April 17, 2013

Here’s a link to a nice Nate Silver interview at Index Universe. Nate Silver is now a celebrity statistician due to his accurate election forecasts, although he started by doing statistics for baseball. In the interview, he discusses some of the ways that predictions can go wrong. In general, human beings are completely wrong about the stock market!

The typical retail investor frankly does things exactly wrong—they tend to buy at the top and sell at the bottom. Theoretically, you make this long-run average return, but a lot of people are buying at the market peaks. For many years, the Gallup Poll has periodically been asking investors whether it’s a good time to invest or not. There’s a strong historical negative correlation between when people think it’s a good time to invest and the five- or 10-year returns on the S&P 500.

Overconfidence can also kill predictions. Other studies have found that the more confident the forecaster the worse the forecast tends to be, something that makes watching articulate bulls and bears on CNBC particularly dangerous!

It’s worth a read.

1 Comment |

1 Comment |  Investor Behavior, Markets | Tagged: investor behavior, stock market |

Investor Behavior, Markets | Tagged: investor behavior, stock market |  Permalink

Permalink

Posted by:

Mike Moody

April 12, 2013

The Wall Street Journal had a small piece on Americans’ retirement readiness. In general, they’re not saving enough. Here’s an excerpt:

A separate study released today by investment firm Edward Jones finds that 79% of 1,008 U.S. adults surveyed in February said that they have committed a money mistake – and of those, 26% reported not having saved enough for retirement as their No. 1 problem. Also on the list: not paying attention to spending and making bad investments.

The EBRI research found that Americans are coming to grips with the dramatic improvements they need to make in their saving habits, with 20% of workers saying they need to save between 20 and 29% of their income to achieve a financially secure retirement, and 23% saying they need to save 30% – or more.

I added the bold. If you are a financial advisor, it’s really worth reading the entire EBRI research brief. It is absolutely eye-opening. You will discover that only 23% of workers ever obtained investment advice in the first place.

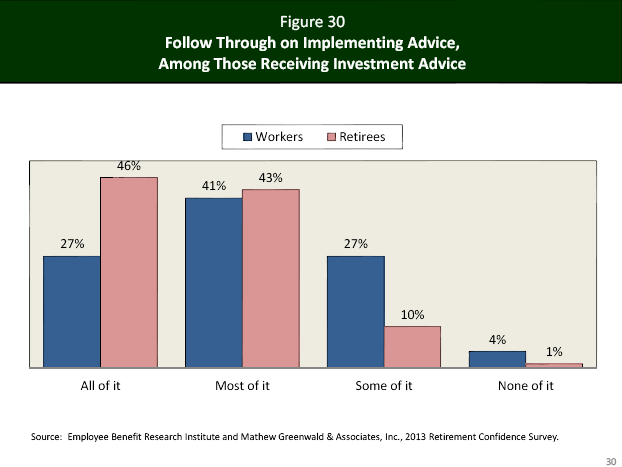

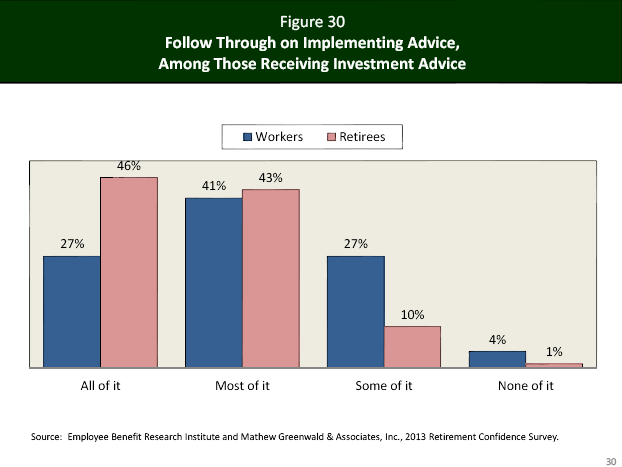

And, when they got advice, they ignored a lot of it! Here’s the graphic from EBRI on follow-through:

Only 27% fully implemented the advice. That makes about 6% of investors that got advice and followed it! (Elsewhere in the report, you will discover that a minority of investors have even tried to figure out what they might need in the way of retirement savings.) It seems obvious that you would have a large chance of falling short if you didn’t even have a goal.

As advisors, we often forget—as frustrated as we sometimes are with clients—that we are dealing with the cream of the crop. We work with investors who 1) have sought out professional advice and 2) follow all or most of it. We get cranky at anything less than 100% implementation, but many investors are doing less than that—if they bother to get advice at all.

So lighten up. Keep nudging your clients to save more, because you know it is their #1 problem. They might think you obnoxious, but they will thank you later. Help them construct a reasonable portfolio. And encourage them to get their friends and colleagues into some kind of planning and investment process. Their odds of success will be better if they get some help.

1 Comment |

1 Comment |  Investor Behavior, Wealth Management | Tagged: investor behavior, wealth management |

Investor Behavior, Wealth Management | Tagged: investor behavior, wealth management |  Permalink

Permalink

Posted by:

Mike Moody

April 4, 2013

I cringe every time I read an article by a value investor that says something like, “You should buy stocks that are on sale, just like you buy [pick your consumer item] on sale.” In the financial markets that can be dangerous.

In a great essay titled, I Want to Buy Losers, Clay Allen of Market Dynamics discusses the problems with this analogy. [You've got to read the whole essay to really appreciate it.]

Many investors buy stocks the way many consumers buy paper towels or any other staple. They are attracted to a sale and loss leaders are a proven method for a retailer to increase the traffic in their store. The value of the item is well known and a sale price gets the attention of potential buyers.

Mr. Allen explains brilliantly and succinctly why this analogy is bunk:

But stocks are not like paper towels. Paper towels can be used to satisfy a need and this is what gives the item its value to the consumer. What gives a stock its value? A stock cannot be used to satisfy a need or accomplish a task. The value of a stock is derived from the financial performance of the company, either actual or expected. The fact that the stock is down in price is usually a sure sign that the financial performance of the company is declining.

…if the value of the stock was constant, then buying bargain stocks would be the correct way to invest in stocks. But stock values are constantly changing as business conditions change for the company and the expectations of investors change.

All in all, it seems to me that relative strength often more closely reflects what the expectations of investors are–and the expectations are what counts. Let’s face it: strong stocks are usually strong because business conditions or fundamentals are good, and weak stocks are usually weak for a reason.

—-this article was originally published 3/26/2010. In the intervening years, my friend Clay Allen has passed away. His wisdom, however, is still with us. His point that a stock is not a paper towel is absolutely correct. The only purpose of an equity investment is to make money.

Leave a Comment » |

Leave a Comment » |  From the Archives, Investor Behavior, Thought Process | Tagged: investor behavior |

From the Archives, Investor Behavior, Thought Process | Tagged: investor behavior |  Permalink

Permalink

Posted by:

Mike Moody

March 25, 2013

Morningstar has a market-beating strategy call “Buy the Unloved” that they update from time to time. Essentially, it consists of buying the fund categories with the most outflows and holding on to them for three years, on the theory that retail investors generally get things wrong. Sadly, “Buy the Unloved” has a good track record, indicating that their thesis is largely correct!

Here are a couple of key excerpts from their 2013 update on the Buy the Unloved strategy:

Morningstar has followed this strategy since the early 1990s, using annual net cash flows to identify each year’s three most unloved and loved equity categories, which feed into two separate portfolios (unloved and loved). We track the average returns for those categories for the subsequent three years, adding in new categories each year and swapping out categories after three years are up. We’ve found that holding a portfolio of the three most unpopular equity categories for at least three years is an effective approach: From 1993 through 2012, the “unloved” strategy gained 8.4% annualized to the “loved” strategy’s 5.1% annualized. The unloved strategy has also beaten the MSCI World Index’s 6.9% annualized gain and has slightly beat the Morningstar US Market Index’s 8.3% return.

According to Morningstar fund flow data, the most popular equity categories in 2012 were diversified emerging markets (inflows of $23.2 billion), foreign large value (inflows of $4.6 billion), and real estate (inflows of $3.8 billion). Those looking across asset classes might want to be cautious on sending new money to intermediate-term bond (inflows of $112.3 billion), short-term bond (inflows of $37.6 billion), and high-yield bond (inflows of $23.6 billion), particularly as interest rates have nowhere to go but up.

The most unloved equity categories are also the most unpopular overall: large growth (outflows of $39.5 billion), large value (outflows of $16 billion), and large blend (outflows of $14.4 billion). These categories have seen outflows despite posting double-digit gains in 2012. The money leaving from these categories reflects a broader trend of investors fleeing equity funds while piling into fixed-income offerings and passive ETFs.

Now that we are almost a full quarter into 2013, it might be worthwhile to think about what we have seen so far this year: good performance from large-cap equities and sluggish performance from bonds.

Morningstar should get a public service award for publishing this data—and it’s worth thinking about what you can learn from it. The most popular investment trends are not always the profitable ones. In fact, their work indicates that it could be valuable to spend time thinking about going into areas that are currently unpopular. Obviously, this does not need to be used (and probably shouldn’t be) as a stand-alone strategy, but it might be useful as a guide to portfolio adjustments.

1 Comment |

1 Comment |  Investor Behavior, Markets, Thought Process | Tagged: behavioral finance, contrary opinion, investor behavior |

Investor Behavior, Markets, Thought Process | Tagged: behavioral finance, contrary opinion, investor behavior |  Permalink

Permalink

Posted by:

Mike Moody

March 20, 2013

AdvisorOne ran an interesting article recently, reporting the results of a retirement study done by Franklin Templeton. Investors are feeling a lot of stress about retirement, even early on. And given how things are going for many of them, feeling retirement stress is probably the appropriate response! In no particular order, here are some of the findings:

A new survey from Franklin Templeton finds that nearly three-quarters (73%) of Americans report thinking about retirement saving and investing to be a source of stress and anxiety.

In contrast to those making financial sacrifices to save, three in 10 American adults have not started saving for retirement. The survey notes it’s not just young adults who are lacking in savings; 68% of those aged 45 to 54 and half of those aged 55 to 64 have $100,000 or less in retirement savings.

…two-thirds (67%) of pre-retirees indicated they were willing to make financial sacrifices now in order to live better in retirement.

“The findings reveal that the pressures of saving for retirement are felt much earlier than you might expect. Some people begin feeling the weight of affording retirement as early as 30 years before they reach that phase of their life,” Michael Doshier, vice president of retirement marketing for Franklin Templeton Investments, said in a statement. “Very telling, those who have never worked with a financial advisor are more than three times as likely to indicate a significant degree of stress and anxiety about their retirement savings as those who currently work with an advisor.”

As advisors, we need to keep in mind that our clients are often very anxious over money issues or feel a lot of retirement stress. We often labor over the math in the retirement income plan and neglect to think about how the client is feeling about things—especially new clients or prospects. (Of course, they do feel much better when the math works!)

The silver lining, to me, was that most pre-retirees were willing to work to improve their retirement readiness—and that those already working with an advisor felt much less retirement stress. I don’t know if clients of advisors are better off for simply working with an advisor (other studies suggest they are), but perhaps even having a roadmap would relieve a great deal of stress. As in most things, the unknown makes us anxious. Working with a qualified advisor might make things seem much more manageable.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Retirement/Saving | Tagged: factor investing, investor behavior, retirement, retirement income |

Investor Behavior, Retirement/Saving | Tagged: factor investing, investor behavior, retirement, retirement income |  Permalink

Permalink

Posted by:

Mike Moody

March 1, 2013

Lots of investors have avoided the stock market since 2009, only to miss out on a long run of good performance. Now, of course, they are concerned about buying because the market is near a 52-week high. Essentially, they are worried about buyer’s remorse—that bittersweet feeling when the market goes down right after you decided to join the party. In practice, this usually just means they will wait even longer to get in and will thus buy at an even higher price.

While it is impossible to know what the market will do next, buyer’s remorse might not be as significant as it seems. World Beta reprised a recent piece from Steve Sjuggerud on what happened when buying near new 52-week highs and lows:

We looked at nearly 100 years of weekly data on the S&P 500 Index, not counting dividends. You might be surprised at what we found…

After the stock market hits a 52-week high, the compound annual gain over the next year is 9.6%. That is a phenomenal outperformance over the long-term “buy and hold” return, which was 5.6% a year.

On the flip side, buying when the stock market is at or near new lows leads to terrible performance over the next 12 months… Specifically, buying anytime stocks are within 6% of their 52-week lows leads to compound annual gain of 0%. That’s correct, no gain at all 12 months later.

Using monthly data, our True Wealth Systems databases go back to 1791. The results are similar… Buying at a 12-month high and holding for 12 months beats the return of buy-and-hold. And buying at a 12-month low and holding for a year does worse than buy-and-hold. Take a look…

The same holds true for a more recent time period, this time starting in 1950…

History’s verdict is clear… You’re much better off buying at new highs than at new lows.

I find this quite interesting in light of the fact that there is no shortage of articles discussing the sky falling with the sequester, or the debt ceiling, or the Greek default, of the ongoing collapse of the Yen. Well, you get the picture. Maybe investors are just afflicted with crisis fatigue at this point. In fact, PE multiples are around average right now. There’s no telling what will happen going forward, but buyer’s remorse need not be at the top of your list of fears.

1 Comment |

1 Comment |  Investor Behavior, Markets | Tagged: investor behavior, stock market |

Investor Behavior, Markets | Tagged: investor behavior, stock market |  Permalink

Permalink

Posted by:

Mike Moody

February 1, 2013

The only thing new under the sun is the history you haven’t read yet.—-Mark Twain

Investors often have the conceit that they are living in a new era. They often resort to new-fangled theories, without realizing that all of the old-fangled things are still around mainly because they’ve worked for a long time. While circumstances often change, human nature doesn’t change much, or very quickly. You can generally count on people to behave in similar ways every market cycle. Most portfolio lessons are timeless.

As proof, I offer a compendium of quotations from an old New York Times article:

WHEN you check the performance of your fund portfolio after reading about the rally in stocks, you may feel as if there is a great party going on and you weren’t invited. Perhaps a better way to look at it is that you were invited, but showed up at the wrong time or the wrong address.

It isn’t just you. Research, especially lately, shows that many investors don’t match market performance, often by a wide margin, because they are out of sync with downturns and rallies.

Christine Benz, director of personal finance at Morningstar, agrees. “It’s always hard to speak generally about what’s motivating investors,” she said, “but it’s emotions, basically,” resulting in “a pattern we see repeated over and over in market cycles.”

Those emotions are responsible not only for drawing investors in and out of the broad market at inopportune times, but also for poor allocations to its niches.

Where investors should be allocated, many professionals say, is in a broad range of assets. That will smooth overall returns and limit the likelihood of big losses resulting from an excessive concentration in a plunging market. It also limits the chances of panicking and selling at the bottom.

In investing, as in party-going, it’s often safer to let someone else drive.

This is not ground-breaking stuff. In fact, investors are probably bored to hear this sort of advice over and over—but it gets repeated because investors ignore the advice repeatedly! This same article could be written today, or written 20 years from now.

You can increase your odds of becoming a successful investor by constructing a reasonable portfolio that is diversified by volatility, by asset class, and by complementary strategy. Relative strength strategies, for example, complement value and low-volatility equity strategies very nicely because the excess returns tend to be uncorrelated. Adding alternative asset classes like commodities or stodgy asset classes like bonds can often benefit a portfolio because they respond to different return drivers than stocks.

As always, the bottom line is not to get carried away with your emotions. Although this is certainly easier said than done, a diversified portfolio and a competent advisor can help a lot.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets, Portfolio Theory, Thought Process, Wealth Management | Tagged: asset allocation, behavioral finance, investor behavior, portfolio, relative strength, stock market, strategies |

Investor Behavior, Markets, Portfolio Theory, Thought Process, Wealth Management | Tagged: asset allocation, behavioral finance, investor behavior, portfolio, relative strength, stock market, strategies |  Permalink

Permalink

Posted by:

Mike Moody

January 22, 2013

It’s well known in behavioral finance that investors experience a loss 2-3x more intensely than a gain of the same magnitude. This loss aversion leads investors to avoid even rational bets, according to a Reuters story on a recent study by a Cal Tech scientist.

Laboratory and field evidence suggests that people often avoid risks with losses even when they might earn a substantially larger gain, a behavioral preference termed ‘loss aversion’,” they wrote.

For instance, people will avoid gambles in which they are equally likely to either lose $10 or win $15, even though the expected value of the gamble is positive ($2.50).

The study indicates that people show fear at even the prospect of a loss. Markets are designed to generate fear, not to mention all of the bearish commentators on CNBC. Fear leads to poor decisions, like selling near the bottom of a correction. Unless you are planning to electrically lesion your amygdala, the fear is going to be there–so what’s the best way to deal with it?

The course we have chosen is to make our investment models systematic. That means the decisions are rules-based, not subject to whatever fear the portfolio managers may be experiencing at any given time. Once in a blue moon, excessive caution pays off, but studies suggest that more errors are made being excessively cautious than overly aggressive. A rules-based method treats risk in a even-handed, mathematical way. In other words, take risks that historically are likely to pay off, and keep taking them regardless of your emotional state. Given enough time, the math is likely to swing things in your favor.

—-this article originally appeared 2/10/2010. In the two years since this was written, investors have continued to pay a high price for their fear as the market has continued to advance. There are always scary things around the corner, but a rules-based process can often help you navigate through them. Investors seem to have a hard time learning that scary things don’t necessarily cause markets to perform poorly. In fact, the opposite is often true.

1 Comment |

1 Comment |  From the Archives, Investor Behavior, Markets | Tagged: investor behavior, stock market, systematic investment process |

From the Archives, Investor Behavior, Markets | Tagged: investor behavior, stock market, systematic investment process |  Permalink

Permalink

Posted by:

Mike Moody

January 18, 2013

With the elimination of traditional pensions in many workplaces, Americans are left to their own devices with their 401k plan. For many of them, it’s not going so well. Beyond the often-poor investment decisions that are made, many investors are also raiding the retirement kitty. Business Insider explains:

Dipping into your 401(k) plan is tantamount to journeying into the future, mugging your 65-year-old self, and then booking it back to present day life.

And still, it turns out one in four workers resorts to taking out 401(k) loans each year, according to a new report by HelloWallet –– to the tune of $70 billion, nationally.

To put that in perspective, consider how much workers contribute to retirement plans on average: $175 billion per year. That means people put money in only to take out nearly half that contribution later.

That’s not good. Saving for retirement is hard enough without stealing your own retirement money. Congress made you an investor whether you like it or not—now you need to figure out how to make the best of it.

Here are a couple of simple guidelines:

- save 15% of your income for your entire working career.

- if you can max out your 401k, do it.

- diversify your portfolio intelligently, by volatility, asset class, and strategy.

- resist all of the temptations to mess with your perfectly reasonable plan.

- if you can’t discipline yourself, for heaven’s sake get help.

I know—easier said than done. But still, if you can manage it, you’ll have a big headstart on a good retirement. Your 401k is too important to abuse.

2 Comments |

2 Comments |  Investor Behavior, Retirement/Saving | Tagged: 401k, diversification, investor behavior, retirement |

Investor Behavior, Retirement/Saving | Tagged: 401k, diversification, investor behavior, retirement |  Permalink

Permalink

Posted by:

Mike Moody

January 17, 2013

According to a fascinating study discussed in Time Magazine based on 27 million hands of Texas Hold’em, it turns out that the more hands poker players win, the more money they lose! What’s going on here?

I suspect it has to do with investor preferences–gamblers often think the same way. Most people like to have a high percentage of winning trades; they are less happy with a lower percentage of winning trades, even if the occasional winner is a big one. In other words, investors will often prefer a system with 65% winning trades over a system with 45% winning trades, even if the latter method results in much greater overall profits.

People overweigh their frequent small gains vis-à-vis occasional large losses,” Siler says.

In fact, you are generally best off if you cut your losses and let your winners run. This is the way that systematic trend following tends to work. Often this results in a few large trades (the 20% in the 80/20 rule) making up a large part of your profits. Poker players and amateur investors obviously tend to work the other way, preferring lots of small profits–which all tend to be wiped away by a few large losses. Taking lots of small profits is the psychological path of least resistance, but the easy way is the wrong way in this case.

—-this article was originally published 2/10/2010. Investors still have irrational preferences about making money. They usually want profits—but apparently only if they are in a certain distribution! Real life doesn’t work that way. Making money is a fairly messy process. Only a few names turn out to be big winners, so you’ve got to give them a chance to run.

7 Comments |

7 Comments |  From the Archives, Investor Behavior, Markets, Thought Process | Tagged: investor behavior, market, relative strength |

From the Archives, Investor Behavior, Markets, Thought Process | Tagged: investor behavior, market, relative strength |  Permalink

Permalink

Posted by:

Mike Moody

January 3, 2013

Barry Ritholtz at The Big Picture has some musings about portfolios for the New Year. I think he’s right about keeping it simple—but I also think his thought is incomplete. He writes:

May I suggest taking control of your portfolio as a worthwhile goal this year?

I have been thinking about this for awhile now. Last year (heh), I read a quote I really liked from Tadas Viskanta of Abnormal Returns. He was discussing the disadvantages of complexity when creating an investment plan:

“A simple, albeit less than optimal, investment strategy that is easily followed trumps one that will abandoned at the first sign of under-performance.”

I am always mindful that brilliant, complex strategies more often than not fail. Why? A simple inability of the Humans running them to stay with them whenever there are rising fear levels (typically manifested as higher volatility and occasional drawdowns).

Let me state this more simply: Any strategy that fails to recognize the psychological foibles and quirks of its users has a much higher probability of failure than one that anticipates and adjusts for that psychology.

Let me just say that there is a lot of merit to keeping things simple. It’s absolutely true that complex things break more easily than simple things, whether you’re talking about kid’s Christmas toys or investor portfolios. I believe in simplicity over complexity.

However, complexity is only the tip of the iceberg that is human nature. Mr. Ritholtz hints at it when he mentions human inability to stay with a strategy when fear comes into the picture. That is really the core issue, not complexity. Adjust for foibles all you want; many investors will still find a way to express their quirks. You can have an obscenely simple strategy, but most investors will still be unable to stay with it when they are fearful.

Trust me, human nature can foil any strategy.

Perhaps a simple strategy will be more resilient than a complex one, but I think it’s most important to work on our resilience as investors.

Tuning out news and pundits is a good start. Delving deeply into the philosophy and inner workings of your chosen strategy is critical too. Understand when it will do well and when it will do poorly. The better you understand your return factor, whether it is relative strength, value, or something else, the less likely you are to abandon it at the wrong time. Consider tying yourself to the mast like Ulysses—make it difficult or inconvenient to make portfolio strategy changes. Maybe use an outside manager in Borneo that you can only contact once per year by mail. I tell clients just to read the sports pages and skip the financial section. (What could be more compelling soap opera than the Jet’s season?) Whether you choose distraction, inconvenience, or steely resolve as your method, the goal is to prevent volatility and the attendant fear it causes from getting you to change course.

The best gift an investor has is self-discipline. As one of our senior portfolio managers likes to point out, “To the disciplined go the spoils.”

2 Comments |

2 Comments |  Investor Behavior, Markets, Thought Process | Tagged: behavioral finance, decision-making, discipline, investor behavior, relative strength, return factor, simple, strategy, volatility |

Investor Behavior, Markets, Thought Process | Tagged: behavioral finance, decision-making, discipline, investor behavior, relative strength, return factor, simple, strategy, volatility |  Permalink

Permalink

Posted by:

Mike Moody

December 12, 2012

If you’ve ever wondered why clients remember their winners so well—and are so quick to sell them-while forgetting the losers and how badly they have done, some academics have done you a favor. You can read this article for the full explanation. Or you can look at this handy graphic from CXO Advisory that explains how clients use different reference points for winners and losers. In short, the winners are compared with their highest-ever price, while losers are compared with their break-even purchase price.

Source: CXO Advisory

It explains a lot, doesn’t it? It explains why clients make bizarre self-estimates of their investment performance. And it explains why clients are perpetually disappointed with their advisors—because they are comparing their winners with the highest price achieved. Any downtick makes it a loser in their eyes. The losers are ignored, in hopes they will get back to even.

The antidote to this cognitive bias, of course, is to use a systematic investment process that ruthlessly evaluates every position against a common standard. If you are a value investor, presumably you are estimating future expected returns as your holding criterion. For relative strength investors like ourselves, we’re constantly evaluating the relative strength ranking of each security in the investment universe. Strong securities are retained, and securities that weaken are swapped out for stronger ones. Only a systematic process is going to keep you from looking at reference points differently for winners and losers.

1 Comment |

1 Comment |  Investor Behavior, Thought Process | Tagged: investor behavior, relative strength, systematic investment process |

Investor Behavior, Thought Process | Tagged: investor behavior, relative strength, systematic investment process |  Permalink

Permalink

Posted by:

Mike Moody

December 9, 2012

Volatility can cause investors to make terrible decisions. Blackrock recently featured an ugly chart comparing the returns of every major asset class since 1992 to the returns of the average investor. Amazingly enough, over that 20-year period investors underperformed every single major asset class including inflation!

Source: Blackrock (click to enlarge)

Here is Blackrock’s take on the chart:

Volatility is often the catalyst for poor decisions at inopportune times. Amidst difficult financial times, emotional instincts often drive investors to take actions that make no rational sense but make perfect emotional sense. Psychological factors such as fear often translate into poor timing of buys and sells. Though portfolio managers expend enormous efforts making investment decisions, investors often give up these extra percentage points in poorly timed decisions.

As Blackrock points out, good investing decisions are often ruined by one poorly timed emotional decision, typically brought about by a response to volatility. Volatility often engenders fear, and fear can overwhelm the client’s rational thought process.

One of the chief benefits of a good financial advisor is preventing clients from undermining themselves when the markets are rocky. From an objective point of view, if you are fearful, it’s going to be difficult to calm the client down. I don’t have any magic ideas about how to keep calm, but you could do worse than the British WWII propaganda poster: Keep calm and carry on.

Source: SkinIt (click to enlarge)

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets | Tagged: behavioral finance, investor behavior, volatility |

Investor Behavior, Markets | Tagged: behavioral finance, investor behavior, volatility |  Permalink

Permalink

Posted by:

Mike Moody

December 9, 2012

If you need another reason to hate the French, besides envy of their excellent cuisine, it turns out that a bevy of winemakers were fined and given suspended sentences for foisting cheap, lousy wine on American consumers and charging them premium prices for it.

On the other hand, it shows that cognitive biases are everywhere. Neither the American company the wine was shipped to nor consumers drinking it ever complained! Because the wine was labeled as premium pinot noir, wine enthusiasts apparently thought it tasted great. In fact, it turns out that wine drinkers think expensive wine tastes better, even when you trick them and give them two glasses of wine from the same bottle.

This behavior is not unknown in the stock market, where cognitive biases run unbridled down Wall Street. Ten years ago, everyone was in love with General Electic. It, too, was high-priced and tasted great. Ten years later, GE is considered cheap swill that leaves a bitter taste in the mouths of investors.

The moral of the story is that you can’t fall in love with your stocks or your wine. You have to like it on its own merits. In the case of our Systematic RS accounts, we like a stock only as long as it has high relative strength. When it becomes weaker and drops in its ranking–indicating that other, stronger stocks are available–we sell it and move on to a better class of grape. (We’ve been known to break a bottle here and there, but the idea is to adapt as tastes change.) In this way, we strive to keep our wine cellar stocked with the best vintages all the time.

—-this article originally appeared 2/19/2012. Cognitive biases are still running wild on Wall Street.

Leave a Comment » |

Leave a Comment » |  From the Archives, Investor Behavior, Just for Fun, Markets, Thought Process | Tagged: investor behavior, relative strength |

From the Archives, Investor Behavior, Just for Fun, Markets, Thought Process | Tagged: investor behavior, relative strength |  Permalink

Permalink

Posted by:

Mike Moody

November 27, 2012

I admit to a prurient interest in behavioral finance. Perhaps this is due to my background in psychology—or just from having dealt with a broad range of clients for many years. Investor behavior is sometimes amazing, and behavioral finance, the academic specialty that has grown up to examine it, is equally interesting. One of the most practical discussions of behavioral finance I have seen appeared recently on AdvisorOne. It was written by Michael Finke, the coordinator for the financial planning program at Texas Tech.

It is my strong recommendation that you read the entire article, but here are a few of the behavioral finance highlights that jumped out at me:

- Breaking habits requires deliberate intention to change routines by using our rider to change the direction of the elephant. How do we motivate people to change behavior to meet long-term goals? Neuroscience suggests that the worst way to motivate people is to focus on numbers. Telling someone they need to save a certain amount to achieve an adequate retirement accumulation goal may be convincing to the rational brain, but not so convincing to the elephant.

- Explaining a concept in a visual or emotional sense uses much more of our brain functions than is used by numbers. If you think of people as being emotional and visual, you’ve essentially tapped into 70% of the brain real estate. There is that rational side, but that rational side might be more like 20% of the real estate. The rational side used to solve math problems might be 8% of the real estate.

- It can be useful to frame desired actions as the status quo in order to take advantage of this preference. For example, setting defaults that are beneficial can have an unexpectedly large impact on improving behavior.

- The most powerful emotional response related to financial choice is fear. Fear leads to a number of observed decision anomalies identified in behavioral finance such as the excessive attention paid to a loss. Framing decisions so that they do not necessarily involve a loss is an important tool advisors can use to avoid bringing the amygdala to the table.

- “Dollar cost averaging is an illusion,” notes James. “Unless we have mean reversion in the market (and if we do we can make lots of market timing bets and make ourselves rich), dollar cost averaging does not work. But if people believe that they are buying shares cheaper in a recession, the story makes people stay in the market at the times when their fear-driven emotional side wants them to get out of the market. We have a story that, even if it’s completely false, is generating the behavior that is going to be portfolio maximizing in the end. So maybe the answer to the usefulness of dollar cost averaging isn’t ‘well we’ve figured it out and it doesn’t work, so don’t use it,’ the answer is ‘actually it’s not true but it gets your clients to behave the right way so keep telling them that.’”

The biggest impediment to good returns is typically investor psychology. If behavioral finance ideas can help clients control their behavior better—and thus lead to better investment outcomes—some of these ideas may prove useful.

Source: Lean Frog (click on image to enlarge)

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Thought Process | Tagged: behavioral finance, investor behavior |

Investor Behavior, Thought Process | Tagged: behavioral finance, investor behavior |  Permalink

Permalink

Posted by:

Mike Moody

November 14, 2012

Nervous energy is a great destroyer of wealth.—-Fayez Sarofim

This quote was embedded in an article written by Jim Goff, the research director at Janus. Along with making the case for equities, he talks about how important it is to have a reasonable allocation that you can stick with—and then to leave it alone.

Mr. Goff talks about the way in which many investors undermine their returns:

The average investor is far from contrarian. I remember vividly when a strategist from a top-tier investment firm in the mid-1990’s told me that while the S&P 500 had grown at 13% per year over the prior 10 years, the realized equity returns of his firm’s retail client base, on average, had compounded at only 5% per year. The S&P would have turned $100,000 into $339,000 during that period, but their average investor ended with $163,000.

Often this is caused by jumping in and out of an asset class, rather than by making tactical adjustments within the asset class. There’s nothing wrong with tactical asset allocation as long as it’s done systematically. Even a lousy version of strategic asset allocation—carried out effectively—will probably beat what most investors are doing! Either way, undisciplined fiddling often ruins investment results. Mr. Sarofim’s quote is something to take to heart.

There are a couple of points relevant to portfolio management.

- Think about a reasonable asset allocation for your situation, one you can stick with.

- Have a systematic process for making portfolio adjustments, not one that is undisciplined and responsive to the news environment.

1 Comment |

1 Comment |  Investor Behavior, Tactical Asset Alloc, Thought Process | Tagged: asset allocation, investor behavior, Tactical Asset Allocation |

Investor Behavior, Tactical Asset Alloc, Thought Process | Tagged: asset allocation, investor behavior, Tactical Asset Allocation |  Permalink

Permalink

Posted by:

Mike Moody

November 1, 2012

A recent article at AdvisorOne suggests that CNBC is detrimental to the well-being of your clients. In truth, it didn’t really single out CNBC. It was applicable to any steady diet of financial news. Here’s what the article had to say about financial news and client stress:

Clients get stressed by things you wouldn’t predict. This is a classic example, uncovered at the Kansas State University (KSU) Financial Planning Research Center by Dr. Sonya Britt of KSU and Dr. John Grable, now at the University of Georgia, in their recent paper “Financial News and Client Stress.” They found that contrary to what you might think, client stress goes up when watching financial news, and hearing that the market went up causes stress levels to rise even higher. “Specifically, 67% of people watching four minutes of CNBC, Bloomberg, Fox Business News and CNN showed increased stress, while 75% of those who watched a positive-only news video exhibited an increase in stress,” they wrote.

Why? “Financial news was found to increase stress levels, particularly among men,” wrote Grable and Britt. Surprisingly, positive financial news, like reports of bullishness in the stock market, created the highest levels of stress, they found, suggesting that positive financial news may trigger regret among some people. The authors referred to previous studies of regret that found “people tend to feel most remorseful when they look back at a situation and realize that they failed to take action.” The authors’ conclusion: Financial advisors should think twice about having office TVs tuned to financial channels.

Surprising, isn’t it, to find out that clients were stressed even when the market was going up? The ups and downs of the market appear to elicit client’s concerns about their financial decisions. Anything that undermines their confidence is probably not a positive. In fact, one of the important things advisors can do is help clients manage their investment behavior. Financial news appears to work at cross-purposes to that. (Other things do too; the full article has a host of useful thoughts on what stresses clients and how to reduce client stress.)

The relationship between high levels of stress and poor decision-making is well-known to psychologists, researchers and sports fans around the world. “Our brains operate on different levels, depending on circumstances,” Britt told me in an interview. “Under high levels of stress, our intellectual decision-making functions shut down, and our emotional flight or fight response kicks in.” Added Grable: “People will adapt to low levels of stress differently, but overwhelming stress results in predictable behavior. When we are stressed, our brains cannot move to make intellectual decisions.”

If we want to help our clients stay calm and stick with their plan, maybe we should ask about their family, their pets, and their hobbies in a relaxed setting rather than inundating them with market data.

1 Comment |

1 Comment |  Investor Behavior, Just for Fun, Thought Process, Wealth Management | Tagged: CNBC, investor behavior, wealth management |

Investor Behavior, Just for Fun, Thought Process, Wealth Management | Tagged: CNBC, investor behavior, wealth management |  Permalink

Permalink

Posted by:

Mike Moody

October 30, 2012

Does human behavior evolve or is human nature relatively unchanging? A recent Wall Street Journal article by Jason Zweig made the case for human nature as relatively stable when it discussed the results of a fascinating study. Here’s the back story:

A fascinating new research paper analyzes how individual investors built stock portfolios soon after building portfolios first became possible: from 1690 to 1730.

The researchers, led by the distinguished financial historian Larry Neal of the University of Illinois, painstakingly replicated all the holdings and trades in the Bank of England, the East India Co. and the United East India Co., the Royal African Co., the Hudson’s Bay Co., the Million Bank and the South Sea Co. These were the dominant companies at the birth of the British capital markets three centuries ago. The share registries survive, so the scholars were able to match virtually every investment with the person who held it – encompassing 5,813 investors during the 1690s and 23,723 by the end of the period.

As a result, the way portfolios were constructed around 1700 can be compared to the way investors construct portfolios now. Mr. Zweig writes:

Three centuries ago, investors:

- underdiversified, with 86% of them owning shares in only a single stock;

- chased performance, with rising prices leading to higher trading volume;

- underperformed the market as a whole, earning lower returns and incurring higher risk.

There’s little evidence of change in human nature now.

Investors today:

He concludes that:

The research findings on investors in the early days of the British stock market should remind us all that human nature is the same today as it was in the days of clay pipes, quill pens and horse-drawn carriages.

The investing crowd is as foolish now as it was then – or perhaps more so, considering that foolishness can spread faster over Twitter and smartphones than it could by foot through cobblestone streets.

In order to be a superior investor, you have to combat the crazy ideas of those around you and, above all, fight the hobgoblins in your own head. That was true in 1720. It is at least as true in 2012 as it was then.

Human nature is not an easy opponent for investors. We can’t run away from it because it is part of who we are. As a result, however, return factors that are based on human nature, like relative strength and value, are unlikely to change. That knowledge, at least, is somewhat comforting.

1 Comment |

1 Comment |  Investor Behavior, Markets | Tagged: human nature, investor behavior, relative strength |

Investor Behavior, Markets | Tagged: human nature, investor behavior, relative strength |  Permalink

Permalink

Posted by:

Mike Moody

October 17, 2012

According to a Merrill Lynch survey of affluent investors, they are beginning to adapt to the current economic and market situation as the new normal, as opposed to looking at it as a temporary period of high volatility. Perhaps because they’ve now made that psychological leap, affluent investors are beginning to feel that their situation is more stable. From a Penta article:

To prepare for a more volatile environment, this affluent group also is making efforts to control what they can by spending less, paying down debt, and generally “putting their lives in check,” Durkin said. Of the families surveyed, 50% said they’ve taken steps to gain greater control of their finances, like sticking to a budget (32%), making more joint investment decisions with a spouse (29%), and setting tangible goals (28%). One third of respondents said they’re living “more within their means.”

In other words, the affluent are adapting by toggling back their lifestyle and saving more.

Making that psychological shift is critical because it allows a lot of good things to happen. It’s also perhaps a realization that although you can’t control the markets, there is a lot you can control that will impact your eventual net worth—namely, living beneath your means and saving more. Being affluent, in and of itself, won’t build net worth.

Once a client has good habits in place, compounding kicks in and net worth tends to grow more rapidly than clients expect. Clients are usually delighted with this discovery!

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets, Retirement/Saving, Wealth Management | Tagged: investor behavior, retirement, savings |

Investor Behavior, Markets, Retirement/Saving, Wealth Management | Tagged: investor behavior, retirement, savings |  Permalink

Permalink

Posted by:

Mike Moody

October 11, 2012

From time to time, I’ve written about karma boomerang: the harder you try to avoid getting nailed, the more likely it is that you’ll get nailed by exactly what you are trying to avoid. This concept came up again in the area of retirement income in an article I saw at AdvisorOne. The article discussed a talk given by Tim Noonan at Russell Investments. The excerpt in question:

In [Noonan's] talk, “Disengagement: Creating the Future You Fear,” he observed that lack of engagement in retirement planning is leading people toward the very financial insecurity they dread. What they need to know, and are not finding out, is simply whether they’ll have enough money for their needs.

I added the bold. This is a challenge for investment professionals. Individuals are not likely on their own to go looking for their retirement number. They are also not likely to go looking for you, the financial professional. They may realize they need help, but are perhaps intimidated to seek it—or fearful of what they might find out if they do investigate.

Retirement income is probably not an area where you want to tempt karma! Retirement income is less secure than ever for many Americans, due to under-funded pension plans, neglected 401k’s, and a faltering Social Security safety net. The only way to secure retirement income for investors is to reach out to them and get them engaged in the process.

Mr. Noonan, among other suggestions, mentioned the following:

- “Personalization” is tremendously appealing. “Tailoring” may be an even more useful term, since “people don’t mind if the tailor reuses the pattern,” Noonan explained. They may even enjoy feeling part of an elite group.

- “Tactical investing” is viewed positively. “People know they should be more adaptive, but they aren’t sure what of,” said Noonan. Financial plans should adapt to the outcomes they’re producing, not to hypothetical market forecasts.

Perhaps personalization and tactical investing can be used as hooks to get clients moving. To reach their retirement income goals, they are going to need to save big and invest intelligently, but none of that will happen if they aren’t engaged in the first place.

Leave a Comment » |

Leave a Comment » |  From the MM, Investor Behavior, Retirement/Saving, Tactical Asset Alloc, Thought Process | Tagged: 401k, investor behavior, karma, Tactical Asset Allocation |

From the MM, Investor Behavior, Retirement/Saving, Tactical Asset Alloc, Thought Process | Tagged: 401k, investor behavior, karma, Tactical Asset Allocation |  Permalink

Permalink

Posted by:

Mike Moody

October 9, 2012

Grant me the serenity to accept the things I cannot change, the courage to change the things I can, and the wisdom to know the difference—-Reinhold Niebuhr

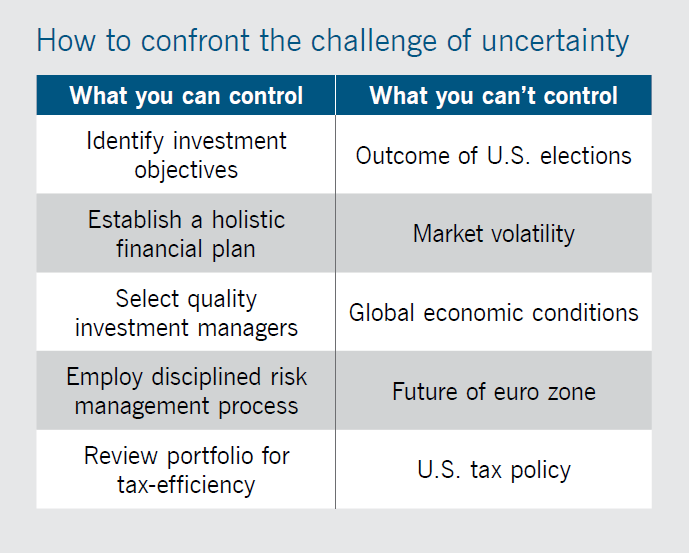

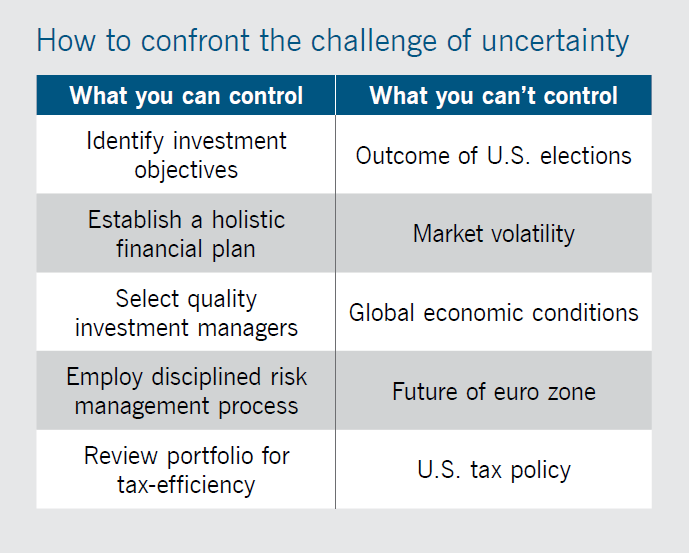

Serenity is in short supply in the investment community! Capital Group/American Funds recently posted a fantastic commentary on uncertainty, pointing out that investors are much better off if they focus on what they can control and don’t sweat the other stuff. Here are some excerpts that struck me—but you should really read the whole thing.

Powerless. That’s how a lot of investors feel. In a recent Gallup poll, 57% of investors said they feel they have little or no control over their efforts to build and maintain their retirement savings. What’s causing them to feel so lost? According to 70% of those polled, the most important factor affecting the investment climate is something they can’t control, the federal budget deficit.

On the flip side, among investors with a written financial plan having specific goals or targets, the poll showed 80% of nonretirees and 88% of retirees said their plan gives them the confidence to achieve their financial goals. It seems like some investors have figured out what they can control and what they can’t.

Life for investors would be simpler if there were a handy timetable by which these issues would be resolved in a quick and orderly fashion. But successful investors know they can’t control the outcome of the euro-zone summits or American fiscal debates, much less plug politics into a spreadsheet.

They can, however, review their goals, manage risk, be mindful of valuation and yield and remember that diversification may matter now more than ever. It’s easy to overlook in such a challenging environment, but unsettled times can also offer opportunities for long-term investors. In the midst of uncertainty, there are companies with strong balance sheets, smart management and innovative products that continue to thrive, and whose shares may be attractively valued.

All true! We’ve written before about what an important investment attribute patience is. Maybe in some important way, serenity contributes to patience. It’s hard to be patient when you’re worried about everything, especially things you have no control over! They even include a handy-dandy graphic with suggested responses to all of those things disturbing your serenity.

Source: American Funds Distributors (click on image to enlarge)

At some level, perhaps we are all control freaks. Unfortunately for us, in a relationship with the market, it’s the market that is in control! We can’t control market events, but we can control our responses to those events. Finding healthy ways to manage market anxiety is a primary focus for every successful investor.

Leave a Comment » |

Leave a Comment » |  From the MM, Investor Behavior, Markets, Thought Process | Tagged: decision-making, investor behavior, patience, serenity |

From the MM, Investor Behavior, Markets, Thought Process | Tagged: decision-making, investor behavior, patience, serenity |  Permalink

Permalink

Posted by:

Mike Moody

October 5, 2012

More money has been lost reaching for yield than at the point of a gun—Raymond Devoe

According to a recent article in the Wall Street Journal, desperate investors are reaching for yield, this time in the high-yield bond market. The less-polite name for these securities is junk bonds. Why do investors love them so? Well, they pay out fat yields—but, of course, they come with commensurate risks. And there are already warning signs in the market.

So much money has flooded into the junk-bond market from yield-hungry investors that weaker and weaker companies are able to sell bonds [they say]. Credit ratings of many borrowers are lower and debt levels are higher, making defaults more likely. And with yields near record lows, they add, investors aren’t being compensated for that risk.

Also worrying money managers is that some new sales have similar hallmarks to those that preceded the financial crisis in 2008. Petco Animal Supplies Inc. and Emergency Medical Services Corp. recently offered to sell bonds that let them pay interest in the form of more bonds, instead of cash, a common provision before the crisis.

Skeptics note that now weaker companies are the ones borrowing. The portion of new bonds sold by high-yield companies with credit ratings of double-B and above shrank last month to 20% from an average of 30% for the year.

After three years of financial improvement, high-yield companies are now weakening by some measures. Total debt for all high-yield companies rose 7.2% in the 12 months through June—the largest rise since 2008—while cash on their balance sheet fell 2.3%, according to research by Morgan Stanley. S&P downgraded 45% more companies than it upgraded in 2012, reversing the trend of 2010 and 2011. And companies are offering investors fewer protections than usual.

Now, this is just supply and demand at work. Investors want yield and companies are happy to oblige them, especially if they are willing to buy really junky securities.

The problem is that, from time to time, investors forget that investing is about total return, not just yield. An 8% yield with a 20% capital loss still puts you in the hole. Likewise, buying a stock that appreciates 20% but that does not pay a dividend still puts you way ahead of the game. When you go to the store to buy groceries, the store owner does not care if the money comes from labor, dividends, interest, or capital gains.

Money is money, however you make it. You’re probably better off—and safer—with a healthy total return from a well-diversified portfolio than you are reaching for yield.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets, Thought Process | Tagged: diversification, high-yield bonds, investor behavior, junk bonds, total return, yield |

Investor Behavior, Markets, Thought Process | Tagged: diversification, high-yield bonds, investor behavior, junk bonds, total return, yield |  Permalink

Permalink

Posted by:

Mike Moody

October 1, 2012

[NYC] cabbies drive in much the way that people typically manage portfolios – alternately “putting pedal to the medal” and slamming on the brakes.—-Bob Seawright, CIO Madison Avenue Securities

I laughed when I read this, thinking back to a NYC cab ride to JFK to catch an ill-fated flight back to Los Angeles. One of our portfolio managers, John Lewis, was in the cab with me and I thought he was either going to yak out his window or club the cabbie with his briefcase. Let’s just say that the cabdriver made full use of both the accelerator and brake pedals.

Is it any wonder investors have a tough time making money when they can’t discipline themselves to coast occasionally?

It’s important to make portfolio changes when necessary—and equally important to know when to leave things alone. As investment professionals, we spend our careers trying to learn the difference.

2 Comments |

2 Comments |  Investor Behavior, Just for Fun | Tagged: investor behavior, patience, portfolio management |

Investor Behavior, Just for Fun | Tagged: investor behavior, patience, portfolio management |  Permalink

Permalink

Posted by:

Mike Moody

September 21, 2012

It’s no secret that investors have had a fairly negative outlook toward the stock market lately. Their negative perception shows up both in flow of funds data and in our own advisor survey of investor sentiment.

One possible—and shocking—reason for the negative sentiment may be that the public thinks the stock market has been going down!

Investment News profiled recent research done by Franklin Templeton Funds. Here is the appropriate clip, which is just stunning to me:

One surprising finding shows that investors are likely so consumed by the negative economic news, including high unemployment and the weak housing market, that they haven’t even noticed the strength of the stock market.

For example, when 1,000 investors were asked whether they thought the S&P was up or down during each of the past three years, 66% thought it was down in 2009, 48% thought it was down in 2010, and 53% thought it was down last year.

In fact, the S&P gained 26.5% in 2009, 15.1% in 2010, and 2.1% last year.

That blows me away. I have never seen a clearer case of the distinction between perception and reality. This data shows clearly that many investors act on their perceptions—that the market has been declining for years—not the reality, which has been a choppy but steadily rising market.

The stock market is ahead again year-to-date and money is continuing to flow out of equity mutual funds. I understand that the market is scary sometimes and difficult always, but really? It amazes me that so many investors think the stock market has been dropping when it has actually been going up. Of course, perhaps investors’ aggregate investment decisions are more understandable when it becomes clear that only a minority of them are in touch with reality!

Advisors obviously have a lot of work to do with anxious clients. The stock market historically has been one of the best growth vehicles for investors, but it won’t do them any good if they choose to stay away. Some of the investor anxiety might be lessened if advisors stick with a systematic investment process using relative strength—and least that way, the client is assured that money will only be moved toward the strongest assets. If stocks really do have a long bear market, as is the current perception, clients may be somewhat shielded from it.

3 Comments |

3 Comments |  Investor Behavior, Markets, Sentiment, Thought Process | Tagged: equities, financial advisor, investor behavior, investor sentiment, stock market |

Investor Behavior, Markets, Sentiment, Thought Process | Tagged: equities, financial advisor, investor behavior, investor sentiment, stock market |  Permalink

Permalink

Posted by:

Mike Moody

September 20, 2012

Indeed, why is trading so hard? Adam Grimes of Waverly Advisors addresses exactly this issue in blog post. This is one of the most articulate expositions of the problems investors face with their own behavior that I have ever read.

What is it about markets that encourages people to do exactly the wrong thing at the wrong time, and why do many of the behaviors that serve us so well in other situations actually work against us in the market?

Part of the answer lies in the nature of the market itself. What we call “the market” is actually the end result of the interactions of thousands of traders across the gamut of size, holding period, and intent. Each trader is constantly trying to gain an advantage over the others; market behavior is the sum of all of this activity, reflecting both the rational analysis and the psychological reactions of all participants. This creates an environment that has basically evolved to encourage individual traders to make mistakes. That is an important point—the market is essentially designed to cause traders to do the wrong thing at the wrong time. The market turns our cognitive tools and psychological quirks against us, making us our own enemy in the marketplace. It is not so much that the market is against us; it is that the market sets us against ourselves.

I added the bold. This is just great writing, and powerful because it is true. Really competent people who are fantastic about making life decisions often have a rough time trading in the market, for just the reason Mr. Grimes’ points out.

He comes to the same solution that we have come to: a systematic investment process that can be implemented rigorously. There’s no shortage of robust return factors that offer potential outperformance—the trick is always implementing them in a disciplined way.

1 Comment |

1 Comment |  Investor Behavior, Markets, Thought Process | Tagged: behavioral finance, decision-making, investor behavior |

Investor Behavior, Markets, Thought Process | Tagged: behavioral finance, decision-making, investor behavior |  Permalink

Permalink

Posted by:

Mike Moody