are mine.)

Equity is ownership, and ownership of productive assets is the way to wealth.

Posted by: Mike Moody

Fund Flows

January 3, 2014Mutual fund flow estimates are derived from data collected by The Investment Company Institute covering more than 95 percent of industry assets and are adjusted to represent industry totals.

Posted by: Andy Hyer

Quote of the Week

January 2, 2014Never argue with stupid people; they will drag you down to their level and then beat you with experience.—-Mark Twain

We’ve all been there. With some clients, sometimes it’s just not worth the fight to educate them about financial markets! Make this your year to find those clients with whom you see eye-to-eye and make something good happen!

Posted by: Mike Moody

Q1 2014 PowerShares DWA Momentum ETFs

January 2, 2014Each quarter, the PowerShares DWA Momentum Indexes are reconstituted. These indexes are designed to evaluate their respective investment universes (U.S Mid and Large-Cap equities, U.S. Small-Cap equities, Developed International Market equities, and Emerging Market equities) and build an index of stocks with superior relative strength characteristics. This quarter’s allocations are shown below.

PDP

DWAS

PIZ

PIE

Source: PowerShares, MSCI, and Standard & Poor’s

While capitalization-weighted indices will tend to have relatively stable sector/country allocations from one quarter to the next, our momentum indices can are designed to adapt to leadership changes. The charts below show allocations to two sectors/countries from each of our indices to give you a sense for some of the key areas of leadership and weakness.

PDP

DWAS

PIZ

PIE

The PowerShares DWA Momentum ETFs finished 2013 with $2.8 billion in assets. 2013 performance is shown below:

The performance numbers are pure price return, not inclusive of fees, dividends, or other expenses. Past performance is no guarantee of future returns. Potential for profit is accompanied by potential for loss. A list of all holdings for the trailing 12 months is available upon request.

See www.powershares.com for more information. The Dorsey Wright SmallCap Momentum Index is calculated by Dow Jones, the marketing name and a licensed trademark of CME Group Index Services LLC (“CME Indexes”). “Dow Jones Indexes” is a service mark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Products based on the Dorsey Wright SmallCap Momentum IndexSM, are not sponsored, endorsed, sold or promoted by CME Indexes, Dow Jones and their respective affiliates make no representation regarding the advisability of investing in such product(s).

Posted by: Andy Hyer

PDP In The News

January 2, 2014ETF Trends says PDP might be A Right Place, Right Time Momentum ETF:

Recent data (and the Federal Reserve’s tapering announcement) indicate the U.S. economy is improving and the current economic expansion is maturing.

Assuming that the recovery is moving into late cycle stages, investors may want to consider momentum-based strategies.

“When positioning portfolios for mid to late cycle economic activity, the momentum factor historically had a stronger track record of performance than either small cap or value in generating return,” according to PowerShares, the fourth-largest U.S. ETF sponsor. “It appears that the maturity of the economic cycle may benefit companies which are showing price strength and are able to leverage economic conditions present in a mature economic expansion.”

Past performance is no guarantee of future returns. See www.powershares.com for more information.

Posted by: Andy Hyer