Hiring and firing money managers is a tricky business. Institutions do it poorly (see background post here ), and retail investors do it horribly (see article on DALBAR ). Why is it so difficult?

This white paper on manager selection from Intech/Janus goes into the mathematics of manager selection. Very quickly it becomes clear why it is so hard to do well.

Many investors believe that a ten-year performance record for a group of managers is sufficiently long to make it easy to spot the good managers. In fact, it is unlikely that the good managers will stand out. Posit a good manager whose true average relative return is 200 basis points (bps) annually and true tracking error (standard deviation of relative return) is 800 bps annually. This manager’s information ratio is 0.25. To put this in perspective, an information ratio of 0.25 typically puts a manager near or into the top quartile of managers in popular manager universes.

Posit twenty bad managers with true average relative returns of 0 bps annually, true tracking error of 1000 bps annually, hence an information ratio of 0.00.

There is a dramatic difference between the good manager and the bad managers.

The probability that the good manager beats all twenty bad managers over a ten-year period is only about 9.6%. This implies that chasing performance leaves the investor with the good manager only about 9.6% of the time and with a bad manager about 90.4% of the time.

In other words, 90% of the time the manager with the top 10-year track record in the group will be a bad manager! Maybe a longer track record would help?

A practical approach is to ask how long a historical performance record is necessary to be 75% sure that the good manager will beat all the bad managers, i.e., have the highest historical relative return. Assuming the same good manager as before and twenty of the same bad managers as before, a 157 year historical performance record is required to achieve a 75% probability that the good manager will beat all the bad managers.

It turns out that it would help, but since none of the manager databases have 150-year track records, in practice it is useless. The required disclaimer that past performance is no guarantee of future results turns out to be true.

There is still an important practical problem to be solved here. Assuming that bad managers outnumber good ones and assuming that we don’t have 150 years to wait around for better odds, how can we increase our probability of identifying one of the good money managers?

The researchers show mathematically how combining an examination of the investment process with historical returns makes the decision much simpler. If the investor can make a reasonable assumption about a manager’s investment process leading to outperformance, the math is straightforward and can be done using Bayes’ Theorem to combine probabilities.

…the answer changes based on the investor’s assessment of the a priori credibility of the manager’s investment process.

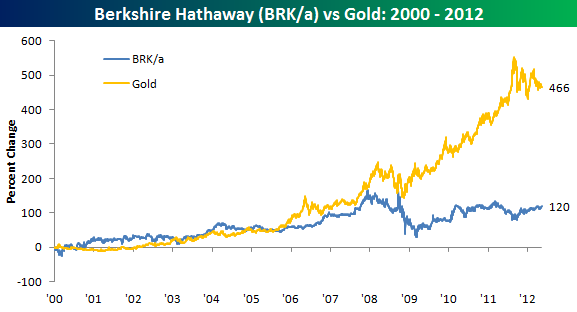

It turns out that the big swing factor in the answer is the credibility of the underlying investment process. What are the odds that an investment process using Fibonacci retracements and phases of the moon will generate outperformance over time? What are the odds that relative strength or deep value will generate outperformance over time?

The research paper concludes with the following words of wisdom:

A careful examination of almost any investor’s investment manager hiring and firing process is likely to reveal that there is a substantial component of performance chasing. Sometimes it is obvious, e.g., when there is a policy of firing a manager if he has negative performance after three years. Other times it is subtle, e.g., when the initial phase of the manager search process strongly weights attractive historical performance. No matter the form that performance chasing takes, it tends to produce future relative returns that are disappointing compared to expectations.

Historical performance alone is not an effective basis for identifying a good manager among a group of bad managers. This does not mean that historical performance is useless. Rather, it means that it must be combined efficiently with other information. The correct use of historical performance relegates it to a secondary role. The primary focus in manager choice should be an analysis of the investment process. [emphasis added]

This research paper is eye-opening in several respects.

1) It shows pretty clearly that historical performance alone–despite what our intuition tells us–is not sufficient to select managers. This probably accounts for a great deal of the poor manager selection, the subsequent disappointment, and rapid manager turnover that goes on.

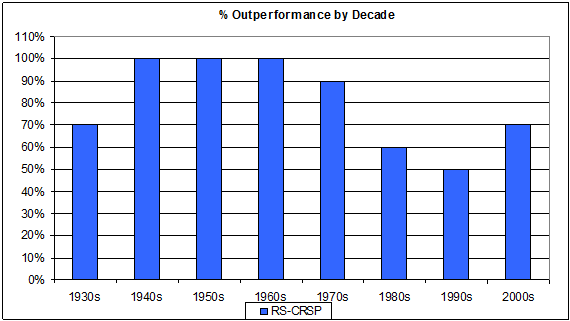

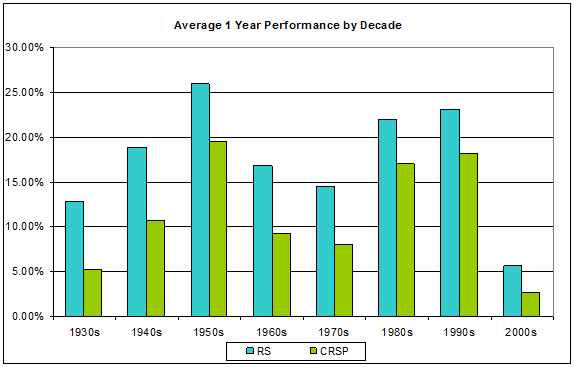

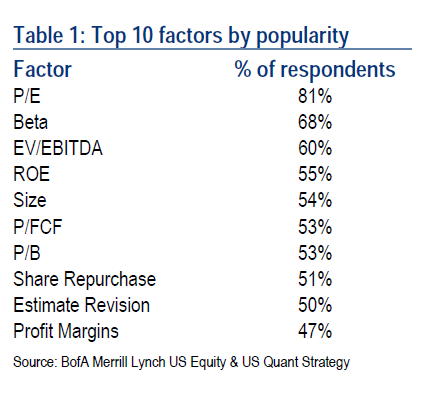

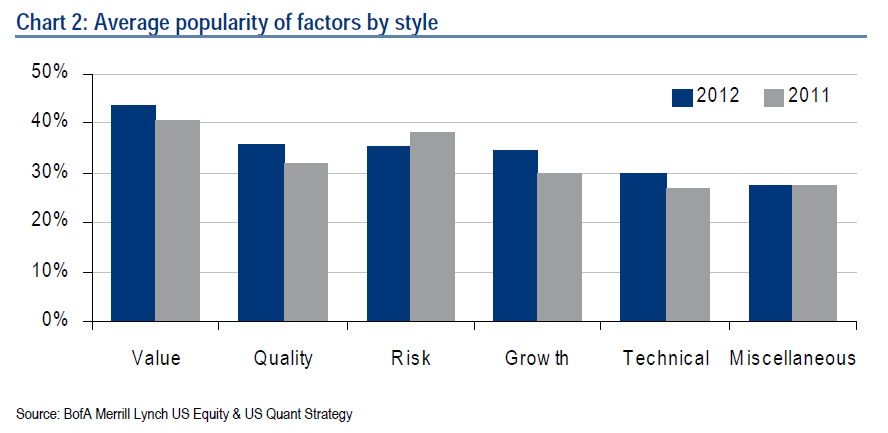

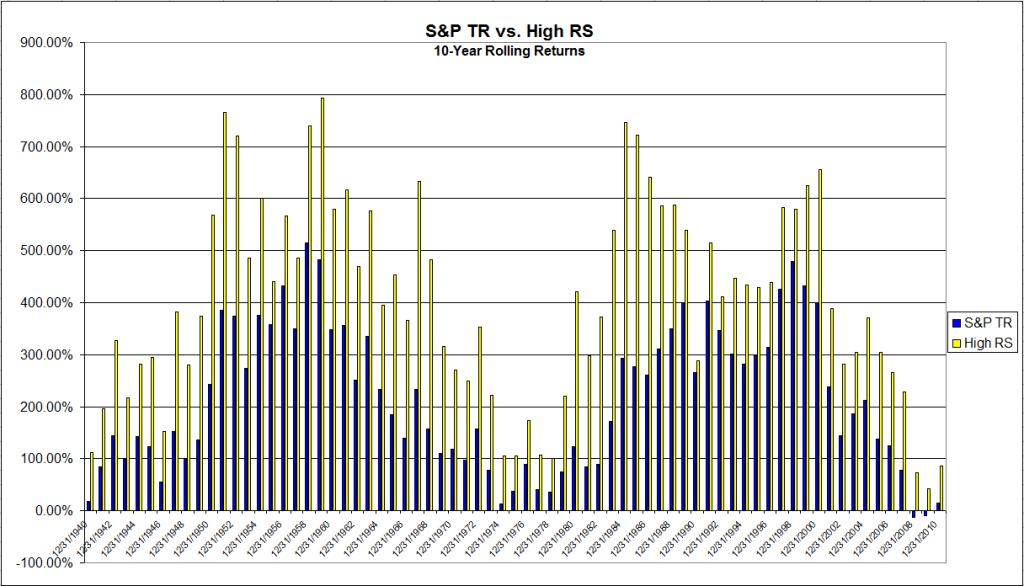

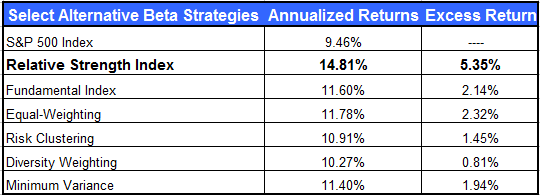

2) It is very clear from the math that only credible investment processes are likely to generate long-term outperformance. Fortunately, lots of substantive academic and practitioner research has been done on factor analysis leading to outperformance. The only two broadly robust factors discovered so far have been relative strength and value, both in various formulations–and, obviously, they have to be implemented in a disciplined and systematic fashion. If your investment process is based on something else, there’s a decent chance you’re going to be disappointed.

3) Significant time is required for the best managers to stand out from the much larger pack of mediocre managers.

This is a demanding process for consultants and clients. They have to willfully reduce their focus on even 10-year track records, limit their selection to rigorous managers using proven factors for outperformance, and then exercise a great deal of patience to allow enough time for the cream to rise to the top. The rewards for doing so, however, might be quite large–especially since almost all of your competition will ignore the correct process and and simply chase performance.

—-this article originally appeared 1/28/2010. I have seen no evidence since then that most consultants have improved their manager selection process, which is a shame.