Thanks to the large amount of stock data available nowadays, we are able to compare the success of different strategies over very long time periods. The table below shows the performance of two investment strategies, relative strength (RS) and value, in relation to the performance of the market as a whole (CRSP) as well as to one another. It is organized in rolling return periods, showing the annualized average return for periods ranging from 1-10 years, using data all the way back to 1927.

The relative strength and value data came from the Ken French data library. The relative strength index is constructed monthly; it includes the top one-third of the universe in terms of relative strength. (Ken French uses the standard academic definition of price momentum, which is 12-month trailing return minus the front-month return.) The value index is constructed annually at the end of June. This time, the top one-third of stocks are chosen based on book value divided by market cap. In both cases, the universes were composed of stocks with market capitalizations above the market median.

Lastly, the CRSP database includes the total universe of stocks in the database as well as the risk-free rate, which is essentially the 3-month Treasury bill yield. The CRSP data serves as a benchmark representing the generic market return. It is also worthwhile to know that the S&P 500 and DJIA typically do worse than the CRSP total-market data, which makes CRSP a harder benchmark to beat.

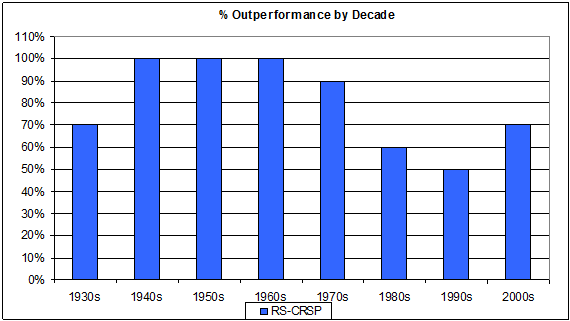

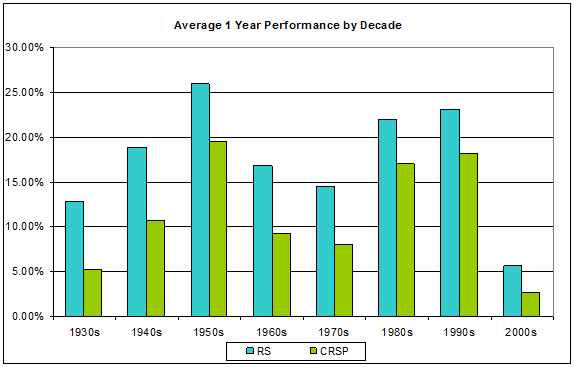

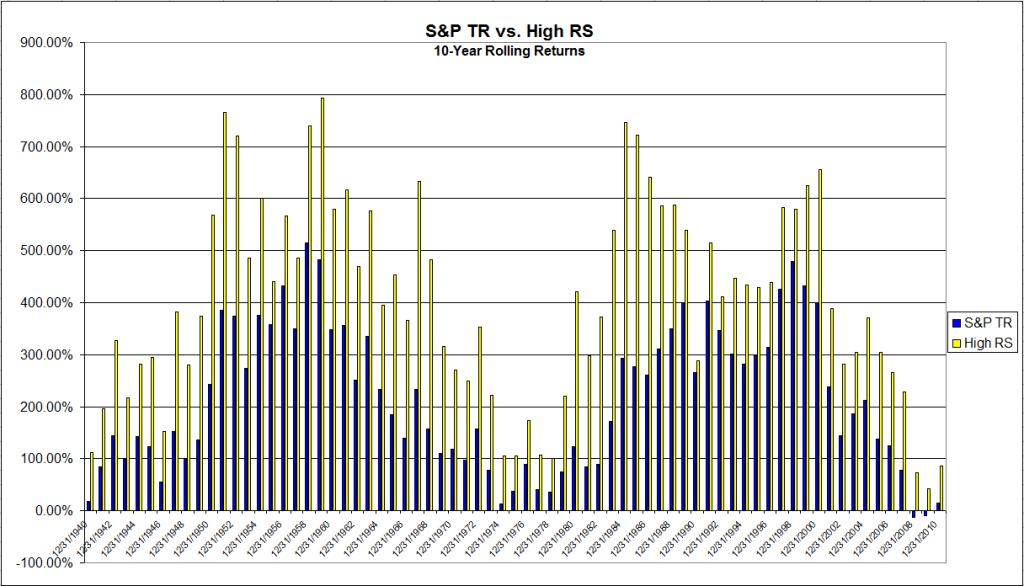

Source:Dorsey Wright Money Management

The data supports our belief that relative strength is an extremely effective strategy. In rolling 10-year periods since 1927, relative strength outperforms the CRSP universe 100% of the time. Even in 1-year periods it outperforms 78.6% of the time. As can be seen here, relative strength typically does better in longer periods. While it is obviously possible do poorly in an individual year, by continuing to implement a winning strategy time and time again, the more frequent and/or larger successful years outweigh the bad ones.

Even more importantly, relative strength typically outperforms value investment. Relative strength defeats value in over 57% of periods of all sizes, doing the best in 10-year periods with 69.3% of trials outperforming. While relative strength and value investment strategies have historically both generally beat the market, relative strength has been more consistent in doing so.