September 26, 2012

Exchange traded funds comprise of groups of assets that are traded on the stock exchange. Similarly to mutual funds, ETFs track a basket of securities. This makes them more diversified than a single stock. Yet like stocks, they are easily traded, can be sold short, and often have lower transaction costs than mutual funds. ETFs tend to perform best under a buy-and-hold approach, but has the ease at which they trade caused investors to trade them more? Vanguard set out to answer this question.

They looked at “3.2 million transactions in more than 500,000 positions held in the mutual fund and ETF share classes of four different Vanguard funds from 2007-2011.” While ETFs were traded more often, mutual funds and exchange traded funds still had similar trading patterns.

Some in the investment community have suggested that ETFs tempt investors to increase their trading activity. Given the lack of investor-level analysis supporting or refuting this presumption, we examined the trading behavior of Vanguard investors. We found that, contrary to speculations in the popular media, most investments are held in a prudent, buy-and-hold manner, regardless of share class. Although behavior in ETFs is more active than behavior in traditional mutual funds, some of that difference is simply due to the fact that investors who are inclined to trade choose ETFs, not that investors who choose ETFs are induced to trade. We conclude that the ETF “temptation effect” is not a significant reason for long-term individual investors to avoid using appropriate ETF investments as part of a diversified investment portfolio.

In short, it is investors themselves that are responsible for increased trading of ETFs, not an inherent quality of the funds. Owning exchange traded funds won’t lure a long-term owner toward short-term trading.

6 Comments |

6 Comments |  Investor Behavior, Markets | Tagged: etf, mutual fund, trade, trend |

Investor Behavior, Markets | Tagged: etf, mutual fund, trade, trend |  Permalink

Permalink

Posted by:

Amanda Schaible

September 21, 2012

It’s no secret that investors have had a fairly negative outlook toward the stock market lately. Their negative perception shows up both in flow of funds data and in our own advisor survey of investor sentiment.

One possible—and shocking—reason for the negative sentiment may be that the public thinks the stock market has been going down!

Investment News profiled recent research done by Franklin Templeton Funds. Here is the appropriate clip, which is just stunning to me:

One surprising finding shows that investors are likely so consumed by the negative economic news, including high unemployment and the weak housing market, that they haven’t even noticed the strength of the stock market.

For example, when 1,000 investors were asked whether they thought the S&P was up or down during each of the past three years, 66% thought it was down in 2009, 48% thought it was down in 2010, and 53% thought it was down last year.

In fact, the S&P gained 26.5% in 2009, 15.1% in 2010, and 2.1% last year.

That blows me away. I have never seen a clearer case of the distinction between perception and reality. This data shows clearly that many investors act on their perceptions—that the market has been declining for years—not the reality, which has been a choppy but steadily rising market.

The stock market is ahead again year-to-date and money is continuing to flow out of equity mutual funds. I understand that the market is scary sometimes and difficult always, but really? It amazes me that so many investors think the stock market has been dropping when it has actually been going up. Of course, perhaps investors’ aggregate investment decisions are more understandable when it becomes clear that only a minority of them are in touch with reality!

Advisors obviously have a lot of work to do with anxious clients. The stock market historically has been one of the best growth vehicles for investors, but it won’t do them any good if they choose to stay away. Some of the investor anxiety might be lessened if advisors stick with a systematic investment process using relative strength—and least that way, the client is assured that money will only be moved toward the strongest assets. If stocks really do have a long bear market, as is the current perception, clients may be somewhat shielded from it.

3 Comments |

3 Comments |  Investor Behavior, Markets, Sentiment, Thought Process | Tagged: equities, financial advisor, investor behavior, investor sentiment, stock market |

Investor Behavior, Markets, Sentiment, Thought Process | Tagged: equities, financial advisor, investor behavior, investor sentiment, stock market |  Permalink

Permalink

Posted by:

Mike Moody

September 20, 2012

The Investment Company Institute is the national association of U.S. investment companies, including mutual funds, closed-end funds, exchange-traded funds (ETFs), and unit investment trusts (UITs). Flow estimates are derived from data collected covering more than 95 percent of industry assets and are adjusted to represent industry totals.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets |

Investor Behavior, Markets |  Permalink

Permalink

Posted by:

JP Lee

September 20, 2012

Indeed, why is trading so hard? Adam Grimes of Waverly Advisors addresses exactly this issue in blog post. This is one of the most articulate expositions of the problems investors face with their own behavior that I have ever read.

What is it about markets that encourages people to do exactly the wrong thing at the wrong time, and why do many of the behaviors that serve us so well in other situations actually work against us in the market?

Part of the answer lies in the nature of the market itself. What we call “the market” is actually the end result of the interactions of thousands of traders across the gamut of size, holding period, and intent. Each trader is constantly trying to gain an advantage over the others; market behavior is the sum of all of this activity, reflecting both the rational analysis and the psychological reactions of all participants. This creates an environment that has basically evolved to encourage individual traders to make mistakes. That is an important point—the market is essentially designed to cause traders to do the wrong thing at the wrong time. The market turns our cognitive tools and psychological quirks against us, making us our own enemy in the marketplace. It is not so much that the market is against us; it is that the market sets us against ourselves.

I added the bold. This is just great writing, and powerful because it is true. Really competent people who are fantastic about making life decisions often have a rough time trading in the market, for just the reason Mr. Grimes’ points out.

He comes to the same solution that we have come to: a systematic investment process that can be implemented rigorously. There’s no shortage of robust return factors that offer potential outperformance—the trick is always implementing them in a disciplined way.

1 Comment |

1 Comment |  Investor Behavior, Markets, Thought Process | Tagged: behavioral finance, decision-making, investor behavior |

Investor Behavior, Markets, Thought Process | Tagged: behavioral finance, decision-making, investor behavior |  Permalink

Permalink

Posted by:

Mike Moody

September 14, 2012

Here we have the next round of the Dorsey, Wright Sentiment Survey, the first third-party sentiment poll. Participate to learn more about our Dorsey, Wright Polo Shirt raffle! Just follow the instructions after taking the poll, and we’ll enter you in the contest. Thanks to all our participants from last round.

As you know, when individuals self-report, they are always taller and more beautiful than when outside observers report their perceptions! Instead of asking individual investors to self-report whether they are bullish or bearish, we’d like financial advisors to weigh in and report on the actual behavior of clients. It’s two simple questions and will take no more than 20 seconds of your time. We’ll construct indicators from the data and report the results regularly on our blog–but we need your help to get a large statistical sample!

Click here to take Dorsey, Wright’s Client Sentiment Survey.

Contribute to the greater good! It’s painless, we promise.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets, Sentiment |

Investor Behavior, Markets, Sentiment |  Permalink

Permalink

Posted by:

JP Lee

September 12, 2012

Why, you may ask, am I writing about investor sentiment from July now that it is mid-September? I think it’s often a useful exercise to look back at the primary sources—the historical data—as my US history teacher used to point out. We all have a way of mis-remembering history. We modify it to fit the present, so that whatever happened seems inevitable. The future, of course, is always uncertain.

Investor sentiment is a peculiar form of history because it generally works in contrary fashion. Studies show that when investors are most bullish, the market tends to go down. And when investors are bearish, the market perversely tends to go up.

July was just such a period. Consider, for example, a CNBC article on the weekly sentiment poll conducted by the American Association of Individual Investors (AAII):

Main Street bulls are fast becoming an endangered species.

Despite the fact that the broad U.S. stock market is up 8.4 percent in 2012, only 22 percent of mom-and-pop investors said they were bullish, the American Association of Individual Investors found in its latest weekly poll.

That’s the lowest sentiment reading since summer 2010, when markets were careening lower in the face of the first post-recession global growth scare and the emergence of Europe’s debt crisis.

But to drive home just how pessimistic Main Street investors have become in the face of a weak U.S. economy, slowing growth in China and continued uncertainty about Europe’s financial crisis, consider that:

• Bullishness now is more depressed than in the fall of 2008, when Wall Street titan Lehman Bros. declared bankruptcy, thrusting the financial crisis into a more dangerous phase.

• The percentage of bulls today is barely above the 18.9 percent on March 5, 2009, just four days before the bottom of the worst stock slide since the Great Depression.

I think it’s fair to say that investor sentiment was pretty negative in July.

So what’s happened since then? All of the bearish investors were not able to make the market go down. Instead, it has risen—the S&P 500 level has gone from about 1350 to 1435!

In fact, this is a typical outcome:

But all the negativity may turn out to be a positive: History shows that super-low sentiment readings tend to act as a contrarian signal. In other words, when everyone is worried, stocks tend to rally.

In fact, according to Bespoke, going back to November 2009, U.S. stocks have posted average gains of 5 percent — with gains 100 percent of the time — in the month after AAII’s sentiment poll showed bullish sentiment readings below 25 percent.

I added the bold to emphasize the cost of bad investor behavior. What if you had exited the market in July because you were bearish? About half of the gains year-to-date have occurred since then. Things always seem darkest before the dawn, but it’s important to resist bailing out when frightened. Better to structure your portfolio so that you can sit tight regardless of the current situation—or to cut back when things seem to be going exceptionally well. It’s tough to get the upside exit right, but it’s relatively easier to flag time periods marked by poor sentiment that are likely to be bad times to get out. If you stay the course, it could make a big positive difference to your returns.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Sentiment | Tagged: contrary opinion, investor behavior, investor sentiment, sentiment |

Investor Behavior, Sentiment | Tagged: contrary opinion, investor behavior, investor sentiment, sentiment |  Permalink

Permalink

Posted by:

Mike Moody

September 10, 2012

Younger investors may have learned the wrong lesson from the past decade. From Bridgeway’s annual report:

The following graph with data from the Investment Company Institute demonstrates a phenomenon we hear about frequently:

Investors are more risk-averse than they were a decade ago. What is most surprising to us at Bridgeway, however, is the breakdown by age: elderly investors have not significantly changed their appetite for risk, while younger investors’ risk appetite has plummeted — to the point that it is slightly lower than that of the baby boomer generation. This seems upside down. Financial advisors typically preach that younger investors can afford to take on more risk and should do so. Something to ponder.

6 Comments |

6 Comments |  Investor Behavior |

Investor Behavior |  Permalink

Permalink

Posted by:

Andy Hyer

September 7, 2012

Lots of studies of investor behavior show that one of the big things that undermines investor returns is emotional behavior. Most often investors are better off constructing an intelligently diversified portfolio and then sticking with the strategy through thick and thin. Inaction is never a popular tactic, especially when things are rocky. Clients usually expect advisors to respond actively to changes in the market—even when those changes are just noise, rather than a fundamental change in the underlying trend.

A humorous view of this was recently expressed by John Bogle in an article at Marketwatch:

“What advisers have to do is respond to events. Activity is something investors expect,” Bogle told USA Today in an interview. “I was talking about buy and hold to some investment advisers, and one said, ‘I tell my investors to do this, and the next year, they ask what they should do, and I say, do nothing, and the third year, I say do nothing.’ The investor says, ‘Every year, you tell me to do nothing. What do I need you for?’ And I told them, ‘You need me to keep you from doing anything.‘”

I put the fun part in bold, although perhaps the correct phrasing is that the advisor is there to keep the client from doing anything stupid. This is noteworthy, because I rarely agree with John Bogle about anything!

I don’t agree with buy-and-hold or most of his other precepts, but he is right that good investing is sometimes as much about inaction as action. Pick a robust strategy like relative strength or value (or better yet, combine a couple of complementary strategies) and then stay the course. Whatever strategy you select will go in and out of favor from time to time, but you can’t let that throw you off your game. You’re much more likely to be rewarded by sticking with it.

With the right strategies, this sloth might make a good investor!

Source: 123rf.com

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets, Thought Process |

Investor Behavior, Markets, Thought Process |  Permalink

Permalink

Posted by:

Mike Moody

September 6, 2012

Uncertainty is usually problematic for investors. If the economy is clearly good or decidedly bad, it’s often easier to figure out what to do. I’d argue that investors typically overreact anyway, but they at least feel like they are justified in swinging for the fence or crawling into a bomb shelter. But when there is a lot of uncertainty and things are on the cusp—and could go either way—it’s tough to figure out what to do.

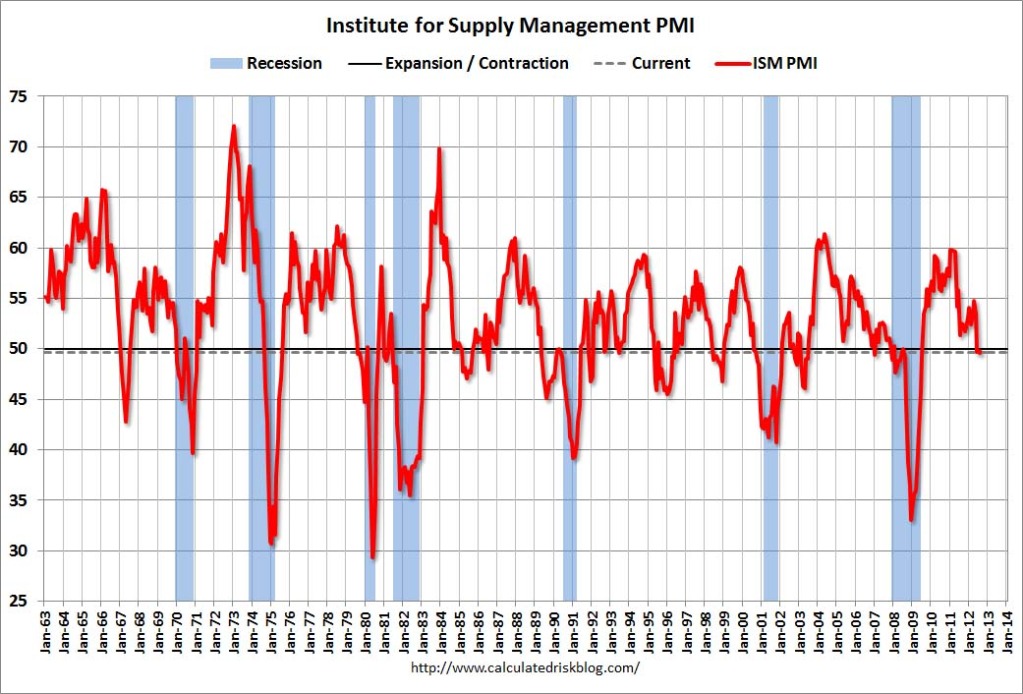

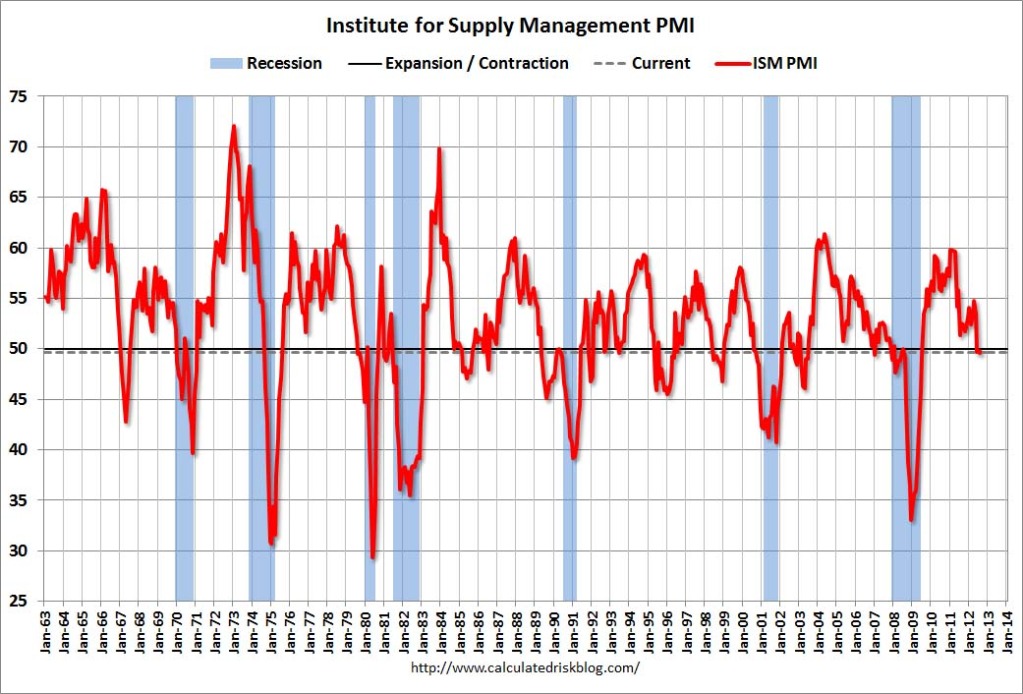

The chart below, from the wonderful Calculated Risk blog, demonstrates the point perfectly.

Source: Calculated Risk (click to enlarge)

You can see the problem. The Purchasing Managers’ Index is hovering right near the line that separates an expanding economy from a contracting one. There’s no slam dunk either way—there are numerous cases of the PMI dropping below 50 that didn’t result in a recession, but also a number that did have a nasty outcome.

So what’s an investor to do?

One possibility is an all-weather fund that has the ability to adapt to a wide variety of environments. The old-school version of this is the traditional 60/40 balanced fund. The idea was that the stocks would behave well when the economy was good and that the bonds would provide an offset when the economy was bad. There are a lot of 60/40 funds still around, largely because they’ve actually done a pretty reasonable job for investors.

The new-school version is the global tactical asset allocation fund. The flexibility inherent in a tactical fund allows it to tilt toward stocks when the market is doing well, or to tilt toward bonds if equities are having a rough go. Many funds also have the potential to invest across alternative asset classes like real estate, commodities, or foreign currencies.

For a client that is wary of the stock market—and that might include most clients these days—a balanced fund or a global tactical asset allocation fund might be just the way to get them to dip their toe in the water. They are going to need exposure to growth assets over the long run anyway and a flexible fund might make that necessary exposure more palatable.

Click here to visit ArrowFunds.com for a prospectus & disclosures. Click here for disclosures from Dorsey Wright Money Management.

2 Comments |

2 Comments |  Investor Behavior, Markets, Tactical Asset Alloc, Thought Process | Tagged: asset allocation, economic uncertainty, investor behavior, PMI, Tactical Asset Allocation |

Investor Behavior, Markets, Tactical Asset Alloc, Thought Process | Tagged: asset allocation, economic uncertainty, investor behavior, PMI, Tactical Asset Allocation |  Permalink

Permalink

Posted by:

Mike Moody

September 5, 2012

I noticed an article the other day in Financial Advisor magazine that discussed a study that was completed by Schwab Retirement Plan Services. The main thrust of the study was how more employers were encouraging 401k plan participation. More employers are providing matching funds, for example, and many employers have instituted automatic enrollment and automatic savings increases. These are all important, as we’ve discussed chronic under-saving here for a long time. All of these things together can go a long way toward a client’s successful retirement.

What really jumped out at me, though, was the following nugget buried in the text:

Schwab data also indicates that employees who use independent professional advice services inside their 401(k) plan have tended to save twice as much, were better diversified and stuck to their long-term plan, even in the most volatile market environments.

Wow! That really speaks to the value of a good professional advisor! It hits all of the bases for retirement success.

- boost your savings rate,

- construct a portfolio that is appropriately diversified by asset class and strategy, and

- stay the course.

If investors were easily able to do this on their own, there wouldn’t be any difference between self-directed accounts and accounts associated with a professional advisor. But there is a big difference—and it points out what a positive impact a good advisor can have on clients’ financial outcomes.

3 Comments |

3 Comments |  From the MM, Investor Behavior, Retirement/Saving | Tagged: 401k, diversification, financial advisor, investor, retirement, strategy |

From the MM, Investor Behavior, Retirement/Saving | Tagged: 401k, diversification, financial advisor, investor, retirement, strategy |  Permalink

Permalink

Posted by:

Mike Moody

September 4, 2012

This just in from Institutional Investor: many backtests fail in real life. They write:

Makers of indexes often fill in the blanks with historic data on the components to produce hypothetical index performance. But a recent Vanguard study found that a large percentage of these hypothetical, back-filled indexes that had outperformed the U.S. stock market didn’t keep up after they went live as the index returns subsequently fell. What may be happening, says senior Vanguard ETF strategist Joel Dickson, is that indexes are being developed by “rearview mirror investing,” that is, through selection bias of what worked well in the past. The result can mean a nasty surprise for investors.

Duh.

Pretty much anyone can do data mining with the computing power available on a desktop computer. And index providers will continue to do data mining as long as investors ram money into products with lousy backtests.

Back-filled index funds attract on average twice the cash flow in the initial launch phase than funds with new indexes that don’t have such data, indicating that the availability of a track record makes the fund more attractive — even if it probably won’t last.

Good backtesting can be very useful and can give investors a good idea of what to expect in the future. But how can an investor tell if the backtest is any good or not?

One thing to examine is how robust the index methodology is. For example, when we built our Systematic Relative Strength products, we subjected them to Monte Carlo testing for robustness. That made it apparent that the systematic investment method itself was sound, even though the range of outcomes on a quarterly or annual basis can be significant.

With the proliferation of indexes for ETFs, it’s becoming important to be able to evaluate how robust the backtesting was. Probably partly because of a robust backtesting process, our Technical Leaders Index has outperformed the market since inception. I’m sure many other indexes are thoughtfully constructed—but I’m just as sure that there are some that are not.

Do your homework before you put client money at risk.

See www.powershares.com for more information. Past performance is no guarantee of future returns. A list of all holding for the previous 12 months is available upon request.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets, Relative Strength Research | Tagged: backtesting, data mining, etf, monte carlo testing, PDP, relative strength, systematic investment process |

Investor Behavior, Markets, Relative Strength Research | Tagged: backtesting, data mining, etf, monte carlo testing, PDP, relative strength, systematic investment process |  Permalink

Permalink

Posted by:

Mike Moody

August 29, 2012

Chuck Jaffe wrote a nice article for Marketwatch, pointing out that fund investors are actually more intelligent than they are given credit for. It’s worth pointing out because nearly every change in the industry is greeted with skepticism by the pessimists. His article ends with a nice summary:

“The knee-jerk reaction to almost all of the advances we have seen has been ‘Oh my goodness, what is going to happen to the industry?’ and ‘Investors will blow themselves up with this,’” said Geoff Bobroff of Bobroff Consulting, a leading fund industry observer. “Surprise, surprise, the world hasn’t come to an end yet and, in fact, the fund world has gotten better for each of these developments.

“Joe Six-Pack is going to do exactly what he has always done,” Bobroff added. “He is not going to change, just because the technology exists for him to do something different. He will adapt, and over time become comfortable with the newer products and newer ways. That doesn’t mean he will always make money; the market won’t always work for Joe Six-Pack, but that won’t be because the fund industry is evolving, it will be because that’s just what the way the market is sometimes.”

The article addresses the concern expressed by many that investors will blow themselves up with ETFs because of their daily liquidity. (John Bogle has expressed this view frequently and loudly.) Mr. Jaffe pulls out some data from a Vanguard (!) study that shows, in fact, that’s not how investors are acting.

Over the years, we’ve heard the same refrain about tactical asset allocation: investors will never be able to get it right, they’ll blow themselves up chasing performance, etc., etc. In fact, tactical allocation funds have acquitted themselves quite nicely over the past few years in a very difficult market environment. For the most part, they’ve behaved pretty much as advertised—better than the worst asset classes, and not as well as the best asset classes—somewhere in the middle of the pack. That kind of consistency, over time, can lead to reasonable returns with moderate volatility.

Reasonable returns with moderate volatility is a laudable goal, which probably explains why hybrid funds have seen new assets this year, even as equity funds are seeing outflows.

In markets, pessimism is almost never the way to go. It’s more productive to be optimistic and to try to find investment strategies that will work for you over the long run.

6 Comments |

6 Comments |  Investor Behavior, Markets, Tactical Asset Alloc, Thought Process | Tagged: etf, innovation, investor behavior, stock market, Tactical Asset Allocation |

Investor Behavior, Markets, Tactical Asset Alloc, Thought Process | Tagged: etf, innovation, investor behavior, stock market, Tactical Asset Allocation |  Permalink

Permalink

Posted by:

Mike Moody

August 27, 2012

Our latest sentiment survey was open from 8/3/12 to 8/10/12. The Dorsey, Wright Polo Shirt Raffle continues to drive advisor participation, and we greatly appreciate your support! We will announce the winner next Monday! This round, we had 44 advisors participate in the survey. If you believe, as we do, that markets are driven by supply and demand, client behavior is important. We’re not asking what you think of the market—since most of our blog readers are financial advisors, we’re asking instead about the behavior of your clients. Then we’re aggregating responses exclusively for our readership. Your privacy will not be compromised in any way.

After the first 30 or so responses, the established pattern was simply magnified, so we are fairly comfortable about the statistical validity of our sample. Some statistical uncertainty this round comes from the fact that we only had four investors say that thier clients are more afraid of missing a stock upturn than being caught in a downdraft. Most of the responses were from the U.S., but we also had multiple advisors respond from at least two other countries. Let’s get down to an analysis of the data! Note: You can click on any of the charts to enlarge them.

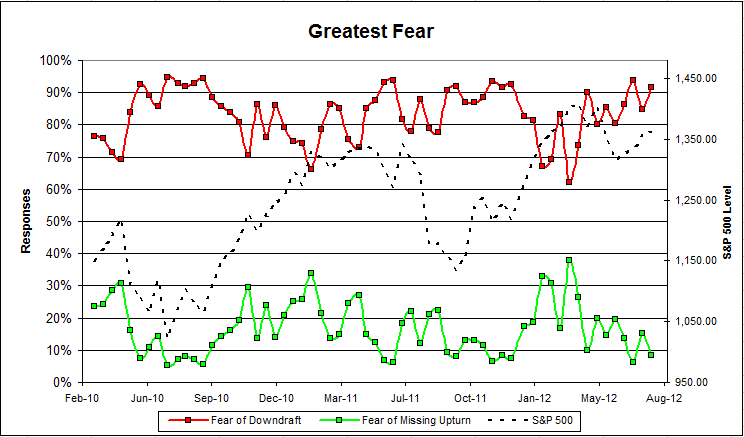

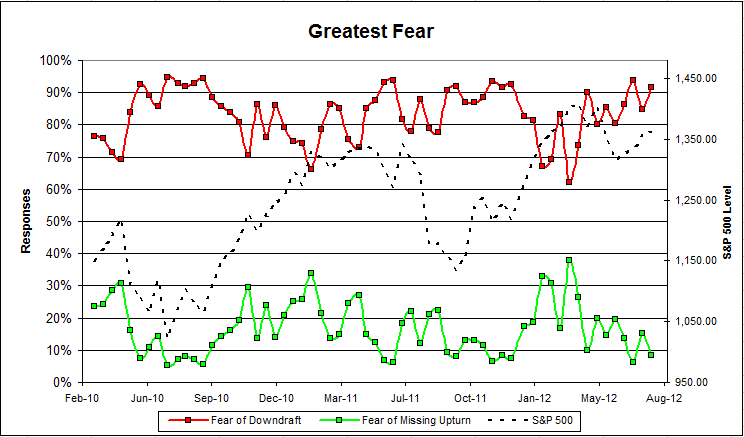

Question 1. Based on their behavior, are your clients currently more afraid of: a) getting caught in a stock market downdraft, or b) missing a stock market upturn?

Chart 1: Greatest Fear. From survey to survey, the S&P 500 rose by just under 4%, but the overall fear numbers did not perform as expected. The fear of downturn number rose from 76% to 79%, while the fear of upturn group fell from 24% to 21%.

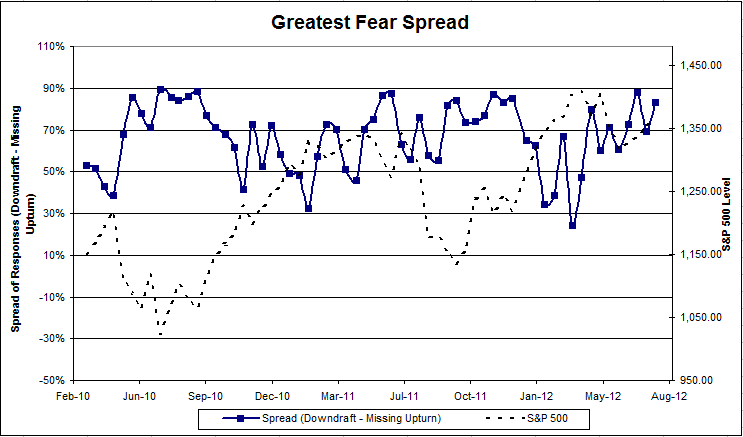

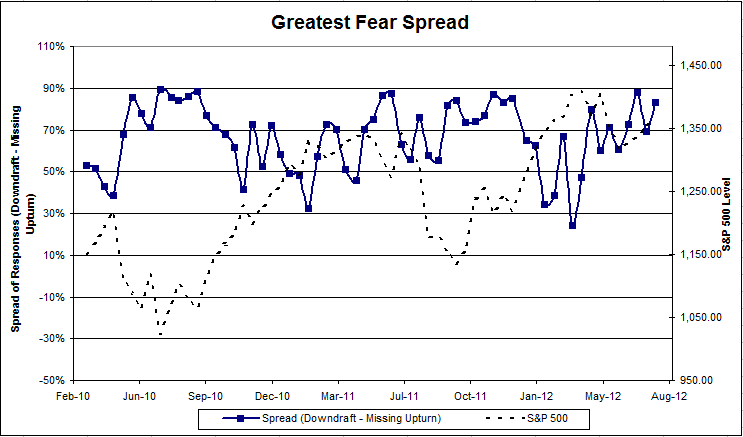

Chart 2: Greatest Fear Spread. Another way to look at this data is to examine the spread between the two groups. The spread rose slightly from 51% to 58%.

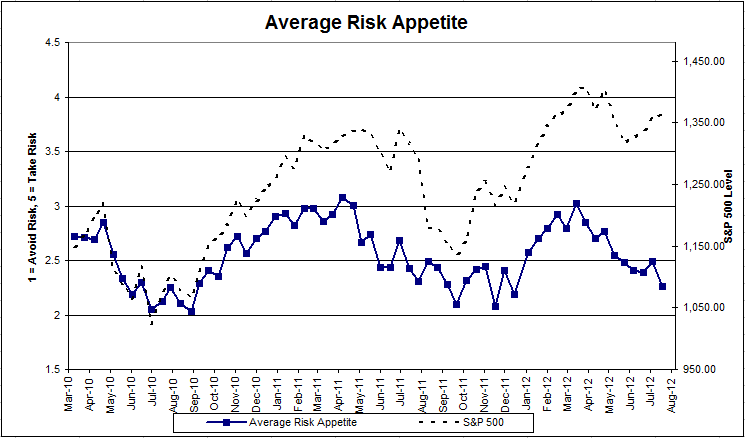

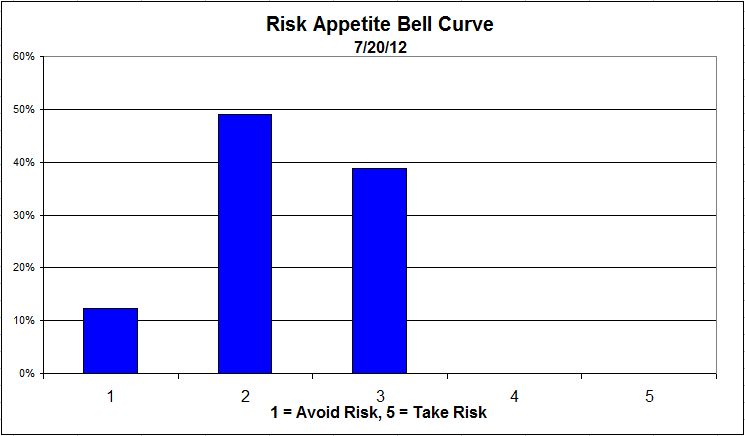

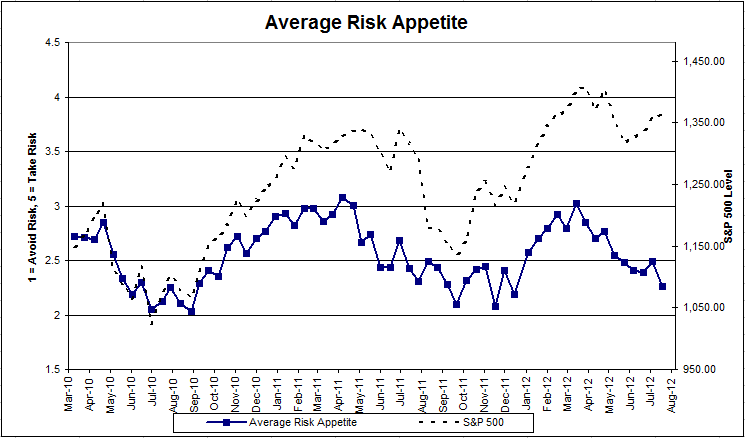

Question 2. Based on their behavior, how would you rate your clients’ current appetite for risk?

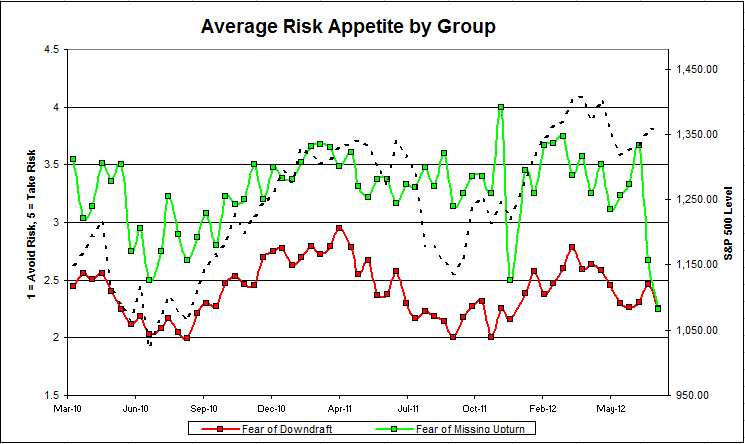

Chart 3: Average Risk Appetite. Unlike the overall fear numbers, overall risk appetite performed exactly as expected, in a big way. Overall risk appetite rose from 2.4 to 2.9, the highest we’ve seen since March 2012. We’ve noticed over time that this indicator performs as we’d expect it to.

Chart 4: Risk Appetite Bell Curve. This chart uses a bell curve to break out the percentage of respondents at each risk appetite level. This round, we saw a big shift towards more risk, and that is reflected in this bell curve. Currently, over 50% of all respondents would like a risk profile of 3 or higher.

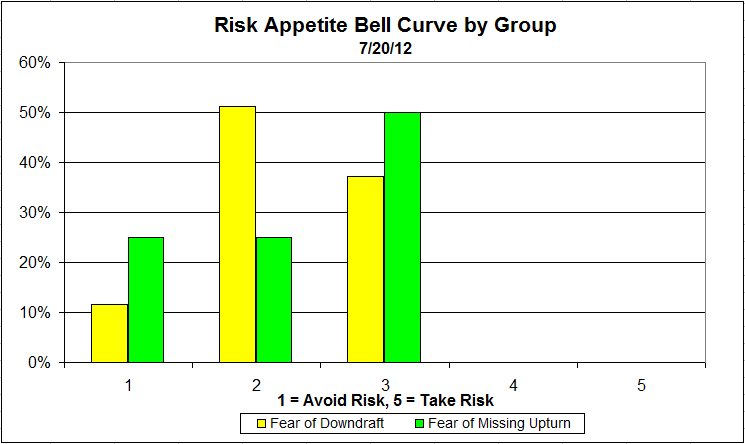

Chart 5: Risk appetite Bell Curve by Group. The next three charts use cross-sectional data. The chat plots the reported client risk appetite separately for the fear of downdraft and for the fear of missing upturn groups. This chart sorts out as expected, with the downturn group wanting less risk and the upturn group looking to add risk.

Chart 6: Average Risk Appetite by Group. The average risk appetite of both groups decreased this week, even as the market did well. Both groups want to add more risk relative to last survey.

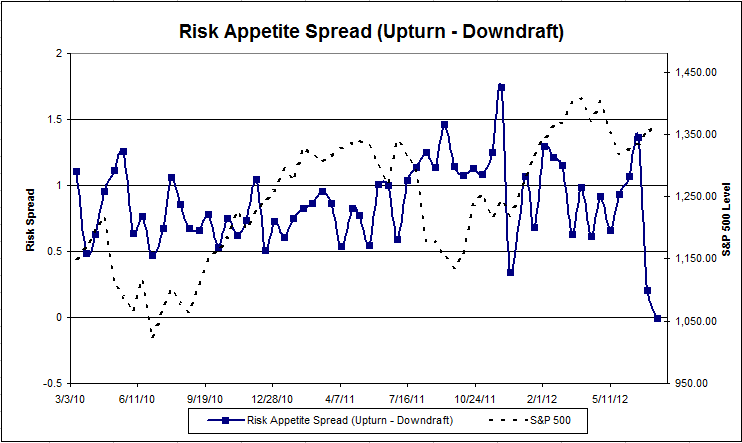

Chart 7: Risk Appetite Spread. This is a chart constructed from the data in Chart 6, where the average risk appetite of the downdraft group is subtracted from the average risk appetite of the missing upturn group. The spread is now back in its normal range.

The S&P 500 shot nearly 4% higher from survey to survey, and the risk appetite indicators responded in-kind. The overall fear numbers pulled back after a big move last round despite the strong market move. As usual, the overall risk appetite indicator maintained the most consistent relationship between market action and client sentiment.

No one can predict the future, as we all know, so instead of prognosticating, we will sit back and enjoy the ride. A rigorously tested, systematic investment process provides a great deal of comfort for clients during these types of fearful, highly uncertain market environments. Until next time, good trading and thank you for participating.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets, Sentiment |

Investor Behavior, Markets, Sentiment |  Permalink

Permalink

Posted by:

JP Lee

August 17, 2012

Here we have the next round of the Dorsey, Wright Sentiment Survey, the first third-party sentiment poll. Participate to learn more about our Dorsey, Wright Polo Shirt raffle! Just follow the instructions after taking the poll, and we’ll enter you in the contest. Thanks to all our participants from last round.

As you know, when individuals self-report, they are always taller and more beautiful than when outside observers report their perceptions! Instead of asking individual investors to self-report whether they are bullish or bearish, we’d like financial advisors to weigh in and report on the actual behavior of clients. It’s two simple questions and will take no more than 20 seconds of your time. We’ll construct indicators from the data and report the results regularly on our blog–but we need your help to get a large statistical sample!

Click here to take Dorsey, Wright’s Client Sentiment Survey.

Contribute to the greater good! It’s painless, we promise.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets, Sentiment |

Investor Behavior, Markets, Sentiment |  Permalink

Permalink

Posted by:

JP Lee

August 16, 2012

Let’s face it; investors often make bad investment decisions. Commonly, this is due to our emotions getting in the way. BlackRock lists some of the emotional investment tendencies that often cloud our judgment and steer us toward poor decisions:

- Anchoring: Holding onto a reference point, even if it’s irrelevant. For example, a $1.5 million house, being presented on its own, might sound expensive. But if you were first shown a $2 million house, and afterwards shown the $1.5 million house, it might then sound like a good deal.

- Herding: Following the crowd. People often pile into the markets when they are doing well and they see “everyone else” doing it.

- Mental Accounting: Separating money into buckets that are treated differently. Earmarking funds for college savings or a vacation home allows you to save for specific goals. But treating those dollars differently may not make sense when they all have the same buying power.

- Framing: Making a different decision based on context. In a research study, when a four-ounce glass had 2 ounces of water poured out of it, 69% of people said it was now “half empty.” If the same glass starts out empty and has 2 ounces of water poured into it, 88% of people say it is “half full.”

Emotional investment tendencies can result in all sorts of problems. Typically these behaviors are so ingrained that we don’t even recognize them as irrational!

One way to combat our emotions is to hire a good advisor. As explained in this previous blog post, one important benefit—maybe even the primary benefit—of having a good advisor is behavior modification. An advisor persuading a client to invest more when the market is doing poorly, instead taking money out, is extremely valuable.

Another option is to invest in a managed product like an ETF or mutual fund (here are some of ours) that will make the decisions for you. For an emotional investor, this may be an easier (and presumably safer) option than picking and obsessively monitoring a few random stocks. Even then, it is important try to avoid the herd mentality. Data shows that it’s most important to avoid panic at market bottoms. Although it is difficult not to panic if other people around you are fearful, the potential difference in your investment return can be significant.

In short, understanding your emotional tendencies may help keep them from interfering in investment decisions. If that isn’t enough, try enlisting the help of an outside source. With the steady hand of a good advisor, it may be possible to mitigate emotional investment tendencies.

2 Comments |

2 Comments |  Investor Behavior, Markets | Tagged: advice, advisor, etf, investment, investor behavior, mental accounting, personal finance |

Investor Behavior, Markets | Tagged: advice, advisor, etf, investment, investor behavior, mental accounting, personal finance |  Permalink

Permalink

Posted by:

Amanda Schaible

August 14, 2012

Ninety percent of what passes for brilliance, or incompetence, in investing is the ebb and flow of investment style (i.e., growth, value, foreign vs. domestic, etc.). Since opportunities by style regress, past performance tends to be negatively correlated with future relative performance. Therefore, managers are often harder to pick than stocks. Clients have to choose between fact (past performance) and the conflicting marketing claims of various managers. As sensible businessmen, clients usually feel they have to go with the past facts. They therefore rotate into previously strong styles, which regress [to the mean], dooming most active clients to failure.—-Jeremy Grantham

This is a pretty long quote, but it’s a gem I found sandwiched into an Advisor Perspectives commentary by Jeffrey Saut. (I commend Mr. Saut for having the perspicacity to throw the quote out there in the first place.)

Mr. Grantham not only has a way with words—he has a valid point in every single sentence. That paragraph pretty much sums up everything that goes wrong for clients.

It’s also true from the standpoint of an investment manager. Our investment style constantly exposes clients to high relative strength stocks or asset classes. Some quarters they perceive us to be brilliant; other quarters, not so much! In reality, we are doing exactly the same thing all the time. Clients are actually reacting to the ebb and flow of investment style, as Mr. Grantham puts it, rather than to anything different we are doing.

The ebb and flow of investment style takes place over a fairly long cycle, often three to five years—in other words, usually an entire business cycle. During the flow period, clients are very excited by good performance and seem quite confident that it will never end. During the ebb period, it’s easy to become discouraged and to become convinced that somehow the investment process is “broken.” Clients become confident that performance will never improve! Grantham’s observation about the when and why of clients changing managers corresponds exactly with DALBAR’s reported poor investor performance and average 3-year holding periods.

Patience and the acknowledgment of ebb and flow would go a long way toward improving investor performance.

Is the ocean broken, or does it just ebb and flow?

Source: Eve Sob blogspot

Leave a Comment » |

Leave a Comment » |  From the MM, Investor Behavior, Just for Fun, Markets, Thought Process | Tagged: DALBAR, ebb and flow, investment style, manager selection, patience |

From the MM, Investor Behavior, Just for Fun, Markets, Thought Process | Tagged: DALBAR, ebb and flow, investment style, manager selection, patience |  Permalink

Permalink

Posted by:

Mike Moody

August 13, 2012

It’s fashionable to bash the US, what with a gridlocked Congress and the fiscal cliff, but if you’re looking to expand your portfolio, you might seriously consider investing domestically instead of overseas. U.S. companies have multiple benefits that you may not find elsewhere. Surprisingly, Politico recently outlined some of America’s investment advantages:

First, the U.S. has favorable demographics — thanks to its relatively high birth rates and immigration. While the BRIC countries —Brazil, Russia, India and China— have generated extraordinary economic growth, the U.S.remains a magnet for many of the smartest, most ambitious people in the world.

Second, the ability to better tap into domestic sources of energy — natural resource-based and, to a lesser but promising extent, the growing array of clean technologies — will spur more job-creating investments, improving our balance of payments.

Third, U.S. policymakers were aggressive in responding to the financial crisis, and the financial sector has been quick to increase capital and reduce leverage.

Fourth, U.S. companies have restructured more quickly and more extensively than others since 2008 — boosting U.S. productivity growth.

The United States is a logical place to invest, but it is not without its problems. Politico also lists ways the United States could improve. Some advice is to “make progress on the long-run fiscal situation…make it easier for people to immigrate…and invest in infrastructure.”

There is no golden place for investment all the time, but it’s useful to understand the pros and cons when deciding where to put your money. Especially given the current strength in the dollar, you could do worse than domestic companies.

American companies have some structural advantages

Source: hotzoneonline

(For those of you interested in investing domestically, we offer two U.S. relative strength ETFs (PDP and DWAS) and a full suite of separate account options. Give Andy a call. He’s been a little lonely lately!)

Please see www.powershares.com for more information. A list of all holdings for the trailing 12 months is available upon request. The Dorsey Wright SmallCap Technical Leaders Index is calculated by Dow Jones, the marketing name and a licensed trademark of CME Group Index Services LLC (“CME Indexes”). “Dow Jones Indexes” is a service mark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Products based on the Dorsey Wright SmallCap Technical Leaders IndexSM, are not sponsored, endorsed, sold or promoted by CME Indexes, Dow Jones and their respective affiliates make no representation regarding the advisability of investing in such product(s).

Click here and here for disclosures. Past performance is no guarantee of future returns.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets | Tagged: america, cons, invest, investment, pros, U.S. |

Investor Behavior, Markets | Tagged: america, cons, invest, investment, pros, U.S. |  Permalink

Permalink

Posted by:

Amanda Schaible

August 13, 2012

Our latest sentiment survey was open from 8/3/12 to 8/10/12. The Dorsey, Wright Polo Shirt Raffle continues to drive advisor participation, and we greatly appreciate your support! We will announce the winner in two weeks [Ed note: Last round we incorrectly stated the prize date]. This round, we had 38 advisors participate in the survey. If you believe, as we do, that markets are driven by supply and demand, client behavior is important. We’re not asking what you think of the market—since most of our blog readers are financial advisors, we’re asking instead about the behavior of your clients. Then we’re aggregating responses exclusively for our readership. Your privacy will not be compromised in any way.

After the first 30 or so responses, the established pattern was simply magnified, so we are fairly comfortable about the statistical validity of our sample. Some statistical uncertainty this round comes from the fact that we only had four investors say that thier clients are more afraid of missing a stock upturn than being caught in a downdraft. Most of the responses were from the U.S., but we also had multiple advisors respond from at least two other countries. Let’s get down to an analysis of the data! Note: You can click on any of the charts to enlarge them.

Question 1. Based on their behavior, are your clients currently more afraid of: a) getting caught in a stock market downdraft, or b) missing a stock market upturn?

Chart 1: Greatest Fear. From survey to survey, the S&P 500 was basically flat, but client sentiment improved noticeably. The fear of downturn group fell from 91% to 76%, while the upturn group rose from 9% to 24%. Clients seemed to have settled down towards the end of the summer.

Chart 2: Greatest Fear Spread. Another way to look at this data is to examine the spread between the two groups. The spread fell from 83% to 51%. We’re still a long way from even though.

Question 2. Based on their behavior, how would you rate your clients’ current appetite for risk?

Chart 3: Average Risk Appetite. Average risk appetite rose this round, from 2.27 to 2.43. This move mirrors the greatest fear indicator.

Chart 4: Risk Appetite Bell Curve. This chart uses a bell curve to break out the percentage of respondents at each risk appetite level. We are still seeing low risk appetites, with most clients having a risk appetite of 2 or 3. We had zero advisers say that their clients were looking for high risk investments (5) this week.

Chart 5: Risk appetite Bell Curve by Group. The next three charts use cross-sectional data. The chat plots the reported client risk appetite separately for the fear of downdraft and for the fear of missing upturn groups. This chart sorts out as expected, with the downturn group wanting less risk and the upturn group looking to add risk.

Chart 6: Average Risk Appetite by Group. The average risk appetite of both groups decreased this week, even as the market did well. After two “off” surveys in a row, the fear of upturn group is back in its normal range, while the downturn group’s risk appetite continues to move lower.

Chart 7: Risk Appetite Spread. This is a chart constructed from the data in Chart 6, where the average risk appetite of the downdraft group is subtracted from the average risk appetite of the missing upturn group. The spread shot higher this round and is back to its normal range.

The S&P 500 was basically flat from survey to survey, but client sentiment improved markedly. Both the overall fear numbers and the overall risk appetite numbers highlighted a push towards a more balanced risk appetite and fear levels. Could client sentiment be improving as the summer doldrums march on?

No one can predict the future, as we all know, so instead of prognosticating, we will sit back and enjoy the ride. A rigorously tested, systematic investment process provides a great deal of comfort for clients during these types of fearful, highly uncertain market environments. Until next time, good trading and thank you for participating.

1 Comment |

1 Comment |  Investor Behavior, Markets, Sentiment | Tagged: client sentiment, survey results |

Investor Behavior, Markets, Sentiment | Tagged: client sentiment, survey results |  Permalink

Permalink

Posted by:

JP Lee

August 3, 2012

The WSJ puts the equity fund redemptions of the last couple years into context:

Almost continuously since 2008, retail investors have been dumping mutual funds that invest in U.S. stocks. More than $129 billion gushed out of U.S. stock funds in the 12 months ending in June, according to Morningstar.

However, in case you are thinking that this is a new phenomenon-perhaps a result of the horrors of electronic trading or some other new development-consider some history:

Of course, individual investors have fled stock mutual funds before. They sold more shares of U.S. stock mutual funds than they bought throughout most of the 1970s—as they had for much of the 1930s, 1940s and 1950s. There isn’t much evidence that, in the long run, flows in or out of mutual funds matter a lot to stock returns. Markets can go up—or down—with or without the retail investor.

Investor psychology just doesn’t change that much over time.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets |

Investor Behavior, Markets |  Permalink

Permalink

Posted by:

Andy Hyer

August 3, 2012

After poor stock market performance over the past few years, many investors are holding on to cash. A survey by BlackRock ranks the reasons why people aren’t investing, and the results may be different from what you had expected.

Uncertainty about where to invest (37%)

Belief that it’s a poor investing environment (26%)

Fear of investing/losing money (23%)

Previous portfolio losses (8%)

Not applicable, have not pulled back on investment activity (6%)

Investors are not completely closed off to the idea of investing, but instead don’t know where they should put their money. One of the chief benefits of employing a relative strength strategy is that it provides the framework for allocating assets-thereby removing the biggest stumbling block to getting investors in the game.

1 Comment |

1 Comment |  Investor Behavior, Sentiment | Tagged: investment, market, sentiment |

Investor Behavior, Sentiment | Tagged: investment, market, sentiment |  Permalink

Permalink

Posted by:

Amanda Schaible

July 30, 2012

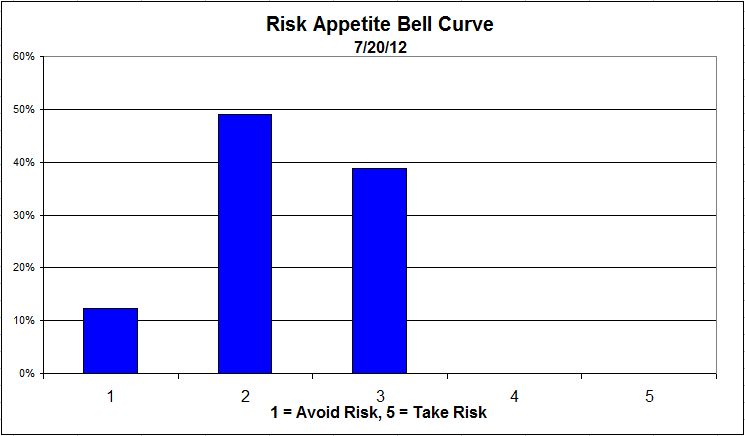

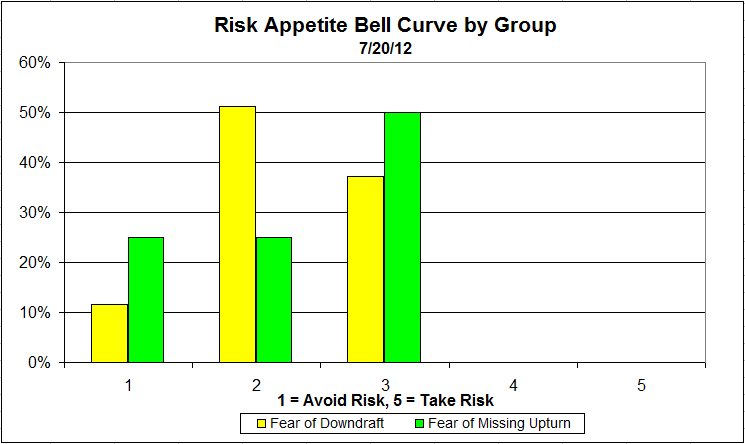

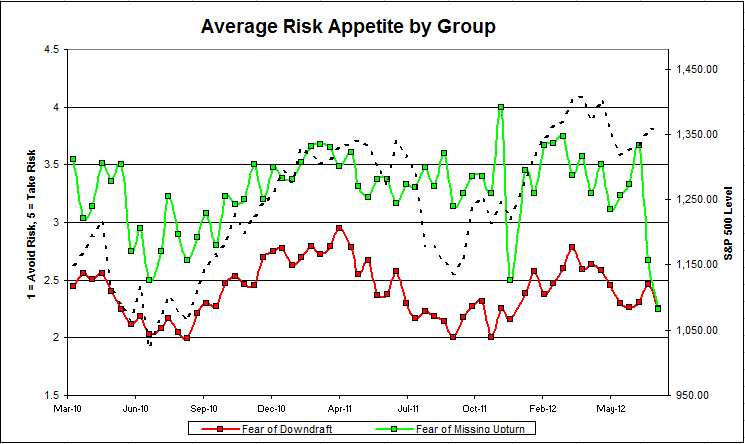

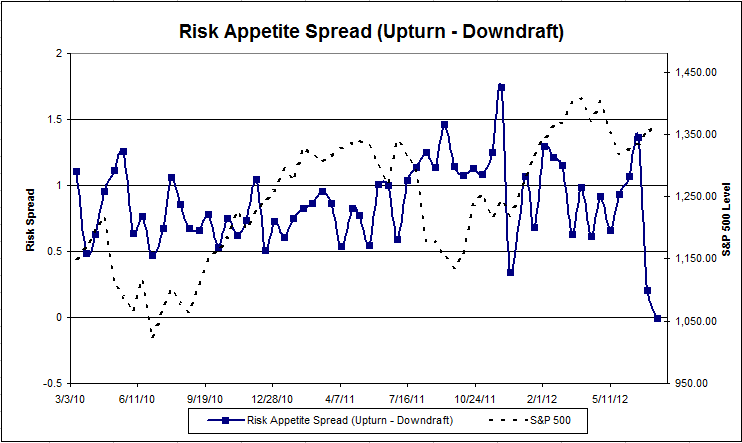

Our latest sentiment survey was open from 7/20/12 to 7/27/12. The Dorsey, Wright Polo Shirt Raffle continues to drive advisor participation, and we greatly appreciate your support! We will announce the winner early next week. This round, we had 49 advisors participate in the survey. If you believe, as we do, that markets are driven by supply and demand, client behavior is important. We’re not asking what you think of the market—since most of our blog readers are financial advisors, we’re asking instead about the behavior of your clients. Then we’re aggregating responses exclusively for our readership. Your privacy will not be compromised in any way.

After the first 30 or so responses, the established pattern was simply magnified, so we are fairly comfortable about the statistical validity of our sample. Some statistical uncertainty this round comes from the fact that we only had four investors say that thier clients are more afraid of missing a stock upturn than being caught in a downdraft. Most of the responses were from the U.S., but we also had multiple advisors respond from at least two other countries. Let’s get down to an analysis of the data! Note: You can click on any of the charts to enlarge them.

Question 1. Based on their behavior, are your clients currently more afraid of: a) getting caught in a stock market downdraft, or b) missing a stock market upturn?

Chart 1: Greatest Fear. From survey to survey, the S&P 500 rose 1.5%, but the greatest fear numbers did not perform as expected. The size of the fear of downturn group increased 85% to 91%, while fear of a missed upturn fell from 15% to 9%. Client sentiment remains poor even as the S&P has risen.

Chart 2: Greatest Fear Spread. Another way to look at this data is to examine the spread between the two groups. The spread increased from 69% to 83%.

Question 2. Based on their behavior, how would you rate your clients’ current appetite for risk?

Chart 3: Average Risk Appetite. Average risk appetite usually falls in line with the market, but this week it did not. As the S&P rose, average risk appetite fell from 2.49 to2.27.

Chart 4: Risk Appetite Bell Curve. This chart uses a bell curve to break out the percentage of respondents at each risk appetite level. We are still seeing low risk appetites, with most clients having a risk appetite of 2 or 3. We had zero advisers say that their clients were looking for high risk investments this week.

Chart 5: Risk appetite Bell Curve by Group. The next three charts use cross-sectional data. The chat plots the reported client risk appetite separately for the fear of downdraft and for the fear of missing upturn groups. This chart performs partially as expected. A higher percentage of the fear of missing an upturn respondents have a risk appetite of 3. However, a higher percentage of the upturn respondents have a risk appetite of 1. Both groups prefer a relatively low amount of risk.

Chart 6: Average Risk Appetite by Group. The average risk appetite of both groups decreased this week, even as the market did well. The average risk appetite for the fear of missing an upturn group dropped to the lowest it has been since we started the survey. In fact, it converged with the average risk appetite of the fear of downdraft group.

Chart 7: Risk Appetite Spread. This is a chart constructed from the data in Chart 6, where the average risk appetite of the downdraft group is subtracted from the average risk appetite of the missing upturn group. The spread decreased this round, and is the smallest spread we’ve seen yet.

The S&P 500 rose by 0.59% from survey to survey, but most of our indicators did not respond accordingly. Average risk appetite fell, and more people feared a downturn. We’re not sure what caused such strange results this round.

No one can predict the future, as we all know, so instead of prognosticating, we will sit back and enjoy the ride. A rigorously tested, systematic investment process provides a great deal of comfort for clients during these types of fearful, highly uncertain market environments. Until next time, good trading and thank you for participating.

1 Comment |

1 Comment |  Investor Behavior, Markets, Sentiment |

Investor Behavior, Markets, Sentiment |  Permalink

Permalink

Posted by:

Amanda Schaible

July 26, 2012

The Investment Company Institute is the national association of U.S. investment companies, including mutual funds, closed-end funds, exchange-traded funds (ETFs), and unit investment trusts (UITs). Flow estimates are derived from data collected covering more than 95 percent of industry assets and are adjusted to represent industry totals.

Leave a Comment » |

Leave a Comment » |  Investor Behavior |

Investor Behavior |  Permalink

Permalink

Posted by:

JP Lee

July 26, 2012

That’s the title of a Jason Zweig article for the Wall Street Journal. In the article, he points out how investors over-react to short-term information.

According to new research, this area of the “rational” brain [frontopolar cortex] forms expectations of future rewards based largely on how the most recent couple of bets paid off. We don’t ignore the long term completely, but it turns out that we weight the short term more heavily than we should – especially in environments (like the financial markets) where the immediate feedback is likely to be random.

In short, the same abilities that make us smart at many things may make us stupid when it comes to investing.

For the ultimate in over-reaction, he writes:

For quick confirmation, look no further than this recent study, which analyzed the accounts of nearly 1.5 million 401(k) investors and found that many of them switch back and forth from stocks to bonds and other “safe” accounts based on data covering very short periods.

You might argue that the long run is nothing but a string of short runs put together, or that you can get peace of mind by limiting your risk to fluctuating markets when prices fall, or that major new information should immediately be factored into even your longest-term decision-making. But many of these 401(k) investors were overhauling their portfolios based entirely on how markets performed on the very same day.

Yep—by “very short period,” he means the same day. That’s what the authors in the academic article, Julie Agnew and Pierluigi Balduzzi, found. They write:

We find that transfers into “safe” assets (money market funds and GICs) correlate strongly and negatively with equity returns. These results hold even after controlling for lead-lag relationships between returns and transfers, day-of-the-week effects, and macro-economic announcements. Furthermore, we find evidence of contemporaneous positive-feedback trading. That is, we find a positive effect of an asset class’ performance on the transfers into that asset class on the same day. Overall, these results are surprising, in light of the limited amount of rebalancing activity documented in 401(k) plans. It appears that while 401(k) investors rarely change allocations, when they do so their decisions are strongly correlated with market returns.

This is a very polite way for academics to say “when the stock market went down, investors panicked and piled into ‘safe’ assets.” Jason Zweig’s article points out that people react to how their last two trials worked out. That’s pretty much in line with anecdotal stories that buyers of profitable trading systems will stop using them after two or three losses in a row. The long-term is ignored in favor of the very short term.

With typical understatement, Agnew and Balduzzi write:

This is potentially worrisome, as it suggests that some investors may deviate from their long-run investment objectives in response to one-day market returns. We provide evidence that these deviations can lead to substantial utility costs.

“Substantial utility costs” in plain English means investors are screwing themselves.

Now, none of this is a surprise for advisors. We all have the same discussion with clients during every decline. The party line is that more investor education is needed, but these neurological studies suggest that people, in general, are just wired to be bad investors. They might overemphasize the last two trials no matter how we educate them.

So what is the takeaway from all of this? I certainly don’t have a simple solution. Perhaps it will be helpful to reframe what a “trial” is for clients as something much bigger than the last couple of quarters or the last two trades. It might help, at the margin, to continue to emphasize process. Maybe our best bet is just to distract them. Like I said, I don’t have a simple solution—but I think that a lot of any advisor’s value proposition is how successful they are at getting the client to invert their normal thought process and get them to focus on the long term rather than the short term.

Source of Stupid Trick: StupidHumans.org

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets | Tagged: 401k, behavioral finance, decision-making, investor behavior |

Investor Behavior, Markets | Tagged: 401k, behavioral finance, decision-making, investor behavior |  Permalink

Permalink

Posted by:

Mike Moody

July 23, 2012

Seth J. Masters, Chief Investment Officer of Bernstein Global Wealth Management says the odds of the Dow hitting 20,000 by the end of the decade are excellent:

Over 10-year periods since 1900, stocks have outperformed bonds 75 percent of the time, according to Bernstein’s calculations. But today, bond prices are relatively high — their yields, which move in the opposite direction, are extraordinarily low — and stock prices are relatively low. So the firm sees the chance of stocks beating bonds over the next 10 years at 88 percent.

Stocks have been cruel and it is hard to love them now. Still, Mr. Masters writes, “We think that 10 years from now, investors will wish they had stayed in stocks — or added to them.”

The damage done to investor psychology over the past decade is going to stay with investors for a long time, maybe even a generation. The fact that the S&P 500 has had an annualized return of 16.38% over the past three years ending 6/30 has not kept investors from scrambling to get out of equities and piling into fixed income (The Barclays Aggregate Bond Index has only had an annualized return of 6.94% over the past three years, ending 6/30).

Being optimistic about stocks is uncommon to say the least right now. Kind of like being pessimistic about stocks in 1999 was uncommon. It could be a big mistake to swear off stocks for the next 5-10 years. Understandably, investors feel an enormous amount of trepidation if they are made to feel that it is an either/or decision. Enter tactical asset allocation strategies that have the ability to increase or decrease exposure to multiple asset classes, including equities and fixed income. Having a framework for dispassionately allocating to strong asset classes, which is the goal of relative strength-driven tactical asset allocation strategies, can be an effective way to deal with the challenge of emotional asset allocation. Clients are open to tactical asset allocation because it speaks to both their hearts and their minds.

HT: Real Clear Markets

2 Comments |

2 Comments |  Investor Behavior, Markets, Tactical Asset Alloc | Tagged: investor behavior |

Investor Behavior, Markets, Tactical Asset Alloc | Tagged: investor behavior |  Permalink

Permalink

Posted by:

Andy Hyer

July 16, 2012

Our latest sentiment survey was open from 7/6/12 to 7/13/12. The Dorsey, Wright Polo Shirt Raffle continues to drive advisor participation, and we greatly appreciate your support! We will announce the winner early next week. This round, we had 59 advisors participate in the survey. If you believe, as we do, that markets are driven by supply and demand, client behavior is important. We’re not asking what you think of the market—since most of our blog readers are financial advisors, we’re asking instead about the behavior of your clients. Then we’re aggregating responses exclusively for our readership. Your privacy will not be compromised in any way.

After the first 30 or so responses, the established pattern was simply magnified, so we are comfortable about the statistical validity of our sample. Most of the responses were from the U.S., but we also had multiple advisors respond from at least three other countries. Let’s get down to an analysis of the data! Note: You can click on any of the charts to enlarge them.

Question 1. Based on their behavior, are your clients currently more afraid of: a) getting caught in a stock market downdraft, or b) missing a stock market upturn?

Chart 1: Greatest Fear. From survey to survey, the S&P 500 rose 1.5%, and the greatest fear numbers performed as expected. The size of the fear of downturn group decreased from 94% to 85%, while fear of a missed upturn rose from 6% to 15%. Overall, client sentiment remains poor.

Chart 2: Greatest Fear Spread. Another way to look at this data is to examine the spread between the two groups. The spread decreased from 88% to 69%.

Question 2. Based on their behavior, how would you rate your clients’ current appetite for risk?

Chart 3: Average Risk Appetite. Once again, the average risk appetite performed as expected, rising from 2.39 to 2.49. This indicator continues to fall in line with the market.

Chart 4: Risk Appetite Bell Curve. This chart uses a bell curve to break out the percentage of respondents at each risk appetite level. We are still seeing a low amount of risk, with most clients wanting a risk appetite of 2 or 3. Very few clients are looking for high risk investments.

Chart 5: Risk appetite Bell Curve by Group. The next three charts use cross-sectional data. The chat plots the reported client risk appetite separately for the fear of downdraft and for the fear of missing upturn groups. This chart performs as expected, with the upturn group wanting more risk than the downturn group. However, both groups prefer a relatively low amount of risk and the difference between the two is slight.

Chart 6: Average Risk Appetite by Group. The average risk appetite of those who fear a downturn increased with a market. However, the average risk appetite of those who fear missing an upturn decreased drastically, even as the market did well.

Chart 7: Risk Appetite Spread. This is a chart constructed from the data in Chart 6, where the average risk appetite of the downdraft group is subtracted from the average risk appetite of the missing upturn group. The spread decreased this round, and is the smallest spread we’ve seen yet.

The S&P 500 rose by 1.5% from survey to survey, and most of our indicators responded accordingly. Average risk appetite rose, and fewer people feared a downturn. However, both groups had low average risk appetites.

No one can predict the future, as we all know, so instead of prognosticating, we will sit back and enjoy the ride. A rigorously tested, systematic investment process provides a great deal of comfort for clients during these types of fearful, highly uncertain market environments. Until next time, good trading and thank you for participating.

Leave a Comment » |

Leave a Comment » |  Investor Behavior, Markets, Sentiment |

Investor Behavior, Markets, Sentiment |  Permalink

Permalink

Posted by:

Amanda Schaible