June 19, 2012

The first two months of the year were pretty rough for global tactical asset allocation strategies as the best performance in those months came from asset classes with weak relative strength. However, things have since turned around as reflected by the percentile ranks of The Arrow DWA Tactical Fund (DWTFX), which we manage. This “go anywhere” fund can invest in domestic equities, international equities, currencies, commodities, real estate, and fixed income.

Source: Morningstar

Over the past three months, DWTFX has outperformed 81% of its peers as we have been able to capitalize on some more stable trends. Current holdings are shown below:

Before investing, please read the Fund’s prospectus and shareholder reports to learn about its investment strategy and potential risks. Mutual Fund investing involves risk including loss of principal. An investor should consider the Fund’s investment objective, charges, expenses, and risks carefully before investing. This and other information about the Fund is contained in the Fund’s prospectus, which can be obtained by calling 1-877-277-6933. Please read the prospectus carefully before investing. Distributed by Northern Lights Distributors, LLC, member FINRA/SIPC. See www.arrowfunds.com for more information.

Leave a Comment » |

Leave a Comment » |  Markets, Tactical Asset Alloc |

Markets, Tactical Asset Alloc |  Permalink

Permalink

Posted by:

Andy Hyer

May 29, 2012

From Barron’s, an interesting insight into the alternative space:

Investor interest in hedge-fund strategies has never been higher—but it’s the mutual-fund industry that seems to be benefiting.

Financial advisors and institutions are increasingly turning to alternative strategies to manage portfolio risk, though the flood of money into that area tapered off a bit last year, according to an about-to-be-released survey of financial advisors and institutional managers conducted by Morningstar and Barron’s. Many of them are finding the best vehicle for those strategies to be mutual funds.

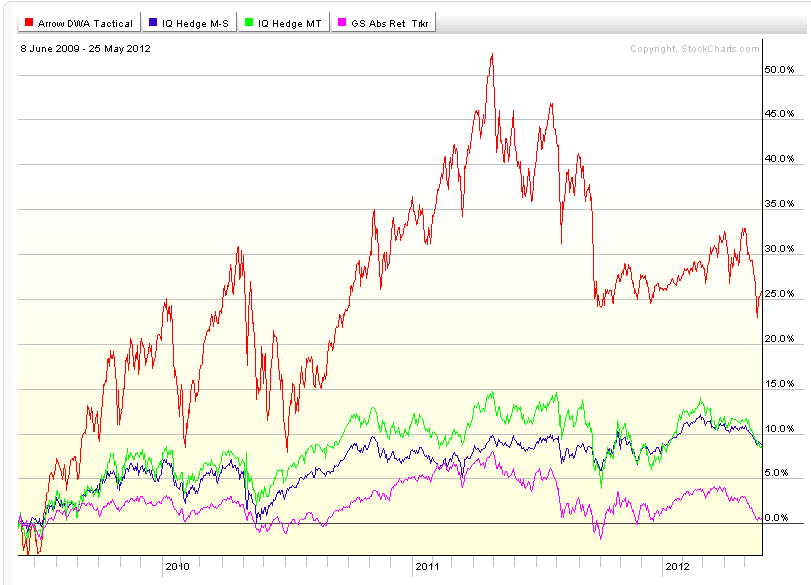

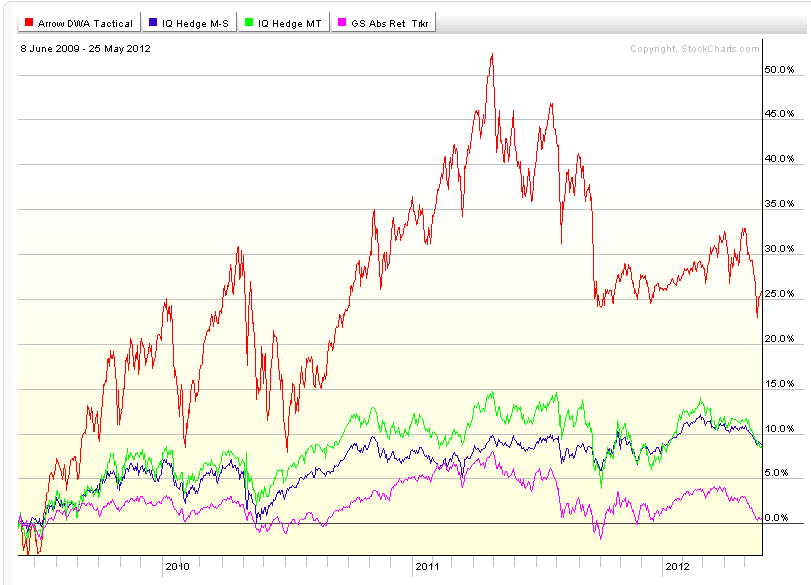

Very intriguing, no? There are quite a few ways now, through ETFs or mutual funds, to get exposure to alternatives. We’ve discussed the Arrow DWA Tactical Fund (DWTFX) as a hedge fund alternative in the past as well. Tactical asset allocation is one way to go, but there are also multi-strategy hedge fund trackers, macro fund trackers, and absolute-return fund trackers, to say nothing of managed futures.

Each of these options has a different set of trade-offs in terms of potential return and volatility. For example, the chart below shows the Arrow DWA Tactical Fund, the IQ Hedge Macro Tracker, the IQ Hedge Multi-Strategy Tracker, and the Goldman Sachs Absolute Return Fund for the maximum period of time that all of the funds have overlapped.

(click on image to enlarge)

You can see that each of these funds moves differently. For example, the Arrow DWA Tactical Fund, which is definitely directional, has a very different profile than the Goldman Sachs Absolute Return Fund, which presumably is not (as) directional.

Very few of these options were even available to retail investors ten years ago. Now they are numerous, giving individuals the opportunity to diversify like never before. With proper due diligence, it’s quite possible you will find an alternative strategy that can improve your overall portfolio.

Leave a Comment » |

Leave a Comment » |  Markets, Tactical Asset Alloc | Tagged: alternative, financial, hedge fund, investment, investor, risk, strategies, tactical |

Markets, Tactical Asset Alloc | Tagged: alternative, financial, hedge fund, investment, investor, risk, strategies, tactical |  Permalink

Permalink

Posted by:

Mike Moody

May 29, 2012

It all depends on who you ask. Apologists for MPT will say that diversification worked, but that it just didn’t work very well last go round. That’s a judgment call, I suppose. Correlations between assets are notoriously unstable and nearly went to 1.0 during the last decline, but not quite. So I guess you could say that diversification “worked,” although it certainly didn’t deliver the kind of results that investors were expecting.

Now even Ibbotson Associates is saying that certain aspects of modern portfolio theory are flawed, in particular using standard deviation as a measurement of risk. In a recent Morningstar interview, Peng Chen, the president of Ibbotsen Associates, addresses the problem.

It’s one thing to say modern portfolio theory, the principle, remained to work. It’s another thing to examine the measures. So when we started looking at the measures, we realized, and this has been documented by many academics and practitioners, we also realized that one of the traditional measures in modern portfolio theory, in particular on the risk side, standard deviation, does not work very well to measure and present the tail risks in the return distribution.

Meaning that, when you have really, really bad market outcomes, modern portfolio theory purely using standard deviation underestimates the probability and severity of those tail risks, especially in short frequency time periods, such as monthly or quarterly.

Leaving aside the issue of how the theory could work if the components do not, this is a pretty surprising admission. Ibbotson is finally getting around to dealing with the “fat tails” problem. It’s a known problem but it makes the math much less tractable. Essentially, however, Mr. Chen is arguing that market risk is actually much higher than modern portfolio theory would have you believe.

In my view, the debate about modern portfolio theory is pretty much done. Stick a fork in it. Rather than grasping about for a new theory, why not look at tactical asset allocation, which has been in plain view the entire time?

Tactical asset allocation, when executed systematically, can generate good returns and acceptable volatility without regard to any of the tenets of modern portfolio theory. It does not require standard deviation as the measure of risk, and it makes no assumptions regarding the correlations between assets. Instead it makes realistic assumptions: some assets will perform better than others, and you ought to consider owning the good assets and ditching the bad ones. It’s the ultimate pragmatic solution.

—-this article originally appeared 1/21/2010. As we gain distance from the 2008 meltdown, investors are beginning to forget how badly their optimized portfolios performed and are beginning to climb back on the MPT bandwagon. Combining uncorrelated strategies always makes for a better portfolio, but the problem of understated risk remains. The tails are still fat. Let’s hope that we don’t get another chance to experience fat tails with the Eurozone crisis. Tactical asset allocation, I think, may still be the most viable solution to the problem.

Leave a Comment » |

Leave a Comment » |  From the Archives, Tactical Asset Alloc, Thought Process | Tagged: investment, market, portfolio, portfolio theory, risk |

From the Archives, Tactical Asset Alloc, Thought Process | Tagged: investment, market, portfolio, portfolio theory, risk |  Permalink

Permalink

Posted by:

Mike Moody

May 25, 2012

Howard Marks is chairman of Oaktree Capital, a large and well-known institutional alternative fixed income manager. Mr. Marks’s memos are always thoughtful and worth reading. This go round he has a discussion of all of the things that could go wrong with the world economy—essentially a list of all of the things that could go wrong. One of the things that could go wrong is inflation.

He believes rates are more likely to go higher than lower, and that inflation, long forgotten as a risk factor, might return. In addition, he has a list of suggestions on how to deal with inflation including TIPs, floating rate debt, gold, real assets like commodities, oil, and real estate, and foreign currencies. His catalog of alternatives is even longer, but you get the idea. (If you want to read the whole memo, you can find it here.)

That’s quite a list, but the first thing that I noticed about it is that not one of these items is generally considered as an investment option by retail investors. Most investors are mentally stuck in the domestic stocks/domestic bonds arena. Diversification consists of hitting more than one Morningstar style box. If inflation does come back, that’s not going to cut it. In fact, Mr. Marks asks investors, “How much of your portfolio are you willing to devote to protect against these macro forces?” He says if the answer is 5%, or 10%, or 15% that those levels are pretty close to doing nothing. He thinks a portfolio will need to devote at least 30-40% of assets toward inflation protection if it recurs.

Investment flexibility and risk diversification were the primary reasons that we launched the Systematic RS Global Macro account as a retail product last year. Many of the inflation hedges in Mr. Marks’ list are asset classes that are available in the Global Macro portfolio, including TIPs, gold, commodities, oil, real estate, and foreign currencies. Given our basket rotation strategy and our adherence to relative strength, the Global Macro portfolio could easily have 40% of its assets, or more, in inflation hedges if inflation were to recur. I think the jury is still out about how the world economy will respond to decreased levels of fiscal stimulus, but it’s good to know that you have options.

—-this article originally appeared 1/25/2010. We have not seen runaway inflation so far, but the point Howard Marks makes is valid. If/when inflation does occur, you might need to devote a lot of your portfolio to inflation protection. Is your investment process up for the challenge?

Leave a Comment » |

Leave a Comment » |  From the Archives, Markets, Tactical Asset Alloc | Tagged: diversification, inflation, investment, portfolio, risk |

From the Archives, Markets, Tactical Asset Alloc | Tagged: diversification, inflation, investment, portfolio, risk |  Permalink

Permalink

Posted by:

Mike Moody

May 17, 2012

By now, it’s pretty apparent that the Euro is eventually going to be toast, just like the ERM imploded before it. (Perhaps it was never logical to assume that one currency and one central bank would be able to satisfy many different cultures and political regimes?) Of course there is a lot of hand-wringing going on about all of the bad things that will happen, but no one is talking about the offsetting good things that will happen.

We’ve written before about beanbag economics, the essence of which is that when you smush in one part of a beanbag, it just poofs out somewhere else. Relative strength is a simple and effective way to see where trends are underway.

Consider a typical bad news lead in this Reuters article:

Worries about a run on Greek banks has rattled Athens this week, after savers withdrew at least 700 million euros on Monday alone…

That sounds quite scary. However, buried deep in the article, at the very end, is the beanbag economics section:

Deposits shifted around Europe dramatically last year, analysis of data from more than 120 listed European banks show.

More than 120 billion euros was taken from two banks in Belgium alone, including an exodus of customer deposits from Dexia (DEXI.BR) which had to be bailed out and restructured. KBC (KBC.BR) also saw a big outflow.

Some 90 billion euros was taken from France’s banks, including around 30 billion each from Credit Agricole (CAGR.PA) and BNP Paribas (BNPP.PA). French banks were hit last year by their heavy exposure to Greece and concerns about their liquidity that forced them to accelerate plans to shrink.

Worries the euro zone crisis would spread also saw about 30 billion euros in deposits leave Italian banks, although inflows to BBVA (BBVA.MC) helped limit the net outflow from Spain.

Cash flooded into Britain; more than 140 billion euros was deposited in four big banks alone. The UK benefits from its position outside the euro zone and its Asia-focused banks HSBC (HSBA.L) and Standard Chartered (STAN.L) are seen as particular safe-havens.

Other banks to see big inflows included Barclays (BARC.L), Germany’s Deutsche Bank (DBKGn.DE), Switzerland’s Credit Suisse (CSGN.VX) and UBS (UBSN.VX) and Russia’s Sberbank (SBER.MM) and VTB (VTBR.MM).

Banks that were in trouble had deposits leave, but they didn’t vanish into thin air. Other banks saw massive inflows at their expense. And—think about it—the Greek and French banks had the money in the first place because depositors saw them as relatively more attractive than European stocks or their mattresses, or whatever, at the time. Times have now changed and the flow of money is being directed somewhere else. It’s not the end of the world when some asset class implodes, unless, of course, you have 100% of your assets in it. That implosion works to the benefit of another asset class somewhere else.

There are always relative winners and losers; things are rarely completely one-sided. This is the primary attraction of using relative strength for tactical asset allocation. It is able to identify shifts in supply and demand by measuring what assets are strong and what assets are weak. Markets all over the world operate and interact in this same way.

Beanbag Economist: Someone has to get those asset flows!

Source: www.indyagenda.com

Leave a Comment » |

Leave a Comment » |  Markets, Tactical Asset Alloc, Thought Process | Tagged: beanbag, debt, economics, greek |

Markets, Tactical Asset Alloc, Thought Process | Tagged: beanbag, debt, economics, greek |  Permalink

Permalink

Posted by:

Mike Moody

May 15, 2012

ETFdb describes the growing ETF universe as follows:

At times, it seems as if the number of ETFs available to U.S. investors will soon exceed the number of stars in the sky. That might be overstating things a bit, but the pace of expansion in the ETF industry has truly been impressive over the last several years. With multiple products seemingly debuting every week and very few shutting down (despite countless predictions to the contrary), the size of the ETF lineup has effectively doubled in a relatively short period of time. And there’s no indication that the product development front is going to be slowing down any time soon; issuers continue to file for both innovative and duplicative products, producing a pipeline full of hundreds of funds that could debut at some point in the next several months.

The proliferation of ETFs, ETNs, and other exchange-traded cousins of these vehicles is, in many ways, a very positive development for investors. There are now ETPs for just about every investment objective, ranging from the very broad and very straightforward to the hyper-targeted and rather complex. And many of the more recent additions to the ETF lineup have further “democratized” the business of investing, delivering cheap and easy access to sophisticated strategies that would otherwise be time consuming and expensive to implement.

My emphasis added. Up to this point, I wholeheartedly agree-the expansion of the ETF universe has been extremely beneficial to investors. It has also played right into our hands here at Dorsey Wright because it has provided a very tax-efficient means of getting exposure to relative strength (See PDP, PIE, and PIZ). Furthermore, the expansion of the ETF universe has enabled us to provide innovative global tactical asset allocation strategies (See DWAFX and DWTFX) where we can efficiently get exposure to a wide variety of global asset classes.

However, ETFdb then states the following:

But the growth spurt for the industry has also made it increasingly difficult to navigate. Moreover, the tremendous variance in level of sophistication and risk tolerance among ETFs can set the stage for confusion and potentially lead to a less-than-ideal experience with ETFs.

That last part is only true if there is no framework for efficiently and thoroughly evaluating each of the ETFs. Without such a framework then, yes, I can certainly understand why some find it “increasingly difficult to navigate.” However, within the context of a relative strength model, more choices are potentially a good thing. The more options for finding uncorrelated returns, the more likely it is that a global tactical asset allocation strategy can generate favorable returns in a variety of market environments. Furthermore, relative strength models evaluate each member of the universe in a systematic fashion and only allocate if dictated by the relative strength rank-a true meritocracy!

Source: Wikipedia

See www.powershares.com and www.arrowfunds.com.

1 Comment |

1 Comment |  Markets, Tactical Asset Alloc | Tagged: arrowfunds, etf, exchange traded funds, powershares |

Markets, Tactical Asset Alloc | Tagged: arrowfunds, etf, exchange traded funds, powershares |  Permalink

Permalink

Posted by:

Andy Hyer

May 9, 2012

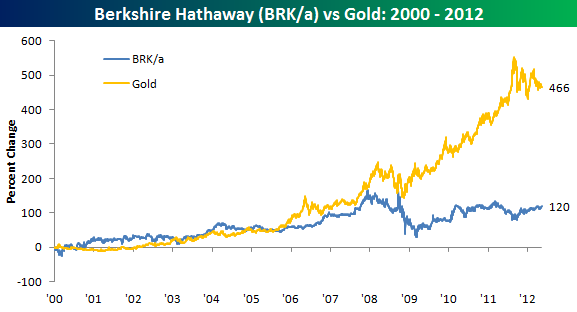

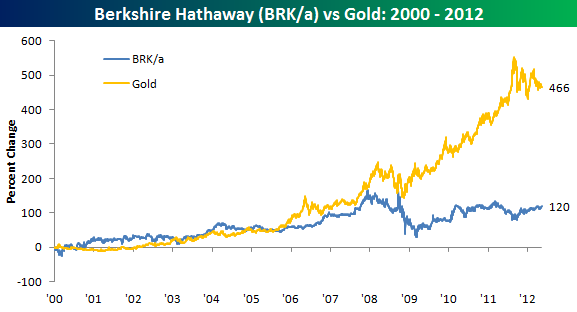

Warren Buffett reiterated at his recent “Woodstock for Capitalists,” otherwise known as Berkshire Hathaway’s annual meeting, that he much preferred productive assets to gold. Charlie Munger agreed. For the record, I’ve got nothing against productive assets. They produce earnings and sometimes dividends and that’s nice. However, a global tactical asset allocator should not be too eager to count out gold.

Gold has had good relative strength for much of the last decade—and as a result it has dramatically outperformed Warren Buffett. Bespoke took up this exact issue and had this to say:

Given the fact that BRK/A does not pay a dividend, no matter how much a holder ‘fondles’ or looks at their holdings, one share of BRK/A stock purchased twelve years ago is still one share today. Sure, you can sell it for more now than you bought it then, but the same is true of gold. In fact, your gain on gold is considerably more than your gain would be on BRK/A. Looking at the performance of the two assets since the start of 2000 shows that the value of gold has increased considerably more than the value of Berkshire Hathaway. In fact, with a gain of 466% since the start of 2000, gold’s gain has been nearly four times the return of BKR/A (466% vs 120%).

Their nifty graphic follows:

Source: Bespoke (click on image to enlarge)

Relative strength has no axe to grind. One of the great benefits of using relative strength to drive tactical asset allocation is that it is objective and adaptive. Relative strength does not have a philosophical bias in favor of, or against, gold. If relative strength is high, perhaps it should be included in the portfolio. If relative strength is low, it’s out—period.

The point of investing is not to serve our biases, but to own the best-performing assets that we can identify.

1 Comment |

1 Comment |  Markets, Tactical Asset Alloc, Thought Process | Tagged: berkshire, berkshire hathaway, buffett, gold, relative strength, warren buffett |

Markets, Tactical Asset Alloc, Thought Process | Tagged: berkshire, berkshire hathaway, buffett, gold, relative strength, warren buffett |  Permalink

Permalink

Posted by:

Mike Moody

May 8, 2012

Rick Ferri on asset allocation:

Practitioners know that the optimal asset allocation can only be known in retrospect. If your time horizon is 20 years, you’ll have to wait 20 years before you find out what asset allocation you should have had during this period to have earned the best risk-adjusted return.

This is the point so often missed by the modern portfolio theory crowd. Using historical data to come up with the optimal mix tells you nothing about how that mix may perform in the future. Thus, the argument for trend following.

HT: Abnormal Returns

Leave a Comment » |

Leave a Comment » |  Tactical Asset Alloc |

Tactical Asset Alloc |  Permalink

Permalink

Posted by:

Andy Hyer

May 4, 2012

Global investing is becoming extremely important, as so much dynamic growth is located overseas. In the last decade, it seems like China has grown tremendously. In fact, if you listen to Congress, they see China as a threat to take American jobs. Maybe this article from the Wall Street Journal will surprise you like it did me. It’s a genius way to look at real wages.

Comparing wages across countries can be difficult, but one economist has come up with a way to track people doing identical jobs to make an identical product all across the world: McDonald’s employees.

Just comparing how much money workers make across countries is too simplistic. A better guide can come from taking a wage rate and dividing it by a good, which allows economists to see how much of that product an hour of work buys — a so-called real wage.

In order to calculate a real wage across countries Orley C. Ashenfelter of Princeton University found an excellent example using McDonald’s employees. In his paper published by the National Bureau of Economic Research, Ashenfelter notes that McDonald’s workers across the globe by design are asked to perform the same tasks to build the same product: a Big Mac. By calculating how many hours of work it takes an employee to earn enough to afford a Big Mac, he can show how wages change across countries.

You’ve got to admit that’s pretty clever. (But Mr. Ashenfelter has been pretty clever in other areas as well.) The graphic that goes along with it is the surprise.

Source: Wall Street Journal

Western Europe, the US, and Canada are all high wage areas. China is significantly cheaper—but look at Latin America and India. They are another magnitude lower in wage rates than China. Usually other factors, including political stability and the rule of law, come into play before a company decides to locate jobs offshore. This suggests that other low-wage areas could boom if they develop political structures that are conducive to business. Maybe China will export jobs to India!

“Real wage rates seem to have been remarkably similar across countries before the industrial revolution,” Ashenfelter says. Since then “real wage rates have diverged across countries, with catch up taking place in different countries at different points in time.”

How can any individual investor keep up with all of this information? No one person is going to be able to synthesize information about so many central banks, political administrations, and legal systems. But guess what—asset prices do that all the time. If prices in Mexico or Columbia or India start to rise, maybe the market is expecting some positive changes. If the price change persists and results in a high degree of relative strength, that becomes notable.

This is just another way of pointing out that money goes where it is treated best. Global tactical asset allocation using relative strength is one way to track these changes as they occur—and to create the opportunity to profit from them.

1 Comment |

1 Comment |  Markets, Tactical Asset Alloc, Thought Process |

Markets, Tactical Asset Alloc, Thought Process |  Permalink

Permalink

Posted by:

Mike Moody

May 4, 2012

Articles like this one in Investment News just confuse me. Apparently the latest trend among pension plan sponsors is to target volatility. I guess it is a human desire to eliminate volatility, but at the end of the day, you have to pay your pension benefits from your returns. Not risk-adjusted returns. Not volatility or standard deviation. Focusing primarily on volatility is completely missing the boat. From the article:

“There’s a big shift in terms of how plan sponsors are defining risk,” said Michael Thomas, chief investment officer for the institutional business in the Americas at Russell. “During the last 10 years, our industry has developed an unhealthy obsession with tracking error, but managing tracking error isn’t managing risk.”

He’s right—tracking error is not the same thing as risk. Nor is volatility the same thing as risk, I might add. Volatility management is just another unhealthy obsession. Besides, the source of all of the evil volatility is readily apparent.

So far, most of the target volatility asset allocation strategies focus on equity exposure, which is, “by far, the biggest contributor of [portfolio] volatility,” Russell’s Mr. Thomas said.

Equity exposure = volatility. To reduce it, just add some Treasury bills or bonds to the portfolio. Duh. That seems like a simpler solution if you really are concerned about reducing volatility.

I don’t think that investors are going to be any more successful targeting volatility than they are trying to target returns. We have no idea year to year what returns are going to be, even though we know exactly what they have been historically. We can’t forecast it or target it-we just put up with whatever returns we get. I don’t think volatility is going to be any more tractable.

4 Comments |

4 Comments |  Investor Behavior, Markets, Tactical Asset Alloc, Thought Process |

Investor Behavior, Markets, Tactical Asset Alloc, Thought Process |  Permalink

Permalink

Posted by:

Mike Moody

April 30, 2012

According to the Wall Street Journal, job growth at US multinationals has been surging for the last two years…overseas.

Thirty-five big U.S.-based multinational companies added jobs much faster than other U.S. employers in the past two years, but nearly three-fourths of those jobs were overseas, according to a Wall Street Journal analysis.

Those companies, which include Wal-Mart Stores Inc., WMT +0.12% International Paper Co., Honeywell International Inc. and United Parcel Service Inc., boosted their employment at home by 3.1%, or 113,000 jobs, between 2009 and 2011, the same rate of increase as the nation’s other employers. But they also added more than 333,000 jobs in their far-flung—and faster-growing— foreign operations.

Economists who study global labor patterns say companies are creating jobs outside the U.S. mostly to pursue sales there, and not to cut costs by shifting work previously performed in the U.S., as has sometimes been the case.

The reason is simple—there is more growth overseas than in the US. Companies naturally desire to be close to their customers, so they put operations nearby to serve them. If you decide to distribute Pepsi in Mongolia, that has to be done by Mongolians. It’s not a matter of evil corporations exporting jobs overseas—there’s just no way for that job to be done in the US.

When I read articles like this, it makes the argument that some type of global macro strategy needs to be part of a core portfolio. We no longer have the investment luxury of staying completely within our borders, figuring that the best returns available can be captured here. The world is changing and global is the new core.

Leave a Comment » |

Leave a Comment » |  Markets, Tactical Asset Alloc, Thought Process |

Markets, Tactical Asset Alloc, Thought Process |  Permalink

Permalink

Posted by:

Mike Moody

April 27, 2012

Ray Dalio of Bridgewater is an interesting character and an independent thinker. He’s also been immensely successful as an investor. If you are interested in economic history and think it might have some relevance to the way things might evolve in the future, you’ll want to read his paper on why countries succeed and fail.

This is also a wake-up call that you need to consider a flexible, global investment policy. You need to go where the returns are, and that can change from cycle to cycle.

Leave a Comment » |

Leave a Comment » |  Markets, Tactical Asset Alloc, Thought Process |

Markets, Tactical Asset Alloc, Thought Process |  Permalink

Permalink

Posted by:

Mike Moody

April 20, 2012

John Maxfield says “Goodbye to Safe Assets”:

For much of the past decade, it was presumed that the debt of developed economies was risk-free. This is why a full $38 trillion, or more than 51%, of the world’s total outstanding marketable safe assets is investment-grade sovereign securities — that is, government bonds.

However, the financial crisis has shown the folly of this presumption. While 68% of advanced economies carried a AAA rating five years ago, the proportion had dropped to 52% by the end of last year, as countries like the United States, France, and Spain all lost their coveted AAA status. And the same trend can be seen in the movement of sovereign bond yields in advanced economies. Prior to 2008, the yields moved in harmony. After 2008, individual countries started peeling away. Greece was the first to depart, followed by Portugal, and then Spain, Italy, and Belgium. All told, $15 trillion in investment-grade sovereign debt has been downgraded.

Why is this happening? Quite simply, countries are far too leveraged. The debt-to-GDP ratio of the euro area went from 66% in 2008 to 85% last year. The United States’ went from 64% to 93%. And Japan went from an already-high 188% to an even higher 220%. While the total general government gross debt of advanced economies amounts to more than $47 trillion today — this includes both investment-grade and non-investment-grade sovereign bonds — the IMF projects this figure will rise to $58 trillion by 2016, an increase of 38%.

In an era of rising debt-to-GDP ratios of developed governments, labels such as “safe” and “risky” are likely to be fluid. It’s entirely possible that asset classes previously considered risky will be the ones that ultimately prove to be the safest from the perspective of preserving purchasing power. Asset allocations that remain flexible enough to respond to unfolding developments are the ones most likely to succeed going forward.

Leave a Comment » |

Leave a Comment » |  Markets, Tactical Asset Alloc |

Markets, Tactical Asset Alloc |  Permalink

Permalink

Posted by:

Andy Hyer

April 16, 2012

When a manager is given the flexibility to seek out the strongest trends from a global investment universe the probability of finding good investment opportunities increase significantly. Effectively allocating among a broad range of asset classes (US equities, international equities, currencies, commodities, real estate, fixed income, and inverse equities) is precisely the goal of our Global Macro portfolio.

Please click here to view a 13 minute video about this portfolio.

To receive the brochure for our Global Macro strategy, click here. For information about the Arrow DWA Tactical Fund (DWTFX), click here.

Click here and here for disclosures. Past performance is no guarantee of future returns.

Leave a Comment » |

Leave a Comment » |  Tactical Asset Alloc |

Tactical Asset Alloc |  Permalink

Permalink

Posted by:

Andy Hyer

April 13, 2012

Advisors just can’t keep their hands off ETFs. And what’s not to like? Tax efficiency is high and fees are low. According to a recent story at ETF Trends, there is another reason advisors like ETFs.

The higher adoption of ETFs among wirehouses and registered investment advisors is “likely due to an increased reliance on asset-based fees in these channels,” Cogent said.

More and more advisors are managing fee-based accounts directly. They need access to smart beta (like PDP, and its cousins PIZ and PIE) and they can utilize ETFs for tactical exposure to a wide variety of asset classes. (Or they can use ETF funds like DWAFX or DWTFX if they want it handled for them.) ETFs are a remarkably flexible tool.

The article goes on to suggest that ETFs will capture 20% of new investment dollars next year. ETFs are now used by 2/3rds of advisors, whereas less than half used them five years ago.

One thing to keep in mind: as a general rule, the more granular the investment option, the better the performance. When testing relative strength models, for example, we find better performance with individual stocks than with ETFs. Of course, the better performance is accompanied by an extra dose of volatility. Some advisors may willingly trade away the better performance for reduced volatility, but others might be better served with a mix of asset types. For most advisors, this is probably a client-by-client decision. As always, investors willing to deal with volatility usually end up with more money at the end.

See www.powershares.com for more information about PDP, PIE and PIZ. Past performance is no guarantee of future returns. A list of all holdings for the trailing 12 months is available upon request.

Leave a Comment » |

Leave a Comment » |  Markets, Tactical Asset Alloc |

Markets, Tactical Asset Alloc |  Permalink

Permalink

Posted by:

Mike Moody

April 12, 2012

Mean-variance optimization, fathered by Harry Markowitz in 1952, is still a widely used approach to asset allocation today despite the fact that the underlying assumptions of the theory have some serious flaws. This approach to asset allocation is derived by using statistical methods to estimate expected returns, volatilities, and covariances. All of this information gets plugged into a piece of software called an optimizer. The optimizer then sifts through every possible combination of assets and produces a graph showing a curve called an efficient frontier. Ranged along it are a series of optimal portfolios, from the lowest risk and return to the highest.

This is an elegant theory, but the theory can only approach reality if the inputs (expected returns, volatilities, and covariances) are accurate going forward. One approach to come up with those inputs is to forecast them, but forecasts, even expert forecasts, are notoriously inaccurate. A second way to come up with those inputs is to just use the long-term averages. An examination of the chart below should illustrate why the latter approach is fraught with danger.

Source: Rex Macey, Investments & Wealth Monitor, March/April 2012 Issue.

This chart demonstrates that historical relationships can change. The five-year correlation between domestic large stocks (Russell 1000) and the MSCI EAFE index varied but never exceeded 0.6 from the start of the dataset until the late 1990s. Consultants used this data to argue for international diversification. Who would have expected based on historical data that the correlation would rise to the 0.9 level matching the correlation of large U.S. stocks with small U.S. stocks? I suspect those relying on international diversification were quite disappointed.

Rather than relying on an approach to asset allocation that makes enormous assumptions about how the future should look, why not embrace a tactical approach to asset allocation that is designed to adapt? Correlations can change, variances can change, and returns can change and tactical asset allocation still has the potential to produce excellent returns over time.

Click here to view a video presentation on our Global Macro portfolio to learn about our approach to tactical asset allocation.

Click here and here for disclosures. Past performance is no guarantee of future returns.

2 Comments |

2 Comments |  Markets, Tactical Asset Alloc |

Markets, Tactical Asset Alloc |  Permalink

Permalink

Posted by:

Andy Hyer

April 12, 2012

Advisor One had an article reprising the findings of the most recent Curian Capital survey of advisors. Their results will not surprise anyone.

• Nearly two-thirds of the advisors say that they have begun using more tactical asset allocation strategies to mitigate economic volatility, and more than half of respondents report they are using more alternative investing strategies.

• As a result of market volatility, nearly 4 out of 5 advisors report an increase in their clients’ demands for more conservative investments; in addition, 72% say their clients have an increased demand for guaranteed income features, 55% report an increase in demand for more tactical asset allocation, and 47% report an increase in demand for alternative investments.

Clients want tactical allocation strategies. This may be for diversification, but it may also be for risk mitigation, since strategic asset allocation didn’t help them much last time around. (I added the emphasis above.)

I find the demand for more tactical allocation interesting for a couple of reasons. Even ten years ago, tactical allocation was derided as market timing by hard core strategic allocation advocates. Now clients are objecting to holding asset classes during a prolonged nosedive, whether it is in service of diversification or not. There’s much more awareness of the risk inherent in strategic asset allocation given that we have gone through two bear markets in the last decade or so.

Now that everyone is a tactical asset allocator, the question really boils down to methodology. What process are you going to employ to make your allocation decisions? I will suggest that gut feel will get you in trouble almost immediately. Relying on emotion is not a good way to go. I think either valuation or relative strength methodologies will work in the long run, but they put different analytic demands on the allocator.

To run a valuation-based process, you need to have a reliable way of generating reasonably accurate expected returns for asset classes. (Simply using past history will not work, as many strategic allocators discovered over the past decade.) That’s not an easy task. It requires a ton a relevant data and a lot of testing to make sure your forecasting process has some validity. You’re still going to have a large margin of error, so your portfolios will never be optimal. Paradigm shifts are still going to create major problems.

Relative strength offers a reasonable alternative. You need to have a reliable ranking method for the assets included in your universe, but we like it because you don’t have to forecast. Instead, you are relying on the ability of the process to cast out losers and adapt to new trends.

Valuation and relative strength don’t have to be mutually exclusive. In fact, excess returns are typically negatively correlated. This is just a fancy way of saying that the two strategies tend to perform well at different times. Combining two tactical allocators, one using relative strength and one using valuation, is also a very good way to go.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets, Tactical Asset Alloc, Thought Process |

Investor Behavior, Markets, Tactical Asset Alloc, Thought Process |  Permalink

Permalink

Posted by:

Mike Moody

April 4, 2012

Barry Ritholtz at the Big Picture had an interesting post about real returns, that is, returns adjusted for inflation. (He illustrated his point with some amazing graphics from The Chart Store, produced by its proprietor, Ron Griess.) Barry apparently loves Ron’s work, and for good reason. Very long term charts are great for perspective. It’s kind of a “YOU ARE HERE” experience.

One of the charts, in particular, struck me. It was a chart of the S&P 500 real return. It shows how far in time and distance we are from the all-time index highs, as well as what has happened in past declines.

Source: The Big Picture/ The Chart Store (click to enlarge)

The real take-away here is that nominal returns can be quite deceptive. Just because the dollar amount on your statement keeps growing does not mean your purchasing power has been maintained. And your wait for real returns may be measured in decades!

It also suggests that it is important to look across a broad group of assets to try to capture returns wherever they are. Investing in stocks has the possibility of augmenting your purchasing power greatly, but there are also long, long periods where market indexes have remained stagnant. Plenty of individual stocks may have done well, but it’s also possible that the best opportunities were in asset classes outside of equities. A realistic investment policy will pursue returns wherever they are available.

Leave a Comment » |

Leave a Comment » |  From the MM, Markets, Tactical Asset Alloc, Thought Process |

From the MM, Markets, Tactical Asset Alloc, Thought Process |  Permalink

Permalink

Posted by:

Mike Moody

April 3, 2012

In finance there is often a marked difference between theory and practice. Advisor Perspectives carried an excellent commentary from Loomis Sayles on an alternative way to think about financial markets. It points out, very clearly, that what is often lost in theory is the human element.

In an often cynical world, standard financial and macroeconomic quantitative models give people the benefit of the doubt. Fundamental economic theory assumes the best of us, supposing that human beings are perfectly rational, know all the facts of a given situation, understand the risks, and optimize our behavior and portfolios accordingly. Reality, of course, is quite different. While a significant portion of individual and market behavior can be modeled reasonably well, the human emotions that drive cycles of fear and greed are not predictable and can often defy historical precedent.

Economic historian Charles Kindleberger can offer some insight. In his book Manias, Panics, and Crashes, Kindleberger explores the anatomy of a typical financial crisis and provides a framework that considers the impact of the powerful human dynamics of fear and greed. Economic historian Charles Kindleberger can offer some insight. In his book Manias, Panics, and Crashes, Kindleberger explores the anatomy of a typical financial crisis and provides a framework that considers the impact of the powerful human dynamics of fear and greed.

Kindleberger famously dubbed this sequence a “hardy perennial,” probably because the galvanizing human conditions of fear and greed are more often than not prone to overshoot fundamental values compared to the behavior of a rational individual, which exists only in macroeconomic theory.

Loomis Sayles contends that Kindleberger provides the qualitative framework for Hyman Minsky’s pioneering work on boom and bust cycles. Their graphic is remarkable in its simplicity and explanatory power—and in its distance from traditional economic equilibrium models. (You can see the image in the article.)

The cycles that Loomis Sayles discusses are driven by behavior, and often not behavior that would be considered ”rational” in the classic economic sense. Relying on precedent—the last time that happened, this happened—may or may not work. In fact, each time there is a paradigm shift, precedent will fail. Overshoots can be significant, so it’s important that an investing approach be adaptive enough to reflect changes in the environment. Most importantly, investing needs to take human behavior into account. Asset prices are a reflection of that behavior, suggesting that paying attention to prices may be far more useful than paying attention to economic theory.

1 Comment |

1 Comment |  From the MM, Investor Behavior, Markets, Tactical Asset Alloc, Thought Process |

From the MM, Investor Behavior, Markets, Tactical Asset Alloc, Thought Process |  Permalink

Permalink

Posted by:

Mike Moody

March 29, 2012

Portfolio construction has typically relied on strategic asset allocation to help control volatility. The idea is that if you combine assets with low correlations, you can significantly reduce the volatility of your returns. Lately, however, correlations have become a problem. Jeff Benjamin, writing in Investment News, discusses the problem:

Asset classes have become so highly correlated over the past few years that many traditional diversification strategies have lost their effectiveness.

For example, take the link between growth and value stocks.

For the decade ended December 2000, the correlation between the Russell 1000 Growth Index and the Russell 1000 Value Index was just 57%. During the decade ended this past December, it jumped to 92%.

For a more extreme case, compare the correlation of the MSCI Emerging Markets Index with the Russell growth index. The former was negatively correlated to the latter by 6% — which was great for those seeking diversification — in the decade through December 2000, but the correlation spiked to 89% in the following decade.

You can see the issue—drastically changing correlations will move your efficient frontier far from where you imagined it was.

Some of the observers Mr. Benjamin quoted were blunt:

“Traditional diversification is like a seat belt that only works when you’re not in a car accident,” said Michael Abelson, senior vice president of investments at Genworth Financial Wealth Management Inc.

“Depending on risk tolerance, we might recommend allocating half a portfolio to a diversified strategic strategy and then 30% to 35% to a tactical strategy and 15% to 20% to alternatives,” Mr. Abelson said.

Besides having a knack for a fine turn of phrase, Mr. Abelson mentions something that we have noticed more and more in recent years. It used to be the case that tactical allocation was used as a satellite strategy and might get only a 10% slice of a portfolio. Now, we often see the tactical strategy with a 35-50% weight. Some advisors are even using the tactical allocation as the core strategy and arranging alternatives and other asset classes as strategic overweights.

With the rise of tactical allocation come new challenges. Chief among them is how to manage the tactical portion of the portfolio. All-in/all-out timing decisions are notoriously difficult to get right. Overweighting and underweighting based on valuation requires sophisticated modeling that must be constantly updated. In addition, many assets are resistant to traditional valuation methods.

One method that does work over time is tactical asset class rotation using relative strength. We’ve chosen that path for our Global Macro strategy because it allows a very large and diversified universe to be ranked on the same metric. That, and because it works.

Click here and here for disclosures. Past performance is no guarantee of future returns.

1 Comment |

1 Comment |  Markets, Relative Strength and Value, Relative Strength Research, Tactical Asset Alloc, Thought Process |

Markets, Relative Strength and Value, Relative Strength Research, Tactical Asset Alloc, Thought Process |  Permalink

Permalink

Posted by:

Mike Moody

March 22, 2012

According to an article in Smart Money, balanced funds have been attracting client money this year.

So-called balanced funds, which invest in a mixture of stocks and bonds — and occasionally cash, commodities and other asset classes — suddenly are back in style. So far this year, investors added $7.1 billion to these portfolios, according to Lipper, a research firm. That is a huge reversal from last year, when investors yanked $20 billion from these funds.

The turnaround also stands in contrast to pure stock funds, which had inflows of just $56 million this year through March 14. And some investing experts say demand for balanced strategies is likely to rise. “There’s a little ‘Goldilocks’ appeal for investors,” says Russel Kinnel, director of fund research for Morningstar, meaning the funds are “just right” in finding a spot between timid and risky.

Indeed, advisers say they are using the funds to bring clients who are still spooked by last year’s extreme market volatility — but tired of record-low yields in the bond market — back into stocks. The pitch is that these funds offer most of the upside if the market surges but less of the downside if it tanks.

…advisers say balanced funds are often a good fit with younger investors, or those looking for a set-it-and-forget investment. Some also use the funds as core holdings for clients, and supplement them with alternative assets and funds to get even broader diversification.

Advisors are finding that clients are a bit more receptive to the equity story, but far from willing to go “all in.” We’re seeing some glimmers of that in our own survey of investors’ risk appetite. Investors are finally peeping out of the foxhole they have been in since 2008 and surveying the environment. They are beginning to realize that today’s low bond yields will not get them to their goals, but they also seem to want some fixed income as a buffer from market volatility. A balanced fund is a pretty good compromise. (You can find more out about balanced funds generally here.)

The Arrow DWA Balanced Fund (DWAFX) that we sub-advise crossed its 5-year anniversary last summer, while outperforming 90% of its peers. There are dedicated sleeves for fixed income, domestic equities, international equities, and alternative investments. The alternative sleeve, which is something many balanced funds do not include, can come in pretty handy for inflation protection and always adds an additional layer of diversification.

I’ve included a snip with the asset allocation as of 12/31/2011 and the performance of each strategy sleeve. Every sleeve has a positive return since inception in 2006, even with the 2008-2009 bear market. I think it is primarily the hybrid nature of these funds that is making them attractive to clients right now—and DWAFX might be something to consider for clients just easing back to a more normal asset allocation.

Source: Arrow Funds

Click here to visit ArrowFunds.com for a prospectus & disclosures. Click here for disclosures from Dorsey Wright Money Management.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets, Tactical Asset Alloc, Thought Process |

Investor Behavior, Markets, Tactical Asset Alloc, Thought Process |  Permalink

Permalink

Posted by:

Mike Moody

March 15, 2012

From an interview on Clusterstock:

Everybody is paying higher prices for oil and that obviously impacts consumption everywhere. It’s not just oil, it’s food and everything else that’s going up. There’s inflation everywhere, the U.S. lies about it. I mean, the U.S. government lies about inflation but there’s inflation everywhere. I mean, I don’t know if you go shopping, but if you do, you know prices are up. The government says they’re not. I don’t know where they shop. Everybody else’s prices are up.

There’s obviously inflation in Mr. Roger’s neighborhood. Based on the Everyday Price Index, inflation is a lot higher than the reported CPI. They’re different measures, but depending on what you buy, your personal inflation rate could be a lot different than the government’s.

The market doesn’t seem to be reacting strongly to inflation pressures right now, but there is no telling if that will change in the future. Some asset classes respond poorly to inflation, but others perform well and can act as inflation hedges.

I don’t get the sense—judging from the public’s heavy bond buying—that inflation is on the radar for most investors. It’s probably wise to have an investment policy that is flexible enough to include inflation hedges if they are needed. Or you could just let a manager handle the global tactical allocation strategy for you. I’m just saying.

Source: CNBC (click to enlarge)

Leave a Comment » |

Leave a Comment » |  Markets, Tactical Asset Alloc, Thought Process |

Markets, Tactical Asset Alloc, Thought Process |  Permalink

Permalink

Posted by:

Mike Moody

March 15, 2012

Time will tell whether Institutional Investor’s Julie Segal was prophetic or just susceptible to well-know behavioral finance tendencies in her article, The Equity Culture Loses Its Bloom, in which she gives a host of reasons why there is no hope for equities going forward. However, I think she has accurately captured the current fears of many investors.

As investment moves away from equities, speculation will likewise shift from stocks to other investments, including real estate, commodities and currencies. “The money supply won’t shrink, and those dollars will need a home,” says Bove. Alternatives will continue to attract money from investors’ erstwhile equity allocations.

Surely, the mindset explained in the article goes a long ways toward explaining why there has been so much demand for our Global Macro strategy this year, which can invest in U.S. equities (long & inverse), international equities (long & inverse), currencies, commodities, real estate, and fixed income. Global Macro is available as a separate account and through the Arrow DWA Tactical Fund (DWTFX). The Global Macro portfolio comes along with a systematic method for determining when and how much exposure to take in various asset classes as conditions change.

Click here to visit ArrowFunds.com for a prospectus & disclosures. Click here for disclosures from Dorsey Wright Money Management.

—-this article originally appeared 12/21/2009. It’s clearly true that investors still don’t like equities! Many advisors are also quite leary of piling into bonds at this stage in the recovery. Global Macro might still be a useful way of easing clients back into the financial markets.

Leave a Comment » |

Leave a Comment » |  From the Archives, Tactical Asset Alloc |

From the Archives, Tactical Asset Alloc |  Permalink

Permalink

Posted by:

Mike Moody

March 14, 2012

We’re big advocates of relative-strength weighting. That’s how our Technical Leaders Index is set up and it’s performed pretty well. Another common alternative is market capitalization weighting, which is the default method for most of the major indexes. A less common, but also robust, method is equal-weighting. With all weighting methods, volatility should be productive if there is some kind of rebalancing going on. The Technical Leaders Index is reconstituted and rebalanced quarterly to take advantage of relative strength trends, for instance.

Relative strength methodologies are quite volatile and weights rise with the trend. Cap weighting and equal weighting are typically mean reversion methods and weights rise against the trend. The Capital Spectator recently carried an article that showed just how productive volatility can really be. James Picerno, who edits The Capital Spectator, has a Global Market Index, which has as its components all of the major global asset classes. (You can click on the link in his article to see what they are. By the way, he has one of the finest blogrolls anywhere-full of great resources.)

In the chart below, the GMI is rebalanced just once a year, to market weights or equal weights, depending on the index.

Source: Capital Spectator (click on image to enlarge)

For most of the time frame shown, equal weighting outperforms. Equal weighting is completely naive. In effect you are saying, “I have no idea what will perform best, so I will just buy equal amounts of everything.” Fortunately, since—in truth—no one has any idea what will perform best, equal weighting works pretty well. Market weighting, if you believe the arguments put forward by Rob Arnott, suffers from overvalued assets getting large weights. In that sense, perhaps equal weighting is the purer approach.

Why are the rebalanced returns higher than the index returns? In a word, volatility. Regardless of the weighting method, rebalancing takes advantage of market volatility. Investors need to reframe the way they think about volatility. Volatility is not necessarily something negative or something to panic about. If it is harnessed, volatility can be the engine for higher returns.

Leave a Comment » |

Leave a Comment » |  Markets, Tactical Asset Alloc, Thought Process |

Markets, Tactical Asset Alloc, Thought Process |  Permalink

Permalink

Posted by:

Mike Moody