It all depends on who you ask. Apologists for MPT will say that diversification worked, but that it just didn’t work very well last go round. That’s a judgment call, I suppose. Correlations between assets are notoriously unstable and nearly went to 1.0 during the last decline, but not quite. So I guess you could say that diversification “worked,” although it certainly didn’t deliver the kind of results that investors were expecting.

Now even Ibbotson Associates is saying that certain aspects of modern portfolio theory are flawed, in particular using standard deviation as a measurement of risk. In a recent Morningstar interview, Peng Chen, the president of Ibbotsen Associates, addresses the problem.

It’s one thing to say modern portfolio theory, the principle, remained to work. It’s another thing to examine the measures. So when we started looking at the measures, we realized, and this has been documented by many academics and practitioners, we also realized that one of the traditional measures in modern portfolio theory, in particular on the risk side, standard deviation, does not work very well to measure and present the tail risks in the return distribution.

Meaning that, when you have really, really bad market outcomes, modern portfolio theory purely using standard deviation underestimates the probability and severity of those tail risks, especially in short frequency time periods, such as monthly or quarterly.

Leaving aside the issue of how the theory could work if the components do not, this is a pretty surprising admission. Ibbotson is finally getting around to dealing with the “fat tails” problem. It’s a known problem but it makes the math much less tractable. Essentially, however, Mr. Chen is arguing that market risk is actually much higher than modern portfolio theory would have you believe.

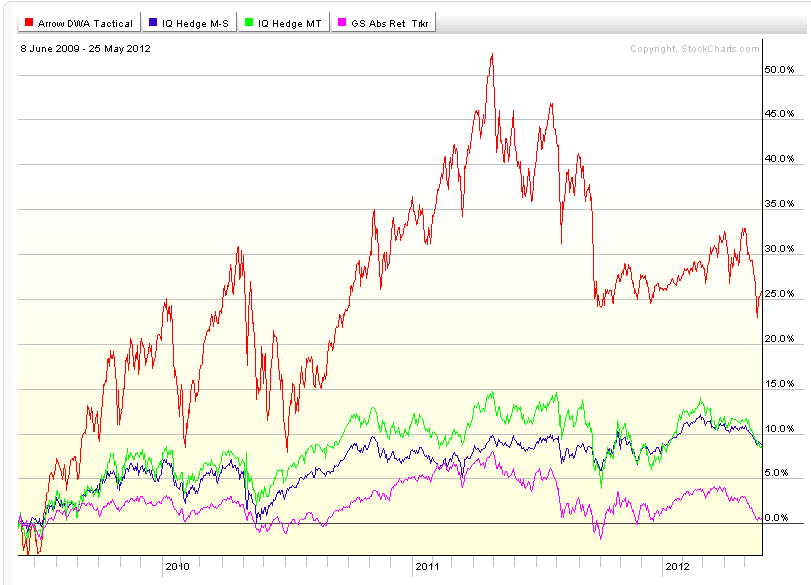

In my view, the debate about modern portfolio theory is pretty much done. Stick a fork in it. Rather than grasping about for a new theory, why not look at tactical asset allocation, which has been in plain view the entire time?

Tactical asset allocation, when executed systematically, can generate good returns and acceptable volatility without regard to any of the tenets of modern portfolio theory. It does not require standard deviation as the measure of risk, and it makes no assumptions regarding the correlations between assets. Instead it makes realistic assumptions: some assets will perform better than others, and you ought to consider owning the good assets and ditching the bad ones. It’s the ultimate pragmatic solution.

—-this article originally appeared 1/21/2010. As we gain distance from the 2008 meltdown, investors are beginning to forget how badly their optimized portfolios performed and are beginning to climb back on the MPT bandwagon. Combining uncorrelated strategies always makes for a better portfolio, but the problem of understated risk remains. The tails are still fat. Let’s hope that we don’t get another chance to experience fat tails with the Eurozone crisis. Tactical asset allocation, I think, may still be the most viable solution to the problem.