March 19, 2013

Our latest sentiment survey was open from 3/8/13 to 3/15/13. The Dorsey, Wright Polo Shirt Raffle continues to drive advisor participation, and we greatly appreciate your support! This round, we had 65 advisors participate in the survey. If you believe, as we do, that markets are driven by supply and demand, client behavior is important. We’re not asking what you think of the market—since most of our blog readers are financial advisors, we’re asking instead about the behavior of your clients. Then we’re aggregating responses exclusively for our readership. Your privacy will not be compromised in any way.

After the first 30 or so responses, the established pattern was simply magnified, so we are fairly comfortable about the statistical validity of our sample. Some statistical uncertainty this round comes from the fact that we only had four investors say that thier clients are more afraid of missing a stock upturn than being caught in a downdraft. Most of the responses were from the U.S., but we also had multiple advisors respond from at least two other countries. Let’s get down to an analysis of the data! Note: You can click on any of the charts to enlarge them.

Question 1. Based on their behavior, are your clients currently more afraid of: a) getting caught in a stock market downdraft, or b) missing a stock market upturn?

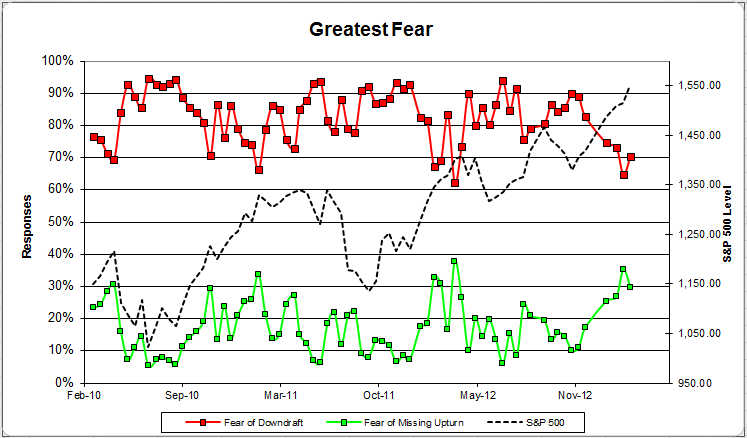

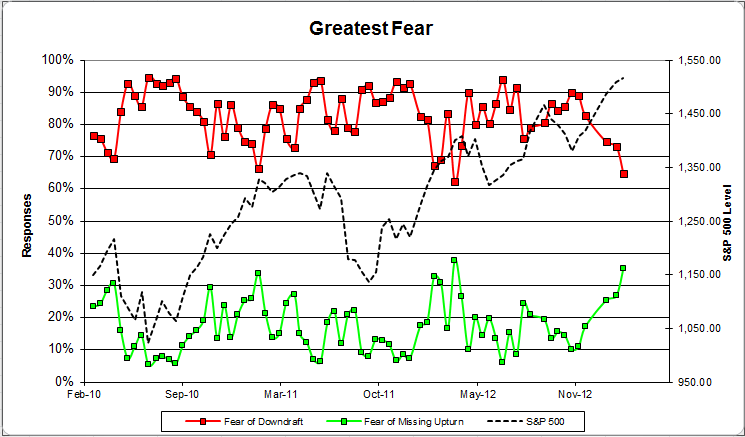

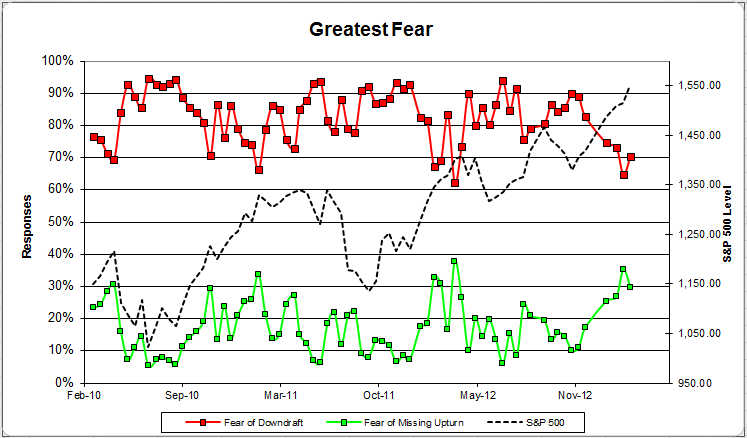

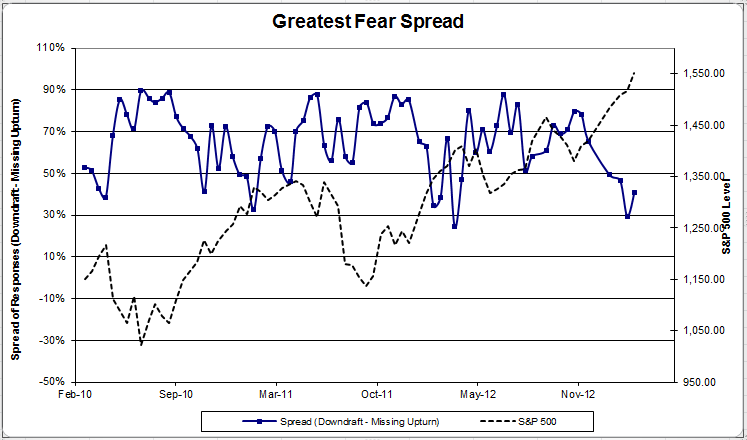

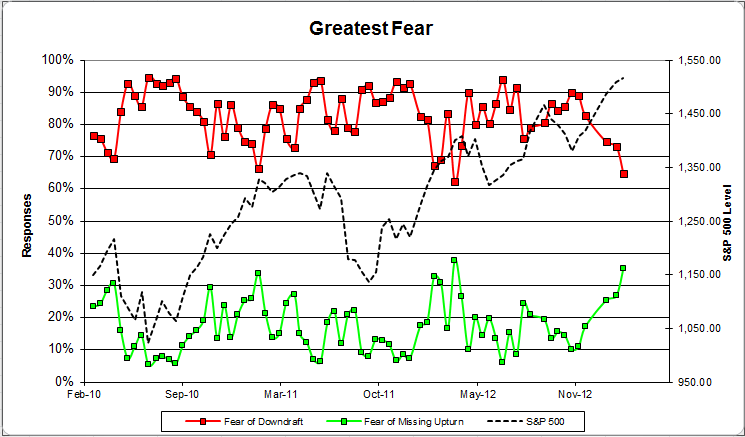

Chart 1: Greatest Fear. From survey to survey, the S&P 500 rose just over +2%, and our indicators responded with a mixed bag. The fear of downturn group actually rose from 65% to 70% in a rising market, which we would not expect to see. The upturn group fell from 35% to 30%.

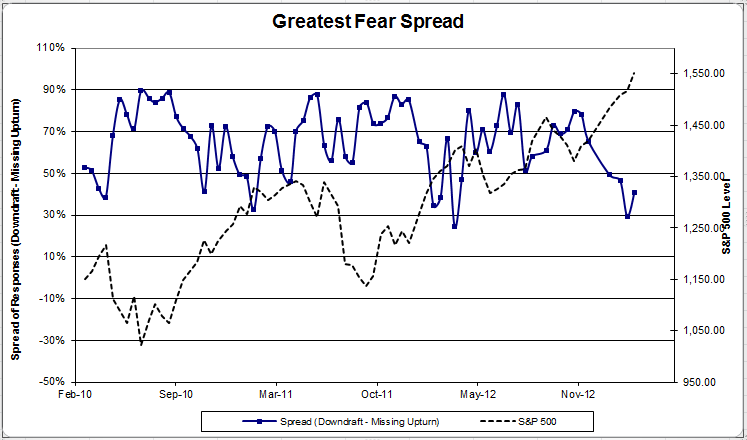

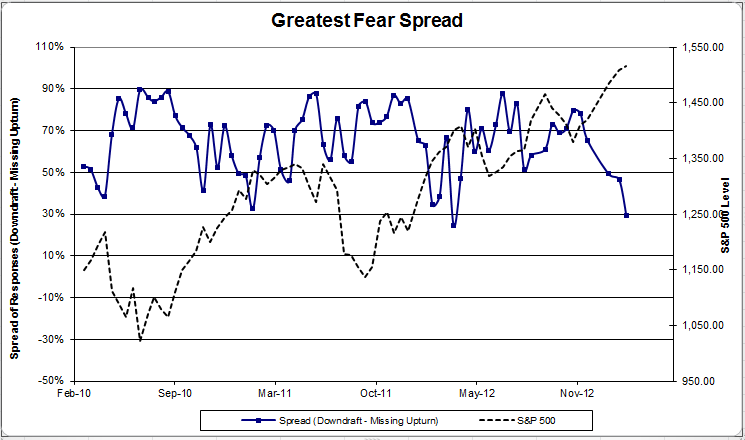

Chart 2: Greatest Fear Spread. Another way to look at this data is to examine the spread between the two groups. The spread rose from 29% to 41%.

Question 2. Based on their behavior, how would you rate your clients’ current appetite for risk?

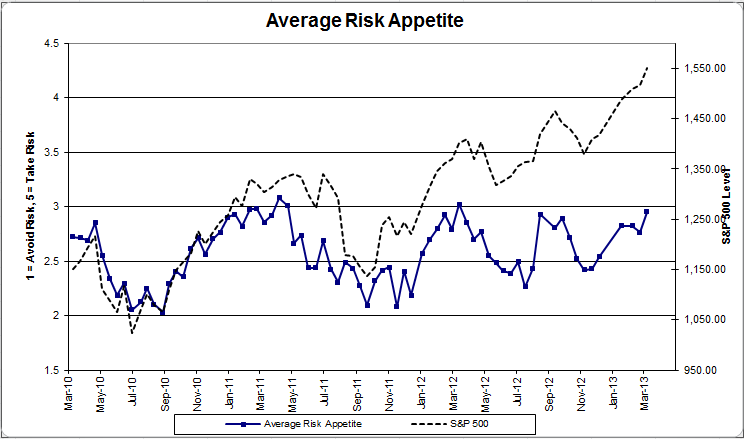

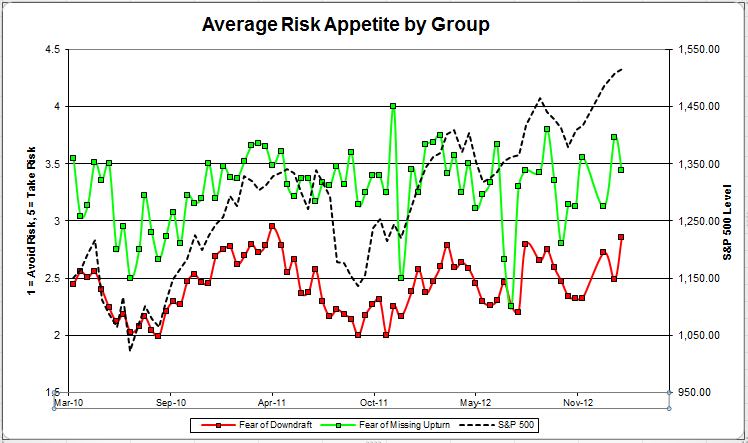

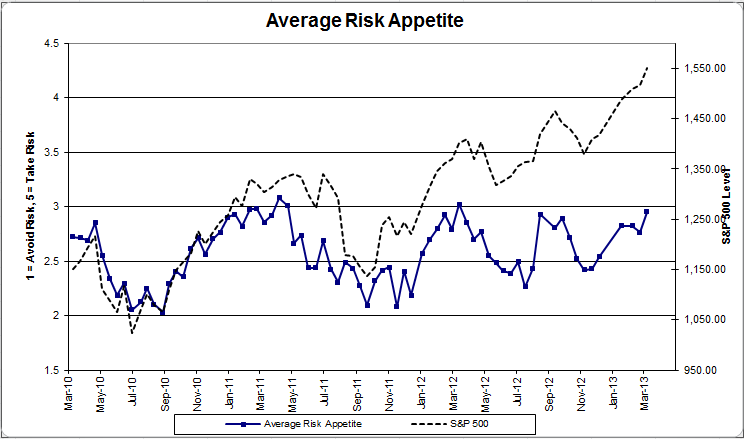

Chart 3: Average Risk Appetite. Average risk appetite jumped this round, from 2.76 to 2.95. We’re sitting just off 1-year highs of client risk appetite at this point. If the market continues to rally, this indicator should be able to break through 3.

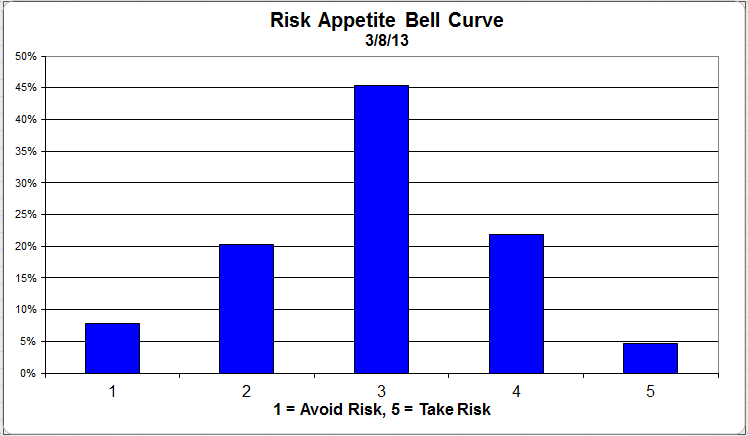

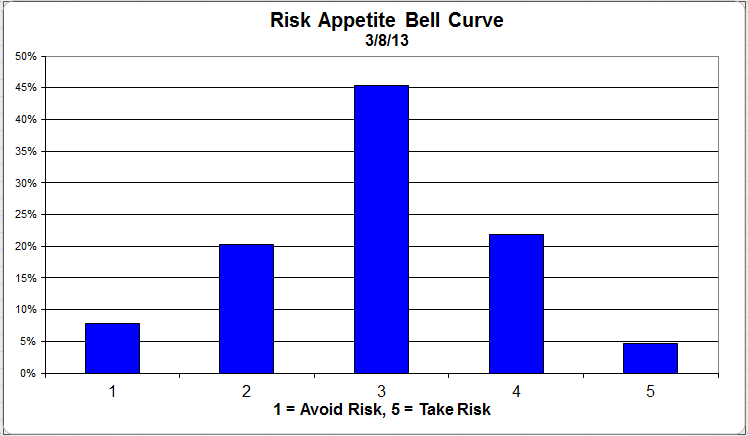

Chart 4: Risk Appetite Bell Curve. This chart uses a bell curve to break out the percentage of respondents at each risk appetite level. This round, nearly 75% of all respondents wanted a risk appetite of 3 or less.

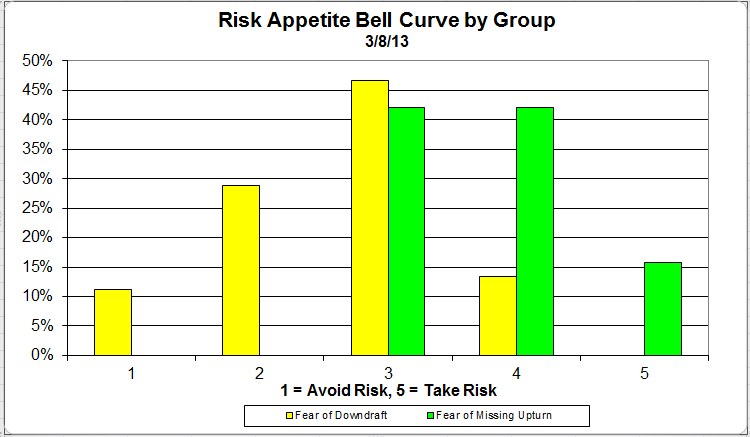

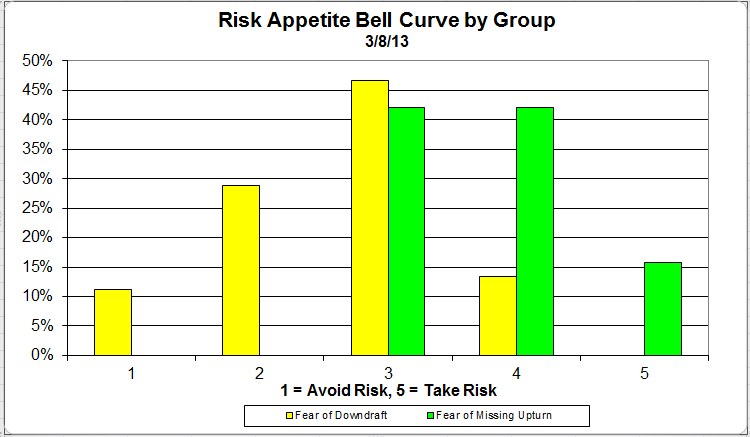

Chart 5: Risk appetite Bell Curve by Group. The next three charts use cross-sectional data. The chat plots the reported client risk appetite separately for the fear of downdraft and for the fear of missing upturn groups. We can see the upturn group wants more risk, while the fear of downturn group is looking for less risk.

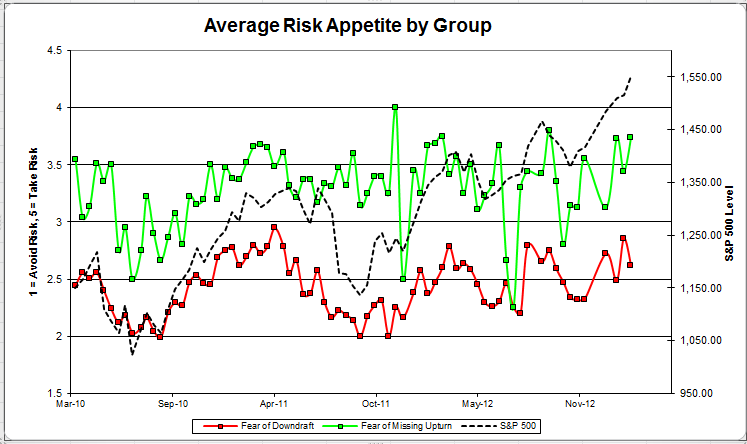

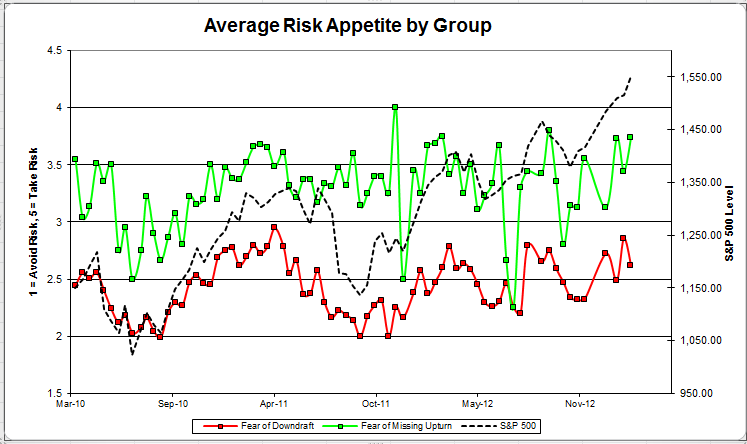

Chart 6: Average Risk Appetite by Group. This round, the downturn group’s average fell, while the upturn group’s average shot higher. This continues to be our most volatile indicator.

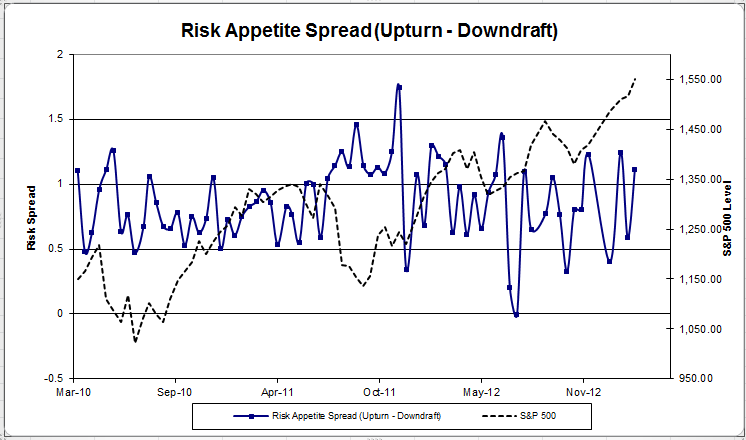

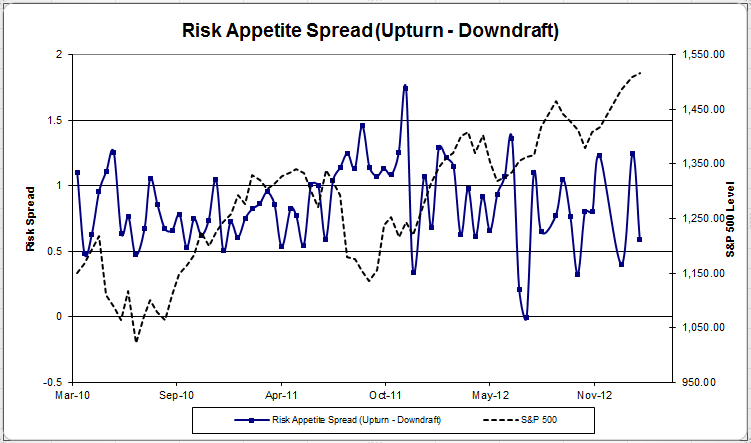

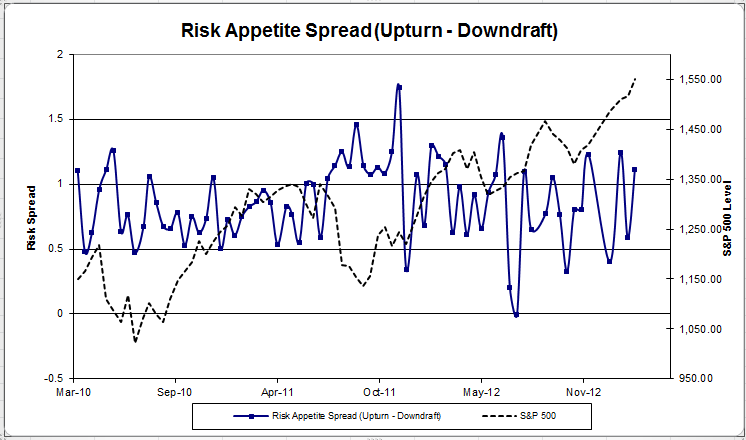

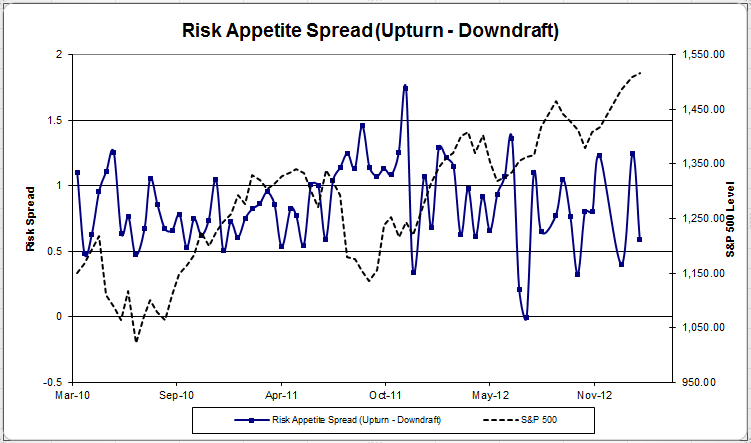

Chart 7: Risk Appetite Spread. This is a chart constructed from the data in Chart 6, where the average risk appetite of the downdraft group is subtracted from the average risk appetite of the missing upturn group. The spread moved higher this round.

The S&P has now managed to rally nearly 10% for the year (as of this writing), and client sentiment has responded favorably. Hopefully, we can see the stock market continue to rally into the second quarter, and clients become more comfortable with taking risk and investing in the market.

No one can predict the future, as we all know, so instead of prognosticating, we will sit back and enjoy the ride. A rigorously tested, systematic investment process provides a great deal of comfort for clients during these types of fearful, highly uncertain market environments. Until next time, good trading and thank you for participating.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets, Sentiment |

Investor Behavior, Markets, Sentiment |  Permalink

Permalink

Posted by:

JP Lee

March 12, 2013

Investing, at its core, is a simple process. You need to determine if the train is going north or south, or just sitting on a track siding doing nothing. Once you’ve found a train going north, you need only to hop aboard. If the train starts to go south, you need to jump off.

The concept is simple, but sometimes investors make the execution more complicated. For us, relative strength and trend following provide the tools and methodology to find the northbound trains. The same tools and methodology can be used to tell you when the switch engine has come along and started to move the train south.

The problems happen when investors deviate from the simple goal-directed hobo mentality and get too clever for their own good. Can you imagine how irrational some investor behavior must look to a hobo? Here are the top six dysfunctional hobo sayings:

1. I wanted to go north, so I hopped on an out-of-favor southbound train, hoping it would go north eventually. (value hobo)

2. I got on a northbound train, but it only went north a few miles. A switch engine came along and started to take my boxcar south. How embarrassing! This train owes me. I’m not getting off. (ego-attached hobo)

3. There are so many trains going north. I want to hop on one eventually, but I’m afraid it will go south right after I get on it. (failure to launch hobo)

4. This northbound train is picking up speed. I’d better get off. (premature ejection hobo)

5. I want to go north, but my train pulled on to a siding and stopped. Maybe I’ll just sit here and see what happens. (buy-and-hold hobo)

6. There are so many trains going north without me. Eventually they will all have to go south, and then I’ll have my revenge! (bitter hobo with economics background)

If you want to go north, get on a northbound train. KISS really applies here. On our good days, we all know this, but it’s so easy to forget.

—-this article originally appeared 5/26/2010. Investing need not be complicated. Relative strength investing, in fact, is pretty simple. However, simple is not the same thing as easy! There is a real skill to the disciplined execution of this strategy—or any other strategy.

35 Comments |

35 Comments |  From the Archives, Investor Behavior, Just for Fun, Markets, Thought Process |

From the Archives, Investor Behavior, Just for Fun, Markets, Thought Process |  Permalink

Permalink

Posted by:

Mike Moody

March 8, 2013

Here we have the next round of the Dorsey, Wright Sentiment Survey, the first third-party sentiment poll. Participate to learn more about our Dorsey, Wright Polo Shirt raffle! Just follow the instructions after taking the poll, and we’ll enter you in the contest. Thanks to all our participants from last round.

As you know, when individuals self-report, they are always taller and more beautiful than when outside observers report their perceptions! Instead of asking individual investors to self-report whether they are bullish or bearish, we’d like financial advisors to weigh in and report on the actual behavior of clients. It’s two simple questions and will take no more than 20 seconds of your time. We’ll construct indicators from the data and report the results regularly on our blog–but we need your help to get a large statistical sample!

Click here to take Dorsey, Wright’s Client Sentiment Survey.

Contribute to the greater good! It’s painless, we promise.

1 Comment |

1 Comment |  Investor Behavior, Markets, Sentiment |

Investor Behavior, Markets, Sentiment |  Permalink

Permalink

Posted by:

JP Lee

March 5, 2013

Our latest sentiment survey was open from 2/22/13 - 3/1/13. The Dorsey, Wright Polo Shirt Raffle continues to drive advisor participation, and we greatly appreciate your support! This round, we had 55 advisors participate in the survey. If you believe, as we do, that markets are driven by supply and demand, client behavior is important. We’re not asking what you think of the market—since most of our blog readers are financial advisors, we’re asking instead about the behavior of your clients. Then we’re aggregating responses exclusively for our readership. Your privacy will not be compromised in any way.

After the first 30 or so responses, the established pattern was simply magnified, so we are fairly comfortable about the statistical validity of our sample. Some statistical uncertainty this round comes from the fact that we only had four investors say that thier clients are more afraid of missing a stock upturn than being caught in a downdraft. Most of the responses were from the U.S., but we also had multiple advisors respond from at least two other countries. Let’s get down to an analysis of the data! Note: You can click on any of the charts to enlarge them.

Question 1. Based on their behavior, are your clients currently more afraid of: a) getting caught in a stock market downdraft, or b) missing a stock market upturn?

Chart 1: Greatest Fear. From survey to survey, the S&P 500 rose about 0.5%, and our indicators responded with a mixed bag. The fear of downturn group fell big this round, from 73% to 65%, while the upturn group rose from 27% to 35%. This indicator is now showing the best client sentiment we’ve seen since March of 2012.

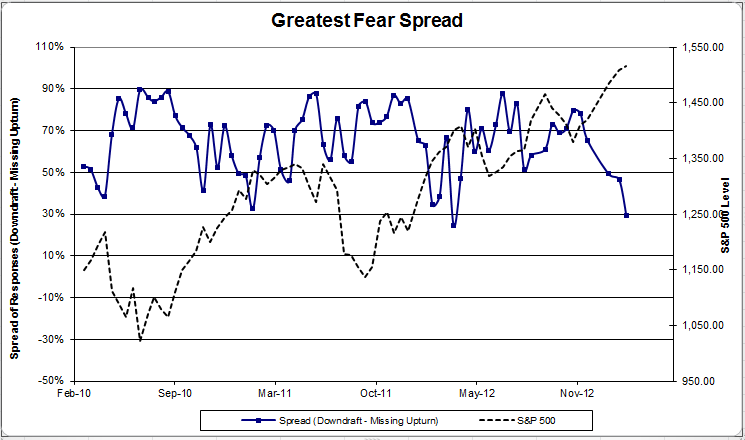

Chart 2: Greatest Fear Spread. Another way to look at this data is to examine the spread between the two groups. The spread continued to fall, from 46% to 29%.

Question 2. Based on their behavior, how would you rate your clients’ current appetite for risk?

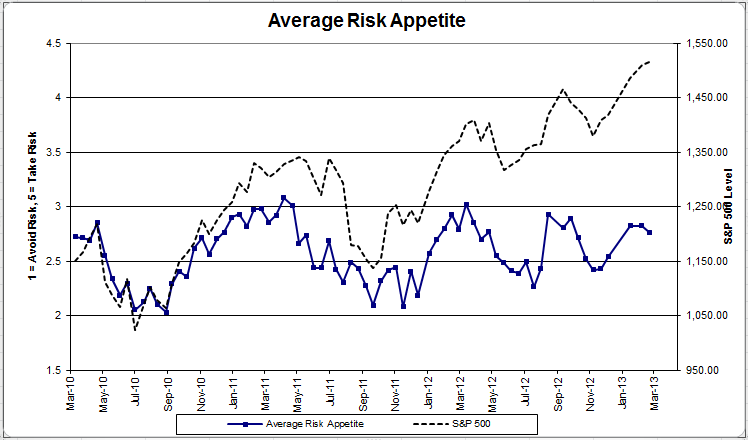

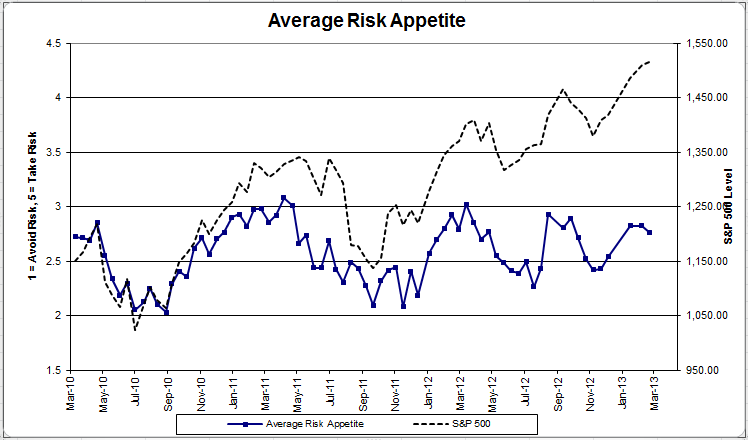

Chart 3: Average Risk Appetite. Average risk appetite fell this round, which is not what we’d expect to see. However, this indicator has been rising steadily with the market over the past few rounds, and it only fell by a small degree. If the market continues to rally, watch for average risk to continue to climb.

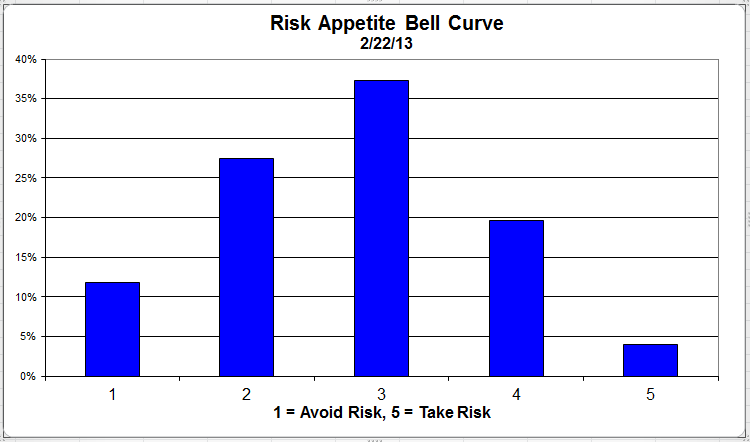

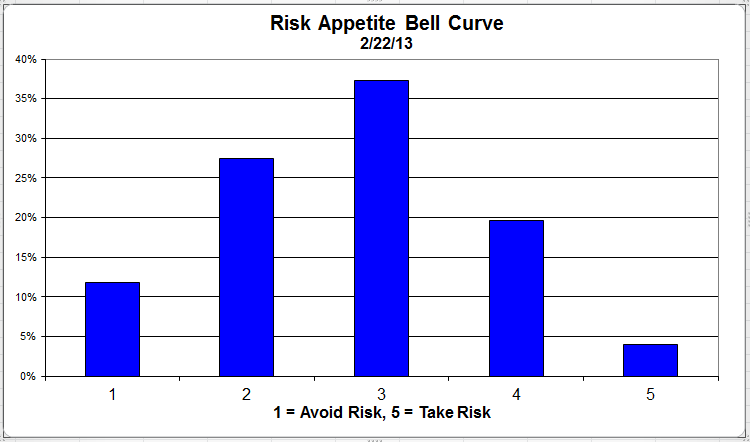

Chart 4: Risk Appetite Bell Curve. This chart uses a bell curve to break out the percentage of respondents at each risk appetite level. This round, over 75% of all respondents wanted a risk appetite of 3 or less.

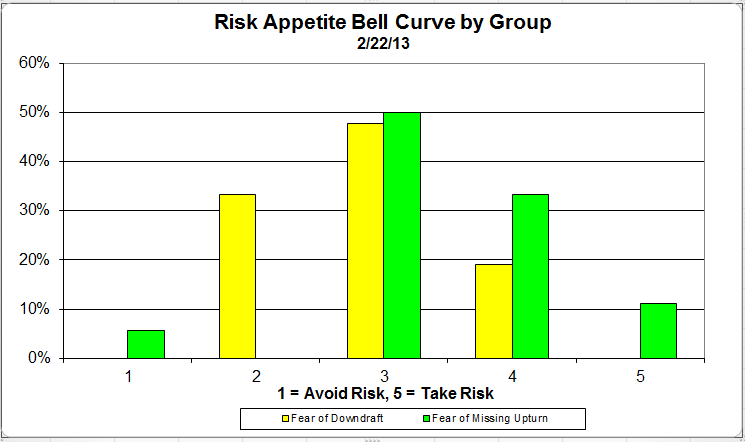

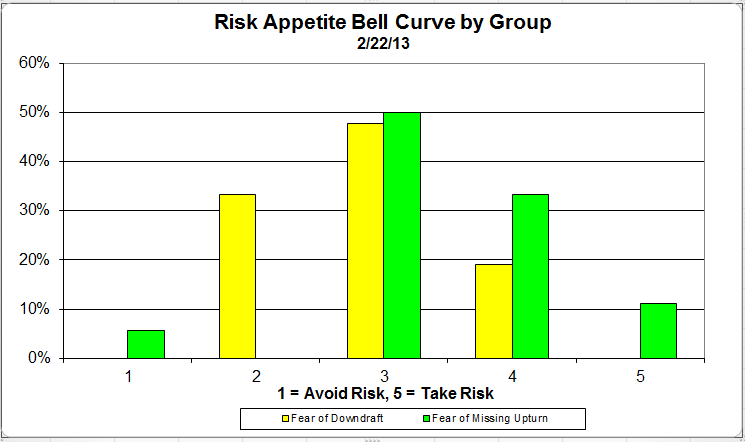

Chart 5: Risk appetite Bell Curve by Group. The next three charts use cross-sectional data. The chat plots the reported client risk appetite separately for the fear of downdraft and for the fear of missing upturn groups. We can see the upturn group wants more risk, while the fear of downturn group is looking for less risk. This is our most volatile indicator, as usual.

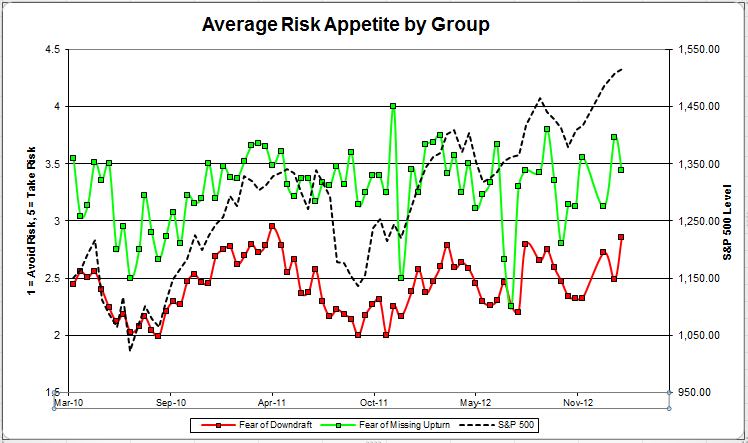

Chart 6: Average Risk Appetite by Group. This round, the downturn group’s average fell, while the upturn group’s average shot higher.

Chart 7: Risk Appetite Spread. This is a chart constructed from the data in Chart 6, where the average risk appetite of the downdraft group is subtracted from the average risk appetite of the missing upturn group. The spread moved higher this round.

The S&P has now rallied for nearly two-thirds of the first quarter, and client sentiment has responded favorably. All of our indicators are showing broad improvement in client sentiment, save a slight mis-step here or there. If the stock market can continue to move higher, there’s no question that clients will become more aggressive and more comfortable with adding risk.

No one can predict the future, as we all know, so instead of prognosticating, we will sit back and enjoy the ride. A rigorously tested, systematic investment process provides a great deal of comfort for clients during these types of fearful, highly uncertain market environments. Until next time, good trading and thank you for participating.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets, Sentiment |

Investor Behavior, Markets, Sentiment |  Permalink

Permalink

Posted by:

JP Lee

March 1, 2013

Lots of investors have avoided the stock market since 2009, only to miss out on a long run of good performance. Now, of course, they are concerned about buying because the market is near a 52-week high. Essentially, they are worried about buyer’s remorse—that bittersweet feeling when the market goes down right after you decided to join the party. In practice, this usually just means they will wait even longer to get in and will thus buy at an even higher price.

While it is impossible to know what the market will do next, buyer’s remorse might not be as significant as it seems. World Beta reprised a recent piece from Steve Sjuggerud on what happened when buying near new 52-week highs and lows:

We looked at nearly 100 years of weekly data on the S&P 500 Index, not counting dividends. You might be surprised at what we found…

After the stock market hits a 52-week high, the compound annual gain over the next year is 9.6%. That is a phenomenal outperformance over the long-term “buy and hold” return, which was 5.6% a year.

On the flip side, buying when the stock market is at or near new lows leads to terrible performance over the next 12 months… Specifically, buying anytime stocks are within 6% of their 52-week lows leads to compound annual gain of 0%. That’s correct, no gain at all 12 months later.

Using monthly data, our True Wealth Systems databases go back to 1791. The results are similar… Buying at a 12-month high and holding for 12 months beats the return of buy-and-hold. And buying at a 12-month low and holding for a year does worse than buy-and-hold. Take a look…

The same holds true for a more recent time period, this time starting in 1950…

History’s verdict is clear… You’re much better off buying at new highs than at new lows.

I find this quite interesting in light of the fact that there is no shortage of articles discussing the sky falling with the sequester, or the debt ceiling, or the Greek default, of the ongoing collapse of the Yen. Well, you get the picture. Maybe investors are just afflicted with crisis fatigue at this point. In fact, PE multiples are around average right now. There’s no telling what will happen going forward, but buyer’s remorse need not be at the top of your list of fears.

1 Comment |

1 Comment |  Investor Behavior, Markets | Tagged: investor behavior, stock market |

Investor Behavior, Markets | Tagged: investor behavior, stock market |  Permalink

Permalink

Posted by:

Mike Moody

February 22, 2013

Here we have the next round of the Dorsey, Wright Sentiment Survey, the first third-party sentiment poll. Participate to learn more about our Dorsey, Wright Polo Shirt raffle! Just follow the instructions after taking the poll, and we’ll enter you in the contest. Thanks to all our participants from last round.

As you know, when individuals self-report, they are always taller and more beautiful than when outside observers report their perceptions! Instead of asking individual investors to self-report whether they are bullish or bearish, we’d like financial advisors to weigh in and report on the actual behavior of clients. It’s two simple questions and will take no more than 20 seconds of your time. We’ll construct indicators from the data and report the results regularly on our blog–but we need your help to get a large statistical sample!

Click here to take Dorsey, Wright’s Client Sentiment Survey.

Contribute to the greater good! It’s painless, we promise.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets, Sentiment |

Investor Behavior, Markets, Sentiment |  Permalink

Permalink

Posted by:

JP Lee

February 20, 2013

Our latest sentiment survey was open from 2/8/13 - 2/15/13. The Dorsey, Wright Polo Shirt Raffle continues to drive advisor participation, and we greatly appreciate your support! This round, we had 70 advisors participate in the survey. If you believe, as we do, that markets are driven by supply and demand, client behavior is important. We’re not asking what you think of the market—since most of our blog readers are financial advisors, we’re asking instead about the behavior of your clients. Then we’re aggregating responses exclusively for our readership. Your privacy will not be compromised in any way.

After the first 30 or so responses, the established pattern was simply magnified, so we are fairly comfortable about the statistical validity of our sample. Some statistical uncertainty this round comes from the fact that we only had four investors say that thier clients are more afraid of missing a stock upturn than being caught in a downdraft. Most of the responses were from the U.S., but we also had multiple advisors respond from at least two other countries. Let’s get down to an analysis of the data! Note: You can click on any of the charts to enlarge them.

Question 1. Based on their behavior, are your clients currently more afraid of: a) getting caught in a stock market downdraft, or b) missing a stock market upturn?

Chart 1: Greatest Fear. From survey to survey, the S&P 500 rose around +1.5%, and our indicators responded as expected. The fear of downdraft group fell from 75% to 73%, while the upturn group rose from 25% to 27%. The market is continuing to rally well into the first quarter.

Chart 2: Greatest Fear Spread. Another way to look at this data is to examine the spread between the two groups. The spread nudged lower , from 49% to 46%.

Question 2. Based on their behavior, how would you rate your clients’ current appetite for risk?

Chart 3: Average Risk Appetite. Average risk remained the same, from 2.825 to 2.821.

Chart 4: Risk Appetite Bell Curve. This chart uses a bell curve to break out the percentage of respondents at each risk appetite level. This round, just under 85% of all respondents wanted a risk appetite of 3 or less.

Chart 5: Risk appetite Bell Curve by Group. The next three charts use cross-sectional data. The chat plots the reported client risk appetite separately for the fear of downdraft and for the fear of missing upturn groups. We can see the upturn group wants more risk, while the fear of downturn group is looking for less risk.

Chart 6: Average Risk Appetite by Group. This round, the downturn group’s average fell, while the upturn group’s average shot higher.

Chart 7: Risk Appetite Spread. This is a chart constructed from the data in Chart 6, where the average risk appetite of the downdraft group is subtracted from the average risk appetite of the missing upturn group. The spread moved higher this round.

The S&P has now rallied for just over half the length of the first quarter, and client sentiment has responded favorably. All of our indicators are showing broad improvement in client sentiment. If the stock market can continue to move higher, there’s no question that clients will become more aggressive and more comfortable with adding risk.

No one can predict the future, as we all know, so instead of prognosticating, we will sit back and enjoy the ride. A rigorously tested, systematic investment process provides a great deal of comfort for clients during these types of fearful, highly uncertain market environments. Until next time, good trading and thank you for participating.

1 Comment |

1 Comment |  Investor Behavior, Markets, Sentiment |

Investor Behavior, Markets, Sentiment |  Permalink

Permalink

Posted by:

JP Lee

February 8, 2013

Here we have the next round of the Dorsey, Wright Sentiment Survey, the first third-party sentiment poll. Participate to learn more about our Dorsey, Wright Polo Shirt raffle! Just follow the instructions after taking the poll, and we’ll enter you in the contest. Thanks to all our participants from last round.

As you know, when individuals self-report, they are always taller and more beautiful than when outside observers report their perceptions! Instead of asking individual investors to self-report whether they are bullish or bearish, we’d like financial advisors to weigh in and report on the actual behavior of clients. It’s two simple questions and will take no more than 20 seconds of your time. We’ll construct indicators from the data and report the results regularly on our blog–but we need your help to get a large statistical sample!

Click here to take Dorsey, Wright’s Client Sentiment Survey.

Contribute to the greater good! It’s painless, we promise.

2 Comments |

2 Comments |  Investor Behavior, Markets, Sentiment |

Investor Behavior, Markets, Sentiment |  Permalink

Permalink

Posted by:

JP Lee

February 1, 2013

The only thing new under the sun is the history you haven’t read yet.—-Mark Twain

Investors often have the conceit that they are living in a new era. They often resort to new-fangled theories, without realizing that all of the old-fangled things are still around mainly because they’ve worked for a long time. While circumstances often change, human nature doesn’t change much, or very quickly. You can generally count on people to behave in similar ways every market cycle. Most portfolio lessons are timeless.

As proof, I offer a compendium of quotations from an old New York Times article:

WHEN you check the performance of your fund portfolio after reading about the rally in stocks, you may feel as if there is a great party going on and you weren’t invited. Perhaps a better way to look at it is that you were invited, but showed up at the wrong time or the wrong address.

It isn’t just you. Research, especially lately, shows that many investors don’t match market performance, often by a wide margin, because they are out of sync with downturns and rallies.

Christine Benz, director of personal finance at Morningstar, agrees. “It’s always hard to speak generally about what’s motivating investors,” she said, “but it’s emotions, basically,” resulting in “a pattern we see repeated over and over in market cycles.”

Those emotions are responsible not only for drawing investors in and out of the broad market at inopportune times, but also for poor allocations to its niches.

Where investors should be allocated, many professionals say, is in a broad range of assets. That will smooth overall returns and limit the likelihood of big losses resulting from an excessive concentration in a plunging market. It also limits the chances of panicking and selling at the bottom.

In investing, as in party-going, it’s often safer to let someone else drive.

This is not ground-breaking stuff. In fact, investors are probably bored to hear this sort of advice over and over—but it gets repeated because investors ignore the advice repeatedly! This same article could be written today, or written 20 years from now.

You can increase your odds of becoming a successful investor by constructing a reasonable portfolio that is diversified by volatility, by asset class, and by complementary strategy. Relative strength strategies, for example, complement value and low-volatility equity strategies very nicely because the excess returns tend to be uncorrelated. Adding alternative asset classes like commodities or stodgy asset classes like bonds can often benefit a portfolio because they respond to different return drivers than stocks.

As always, the bottom line is not to get carried away with your emotions. Although this is certainly easier said than done, a diversified portfolio and a competent advisor can help a lot.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets, Portfolio Theory, Thought Process, Wealth Management | Tagged: asset allocation, behavioral finance, investor behavior, portfolio, relative strength, stock market, strategies |

Investor Behavior, Markets, Portfolio Theory, Thought Process, Wealth Management | Tagged: asset allocation, behavioral finance, investor behavior, portfolio, relative strength, stock market, strategies |  Permalink

Permalink

Posted by:

Mike Moody

January 29, 2013

Our latest sentiment survey was open from 1/18/13 - 1/25/13. The Dorsey, Wright Polo Shirt Raffle continues to drive advisor participation, and we greatly appreciate your support! This round, we had 63 advisors participate in the survey. If you believe, as we do, that markets are driven by supply and demand, client behavior is important. We’re not asking what you think of the market—since most of our blog readers are financial advisors, we’re asking instead about the behavior of your clients. Then we’re aggregating responses exclusively for our readership. Your privacy will not be compromised in any way.

After the first 30 or so responses, the established pattern was simply magnified, so we are fairly comfortable about the statistical validity of our sample. Some statistical uncertainty this round comes from the fact that we only had four investors say that thier clients are more afraid of missing a stock upturn than being caught in a downdraft. Most of the responses were from the U.S., but we also had multiple advisors respond from at least two other countries. Let’s get down to an analysis of the data! Note: You can click on any of the charts to enlarge them.

Question 1. Based on their behavior, are your clients currently more afraid of: a) getting caught in a stock market downdraft, or b) missing a stock market upturn?

Chart 1: Greatest Fear. From survey to survey (it’s been just over 1 month), the S&P 500 rose nearly +5%, and our indicators responded as expected. The fear of downdraft group fell from 83% to 75%, while the upturn group rose from 17% to 25%. The market is off to a strong start this year, and client sentiment is showing strong signs of improvement after a lackluster end of 2012.

Chart 2: Greatest Fear Spread. Another way to look at this data is to examine the spread between the two groups. The spread dropped by a large margin, down from 65% to 49%.

Question 2. Based on their behavior, how would you rate your clients’ current appetite for risk?

Chart 3: Average Risk Appetite. Average risk moved strongly upwards, from 2.54 to 2.83.

Chart 4: Risk Appetite Bell Curve. This chart uses a bell curve to break out the percentage of respondents at each risk appetite level. This round, over 85% of all respondents wanted a risk appetite of 3 or less.

Chart 5: Risk appetite Bell Curve by Group. The next three charts use cross-sectional data. The chat plots the reported client risk appetite separately for the fear of downdraft and for the fear of missing upturn groups. We can see the upturn group wants more risk, while the fear of downturn group is looking for less risk.

Chart 6: Average Risk Appetite by Group. This round, the upturn group’s risk appetite average fell, while the downturn group’s rose.

Chart 7: Risk Appetite Spread. This is a chart constructed from the data in Chart 6, where the average risk appetite of the downdraft group is subtracted from the average risk appetite of the missing upturn group. The spread fell this round.

The S&P shot out of the gate for 2013, and client sentiment responded favorably. The fear of losing money in the market percentage declined to 75%. Average risk appetite climbed steadily with the market. If the stock market can manage to put together a rally over the first six months of the year, we definitely have a chance at seeing some of the best client sentiment in the history of this survey.

No one can predict the future, as we all know, so instead of prognosticating, we will sit back and enjoy the ride. A rigorously tested, systematic investment process provides a great deal of comfort for clients during these types of fearful, highly uncertain market environments. Until next time, good trading and thank you for participating.

2 Comments |

2 Comments |  Investor Behavior, Markets, Sentiment |

Investor Behavior, Markets, Sentiment |  Permalink

Permalink

Posted by:

JP Lee

January 22, 2013

It’s well known in behavioral finance that investors experience a loss 2-3x more intensely than a gain of the same magnitude. This loss aversion leads investors to avoid even rational bets, according to a Reuters story on a recent study by a Cal Tech scientist.

Laboratory and field evidence suggests that people often avoid risks with losses even when they might earn a substantially larger gain, a behavioral preference termed ‘loss aversion’,” they wrote.

For instance, people will avoid gambles in which they are equally likely to either lose $10 or win $15, even though the expected value of the gamble is positive ($2.50).

The study indicates that people show fear at even the prospect of a loss. Markets are designed to generate fear, not to mention all of the bearish commentators on CNBC. Fear leads to poor decisions, like selling near the bottom of a correction. Unless you are planning to electrically lesion your amygdala, the fear is going to be there–so what’s the best way to deal with it?

The course we have chosen is to make our investment models systematic. That means the decisions are rules-based, not subject to whatever fear the portfolio managers may be experiencing at any given time. Once in a blue moon, excessive caution pays off, but studies suggest that more errors are made being excessively cautious than overly aggressive. A rules-based method treats risk in a even-handed, mathematical way. In other words, take risks that historically are likely to pay off, and keep taking them regardless of your emotional state. Given enough time, the math is likely to swing things in your favor.

—-this article originally appeared 2/10/2010. In the two years since this was written, investors have continued to pay a high price for their fear as the market has continued to advance. There are always scary things around the corner, but a rules-based process can often help you navigate through them. Investors seem to have a hard time learning that scary things don’t necessarily cause markets to perform poorly. In fact, the opposite is often true.

1 Comment |

1 Comment |  From the Archives, Investor Behavior, Markets | Tagged: investor behavior, stock market, systematic investment process |

From the Archives, Investor Behavior, Markets | Tagged: investor behavior, stock market, systematic investment process |  Permalink

Permalink

Posted by:

Mike Moody

January 18, 2013

Here we have the next round of the Dorsey, Wright Sentiment Survey, the first third-party sentiment poll. Participate to learn more about our Dorsey, Wright Polo Shirt raffle! Just follow the instructions after taking the poll, and we’ll enter you in the contest. Thanks to all our participants from last round.

As you know, when individuals self-report, they are always taller and more beautiful than when outside observers report their perceptions! Instead of asking individual investors to self-report whether they are bullish or bearish, we’d like financial advisors to weigh in and report on the actual behavior of clients. It’s two simple questions and will take no more than 20 seconds of your time. We’ll construct indicators from the data and report the results regularly on our blog–but we need your help to get a large statistical sample!

Click here to take Dorsey, Wright’s Client Sentiment Survey.

Contribute to the greater good! It’s painless, we promise.

1 Comment |

1 Comment |  Investor Behavior, Markets, Sentiment |

Investor Behavior, Markets, Sentiment |  Permalink

Permalink

Posted by:

JP Lee

January 18, 2013

With the elimination of traditional pensions in many workplaces, Americans are left to their own devices with their 401k plan. For many of them, it’s not going so well. Beyond the often-poor investment decisions that are made, many investors are also raiding the retirement kitty. Business Insider explains:

Dipping into your 401(k) plan is tantamount to journeying into the future, mugging your 65-year-old self, and then booking it back to present day life.

And still, it turns out one in four workers resorts to taking out 401(k) loans each year, according to a new report by HelloWallet –– to the tune of $70 billion, nationally.

To put that in perspective, consider how much workers contribute to retirement plans on average: $175 billion per year. That means people put money in only to take out nearly half that contribution later.

That’s not good. Saving for retirement is hard enough without stealing your own retirement money. Congress made you an investor whether you like it or not—now you need to figure out how to make the best of it.

Here are a couple of simple guidelines:

- save 15% of your income for your entire working career.

- if you can max out your 401k, do it.

- diversify your portfolio intelligently, by volatility, asset class, and strategy.

- resist all of the temptations to mess with your perfectly reasonable plan.

- if you can’t discipline yourself, for heaven’s sake get help.

I know—easier said than done. But still, if you can manage it, you’ll have a big headstart on a good retirement. Your 401k is too important to abuse.

2 Comments |

2 Comments |  Investor Behavior, Retirement/Saving | Tagged: 401k, diversification, investor behavior, retirement |

Investor Behavior, Retirement/Saving | Tagged: 401k, diversification, investor behavior, retirement |  Permalink

Permalink

Posted by:

Mike Moody

January 17, 2013

According to a fascinating study discussed in Time Magazine based on 27 million hands of Texas Hold’em, it turns out that the more hands poker players win, the more money they lose! What’s going on here?

I suspect it has to do with investor preferences–gamblers often think the same way. Most people like to have a high percentage of winning trades; they are less happy with a lower percentage of winning trades, even if the occasional winner is a big one. In other words, investors will often prefer a system with 65% winning trades over a system with 45% winning trades, even if the latter method results in much greater overall profits.

People overweigh their frequent small gains vis-à-vis occasional large losses,” Siler says.

In fact, you are generally best off if you cut your losses and let your winners run. This is the way that systematic trend following tends to work. Often this results in a few large trades (the 20% in the 80/20 rule) making up a large part of your profits. Poker players and amateur investors obviously tend to work the other way, preferring lots of small profits–which all tend to be wiped away by a few large losses. Taking lots of small profits is the psychological path of least resistance, but the easy way is the wrong way in this case.

—-this article was originally published 2/10/2010. Investors still have irrational preferences about making money. They usually want profits—but apparently only if they are in a certain distribution! Real life doesn’t work that way. Making money is a fairly messy process. Only a few names turn out to be big winners, so you’ve got to give them a chance to run.

91 Comments |

91 Comments |  From the Archives, Investor Behavior, Markets, Thought Process | Tagged: investor behavior, market, relative strength |

From the Archives, Investor Behavior, Markets, Thought Process | Tagged: investor behavior, market, relative strength |  Permalink

Permalink

Posted by:

Mike Moody

January 3, 2013

Barry Ritholtz at The Big Picture has some musings about portfolios for the New Year. I think he’s right about keeping it simple—but I also think his thought is incomplete. He writes:

May I suggest taking control of your portfolio as a worthwhile goal this year?

I have been thinking about this for awhile now. Last year (heh), I read a quote I really liked from Tadas Viskanta of Abnormal Returns. He was discussing the disadvantages of complexity when creating an investment plan:

“A simple, albeit less than optimal, investment strategy that is easily followed trumps one that will abandoned at the first sign of under-performance.”

I am always mindful that brilliant, complex strategies more often than not fail. Why? A simple inability of the Humans running them to stay with them whenever there are rising fear levels (typically manifested as higher volatility and occasional drawdowns).

Let me state this more simply: Any strategy that fails to recognize the psychological foibles and quirks of its users has a much higher probability of failure than one that anticipates and adjusts for that psychology.

Let me just say that there is a lot of merit to keeping things simple. It’s absolutely true that complex things break more easily than simple things, whether you’re talking about kid’s Christmas toys or investor portfolios. I believe in simplicity over complexity.

However, complexity is only the tip of the iceberg that is human nature. Mr. Ritholtz hints at it when he mentions human inability to stay with a strategy when fear comes into the picture. That is really the core issue, not complexity. Adjust for foibles all you want; many investors will still find a way to express their quirks. You can have an obscenely simple strategy, but most investors will still be unable to stay with it when they are fearful.

Trust me, human nature can foil any strategy.

Perhaps a simple strategy will be more resilient than a complex one, but I think it’s most important to work on our resilience as investors.

Tuning out news and pundits is a good start. Delving deeply into the philosophy and inner workings of your chosen strategy is critical too. Understand when it will do well and when it will do poorly. The better you understand your return factor, whether it is relative strength, value, or something else, the less likely you are to abandon it at the wrong time. Consider tying yourself to the mast like Ulysses—make it difficult or inconvenient to make portfolio strategy changes. Maybe use an outside manager in Borneo that you can only contact once per year by mail. I tell clients just to read the sports pages and skip the financial section. (What could be more compelling soap opera than the Jet’s season?) Whether you choose distraction, inconvenience, or steely resolve as your method, the goal is to prevent volatility and the attendant fear it causes from getting you to change course.

The best gift an investor has is self-discipline. As one of our senior portfolio managers likes to point out, “To the disciplined go the spoils.”

2 Comments |

2 Comments |  Investor Behavior, Markets, Thought Process | Tagged: behavioral finance, decision-making, discipline, investor behavior, relative strength, return factor, simple, strategy, volatility |

Investor Behavior, Markets, Thought Process | Tagged: behavioral finance, decision-making, discipline, investor behavior, relative strength, return factor, simple, strategy, volatility |  Permalink

Permalink

Posted by:

Mike Moody

December 17, 2012

Our latest sentiment survey was open from 12/7/12 to 12/14/12. The Dorsey, Wright Polo Shirt Raffle continues to drive advisor participation, and we greatly appreciate your support! This round, we had 58 advisors participate in the survey. If you believe, as we do, that markets are driven by supply and demand, client behavior is important. We’re not asking what you think of the market—since most of our blog readers are financial advisors, we’re asking instead about the behavior of your clients. Then we’re aggregating responses exclusively for our readership. Your privacy will not be compromised in any way.

After the first 30 or so responses, the established pattern was simply magnified, so we are fairly comfortable about the statistical validity of our sample. Some statistical uncertainty this round comes from the fact that we only had four investors say that thier clients are more afraid of missing a stock upturn than being caught in a downdraft. Most of the responses were from the U.S., but we also had multiple advisors respond from at least two other countries. Let’s get down to an analysis of the data! Note: You can click on any of the charts to enlarge them.

Question 1. Based on their behavior, are your clients currently more afraid of: a) getting caught in a stock market downdraft, or b) missing a stock market upturn?

Chart 1: Greatest Fear. From survey to survey, the S&P 500 rose by around +0.5%, and our indicators responded as expected. The fear of downdraft group fell from 89% to 83%, while the upturn group rose from 11% to 17%. Despite the modest move towards more risk, client sentiment remains poor.

Chart 2: Greatest Fear Spread. Another way to look at this data is to examine the spread between the two groups. The spread dropped again, from 78% to 65%.

Question 2. Based on their behavior, how would you rate your clients’ current appetite for risk?

Chart 3: Average Risk Appetite. Average risk moved higher this round with the market, from 2.43% to 2.54%.

Chart 4: Risk Appetite Bell Curve. This chart uses a bell curve to break out the percentage of respondents at each risk appetite level. This round, over 90% of all respondents wanted a risk appetite of 3 or less for the third survey round in a row.

Chart 5: Risk appetite Bell Curve by Group. The next three charts use cross-sectional data. The chat plots the reported client risk appetite separately for the fear of downdraft and for the fear of missing upturn groups. We can see the upturn group wants more risk, while the fear of downturn group is looking for less risk.

Chart 6: Average Risk Appetite by Group. This round, the downturn group’s average remained exactly the same, while the upturn group’s average jumped by a large degree.

Chart 7: Risk Appetite Spread. This is a chart constructed from the data in Chart 6, where the average risk appetite of the downdraft group is subtracted from the average risk appetite of the missing upturn group. The spread jumped this round.

The S&P 500 inched higher from survey to survey, and our indicators responded in-kind to the same degree. The greatest fear numbers moved slightly towards the positive, and overall risk appetite nudged higher. Client sentiment remains poor overall.

No one can predict the future, as we all know, so instead of prognosticating, we will sit back and enjoy the ride. A rigorously tested, systematic investment process provides a great deal of comfort for clients during these types of fearful, highly uncertain market environments. Until next time, good trading and thank you for participating.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets, Sentiment |

Investor Behavior, Markets, Sentiment |  Permalink

Permalink

Posted by:

JP Lee

December 12, 2012

If you’ve ever wondered why clients remember their winners so well—and are so quick to sell them-while forgetting the losers and how badly they have done, some academics have done you a favor. You can read this article for the full explanation. Or you can look at this handy graphic from CXO Advisory that explains how clients use different reference points for winners and losers. In short, the winners are compared with their highest-ever price, while losers are compared with their break-even purchase price.

Source: CXO Advisory

It explains a lot, doesn’t it? It explains why clients make bizarre self-estimates of their investment performance. And it explains why clients are perpetually disappointed with their advisors—because they are comparing their winners with the highest price achieved. Any downtick makes it a loser in their eyes. The losers are ignored, in hopes they will get back to even.

The antidote to this cognitive bias, of course, is to use a systematic investment process that ruthlessly evaluates every position against a common standard. If you are a value investor, presumably you are estimating future expected returns as your holding criterion. For relative strength investors like ourselves, we’re constantly evaluating the relative strength ranking of each security in the investment universe. Strong securities are retained, and securities that weaken are swapped out for stronger ones. Only a systematic process is going to keep you from looking at reference points differently for winners and losers.

1 Comment |

1 Comment |  Investor Behavior, Thought Process | Tagged: investor behavior, relative strength, systematic investment process |

Investor Behavior, Thought Process | Tagged: investor behavior, relative strength, systematic investment process |  Permalink

Permalink

Posted by:

Mike Moody

December 10, 2012

The Globe and Mail on quantitative strategies:

A huge pile of research points to an array of simple numerical stock strategies that boosts returns over the long term. Such methods range from low-ratio value strategies to momentum-oriented schemes.

If the studies are to be believed, it should be easy as pie to make a small fortune on Bay Street. (Even when you don’t start with a large one.) All you have to do is to select a strategy and stick with it, letting the cold, hard numbers determine your buying and selling for you.

Picking a good long-term approach is one thing. But actually following it for a long period is quite another. It turns out that there are more than a few devils in the practical details.

I was recently reminded of a big one when I watched Tobias Carlisle’s informative presentation to the UC Davis MBA Value Investing Class on quantitative techniques. He discussed James Montier’s suggestion that numerical methods might represent a ceiling to potential returns, rather than a floor, for those who tinker with them.

My emphasis added. Anyone who can read can see that the results of momentum strategies are compelling over time. The challenge for those inclined to tinker is resisting the urge to mess with a good model. There are very good reasons for the systematic in Systematic Relative Strength.

HT: Abnormal Returns

1 Comment |

1 Comment |  Investor Behavior, Portfolio Theory |

Investor Behavior, Portfolio Theory |  Permalink

Permalink

Posted by:

Andy Hyer

December 9, 2012

Volatility can cause investors to make terrible decisions. Blackrock recently featured an ugly chart comparing the returns of every major asset class since 1992 to the returns of the average investor. Amazingly enough, over that 20-year period investors underperformed every single major asset class including inflation!

Source: Blackrock (click to enlarge)

Here is Blackrock’s take on the chart:

Volatility is often the catalyst for poor decisions at inopportune times. Amidst difficult financial times, emotional instincts often drive investors to take actions that make no rational sense but make perfect emotional sense. Psychological factors such as fear often translate into poor timing of buys and sells. Though portfolio managers expend enormous efforts making investment decisions, investors often give up these extra percentage points in poorly timed decisions.

As Blackrock points out, good investing decisions are often ruined by one poorly timed emotional decision, typically brought about by a response to volatility. Volatility often engenders fear, and fear can overwhelm the client’s rational thought process.

One of the chief benefits of a good financial advisor is preventing clients from undermining themselves when the markets are rocky. From an objective point of view, if you are fearful, it’s going to be difficult to calm the client down. I don’t have any magic ideas about how to keep calm, but you could do worse than the British WWII propaganda poster: Keep calm and carry on.

Source: SkinIt (click to enlarge)

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets | Tagged: behavioral finance, investor behavior, volatility |

Investor Behavior, Markets | Tagged: behavioral finance, investor behavior, volatility |  Permalink

Permalink

Posted by:

Mike Moody

December 9, 2012

If you need another reason to hate the French, besides envy of their excellent cuisine, it turns out that a bevy of winemakers were fined and given suspended sentences for foisting cheap, lousy wine on American consumers and charging them premium prices for it.

On the other hand, it shows that cognitive biases are everywhere. Neither the American company the wine was shipped to nor consumers drinking it ever complained! Because the wine was labeled as premium pinot noir, wine enthusiasts apparently thought it tasted great. In fact, it turns out that wine drinkers think expensive wine tastes better, even when you trick them and give them two glasses of wine from the same bottle.

This behavior is not unknown in the stock market, where cognitive biases run unbridled down Wall Street. Ten years ago, everyone was in love with General Electic. It, too, was high-priced and tasted great. Ten years later, GE is considered cheap swill that leaves a bitter taste in the mouths of investors.

The moral of the story is that you can’t fall in love with your stocks or your wine. You have to like it on its own merits. In the case of our Systematic RS accounts, we like a stock only as long as it has high relative strength. When it becomes weaker and drops in its ranking–indicating that other, stronger stocks are available–we sell it and move on to a better class of grape. (We’ve been known to break a bottle here and there, but the idea is to adapt as tastes change.) In this way, we strive to keep our wine cellar stocked with the best vintages all the time.

—-this article originally appeared 2/19/2012. Cognitive biases are still running wild on Wall Street.

Leave a Comment » |

Leave a Comment » |  From the Archives, Investor Behavior, Just for Fun, Markets, Thought Process | Tagged: investor behavior, relative strength |

From the Archives, Investor Behavior, Just for Fun, Markets, Thought Process | Tagged: investor behavior, relative strength |  Permalink

Permalink

Posted by:

Mike Moody

December 7, 2012

Here we have the next round of the Dorsey, Wright Sentiment Survey, the first third-party sentiment poll. Participate to learn more about our Dorsey, Wright Polo Shirt raffle! Just follow the instructions after taking the poll, and we’ll enter you in the contest. Thanks to all our participants from last round.

As you know, when individuals self-report, they are always taller and more beautiful than when outside observers report their perceptions! Instead of asking individual investors to self-report whether they are bullish or bearish, we’d like financial advisors to weigh in and report on the actual behavior of clients. It’s two simple questions and will take no more than 20 seconds of your time. We’ll construct indicators from the data and report the results regularly on our blog–but we need your help to get a large statistical sample!

Click here to take Dorsey, Wright’s Client Sentiment Survey.

Contribute to the greater good! It’s painless, we promise.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets, Sentiment |

Investor Behavior, Markets, Sentiment |  Permalink

Permalink

Posted by:

JP Lee

December 4, 2012

Our latest sentiment survey was open from 11/23/12 to 11/30/12. The Dorsey, Wright Polo Shirt Raffle continues to drive advisor participation, and we greatly appreciate your support! This round, we had 73 advisors participate in the survey. If you believe, as we do, that markets are driven by supply and demand, client behavior is important. We’re not asking what you think of the market—since most of our blog readers are financial advisors, we’re asking instead about the behavior of your clients. Then we’re aggregating responses exclusively for our readership. Your privacy will not be compromised in any way.

After the first 30 or so responses, the established pattern was simply magnified, so we are fairly comfortable about the statistical validity of our sample. Some statistical uncertainty this round comes from the fact that we only had four investors say that thier clients are more afraid of missing a stock upturn than being caught in a downdraft. Most of the responses were from the U.S., but we also had multiple advisors respond from at least two other countries. Let’s get down to an analysis of the data! Note: You can click on any of the charts to enlarge them.

Question 1. Based on their behavior, are your clients currently more afraid of: a) getting caught in a stock market downdraft, or b) missing a stock market upturn?

Chart 1: Greatest Fear. From survey to survey, the S&P 500 rose by just over 2%, and our indicators responded as expected. The fear of downdraft group ticked slightly lower, from 90% to 89%, while the upturn group managed to rise from 10% to 11%.

Chart 2: Greatest Fear Spread. Another way to look at this data is to examine the spread between the two groups. The spread dipped from 80% to 78%.

Question 2. Based on their behavior, how would you rate your clients’ current appetite for risk?

Chart 3: Average Risk Appetite. Average risk appetite bounced ever so slightly with the rising market, from 2.42 to 2.43.

Chart 4: Risk Appetite Bell Curve. This chart uses a bell curve to break out the percentage of respondents at each risk appetite level. This round, over 90% of all respondents wanted a risk appetite of 3 or less for the second survey round in a row.

Chart 5: Risk appetite Bell Curve by Group. The next three charts use cross-sectional data. The chat plots the reported client risk appetite separately for the fear of downdraft and for the fear of missing upturn groups. We can see the upturn group wants more risk, while the fear of downturn group is looking for less risk.

Chart 6: Average Risk Appetite by Group. This round, both groups’ average managed to move slightly lower, while the overage average ticked barely higher.

Chart 7: Risk Appetite Spread. This is a chart constructed from the data in Chart 6, where the average risk appetite of the downdraft group is subtracted from the average risk appetite of the missing upturn group. The spread remained unchanged.

The S&P 500 rose around 2% from survey to survey, and our indicators nudged themselves into the right direction. The fear of downdraft group fell by a measly 1%. Overall risk appetite increased by a whopping .01 point, indicating a very tepid response to a short-term move higher in the market. Things still look bad sentiment-wise.

No one can predict the future, as we all know, so instead of prognosticating, we will sit back and enjoy the ride. A rigorously tested, systematic investment process provides a great deal of comfort for clients during these types of fearful, highly uncertain market environments. Until next time, good trading and thank you for participating.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets, Sentiment |

Investor Behavior, Markets, Sentiment |  Permalink

Permalink

Posted by:

JP Lee

November 27, 2012

I admit to a prurient interest in behavioral finance. Perhaps this is due to my background in psychology—or just from having dealt with a broad range of clients for many years. Investor behavior is sometimes amazing, and behavioral finance, the academic specialty that has grown up to examine it, is equally interesting. One of the most practical discussions of behavioral finance I have seen appeared recently on AdvisorOne. It was written by Michael Finke, the coordinator for the financial planning program at Texas Tech.

It is my strong recommendation that you read the entire article, but here are a few of the behavioral finance highlights that jumped out at me:

- Breaking habits requires deliberate intention to change routines by using our rider to change the direction of the elephant. How do we motivate people to change behavior to meet long-term goals? Neuroscience suggests that the worst way to motivate people is to focus on numbers. Telling someone they need to save a certain amount to achieve an adequate retirement accumulation goal may be convincing to the rational brain, but not so convincing to the elephant.

- Explaining a concept in a visual or emotional sense uses much more of our brain functions than is used by numbers. If you think of people as being emotional and visual, you’ve essentially tapped into 70% of the brain real estate. There is that rational side, but that rational side might be more like 20% of the real estate. The rational side used to solve math problems might be 8% of the real estate.

- It can be useful to frame desired actions as the status quo in order to take advantage of this preference. For example, setting defaults that are beneficial can have an unexpectedly large impact on improving behavior.

- The most powerful emotional response related to financial choice is fear. Fear leads to a number of observed decision anomalies identified in behavioral finance such as the excessive attention paid to a loss. Framing decisions so that they do not necessarily involve a loss is an important tool advisors can use to avoid bringing the amygdala to the table.

- “Dollar cost averaging is an illusion,” notes James. “Unless we have mean reversion in the market (and if we do we can make lots of market timing bets and make ourselves rich), dollar cost averaging does not work. But if people believe that they are buying shares cheaper in a recession, the story makes people stay in the market at the times when their fear-driven emotional side wants them to get out of the market. We have a story that, even if it’s completely false, is generating the behavior that is going to be portfolio maximizing in the end. So maybe the answer to the usefulness of dollar cost averaging isn’t ‘well we’ve figured it out and it doesn’t work, so don’t use it,’ the answer is ‘actually it’s not true but it gets your clients to behave the right way so keep telling them that.’”

The biggest impediment to good returns is typically investor psychology. If behavioral finance ideas can help clients control their behavior better—and thus lead to better investment outcomes—some of these ideas may prove useful.

Source: Lean Frog (click on image to enlarge)

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Thought Process | Tagged: behavioral finance, investor behavior |

Investor Behavior, Thought Process | Tagged: behavioral finance, investor behavior |  Permalink

Permalink

Posted by:

Mike Moody

November 26, 2012

Here we have the next round of the Dorsey, Wright Sentiment Survey, the first third-party sentiment poll. Participate to learn more about our Dorsey, Wright Polo Shirt raffle! Just follow the instructions after taking the poll, and we’ll enter you in the contest. Thanks to all our participants from last round.

As you know, when individuals self-report, they are always taller and more beautiful than when outside observers report their perceptions! Instead of asking individual investors to self-report whether they are bullish or bearish, we’d like financial advisors to weigh in and report on the actual behavior of clients. It’s two simple questions and will take no more than 20 seconds of your time. We’ll construct indicators from the data and report the results regularly on our blog–but we need your help to get a large statistical sample!

Click here to take Dorsey, Wright’s Client Sentiment Survey.

Contribute to the greater good! It’s painless, we promise.

2 Comments |

2 Comments |  Investor Behavior, Markets, Sentiment |

Investor Behavior, Markets, Sentiment |  Permalink

Permalink

Posted by:

JP Lee

November 21, 2012

Paul Merriman, in a column for Marketwatch, has a nice discussion about the power of compound interest. He shows that the effect of compound interest is exponential, not linear, and points out what a huge difference time and a somewhat higher compounding rate can make.

One big mistake clients often make is that they don’t allow enough time for their investments to compound. DALBAR documents that the holding periods for both stock and bond funds average around three years. Although compound interest is astonishing, that is not nearly enough time to let an exponential function kick in. With exponential growth, by definition, much of the growth is going to be backloaded. Investment growth will be much more noticeable after twenty good years than after three.

Advisors that can get their clients to be patient and leave their investment funds alone, whether achieved through a strong and trusting relationship or through a calming asset allocation, will allow the clients a chance to reap rewards over time. If the client is changing course every three years, there’s almost no chance for that to happen. In the investment industry, we like to think of ourselves as investment gurus-but it might be better to re-imagine ourselves as compound interest gurus.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Thought Process |

Investor Behavior, Thought Process |  Permalink

Permalink

Posted by:

Mike Moody