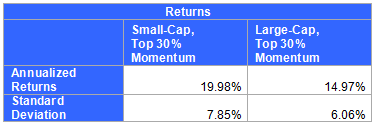

We’ve just released a small-cap ETF with PowerShares (DWAS), which is the first U.S. relative strength small-cap ETF. We’ve done our own testing, of course, but it might also be instructive to take a look at other small-cap relative strength returns. Once again, we used the Ken French data library to calculate annualized returns and standard deviation. The construction of their relative strength index is explained here. The difference this time around is that we used small-cap stocks instead of large-cap stocks. Generally speaking, a small-cap stock is one whose price times number of outstanding shares (market capitalization) is between $300 million and $2 billion. However, the Ken French data used also includes micro-cap stocks which have an even smaller market capitalization (typically between $50-$300 million). Market cap is above $10 billion for large-cap stocks.

In the past, small-cap stocks have yielded high returns. They often perform well because companies in early stages of development have large growth potential. However, the potential of high earnings also comes with high risk. Small-cap companies face limited reserves, which make them more vulnerable than larger ones. Furthermore, in order to grow, they need to be able to replicate their business model on a bigger scale.

This is the sort of tradeoff investors must think about when choosing how to structure their portfolio. Typical factor models suggest that there are excess returns to be had in areas like value, relative strength, and small-cap, often at the cost of a little extra volatility. If you’re willing to take on more risk for the chance of higher returns, a portfolio that combines relative strength with small-cap stocks might be a good place to look!