The “new normal” is a phrase that strikes fear into the heart of many investors. It is shorthand for the belief that the US economy will grow very slowly going forward, as opposed to resuming its typical growth rate. For example, here is the Research Affliliates version of the new normal, as presented in a recent article from AdvisorOne:

Unless the U.S. makes politically difficult changes in immigration, employment and investment policies, Americans should expect a long-term “new normal” rate of growth of just 1%. So says investment management firm Research Affiliates, in a research note that brings a wealth of demographic and historic data to bear on current fiscal projections.

Christopher Brightman, the report’s author and head of investment management for the Newport Beach, Calif. Firm founded by indexing guru Rob Arnott, is critical of White House and Congressional Budget Office growth projections that assume 2.5% long-term growth.

Brightman argues the U.S. will find it nearly impossible to recapture the 3.3% average annual growth that prevailed from 1951 to 2000 as a result of negative trends in the key areas that affect GDP: population growth, employment rate growth and productivity.

PIMCO and other firms have also been exponents of the new normal view, and although the specifics may vary from strategist to strategist, the general outlook for sluggish growth is the same.

Investor response to date has been less than constructive and has mostly resembled curling up into the fetal position. Although I have no idea how likely it is the new normal theory will pan out, let’s think for a moment about some of the possible implications.

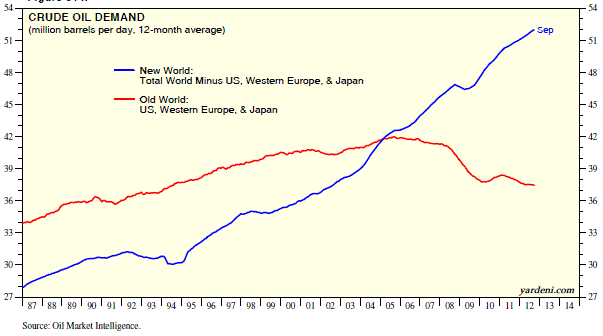

- if US economic growth is slow, it may slow growth overseas, especially when the US is their primary export market.

- economies less linked to the US may decouple and retain strong growth characteristics.

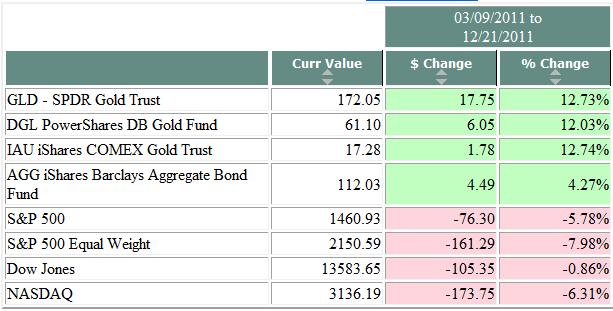

- inflation and interest rates may stay low, leading to better-than-expected bond returns (where default is not an issue).

- ever more heroic measures to stimulate US economic growth may backfire, creating a debt bomb and high future inflation.

- growth may be priced at a premium multiple for those stocks and sectors that are demonstrating strong fundamentals. In other words, if growth is hard to find, investors may be willing to pay up for it.

- slow economic growth may cause a collapse in multiples, as future growth is discounted at a much lower rate.

In other words, you can still get pretty much any investment scenario out of new normal assumptions. It’s just about whether a particular strategist is feeling pessimistic or optimistic that day, or more cynically, whether they are talking their book.

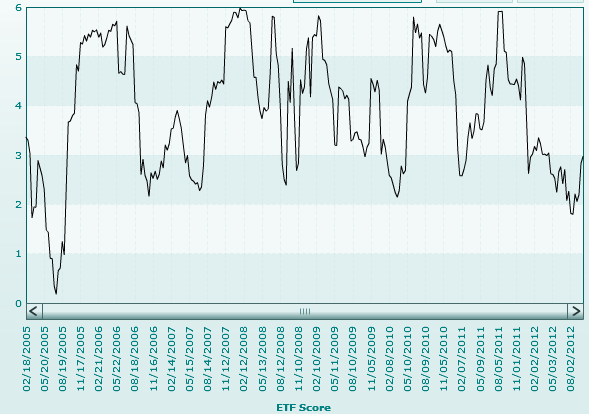

To me, this is one of the best arguments in favor of tactical asset allocation driven by relative strength. Relative strength lets the market decide, based on which assets are strong, what to buy. At any given time it could be currencies, commodities, stocks, bonds, real estate, or even inverse funds. And it might change over time, as new perceptions creep into the market or as policy responses and market consequences interact in a feedback loop. Relative strength doesn’t make any assumptions about what will happen; it treats good performance favorably regardless of the source. Tactical asset allocation, then, is just an attempt to extract returns from wherever they might be available. That trait may come in handy in a tough market.